订阅 wiki

Share wiki

Bookmark

BlackRock USD Institutional Digital Liquidity Fund (BUIDL)

0%

BlackRock USD Institutional Digital Liquidity Fund (BUIDL)

贝莱德美元机构数字流动性基金 (BUIDL) 是由全球最大的资产管理公司贝莱德推出的代币化货币市场基金。截至2025年11月,其管理资产超过25亿美元,是公共区块链上最大的代币化货币市场基金,旨在为机构投资者提供美国国债收益率,同时保持传统货币市场投资的安全性和流动性。 [16] [1]

概述

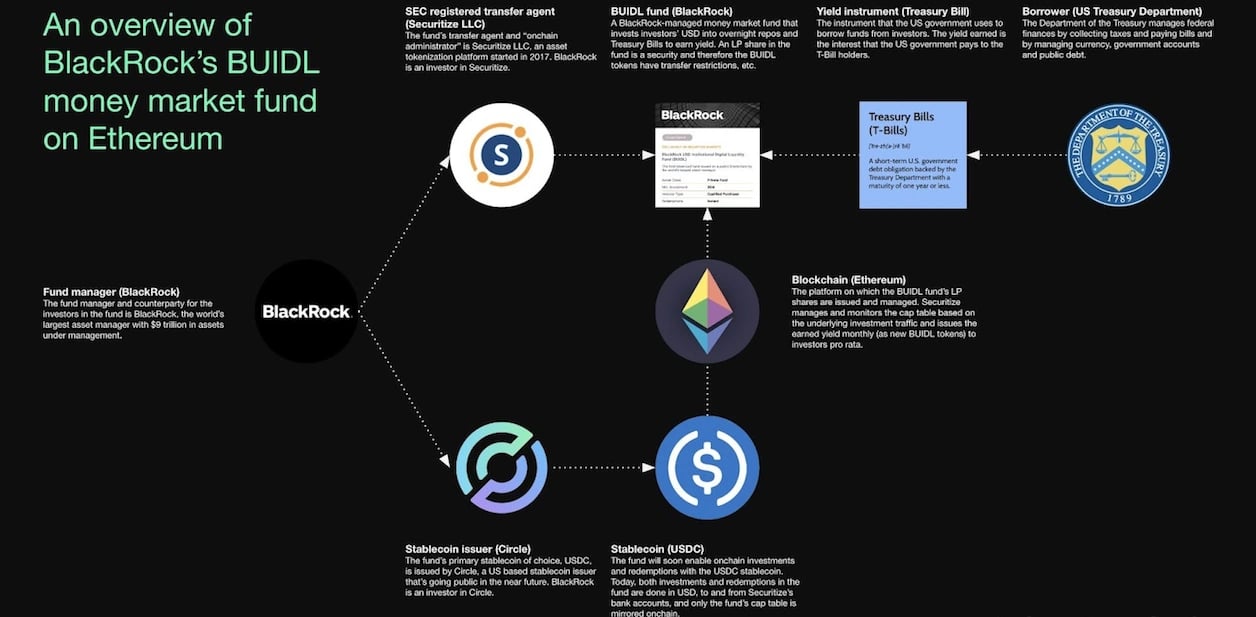

BlackRock USD Institutional Digital Liquidity Fund (BUIDL) 代表了贝莱德向加密货币领域的战略扩张。该基金于 2024 年 3 月推出,将区块链技术与传统货币市场基金相结合。[16] BUIDL 最初在 Ethereum 上推出,此后进行了扩展,现在跨八个区块链运营,包括 Solana 和 BNB Chain,允许投资者利用区块链的账本和支付功能。[2] [17] 这一举措符合金融领域将金融资产从传统格式过渡到基于区块链的系统的更广泛的代币化趋势。BUIDL 建立在区块链技术之上,与传统金融工具相比,能够实现更快的结算时间、更高的透明度和更高的运营效率。

作为一个货币市场基金,BUIDL 主要投资于短期、高质量的债务证券,包括美国国库券、商业票据和其他现金等价物。该基金旨在保持稳定的资产净值 (NAV),同时为机构投资者提供有竞争力的收益率。BUIDL 已被整合到更广泛的 真实世界资产 (RWA) 代币化领域,并且对贝莱德基金日益增长的兴趣表明机构对代币化 RWA 的需求不断增长,这主要是由于监管清晰度的提高,正如欧洲 RWA 平台 Brickken 的联合创始人兼首席执行官 Edwin Mata 所指出的那样。[1] [3] [8]

主要特点

BUIDL 提供了几个独特的特性,使其与传统的货币市场基金和其他数字资产区分开来:

- 代币化:基金的份额在区块链上表示为数字代币,从而实现可编程功能并与数字资产生态系统集成。

- 机构关注:与许多数字资产不同,BUIDL 专为机构投资者设计,具有适当的合规性、安全性和报告功能。

- 监管合规:该基金在现有货币市场基金的监管框架内运作,同时利用 区块链 技术。

- 稳定性:作为货币市场基金,BUIDL 旨在保持稳定的价值,使其比许多 加密货币 的波动性更小。

- 流动性管理:该基金提供机构级的流动性管理,并具有 区块链 技术的效率优势。

- 生态系统集成:BUIDL 有可能与各种区块链协议和 去中心化金融 (DeFi) 应用程序集成。

- 抵押:代币化股份可用作场外 抵押品,用于在 币安 等交易所进行机构交易,从而提高交易者的资本效率。 [16]

技术基础设施

- 区块链平台:该基金在多链基础上运行,以提高可访问性。 BUIDL 最初在 以太坊 上启动,后来扩展到包括 Aptos、Avalanche、Arbitrum、BNB Chain、Optimism、Polygon 和 Solana。 [18]

- 智能合约:该基金可能使用 智能合约 来自动化基金管理的各个方面,包括发行、赎回和股息分配。

- 托管解决方案:BlackRock 实施了机构级数字资产托管解决方案,以保护基金的代币化资产。

- 集成能力:该技术堆栈包括与传统银行系统的集成能力,允许在传统金融轨道和基于 区块链 的系统之间无缝移动。 为了与数字资产交易所集成,BUIDL 与 Ceffu 等机构托管解决方案兼容,Ceffu 是 币安 的托管合作伙伴。 [18]

- 合规机制:该基础设施包含自动化合规机制,以确保遵守 KYC/AML 要求和其他监管义务。

投资策略

BUIDL的投资策略遵循传统货币市场基金的原则,同时利用区块链技术的优势:

- 资产配置:该基金主要投资于短期、高质量的债务工具,包括美国国债、政府机构债务、存款凭证、商业票据和其他货币市场工具。

- 风险管理:BUIDL采用货币市场基金典型的保守风险管理措施,侧重于资本保全和流动性。

- 收益生成:该基金旨在提供与传统货币市场基金相比具有竞争力的收益率,并可能通过区块链技术提高运营效率。

- 流动性管理:投资策略优先考虑保持足够的流动性,以满足赎回请求,同时优化回报。

代币经济学

BlackRock Token (BUIDL)

该基金可在多个区块链上使用,包括以太坊、Polygon、Avalanche、Optimism、Arbitrum、Aptos、Solana和BNB 链。 [4] [5] [17]

代币效用

- 资产支持代币:BUIDL 代币代表底层货币市场基金中的份额,每个代币都由该基金的短期债务证券组合支持。

- 价值稳定性:与许多 加密货币 不同,BUIDL 旨在保持稳定的价值,类似于传统的货币市场基金。

- 抵押:代币化份额作为一种计息 抵押品 选项,使机构客户能够在 币安 等交易所支持交易活动,而无需清算其持仓。 [16]

- 供应动态:代币供应量根据投资者的资金流入和流出而扩张和收缩,而不是遵循预定的发行时间表。

- 收益分配:基础资产产生的回报以新代币的形式作为每日股息支付给代币持有者。 [17]

- 赎回机制:代币持有者可以将其代币兑换为基金资产的潜在价值,从而在代币价格和基金资产净值之间建立直接关联。

合作关系

AI基础设施合作伙伴关系 (AIP)

BUIDL 已与全球基础设施合作伙伴 (GIP)、微软、MGX、英伟达、xAI、GE Vernova 和 NextEra Energy 建立了战略合作伙伴关系,作为人工智能基础设施合作伙伴关系 (AIP) 的一部分。此次合作的重点是投资于人工智能就绪的数据中心和能源基础设施,以满足对计算资源日益增长的需求。

英伟达和 xAI 在人工智能加速和数据中心基础设施方面贡献技术专长,而 GE Vernova 和 NextEra Energy 则致力于能源解决方案以支持人工智能的发展。该合作伙伴关系旨在通过利用来自私人和机构投资者的资本,调动高达 1000 亿美元的投资。

BUIDL 参与 AIP 符合开发开放架构人工智能生态系统的努力,确保在美国、经合组织国家和主要合作伙伴地区的规模化和广泛的行业参与。 [6] [7]

Ondo Finance & BUIDL

Ondo Finance 已与贝莱德的 BUIDL 合作,以增强 区块链 生态系统内的流动性。此次合作旨在增加投资者参与度,并利用区块链技术来改进资产管理和 清算。Ondo Finance 是 BUIDL 项目的重要合作伙伴,计划通过将 BUIDL 与其 OUSG 产品集成,将其储备多元化到五个新的区块链上,该产品支持去中心化国库持有。这项举措旨在增强区块链网络之间的流动性,为 Ondo 的投资者创造更高效的交易环境。 [9]

与 Frax Finance 的整合

在 2025 年初,Frax Finance 推出了一种新的稳定币,frxUSD,其结构是由贝莱德美元机构数字流动性基金 (BUIDL) 持有的代币化资产支持。frxUSD 的发行标志着一个用例,其中链上稳定价值由受监管机构管理的传统资产基金的股份抵押。

frxUSD 的发行和代币化通过 Securitize 进行,Securitize 既是代币化平台又是转账代理。每个 frxUSD 代币对应于 BUIDL 基金中等值的股份。基础基金资产包括短期美国国债工具、现金和回购协议,旨在提供资本保值和每日流动性。

支持稳定币的股份保存在隔离的钱包中,链上可见性支持对储备金的独立验证。该模型用基于 区块链 的可审计性取代了链下证明,使用公开可访问的交易数据来确认抵押品持有量。

根据公开披露,frxUSD 在一个将受监管证券纳入基于 区块链 的基础设施的框架内运作。该结构符合 Frax 部署由 现实世界资产 支持的稳定币,同时与 去中心化金融 (DeFi) 协议集成的目标。

BUIDL 在此安排中的作用代表了使用传统金融工具的代币化表示作为 稳定币 设计中的抵押品。frxUSD 机制定位于将基金代币化应用于 区块链 原生资产的更广泛趋势中,从而在金融系统之间提供新的互操作性形式。 [10] [11] [12] [13] [14] [15]

币安和BNB链集成

2025年11月14日,贝莱德和币安宣布合作,将BUIDL基金整合到币安生态系统中。作为合作的一部分,BUIDL在BNB链上推出了新的份额类别,扩展了该基金的多链业务。 [17] [18]

该合作关系的一个关键组成部分是币安接受BUIDL作为其机构和VIP客户的交易所外抵押品。此功能允许交易者使用其产生收益的BUIDL份额来支持交易活动,而无需将资产直接转移到交易所,从而利用Ceffu等托管合作伙伴。 [16] [19]

币安VIP和机构主管Catherine Chen指出,此举是为了满足客户对“他们可以作为抵押品持有的更多计息稳定资产”的需求。根据一份联合声明,此次合作旨在确立“BUIDL作为链上金融的基础构建块的角色”。 [16] [18]

发现错误了吗?