订阅 wiki

Share wiki

Bookmark

Meta Pool

0%

Meta Pool

Meta Pool 是一个基于多链、流动性质押的生态系统。它支持在 Ethereum、NEAR、Solana 和 Aurora 上的流动性质押代币。该生态系统还具有流动性池,供任何人成为流动性提供者;一个启动板,用于启动具有质押奖励的新项目;以及一个用于交易锁定头寸的债券市场。 [1]

生态系统

Meta Pool的生态系统DApp简化了质押和债券购买的身份验证,消除了重复钱包连接的需要。NEAR、Aurora、ETH和mpDAO代币持有者可以无摩擦地与每个DApp交互,并在同一平台上与NEAR、Aurora和Ethereum协议交互。 [2]

多链流动性质押

Meta Pool 允许质押 NEAR、AURORA、wNEAR 和 ETH。[3]

流动性质押消除了锁定期,允许用户在不锁定代币的情况下质押 NEAR,并且无需等待大约 48-72 小时(4-6 个 epoch)来取消质押。此外,用户还会收到 stNEAR,可用于各种 DeFi 协议,例如借贷、借款和提供流动性。在 Meta Pool 中,代币被委托给一系列高性能验证器。用户可以通过支付费用立即从流动性池中检索他们的 NEAR 代币。[3]

在 Meta Pool 上质押所需的最低金额为 1 NEAR。Meta Pool 通过其质押智能合约自动将质押分配给 80 多个验证器节点,因此用户无需手动选择验证器。Meta Pool 不维护验证器节点白名单,因为 NEAR 基金会的新节点流程有效地过滤了新的服务提供商。但是,Meta Pool 在新节点上进行质押时会考虑几个标准,包括正常运行时间和性能、NEAR 奖励(收益)的百分比以及验证器收取的费用,优先考虑费用较低的验证器。[3]

用户有两种取消质押的选择:流动性取消质押或延迟取消质押。流动性取消质押允许立即将质押代币转换为其原始形式,流动性费用范围为 0.3% 到 5%。或者,延迟取消质押不收取任何费用,但需要等待一段时间:$NEAR 为 2-4 天,$AURORA 最多 4 天,$ETH 最多 9 天。在这两种情况下,用户都需要少量 NEAR 代币用于 NEAR 区块链交易,以及少量 ETH 代币用于 Aurora 和 Ethereum 网络上的交易。[3]

机构流动性质押

Meta Pool 连接区块链协议和传统金融及金融科技组织,以提供流动性质押服务。它与 Fireblocks、Qredo 和 Finoa 等托管提供商合作。Finoa 根据 §64y Para. 1 KWG 作为认证的加密资产托管人运营,并受德国联邦金融监管局 (BaFin) 的监管。它为客户提供安全访问托管、质押、交易和 DeFi 服务的途径。 [2][4]

众筹启动台

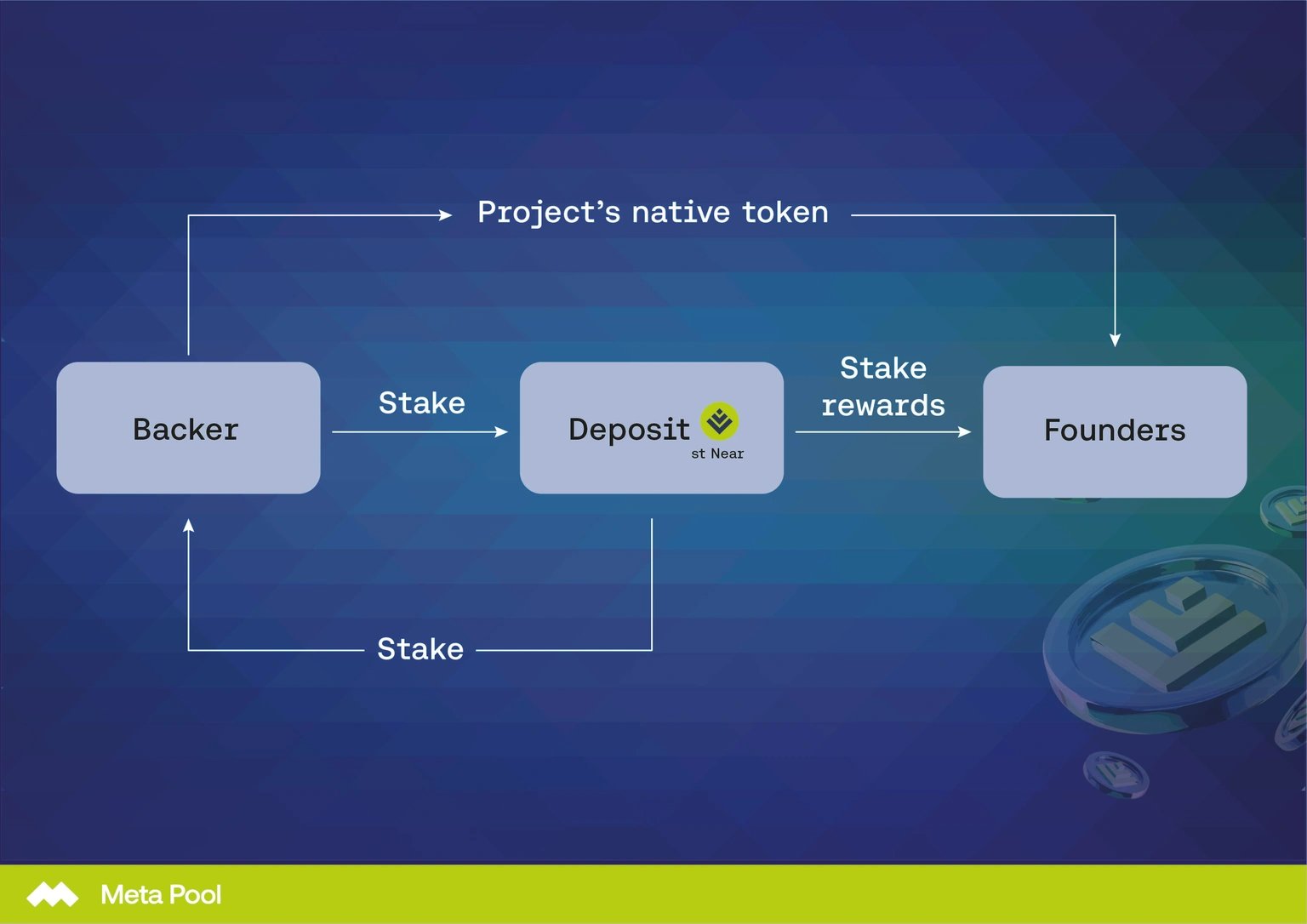

启动台是一个 Web3 众筹平台,为 NEAR 项目提供支持,利用无损质押奖励为 NEAR 社区提供资金支持和曝光。该平台通过流动性质押为 NEAR 协议上的 Web 3.0 项目提供资金支持,仅使用质押奖励。它为支持者和项目利益相关者提供了简化的体验。 [5]

- 创始人请求特定数量的 $NEAR 来资助他们的项目。项目获得质押奖励,约为支持者承诺总金额的 10%。

- 用户通过基于 Web3 生态系统中 NEAR 质押奖励的无损筹款过程,为项目提供资金支持。支持者从 NEAR 上启动的新项目中获得代币,或参与即将到来的 NFT 投放。

- 支持者锁定他们的 stNEAR 代币,并将他们所有的 NEAR 质押奖励分配给项目,以换取项目的原生代币。

用户收到 $NEAR 的 IOU 收据,允许他们在项目获得所有奖励后索取他们的资产。支持者在锁定期结束时重新获得对其加密资产的完全访问权限,收回 100% 的 NEAR。

债券市场

Meta Bond Market是一个平台,允许Launchpad投资者以债券形式交易他们的投资和收益。该平台旨在提供一种工具,用于获取和提供由Launchpad上支持的项目生成的各种类型的债券。 [6]

用户在早期阶段投资Meta Launchpad项目。如果这些项目达到第一个投资目标,支持者将获得项目代币奖励,这些代币会逐步释放以回报他们锁定的投资。 [6]

基金期结束后,Meta Bonds会为支持者生成两种债券:

- 第一种债券以NEAR代币形式存在,对应于基金期结束时锁定的stNEAR价值。

- 第二种债券等于支持项目的代币数量,并逐步释放。

支持者可以选择在锁定期内出售一种或两种债券。如果未售出,债券到期,并且在锁定期结束时,投资将返还给持有人。 [6]

治理

mpDAO 代币是治理代币,支持社区对协议的管理。代币持有者可以参与 mpDAO 的投票流程。积极参与投票者会因参与治理而获得补偿。每个月,协议费用的 65% 会分配给那些锁定代币并使用投票权的人。付款与使用的投票权成正比,并在下个月的第三天分配。 [7]

mpDAO 代币

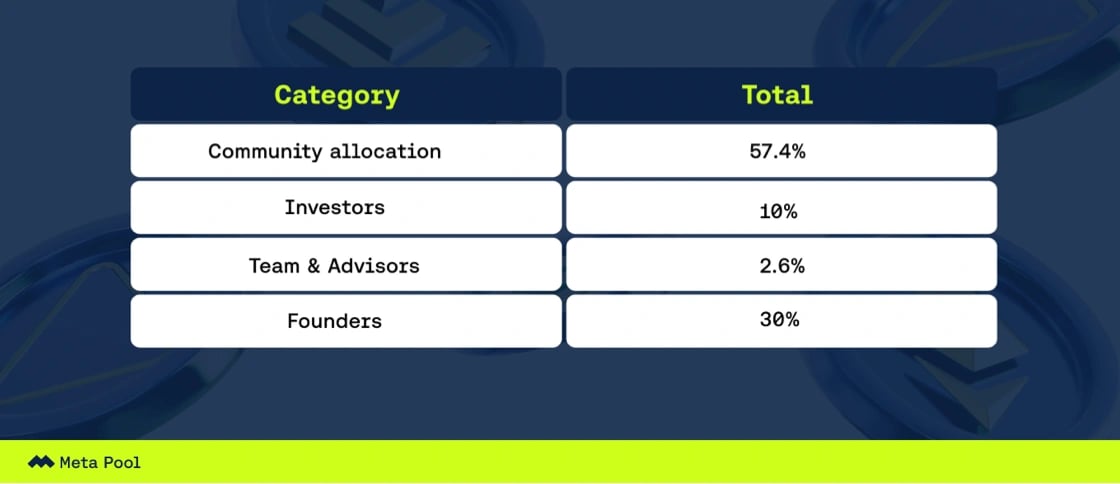

mpDAO 代币是 Meta Pool 的治理代币,最大供应量为 1,000,000,000 个代币。它有两种格式:NEAR 协议上的 NEP-141 和以太坊网络上的原生 ERC-20 代币。mpDAO 的分配分为四个类别。 [8]

作为建设者,团队欢迎社区成员参与到去中心化的进程中。Meta Pool DAO 将逐步承担更大的责任,包括: [8]

- 添加和删除区块链网络

- 更新 智能合约

- 调整产品费用

- 提出项目和倡议以获得支持

- 增强代币效用

未来的计划包括分享 Meta Pool DAO 的详细路线图,并邀请活跃的社区成员加入工作组,确保不同的观点指导组织走向更大的去中心化。 [8]

代币迁移

2024 年 4 月,Meta Pool 宣布批准 Meta Pool 改进提案 3,该提案涉及重新启动治理代币。此过渡符合 Meta Pool 的多链治理愿景,使用户能够控制其资产并参与塑造协议的未来。 [9]

社区完成了几个准备阶段,并进入代币迁移阶段,从 $META 代币过渡到 $mpDAO 代币。迁移期为 2024 年 4 月 15 日至 4 月 30 日。 [9]

在此期间,用户将其 $META 锁定头寸迁移到新的 mpDAO 投票合约。具有正在进行的解锁头寸的用户重新锁定它们以继续进行迁移。即使在迁移后,旧的锁定的 META 和投票仍然有效,直到四月底。所有锁定头寸都得到保留,确保新合约中的 mpDAO 锁定天数与旧的 $META 合约中的锁定天数相同。 [9]

迁移完成后,用户每锁定一个 $META 代币,就会收到一个锁定的 $mpDAO 代币。 [9]

mpDAO

mpDAO(Meta Pool的去中心化自治组织)是Meta Pool生态系统的核心治理系统。它促进透明度、包容性和去中心化。通过mpDAO,社区参与决策、提案批准和资源分配,从而塑造Meta Pool的流动性质押和DeFi解决方案的发展。[10]

合作关系

QiDAO

Meta Pool 宣布与领先的去中心化金融协议 QiDAO 建立战略联盟,以增强 MAI 稳定币的发行,使用 Meta Pool 的流动性代币 mpETH 作为抵押品。 [11]

该合作关系侧重于 mpETH,它提供 5% 的 APY 并持续积累质押奖励,使其成为理想的抵押品选择。此次合作还通过与低成本交易平台 Linea 的集成来降低交易成本。Meta Pool 和 QiDAO 将与 Lynex 合作推广 mpETH<>MAI 池。 [11]

Meta Pool 用户可以获得每月 3,000 美元至 4,000 美元的可变月度奖励,并且可以使用 mpETH 作为抵押品来铸造 MAI,从而产生额外的收益。 [11]

该联盟支持 Meta Pool DAO 的发展,改善 staking 体验,并加强加密货币生态系统,以实现更具包容性的数字经济。 [11]

Linea

本次合作旨在为Linea提供一种易于访问的流动性质押代币,以便大规模采用。借鉴以往的合作经验,例如与Aurora的合作,开发团队宣布计划使用经过测试和审计的合约,为Linea上的wETH代币持有者在以太坊区块链上实现原生质押,从而无需支付高昂的gas费用。[12]

TENET

通过与TENET的合作,mpETH持有者可以以非托管的方式将其LST委托给TENET网络,无论是作为验证者还是委托人。这使他们能够从以太坊网络赚取质押奖励,以及来自多元化权益证明协议的额外区块奖励和交易费用。 [13]

TENET提出了一个跨链合作,以增强区块链安全性,其中Meta Pool DAO可以贡献mpETH来保护他们的协议。一旦mpETH被委托,持有者可以铸造tmpETH,用作抵押品来借用LSDC,这是TENET的原生稳定币,由Liquity的修改版本支持,该版本适用于多种抵押品。 [13]

Ref Finance

与 Ref Finance 的合作宣布在其AMM平台上推出首个stNEAR池。Meta Pool被认为是NEAR最初的流动性质押提供商,在Ref Finance上推出了stNEAR-wNEAR交易对。通过此次合作,超过2100名使用流动性质押平台的stNEAR持有者可以选择参与Ref协议,从而通过向stNEAR-wNEAR池提供流动性来赚取REF奖励。 [14]

Meta Pool流动性质押解决方案使NEAR用户能够获得来自NEAR协议的质押奖励,同时保留钱包中的stNEAR以供使用。此外,Ref Finance正在接受stNEAR与wNEAR配对,形成一个新的激励流动性池,为流动性提供者提供利用其stNEAR代币赚取REF代币的机会。 [14]

融资

Meta Pool 在关键支持者的支持下获得了种子轮融资。在成功启动社区后,他们与 NEAR 代币的长期持有者进行了互动。根据 Messari 的一份报告,NEAR 是风险投资公司持有的顶级数字资产之一。[15]

这促成了与机构投资者的互动,并得到了 Proximity Labs 和顾问的支持。Meta Pool 欢迎 Dragonfly Capital、A&T Capital、Move Capital、Blockwall、D1 Ventures 和 Sky Vision Capital 成为新的合作伙伴。这些机构将帮助在 NEAR 协议上开发领先的流动性质押解决方案,并支持 DeFi 生态系统,为提升 NEAR 生态系统的价值提供指导。[15]

发现错误了吗?