위키 구독하기

Share wiki

Bookmark

Celo

0%

Celo

Celo는 빠른 속도와 저렴한 비용으로 전 세계 결제를 위해 설계된 Ethereum 레이어-2 및 모바일 우선 블록체인 네트워크입니다. Celo 생태계에는 지분 증명 블록체인 (Celo 플랫폼), 기본 CELO 토큰, USDC 및 USDT가 가스 통화, Mento 스테이블 자산 (cUSD, cEUR, cREAL, eXOF), 그리고 Uniswap V3, Curve, Chainlink 및 Rarible과 같은 인프라와의 통합이 포함됩니다. 2020년 지구의 날에 출시된 Celo의 오픈 소스 메인넷은 전 세계 번영을 목표로 하는 1,000개 이상의 프로젝트를 지원합니다. Rene Reinsberg와 Marek Olszewski는 Celo, Celo 재단 및 cLabs의 공동 창립자입니다. [1][2]

개요

Celo는 빠르고 저렴한 글로벌 결제를 위해 설계된 이더리움 레이어-2 및 모바일 우선 블록체인 네트워크입니다. 모바일 사용자에게 접근 가능한 글로벌 금융 생태계를 조성하여 휴대폰 번호만으로 진입할 수 있도록 설계되었습니다. 주요 기능으로는 레이어-1 프로토콜, EVM 호환성, 지분 증명, 탄소 네거티브 접근 방식, 모바일 우선 신원, 초경량 클라이언트, 현지화된 스테이블코인 (cUSD, cEUR, cREAL), 여러 통화로 지불 가능한 가스 등이 있습니다. Celo는 분산형 신원 레이어를 사용하여 전화 번호를 지갑 주소에 매핑하여 간편한 결제를 지원하며, 모바일 참가자는 시스템 보안 및 유지 관리에 대한 보상을 받습니다. 새로운 주소 기반 암호화 알고리즘과 법정 통화에 고정된 안정적인 가치 토큰을 사용하여 Celo는 전화 번호를 지갑 주소에 매핑하고 시스템 보안 및 유지 관리에 대한 보상을 제공함으로써 문자를 보내는 것처럼 쉽게 결제를 보낼 수 있도록 합니다. [1][2]

Dango 테스트넷

EthCC 2023에서 처음 제안된 Dango 테스트넷은 Celo 레이어 2를 위한 첫 번째 공개 테스트 네트워크이며, Cel2에서 작업하는 개발자를 대상으로 합니다. 2024년 7월 7일에 출시되었으며, 목표는 성공적인 상태 마이그레이션을 시연하고 미래 개발을 위한 견고한 기반을 마련하는 것입니다. Dango는 기존 Alfajores 테스트넷과 함께 실행되어 인프라 제공업체가 다른 테스트넷 및 궁극적으로 Celo 메인넷을 업그레이드하기 전에 L2 코드베이스에 적응할 수 있도록 합니다. Dango는 Celo의 대부분의 기능을 유지하면서 전체 Alfajores 기록 및 상태, CELO 토큰의 이중 사용, 수수료 추상화, 레이어 1과의 기본 브리징, EigenDA를 통한 데이터 가용성, 스테이킹 및 Ultragreen Money와 같은 새로운 기능을 추가합니다. [10][14]

아키텍처

Celo 스택

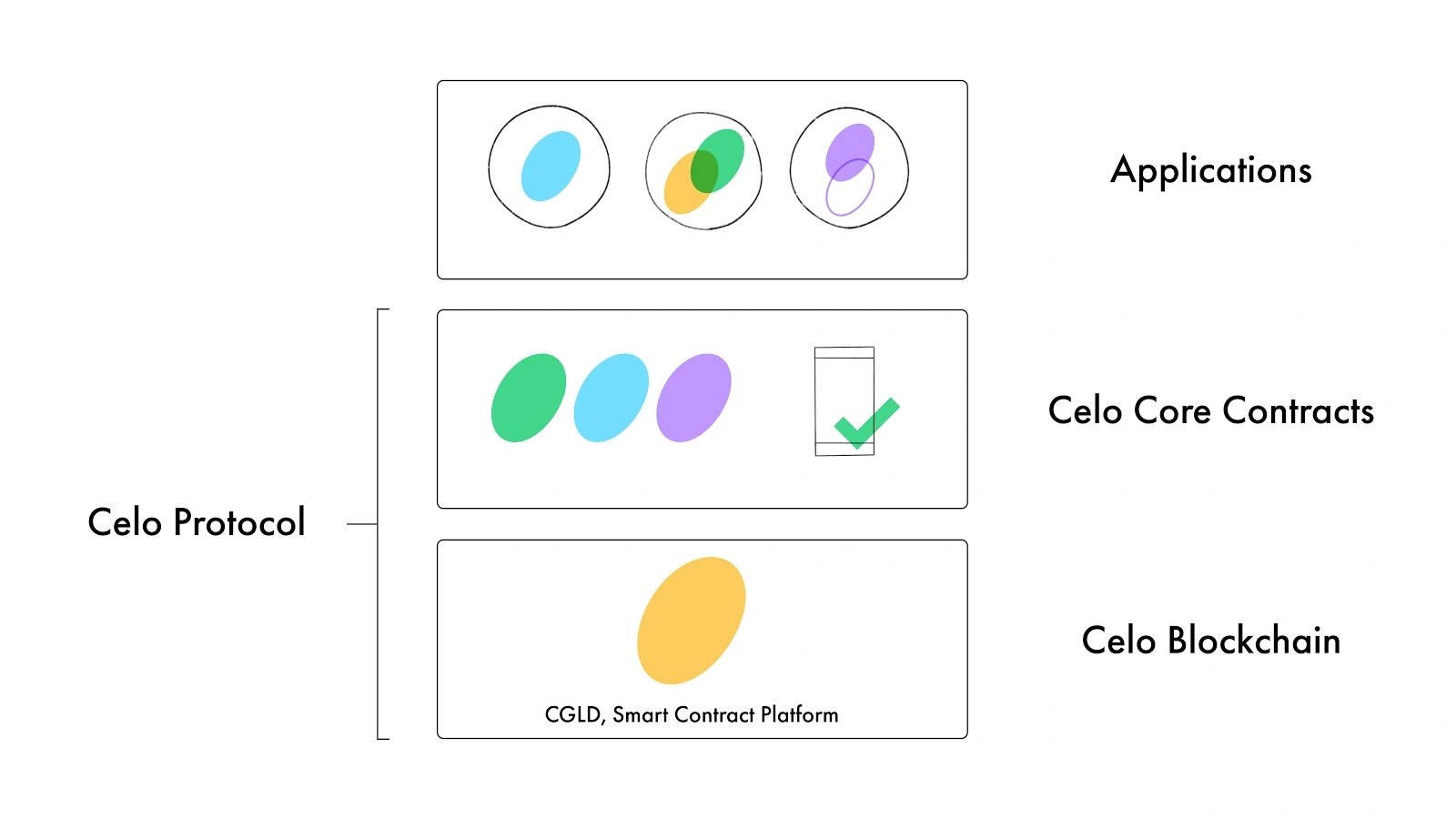

Celo는 암호화폐에 익숙하지 않고 연결성이 제한된 저가 장치를 사용하는 사람들에게 간단한 사용자 경험을 제공하는 데 중점을 둡니다. 네트워크 노드 운영자와 같은 다른 이해 관계자를 고려하면서 최종 사용자를 염두에 두고 각 레이어를 설계하는 풀 스택 접근 방식을 사용합니다. [3]

Celo 블록체인

Celo는 안전하고 분산화된 트랜잭션 및 스마트 컨트랙트를 가능하게 하는 개방형 암호화 프로토콜입니다. 이더리움과 유사하며 완전한 EVM 호환성을 유지하지만, Celo는 작업 증명 대신 비잔틴 장애 허용 (BFT) 합의 메커니즘 (지분 증명)을 사용합니다. 고유한 블록 및 트랜잭션 형식, 클라이언트 동기화 프로토콜, 가스 지불 및 가격 책정 메커니즘을 특징으로 합니다. [3]

핵심 컨트랙트

Celo 핵심 컨트랙트는 Celo 블록체인의 스마트 컨트랙트로 구성되어 있으며, ERC-20 스테이블 통화, 신원 증명, 지분 증명 및 거버넌스와 같은 플랫폼 기능을 처리합니다. 분산형 거버넌스 프로세스가 이러한 업그레이드 가능한 컨트랙트를 관리합니다. Celo 지갑 앱과 같이 Celo 플랫폼에 구축된 애플리케이션을 통해 최종 사용자는 Celo 블록체인과 상호 작용하고 Celo 핵심 컨트랙트의 API를 호출하여 계정을 관리하고 결제를 할 수 있습니다. 타사 개발자는 사용자 정의 스마트 컨트랙트를 배포하여 이러한 핵심 컨트랙트를 활용할 수 있으며, 일부 애플리케이션 기능은 중앙 집중식 클라우드 서비스를 사용할 수 있습니다. Celo 블록체인과 Celo 핵심 컨트랙트의 결합은 Celo 프로토콜을 형성합니다. [3]

Celo 프로토콜

Celo의 블록체인 참조 구현은 Ethereum 프로토콜의 Go 구현체인 go-ethereum을 기반으로 합니다. Celo 팀은 Ethereum을 자체 궤적을 가진 독립적인 프로젝트로 인식하면서도 Geth 커뮤니티의 기초 작업에 힘입어 변경 사항을 기여하고자 합니다. Celo 프로토콜의 핵심 구성 요소는 스마트 계약 수준과 오프체인에서 구현됩니다. Celo는 새로운 블록에 합의하기 위해 비잔틴 장애 허용(BFT) 합의 프로토콜을 사용합니다. 이 합의 프로토콜에 참여하는 소프트웨어 인스턴스는 검증자로 알려져 있으며, 특히 활성 또는 선출된 검증자는 적극적으로 선택되지 않은 등록된 검증자와 구별됩니다. Celo의 합의 프로토콜은 AMIS에서 개발하고 go-ethereum에 대한 확장으로 제안된 Istanbul(IBFT)을 기반으로 합니다. IBFT는 go-ethereum에 병합되지 않았지만 Quorum 및 Pantheon 클라이언트에 모두 변형이 존재합니다. Celo는 최신 go-ethereum 릴리스에 맞춰 Istanbul을 업데이트하여 정확성 활성도 문제를 해결하고 확장성 및 보안을 강화했습니다. [4]

검증자 선거

Celo의 검증자 선거에서 기본 자산인 CELO 보유자는 참여하여 보상을 얻을 수 있습니다. 계정은 검증자를 직접 투표하는 대신 검증자 그룹에 투표합니다. 투표하기 전에 CELO 보유자는 잔액을 Locked Gold 스마트 계약으로 이동합니다. Locked Gold는 검증자 선거에서 투표하고, 검증자 또는 검증자 그룹으로 등록하기 위한 지분을 유지하고, 온체인 거버넌스 제안에 투표하는 데 동시에 사용할 수 있습니다. 이를 통해 검증자와 그룹은 지분으로 투표하고 보상을 얻을 수 있습니다. [5]

초경량 동기화

이더리움의 풀, 패스트, 라이트 싱크 모드 외에도 Celo는 초경량 싱크 모드를 지원합니다. 초경량 노드는 이전 각 에포크의 마지막 헤더를 다운로드하고 유효성 검사기 세트 차이를 적용하여 현재 에포크에 대한 유효성 검사기 세트를 계산합니다. 그런 다음 최신 블록 헤더를 다운로드하여 현재 에포크에 대한 유효성 검사기 세트의 최소 2/3가 서명했는지 확인합니다. 초경량 노드는 5초 블록 주기와 1일 에포크로 Celo 메인넷에서 최신 블록을 동기화하기 위해 라이트 노드보다 약 17,000배 적은 헤더를 다운로드합니다. [6]

거버넌스

Celo는 스마트 컨트랙트 변경, 스테이블 코인 추가 또는 준비 자산 할당 수정 등 프로토콜을 관리하고 업그레이드하기 위해 온체인 거버넌스 메커니즘을 사용합니다. 모든 변경 사항은 CELO 보유자의 승인을 받아야 하며, 제안 통과에 필요한 투표 수를 결정하는 정족수 임계값이 있습니다. [7]

Celo 네트워크

Celo 네트워크의 토폴로지는 다양한 구성으로 Celo 블록체인 소프트웨어를 실행하는 머신들로 구성됩니다. 검증자는 다른 노드로부터 트랜잭션을 수집하고, 관련 스마트 컨트랙트를 실행하여 새로운 블록을 형성하고, 비잔틴 장애 허용 (BFT) 합의 프로토콜을 사용하여 네트워크 상태를 발전시킵니다. BFT 프로토콜의 확장성 및 보안 제한으로 인해 제한된 수의 노드만이 지분 증명 메커니즘을 통해 검증자 역할을 할 수 있습니다. 검증자로 구성되거나 선출되지 않은 전체 노드는 주로 라이트 클라이언트의 요청을 처리하고 트랜잭션 수수료를 대가로 트랜잭션을 전달합니다. 그들은 최소한 부분적인 블록체인 기록을 유지하고 언제든지 네트워크에 참여하거나 떠날 수 있습니다. Celo Wallet을 위해 사용자 장치에서 실행되는 것과 같은 라이트 클라이언트는 전체 블록체인 상태를 유지하지 않고 계정 및 트랜잭션 데이터를 요청하고 새로운 트랜잭션을 서명하고 제출하기 위해 전체 노드에 연결합니다. [3]

Celo Wallet

Celo Wallet 애플리케이션은 사용자가 키와 계정을 사용하여 자금을 자체 보관할 수 있도록 하는 비관리형 지갑입니다. 트랜잭션 전송 및 잔액 확인과 같은 중요한 기능은 P2P 경량 클라이언트 프로토콜을 사용하여 신뢰 없이 실행됩니다. 그러나 지갑은 사용자 경험을 향상시키기 위해 몇 가지 중앙 집중식 클라우드 서비스를 사용합니다. 예를 들어 초대장을 미리 로드하기 위한 Google Play Services, 푸시 알림을 보내기 위한 Celo Wallet Notification Service, 트랜잭션을 쿼리하고 사용자 활동 피드를 구현하기 위한 GraphQL API를 제공하는 Celo Wallet Blockchain API가 있습니다. Google Play Store와 같은 플랫폼에서 Celo Wallet을 다운로드하는 사용자는 cLabs(또는 앱을 제공한 엔터티)과 Google이 올바른 바이너리를 제공할 것이라고 신뢰하며, 많은 사용자는 제공되는 추가 기능을 위해 중앙 집중식 서비스에 대한 이러한 의존이 허용 가능하다고 생각합니다. [3]

이니셔티브

Bloom

Bloom은 생태계 토큰 생성 이벤트(TGE)를 위한 자문 프로그램으로, 프로젝트가 TGE 준비 및 제품 로드맵 개발을 거치도록 안내합니다. 이 프로그램은 런치패드, 액셀러레이터 프로그램, 거래소 지원, 마케팅, 투자자 네트워크, 토큰 구조 및 배포에 대한 전략적 자문, 감사 서비스, 주요 오피니언 리더에 대한 액세스를 지원합니다. Bloom은 창업자가 장기적인 제품 개발 및 전략에 집중할 수 있도록 실질적인 지원을 제공하는 것을 목표로 합니다. [8]

세계 연결

2022년 4월, Celo 재단은 전 세계적으로 Celo의 고품질 온-오프 램프 개발을 촉진하기 위해 2천만 달러 규모의 "Connect the World" 캠페인을 시작했습니다. 이 이니셔티브에는 통합을 간소화하고 확장하기 위한 오픈 소스 API 사양인 FiatConnect 도입이 포함됩니다. 이 캠페인은 각 국가에서 FiatConnect를 통합하고 품질 표준을 충족하는 최초의 결제 제공업체에 5만 달러를 제공합니다. 또한 사용자 접근 비용을 줄이기 위해 모든 제공업체에 최대 10만 달러의 온-램프 수수료를 지원합니다. [9]

CELO

CELO는 Celo 블록체인의 기본 자산으로, 성장과 발전을 지원합니다. CELO 보유자는 보상을 받고, 검증인과 스테이킹하며, Celo 생태계의 미래에 영향을 미치는 제안에 투표할 수 있습니다. 토큰의 최대 공급량은 10억 개입니다. [2][11]

멘토

멘토(이전 CP-DOTO)는 사용자 수요에 따라 Celo 스테이블 자산의 공급을 조정합니다. 사용자는 CELO를 예치하여 새로운 Celo Dollar를 생성하거나 Celo Dollar를 CELO로 교환할 수 있습니다. 이 시스템은 CELO와 미국 달러 간의 정확한 오라클 환율에 의존합니다. Celo Dollar에 대한 수요가 공급을 초과하면 사용자는 시장 가격으로 CELO를 구매하고 Celo Dollar로 교환하여 더 높은 시장 가격으로 판매함으로써 이익을 얻을 수 있습니다. 반대로 수요가 감소하면 사용자는 더 낮은 가격으로 Celo Dollar를 구매하고 CELO로 교환하여 시장 가치로 판매할 수 있습니다. 멘토는 Uniswap 모델에서 영감을 받아 CELO와 Celo Dollar의 두 가상 버킷을 통해 준비금 고갈을 방지하는 것을 목표로 합니다. [12]

Granda Mento

Granda Mento는 Mento 및 장외 거래(OTC)의 한계를 해결하여 대량의 CELO를 Celo 스테이블 토큰으로 교환하는 것을 용이하게 합니다. Mento는 스테이블 토큰의 안정성을 효과적으로 유지하지만, 상수 곱 마켓 메이커는 대규모 거래에서 상당한 슬리피지를 유발할 수 있습니다. 여기서 슬리피지는 거래 중 가격 변동을 의미합니다. Granda Mento는 리저브를 사용하여 토큰을 발행하거나 소각하는 방식으로 Mento와 유사하게 작동합니다. 구매한 스테이블 토큰은 생성되고, 판매된 토큰은 소멸됩니다. 예를 들어, 50,000 CELO를 100,000 cUSD로 교환하면 CELO가 리저브로 전송되고 cUSD가 발행됩니다. Granda Mento는 기관 등급의 유동성을 제공하여 대량의 스테이블 토큰을 발행하거나 소각하는 것을 목표로 하며, 한 번에 수백만 개를 처리합니다. [13]

스테이블코인

Celo Dollars (cUSD), Celo Euros (cEUR) 및 Celo Reals (cREAL)은 빠르고 저렴하며 쉬운 모바일 거래를 위해 설계된 Mento 스테이블 코인입니다. 이러한 스테이블 코인은 저렴한 송금, 국경 간 결제, 글로벌 자선 지원 배포, 온라인 결제 및 특히 통화 변동성이 큰 시장에서 거래소 내 가치 이전을 용이하게 합니다. [2]

파트너십

- Safe

- Chainlink

- Animoca Brands

- Google Cloud

- Circle

- Rarible API

- Tether

- Optimism

- Brave

- EthicHub

- Toucan

- ZeroSwap

- Minipay

잘못된 내용이 있나요?