订阅 wiki

Share wiki

Bookmark

Berachain

0%

Berachain

Berachain 协议是一个与 EVM 兼容的 layer-1 区块链,构建于 Cosmos SDK 之上,并由流动性证明驱动。[1][2]

2025 年 2 月,Berachain 达到了一个里程碑,其总锁定价值 (TVL) 超过 32.6 亿美元,使其成为去中心化金融 (DeFi) 中第六大区块链网络,数据来自 DeFi 数据追踪器 DefiLlama。

概述

Berachain 由四位匿名创始人(Smokey the Bera、Papa Bear、Homme Bera 和 Dev Bear)推出,是一个高性能的与 EVM 兼容的区块链,构建于流动性证明共识之上。流动性证明是一种旨在协调网络激励的共识机制,在 Berachain 验证者和项目生态系统之间建立强大的协同作用。Berachain 的技术构建于 Polaris 之上,Polaris 是一个高性能区块链框架,用于在 CometBFT 共识引擎之上构建与 EVM 兼容的链。[3]

Berachain 协议构建于 Polaris EVM 之上,允许从 Solidity 或 Vyper 编译的 智能合约 转换为字节码。该协议采用 CometBFT 进行共识,并且由于它构建于 Cosmos SDK 之上,因此可以为不同的客户端、数据层等提供模块化。[3]

融资

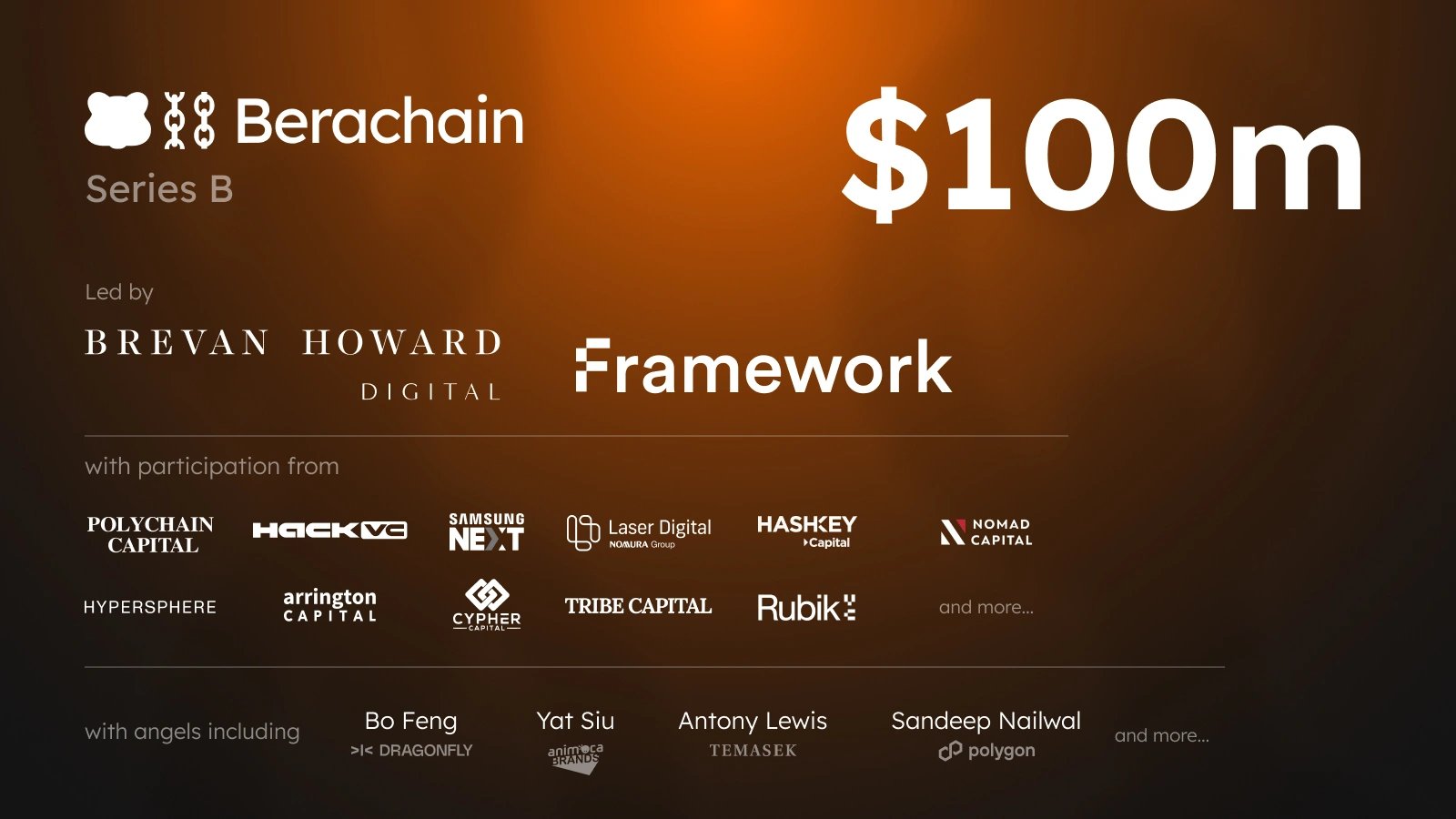

2024 年 4 月 12 日,Berachain 宣布完成 1 亿美元的 B 轮融资,由 Brevan Howard 和 Framework Ventures 共同领投。[13]

现有和新的投资者也加入了,包括 Polychain Capital、Hack VC、Tribe Capital、Nomura、Laser Digital、Hashkey Capital、Samsung Next、Hypersphere、Nomad Capital、Arrington Capital 等。天使投资人包括 Bo Feng、Yat Siu、Antony Lewis、Sandeep Naiwal 等。[13][14]

“我们认为这次融资是对我们构建区块链方法的重大验证,该区块链建立在来自真实用户和开发者的反馈之上,并将价值驱动到那些真正为网络增长做出贡献的群体,”Berachain 联合创始人 Smokey the Bera 在新闻稿中表示

Berachain 计划利用筹集的 1 亿美元来加强其“经济增长计划和工程资源”,并将其全球业务扩展到香港、新加坡、东南亚、拉丁美洲和非洲。[19]

2023 年 4 月,Berachain 以 4.2069 亿美元的估值筹集了 4200 万美元的 A 轮融资。该轮融资由 Polychain Capital 领投,投资者包括 Hack VC、dao5、Tribe Capital、Shima Capital、CitizenX 和 Robot Ventures,以及几家未公开的中心化加密货币交易所。[18]

技术

流动性证明

Berachain 经济模型流动性证明 (PoL) 是一种共识机制和区块链治理方法,旨在解决去中心化网络的关键挑战。[4]

Polaris EVM

Polaris EVM 是一个模块化 EVM 框架,为 Berachain 上的 智能合约 提供执行环境。其 EVM 兼容性由 Berachain Polaris EVM 库促进。Polaris Ethereum 增强了 EVM 体验,超越了 Ethereum 的基本实现,为开发人员提供了创建有状态预编译和自定义模块的能力,以实现更高效的智能合约,同时保持可靠的 Ethereum 功能。[5]

CometBFT

CometBFT 为 Berachain 提供动力,作为其共识引擎,支持跨多台机器的安全和一致的应用程序复制。它通过容忍少于三分之一的机器故障来确保安全性,并通过在非故障机器之间同步事务日志和状态来保持一致性。这种复制对于从货币到基础设施编排的各种应用程序中的容错至关重要。[6]

CometBFT 实现了 拜占庭容错 (BFT),使其能够处理机器故障,包括恶意故障。虽然 BFT 理论已经存在了几十年,但其最近的普及归因于 比特币 和 Ethereum 等区块链技术,这些技术通过点对点网络和加密身份验证使 BFT 现代化。[6]

CometBFT 包含一个区块链共识引擎和一个应用程序区块链接口 (ABCI),基于 Tendermint 共识算法,确保一致的事务记录和交付给应用程序进行处理。与其他解决方案不同,CometBFT 允许开发人员为以任何编程语言或开发环境编写的应用程序实现 BFT 状态机复制。[6]

预编译

预编译或预编译合约是一种独特的智能合约类别,其功能直接集成到 EVM 中,而不是作为字节码执行,每个合约都分配了一个特定的地址。执行这些合约的 gas 费用 是预先确定的。[7]

在 Berachain 中,这主要用于在链上启用更深层次的功能,这些功能直接与各种 Cosmos 模块交互,否则这些模块在 EVM 之外将无法访问。[7]

Berachain 治理

提案

提案通常是适用于验证者、白名单池、白名单代币等的拟议功能。此功能借鉴了 Cosmos SDK 治理模块,并允许在链上完成提案和投票。也可以通过 BGT Station 查看和创建提案。[8]

可用的 4 种不同类型的提案包括:

- 文本提案 - 通过后没有自动实现功能的提案

- Gauge 提案 - 新的 流动性提供者 被列入白名单,允许验证者选择他们以接受 BGT 排放

- 抵押品提案 - 新的代币被列入白名单并映射到 Honey,可以通过 BEX 进行交易

- 市场提案 - 可以提议在 BEX 中交易包装的代币[8]

投票

验证者和委托者可以对提案进行投票,这些提案可以自动更改系统的预设参数(例如区块 gas 限制)、协调升级以及对管理 Berachain 政策的人工可读章程进行修正投票。该章程允许利益相关者在盗窃和错误等问题上保持凝聚力,从而实现更快、更清晰的解决方案。[8]

代币

BERA 代币

BERA 是用于在区块链上发送交易的网络代币,这就是为什么它有时被称为“gas 代币”。它用于支付交易的 gas 费用。[9]

BGT 代币

权益证明 区块链有一个治理代币,用于通过与验证者 质押 来保护网络。网络中质押的所有代币的经济价值加起来构成了链的安全性。通常,这是主要的网络代币。[10]

但是,由于 Berachain 的 流动性证明 模型,此代币是 BGT(Bera 治理代币)。BGT 不可转让,只能通过在原生 BEX 中存入流动性来获得。[10]

实用性

BGT 在委托给验证者后,可用于创建和投票治理提案,例如决定哪些 LP 池 接收 BGT 排放的提案。委托后,用户将开始从网络中获得各种奖励。[10]

Honey 稳定币

许多协议对其代币的价格稳定性要求高于标准 加密货币 所能提供的。这导致了稳定币的概念,即与 法定货币 的真实美元价值挂钩的代币。[11]

在 Berachain 中,HONEY 充当 稳定币,旨在近似 1 USDC,也可以 1:1 销毁 以换取 BERA。[11]

合作伙伴

发现错误了吗?