위키 구독하기

Share wiki

Bookmark

Centrifuge

0%

Centrifuge

Centrifuge는 온체인 금융 및 실제 자산 토큰화 플랫폼으로, 투자자에게 다양한 자산에 대한 접근성을 제공합니다. 이 프레임워크는 투명성을 높이고 투자자에게 더 나은 포트폴리오 인사이트를 제공하는 것을 목표로 합니다. [1][2][14]

역사

Centrifuge는 2017년에 블록체인 기술을 통해 금융 시스템의 비효율성을 해결하기 위해 설립되었습니다. [3]

2021년 중반, Centrifuge는 최초의 실제 자산 풀을 MakerDAO와 통합했습니다. 이는 MakerDAO를 신용 시설로 사용한 최초의 대출이자, 실제 자산으로 뒷받침되는 최초의 스테이블코인 (DAI)의 사례였습니다. 2021년 후반에는 RWA 마켓이 출시되었으며, Centrifuge의 RWA에 유동성을 제공하기 위해 Aave 프로토콜이 사용되었습니다. [1][3]

2022년 10월, BlockTower Credit은 Centrifuge를 통해 2억 2천만 달러 상당의 실제 자산을 자금 조달하여 담보 대출 운영을 온체인으로 가져온 최초의 기관 신용 펀드가 되었습니다. MakerDAO는 BlockTower의 Centrifuge 풀에 1억 5천만 달러의 선순위 자본을 제공했습니다. 이는 실제 자산에 대한 최대 규모의 온체인 투자였습니다. [4][5]

2023년, Centrifuge는 DAO, 스테이블코인 및 프로토콜과 같은 DeFi 네이티브 조직이 실제 자산 포트폴리오를 온보딩하고 확장하는 데 도움이 되는 제품인 Centrifuge Prime을 출시했습니다. 고객으로는 Frax 및 Gnosis가 있습니다. [6][7]

또한 2023년에는 Centrifuge가 최초의 실제 자산 서밋을 개최하여 전통 금융과 DeFi의 리더들을 모아 토큰화된 자산 산업의 미래를 가속화했습니다. Centrifuge는 또한 Circle, Coinbase 등과 같은 업계 리더들과 함께 토큰화된 자산 연합의 창립 멤버 중 하나였습니다. [3]

2023년 말, Centrifuge는 또한 유동성 풀을 출시했습니다. 이는 모든 EVM 기반 체인에 배포할 수 있는 스마트 계약으로, 이러한 체인의 사용자가 Centrifuge의 풀에 투자할 수 있도록 합니다. [3]

온체인 펀드 관리 플랫폼

2024년 3월 19일, Centrifuge는 펀드 관리를 보다 원활하게 제공하기 위해 신용 펀드를 퍼블릭 블록체인에 온보딩하도록 설계된 펀드 관리 플랫폼 출시를 발표했습니다. [15][16][17]

"기관 투자자는 최고의 기회가 온체인에 있을 때 올 것입니다."라고 Centrifuge의 공동 창립자인 Lucas Vogelsang이 말했습니다. [15]

"그래서 우리는 자산 관리자가 온체인에서 더 나은 비즈니스를 구축하는 데 필요한 보고, 자동화 및 타사 통합 기능을 제공하여 펀드를 토큰화하도록 유도하는 데 집중하고 있습니다."[15]

자금 조달

2022년 11월, Centrifuge는 4백만 달러의 전략적 자금 조달 라운드를 발표했습니다. 이 라운드는 Coinbase Ventures가 주도했으며 L1 Digital 및 Scytale이 참여했습니다. 이 자금 조달은 Centrifuge가 엄청난 추진력을 얻고 금융 및 암호화폐 부문에서 실제 자산에 대한 관심이 높아지는 시기에 이루어졌습니다. [12][13]

그해 초, 암호화폐 및 블록체인 투자 회사인 BlockTower Capital은 Centrifuge와의 3백만 달러 전략적 파트너십을 발표했습니다. [12]

"우리는 미래의 신용 시장을 구축하고 있으며, 이와 함께 기관이 체인에서 거래할 수 있도록 금융 생태계를 구축해야 합니다."라고 Centrifuge의 CEO 겸 공동 창립자인 Lucas Vogelsang이 말했습니다. "Coinbase 및 BlockTower와 같은 파트너는 Centrifuge가 실제 자산 및 온체인 담보 신용을 위한 플랫폼이 됨에 따라 이 인프라의 중요한 부분을 구축하는 데 필수적입니다."[12]

개요

Centrifuge는 다양한 실제 자산 포트폴리오를 토큰화, 관리 및 투자하는 데 필요한 인프라와 생태계를 제공합니다. 이러한 자산 풀은 완전히 담보화되어 투자자에게 법적 구제 수단을 제공합니다. 이 프로토콜은 자산 클래스에 구애받지 않으며 구조화된 신용, 부동산, 미국 국채, 탄소 배출권 및 소비자 금융과 같은 다양한 자산을 수용합니다. [1][8]

또한 Centrifuge의 생태계에는 금융 전문가와 개발자가 지원하는 DAO가 포함됩니다. 목표는 전체 구조화된 신용 시장을 블록체인으로 가져와 금융 시스템의 투명성과 경제성을 높이는 것입니다. [1][8]

제품

Centrifuge Chain

Centrifuge Chain은 실제 자산(RWA) 자금 조달을 위해 특별히 구축된 레이어 1 블록체인입니다. Centrifuge Chain에는 풀, 자산, 트랜치, 온체인 거버넌스, 재무 및 CFG 토큰이 있습니다. 실제 자산은 온체인 표현을 만들기 위해 NFT(Non-Fungible Tokens)로 토큰화되고 자세한 오프체인 데이터에 연결됩니다. 자산은 함께 풀링되고 발행자가 증권화합니다. Centrifuge Chain은 온체인 RWA에 필요한 필수 기능과 기존 금융 시스템과의 통합을 가능하게 합니다. [9]

Centrifuge Chain의 기본 토큰인 CFG 토큰은 CFG 보유자가 Centrifuge 프로토콜 개발을 관리할 수 있도록 하는 온체인 거버넌스 메커니즘으로 사용됩니다. [9]

EVM 호환성을 통해 Centrifuge는 사용자가 MetaMask와 같은 인기 있는 Ethereum 기반 지갑을 통해 거래를 수행할 수 있도록 합니다. 유동성 풀을 통해 Ethereum(및 Ethereum 레이어 2) 생태계의 사용자는 Centrifuge 풀에 유동성을 기여할 수 있습니다. [9]

Centrifuge 앱

Centrifuge 앱은 투자자가 RWA에 투자하고 발행자가 자산 풀을 관리하고 토큰화된 자산에서 자금을 조달할 수 있는 인터페이스를 제공합니다. [1][9]

이 앱은 지원되는 모든 EVM(Ethereum Virtual Machine) 체인과 Centrifuge Chain과의 직접 연결을 통해 액세스할 수 있습니다. 유동성 풀의 통합은 지원되는 모든 EVM 체인에서 투자를 가능하게 하여 사용자가 Centrifuge의 풀에 투자하고 상환하기 위해 선호하는 체인(Ethereum, Arbitrum 등)에서 전환할 필요성을 제거합니다. [9]

유동성 풀

Centrifuge의 유동성 풀은 Ethereum 및 레이어 2 네트워크와 같은 모든 Ethereum Virtual Machine(EVM) 체인과 "Alt-L1"에 배포할 수 있는 스마트 계약 세트입니다. 유동성 풀을 통해 이러한 체인의 사용자와 조직은 기본 체인을 떠나지 않고도 Centrifuge의 풀에 투자할 수 있습니다. [9]

Centrifuge Prime

Centrifuge Prime은 DAO, 프로토콜 및 프로토콜 재단과 같은 엔터티와 같은 온체인 조직을 위해 설계된 제품입니다. Centrifuge Prime은 이러한 조직을 위해 RWA 포트폴리오를 온보딩하고 확장하는 프로세스를 간소화합니다. RWA 투자와 관련된 기술적 및 법적/오프체인 고려 사항을 모두 해결합니다. [9]

CFG 토큰

CFG는 Centrifuge의 기본 토큰으로, 중앙 집중식 제3자에 의존하지 않고 CFG 보유자가 Centrifuge의 개발을 이끌 수 있도록 하는 온체인 거버넌스 시스템을 용이하게 합니다. CFG는 또한 Centrifuge Chain에서 거래 비용을 지불하는 데 사용됩니다. Centrifuge 프로토콜 또는 CFG 토큰 모델의 모든 변경 사항은 거버넌스 제안을 거치며 CFG 토큰 보유자가 구현해야 합니다. [10]

거버넌스

CFG 토큰은 체인 런타임 코드를 업그레이드하기 위해 투표하여 프로토콜에 대한 지분에 비례하여 기술 거버넌스에 참여할 수 있는 능력에 활용됩니다. CFG 보유자는 제안에 대한 온체인 투표 메커니즘을 통해 거버넌스에 참여합니다. 런타임 업그레이드 제안은 토큰 보유자가 투표합니다. 승인된 제안은 온체인에서 프로그래밍 방식으로 제정됩니다. [11]

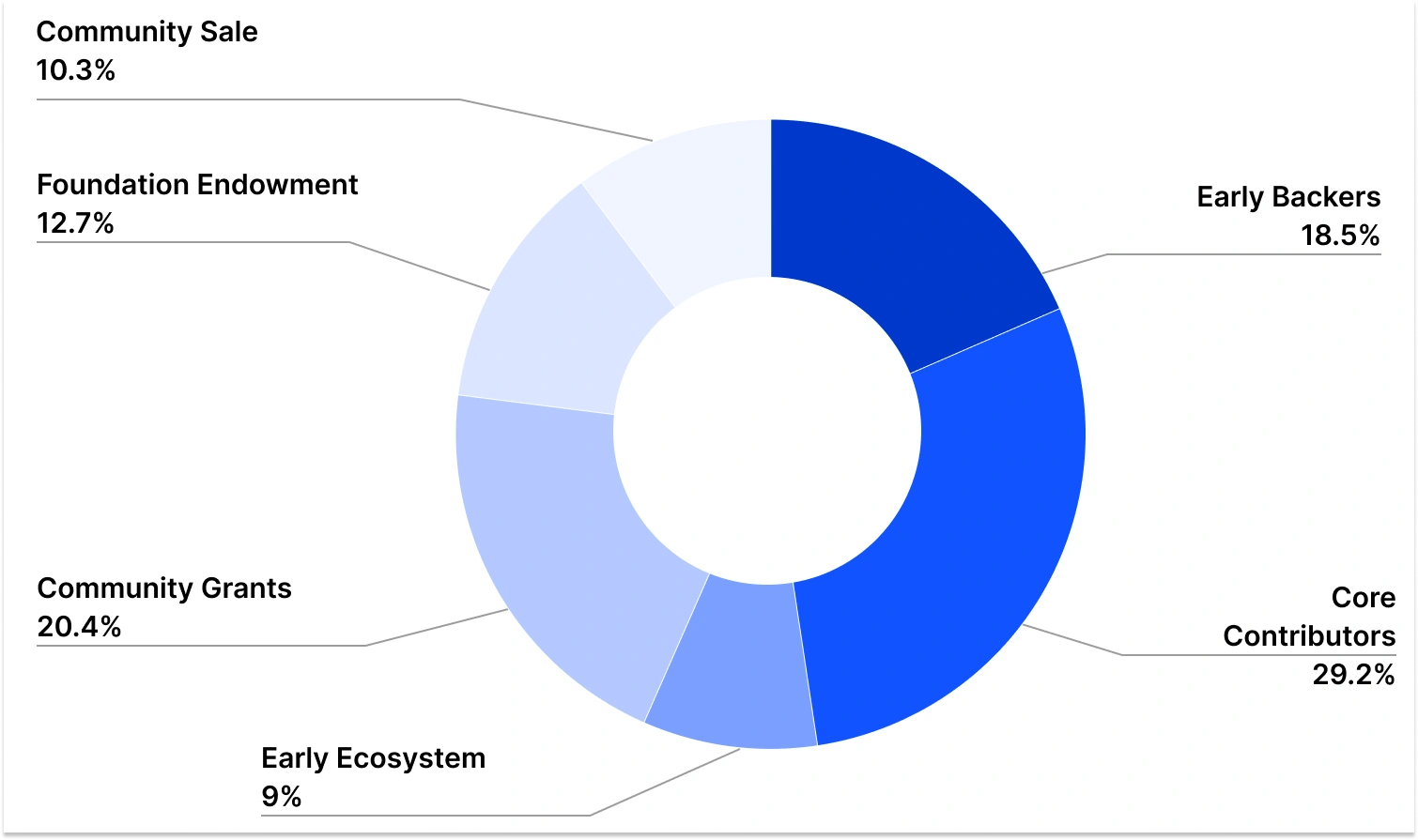

토큰노믹스 및 배포

CFG 토큰은 Centrifuge Chain에 기본적으로 존재하지만 Ethereum으로 1:1로 브리징되어 ERC-20 토큰으로 사용할 수 있습니다. ERC20 토큰은 Ethereum에서도 CFG라고 합니다. CFG는 거버넌스, 풀 시작 및 거래/풀 수수료 지불에 사용할 수 있습니다. [10]

최초 CFG 생성 이벤트는 Centrifuge Network Foundation에서 실행했습니다. 초기 배포는 4억 CFG를 생성했으며, 이는 재단 및 핵심 팀, 투자자 및 검증자를 포함한 초기 기여자에게 배포되었습니다. 제네시스 이후 체인 보안에 대한 보상과 채택을 장려하기 위해 추가 토큰이 민팅되었습니다. [10]

잘못된 내용이 있나요?