订阅 wiki

Share wiki

Bookmark

Synthswap

0%

Synthswap

Synthswap 是建立在 Base 生态系统上的一个 去中心化交易所 (DEX),利用 自动化做市商 (AMM) 模型进行交易和 收益耕作。它作为一个非托管协议运行,具有低 交易费用,并专注于用户治理和高效的 流动性 管理。 [1]

概述

Synthswap 是 Base 生态系统中的一个 去中心化交易所 (DEX),利用 自动化做市商 (AMM) 模型。使用非托管协议,用户可以进行交易并参与 收益耕作。Synthswap 不直接执行交易或提供清算服务,而是提供有关其协议的信息,确保用户了解其运营和更广泛的生态系统。 [2][3]

该平台不控制或管理用户的 加密货币 资产,并且不参与交易。它也不认可第三方资源,保持对去中心化的关注。主要功能包括低 交易费用,这是通过集中和主动的 流动性 管理实现的,从而优化了效率并提高了 质押 和 收益耕作 的回报。 [2][3]

Synthswap 通过治理投票强调社区参与,允许用户影响协议变更。它提供以用户为中心的去中心化体验,专注于低费用、高效的 流动性 和社区驱动的治理,同时保持纯粹的信息角色。 [2][3]

特点

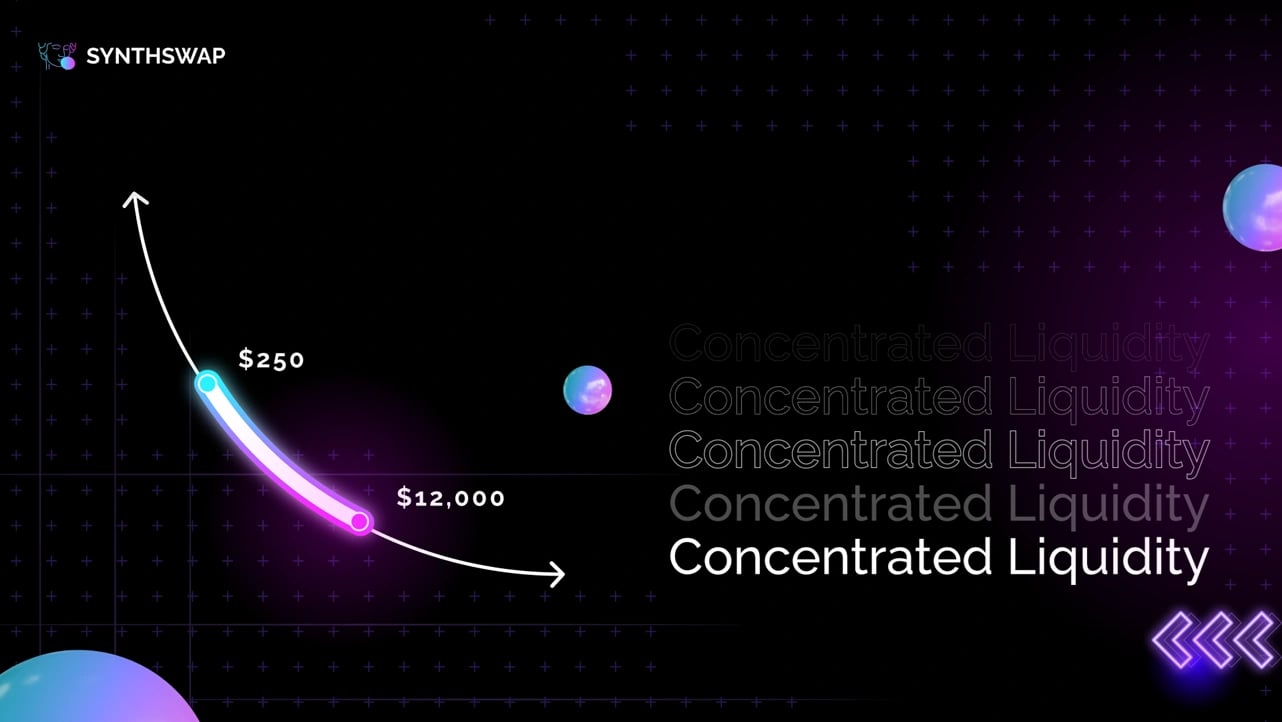

集中流动性

集中 流动性 允许 流动性提供者 (LP) 在自定义价格范围内分配资金,从而优化资本效率并最大限度地减少 无常损失。与早期的 XYK 公式等模型不同,在 XYK 公式中,流动性 分布在所有价格范围内,而集中 流动性 则将资金集中在特定区间内。这确保了当价格进入其指定范围时,LP 可以赚取更高的 交易费用,因为他们的 流动性 会在交易中被积极使用。这种方法提高了费用产生,减少了交易者的 滑点,并允许 LP 根据自己的喜好定制头寸,从而使 流动性 管理更加高效和有利可图。 [4]

Gamma

使用 Gamma 的主动流动性管理 (ALM) 可自动执行 流动性 再平衡和费用复合,从而优化用户资本效率。Gamma 是一种非托管协议,通过处理再平衡和头寸设置等任务来简化集中 流动性 池的管理,从而降低了 去中心化金融 中主动 流动性 管理的复杂性。通过自动化这些流程,Gamma 缓解了集中 流动性 的挑战,例如 无常损失 和持续监督的需要,同时允许通过 流动性 头寸的 ERC-20 表示形式实现更高的可组合性。 [5]

期货

期货合约允许交易者在不拥有标的资产的情况下推测 加密货币 的未来价值。交易者可以从上涨和下跌的市场中获利,多头头寸旨在从价格上涨中获利,而空头头寸则从价格下跌中获利。在 Synthswap 上,用户可以参与高达 x50 倍杠杆的期货交易,从而允许他们以市价或限价单开设多头或空头头寸。该平台还支持无价格影响的互换,从而在管理交易策略方面提供了灵活性。主要风险包括价格变动对交易者头寸的不利影响,从而导致潜在损失。 [6]

SYNTH

SYNTH 代币是 Synthswap 的原生代币,遵循公平启动模型进行分发,旨在实现去中心化和公平性。没有对团队或投资者的初始分配,并且该代币使用固定供应量以及线性排放和通货紧缩机制来随着时间的推移减少总体供应量。 [7]

代币经济学

SYNTH 的最大供应量为 250,000 个代币,并具有以下分配: [7]

- 流动性激励:35%

- 核心贡献者:25%

- 开发/营销:20%

- 生态系统/合作伙伴:15%

- 协议流动性:5%

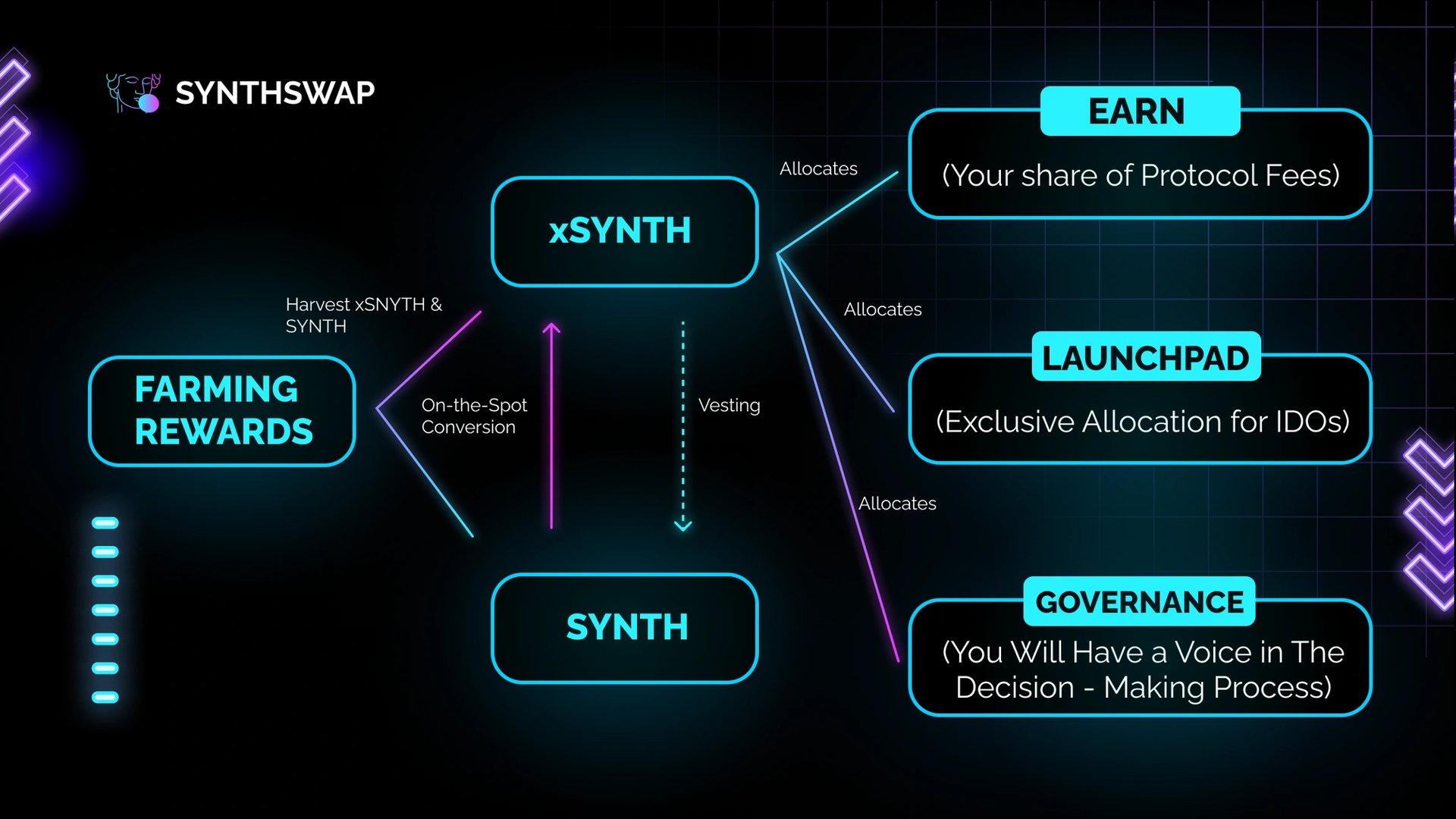

xSYNTH

xSYNTH 是一种不可转让的托管代币,与 SYNTH 协议相关联。它代表 质押 的 SYNTH,用于利润分享、治理和启动板分配。通过 质押 xSYNTH,用户可以赚取奖励、参与协议利润并影响治理决策。奖励每月不同,具体取决于当前的周期对。此外,质押 xSYNTH 增加了平台上启动板的项目分配机会。xSYNTH 可以在归属期后转换回 SYNTH,完全转换可以在 180 天后进行,部分转换可以在 14 天后进行,剩余的 SYNTH 将被 销毁。 [8]

合作伙伴

- Algebra

- Axelar

- PeckShield

- Rabby Wallet

- Firebird Finance

- Kado

- Yahoo! Finance

- Bloomberg

- Cointelegraph

发现错误了吗?