订阅 wiki

Share wiki

Bookmark

Blast

0%

Blast

Blast 是一个 以太坊 Layer 2 (L2) 网络,旨在提高以太坊区块链上的可扩展性和交易效率。Blast 于 2024 年 2 月推出,引入了原生收益的概念,允许用户通过持有某些代币来赚取被动加密货币收入。Blast 由 Tieshun Pacman Roquerre 创立,他也因创建 NFT 市场 Blur 而闻名,Blast 在 区块链 社区迅速获得关注,在主网发布后不久就超过了 10 亿美元的总锁定价值。 [3]

概述

Blast 作为一个与 EVM 兼容的 乐观 Rollup 解决方案运行,在提高以太坊交易吞吐量的同时,降低了与主链相比的成本。与传统以太坊质押(用户手动锁定代币以获取奖励)不同,Blast 自动执行此过程。桥接到 Blast 的资产会自动进行质押,产生的收益将作为以太币 (ETH) 或稳定币(例如 USDT、USDC 和 DAI)直接分配到用户的钱包。

该平台提供 4% 的 ETH 收益和 5% 的稳定币收益,这些收益会根据无风险利率 (RFR) 收益结构随时间复利。ETH 收益来自流动性质押合作,利用以太坊的 权益证明 (PoS) 模型。同时,稳定币通过 MakerDAO 的 T-bill 机制等协议赚取收益,从而增强 Blast 生态系统内的资产价值保值和增长。

特点

Blast的原生收益机制在L2领域中脱颖而出,它允许用户在不主动质押资产的情况下赚取收益,这与其他主要关注可扩展性的L2网络形成对比。这种方法不仅激励了长期资产持有,还将DeFi、游戏、SocialFi和NFT生态系统整合到一个统一的平台,供用户和开发者使用。 [2]

代币经济学

概述

- 代码: BLAST

- 总供应量: 1000亿

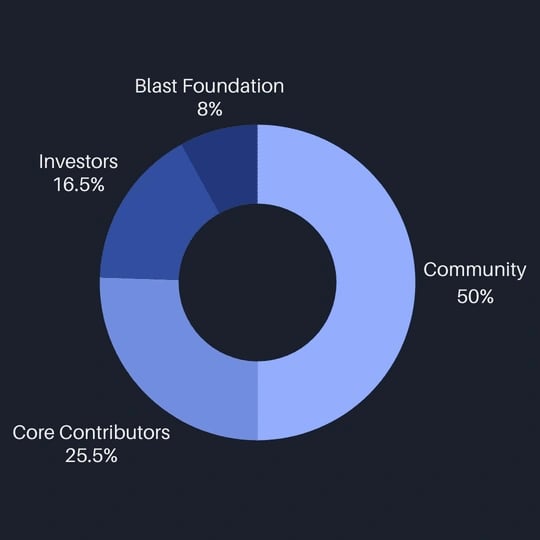

代币分配

- 数量: 50,000,000,000 BLAST 总BLAST供应量的50%分配给社区。此分配通过各种激励活动进行分配,并从代币生成事件(TGE)开始,在3年内线性解锁,遵循Blast基金会设定的时间表。

- 数量: 25,480,226,842 BLAST 核心贡献者的代币有4年的锁定期。25%在TGE后1年解锁,剩余代币在随后的3年中每月线性解锁。

- 数量: 16,519,773,158 BLAST 投资者代币有4年的锁定期,25%在TGE后1年解锁,随后在随后的3年中每月线性解锁。

- 数量: 8,000,000,000 BLAST 基金会的分配用于基础设施和生态系统增长。这些代币从TGE开始,在4年内线性解锁。

-

Blast 积分 (7%) -

Blast 黄金 (7%) - 数量: 7,000,000,000 BLAST 为Dapps的成功做出贡献的用户获得了Blast黄金,并将获得总BLAST供应量的7%。

6. 归属 排名前0.1%的用户(约1000个钱包)将根据第一阶段的活动情况,在6个月内线性归属部分空投,但需要满足每月积分阈值。 7. Blur 基金会 (3%)

- 数量: 3,000,000,000 BLAST

Blur基金会将获得总BLAST供应量的3%,用于分配给Blur社区,包括追溯性和未来的空投。

BLAST 代币经济学旨在通过分配代币的方式来支持社区,激励贡献者,并通过分配和归属计划来确保Blast网络生态系统的可持续增长。[6]

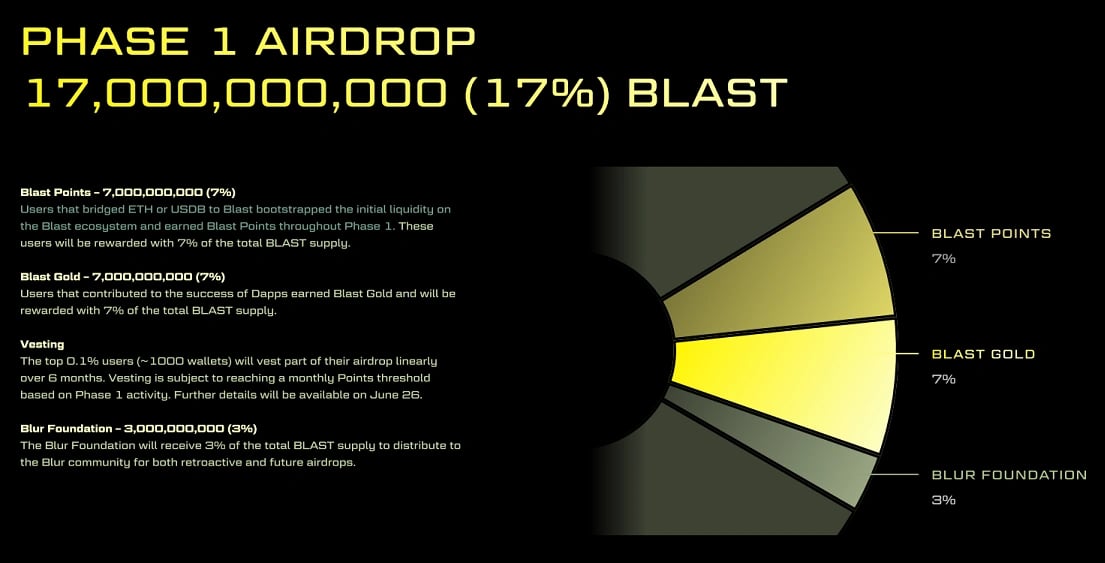

Blast空投

Blast空投是Blast社区参与战略不可或缺的一部分。它被构建为两个不同的积分系统:Blast积分和Blast黄金。Blast积分奖励用户桥接资产和推荐新成员,并可以从2024年5月开始兑换为BLAST代币。Blast黄金专为开发者保留,以激励Blast生态系统内的dApp创建和增长。

第一阶段

Blast空投的初始阶段于2024年6月26日开始,将总代币供应量的17%分配给早期用户。此次分配是以太坊Layer 2 Blast网络为早期采用者启动的一部分,于2024年6月25日宣布。在总供应量中,7%分配给将以太币(ETH)或美元Blast(USDB)桥接到网络的用户。另有7%分配给那些为Blast上的去中心化应用程序(DApps)的成功做出贡献的人,3%分配给Blur基金会,用于未来向其社区进行空投。

一份随附的报告详细说明,在积分方面排名前1000的钱包将在线性地归属其空投的一部分,为期六个月,以防止这些账户立即出售其所有代币。Blur基金会计划将其代币奖励份额分配给已经使用或将要使用其平台的交易者和持有者。总供应量的1%将分配给第三季的交易者和持有者,0.5%将保留给第四季,另有0.5%将保留供将来使用。剩余的0.5%尚未明确。

总共有50%的Blast代币供应计划分配给社区,其中17%在第一阶段发布。剩余的33%将在后续阶段发布,稍后公布。此外,总供应量的25.5%分配给核心贡献者,16.5%分配给投资者,8%分配给Blast基金会,以支持基础设施开发和生态系统增长。给予核心贡献者、投资者和基金会的代币将在四年内归属和解锁。[4][5][7][8][9]

第二阶段

Blast空投的第二阶段涉及分配100亿个BLAST代币以构建全栈链。此阶段将持续到2025年6月,为期12个月。第二阶段奖励的一半分配给Blast积分,另一半分配给Blast黄金。

钱包余额

第二阶段奖励的50%分配给Blast积分。钱包根据其ETH、WETH或USDB余额,每区块自动赚取积分,并在Blast.io仪表板上实时反映。要增加积分,用户可以桥接更多资产到Blast。由于Blast上的原生收益(ETH/WETH约为4%,USDB约为5%),钱包余额增加,积分收益也会随着时间增长。

ETH和WETH余额以恒定速率赚取积分,而USDB和BLAST余额根据ETH的当前价格以可变速率赚取积分。USDB/ETH和BLAST/ETH的积分转换率在账户接收或发送USDB或BLAST时更新。此外,BLAST赚取积分的速度是ETH/WETH/USDB的两倍。

Dapps

Dapps 根据其 TVL 以与钱包相同的速率赚取积分。当用户将 ETH、WETH 或 USDB 从他们的钱包转移到 Dapps 时,Dapps 开始根据转移的金额赚取积分。Dapps 预计通过与 Blast Points API 集成,将他们赚取的积分分配回给用户。

乘数

乘数可以增加积分余额和赚取率。例如,如果用户有100积分,每小时赚取20积分,那么2倍的乘数会将积分余额和赚取率都翻倍。乘数会随着时间的推移而发布,在2025年6月积分兑换之前只有12个可用。用户可以通过与Dapps互动来获得乘数。

赚取 Gold

第二阶段奖励的 50% 分配给 Blast Gold。与积分不同,Gold 由 Blast 激励委员会每两周手动分配一次。Gold 旨在激励 Dapp 的增长,Dapp 需要通过与 Blast Points API 集成,将其获得的 100% Gold 奖励分配给用户。

Dapp 激励

第二阶段的激励分为 Blast 积分和 Blast 黄金。Blast 积分根据 ETH、WETH、USDB 和 BLAST 的余额,每个区块自动分配。Blast 黄金由 Blast 基金会手动分配给 Dapps。积分奖励流动性,而黄金则用作 Dapp 增长的激励。Dapp 应该通过 Blast 积分 API 将积分和黄金重新分配给他们的用户。 [10][11][12][9]

提款时间缩短

Blast已将资产从Blast桥接到以太坊 主网的提款时间缩短至7天,低于之前的14天。此更改是在分析过去四个月的提款活动后实施的,分析表明较小的缓冲期仍然可以满足几乎所有的提款请求。

该网络于2024年7月16日通过社交媒体帖子宣布了此更新,解释说此调整旨在提高其平台上的效率和用户体验。之前14天的桥接期最初是为了给Lido提款提供缓冲,Blast依赖Lido提款来获得以太坊收益。然而,最近的分析表明,不再需要这个延长的期限。

尽管有了这一改进,Blast指出,在极少数情况下,桥接过程可能仍然需要超过7天。桥接时间的缩短仅适用于从Blast到以太坊 主网的转移,而从以太坊到Blast的转移仍然只需几分钟即可完成。预计此更改将增强用户在使用Blast网络进行区块链交易时的流动性和灵活性。 [13][14][15]

发现错误了吗?