위키 구독하기

Share wiki

Bookmark

SingularityDAO

0%

SingularityDAO

Singularity DAO는 AI 알고리즘을 사용하여 동적으로 관리 및 최적화되는 암호화폐 자산 세트인 DynaSet을 감독하는 DAO (탈중앙화 자율 조직)입니다. 이는 AI 협업을 위한 탈중앙화 마켓플레이스인 SingularityNET의 AI 기반 위험 관리를 통합합니다.[1][2]

개요

SingularityDAO는 2021년 4월 28일에 소개되었으며, Marcello Mari가 CEO 겸 공동 창립자로, Ben Goertzel이 SingularityNET의 CEO 겸 공동 창립자로 함께 했습니다. SingularityDAO는 AI를 활용하여 포트폴리오 관리, 효율적인 자산 배분, 탈중앙화 거래소(DEX)에서의 유동성 공급을 수행합니다. AI 기반 데이터 분석 서비스를 통해 자동화된 거래 전략을 가능하게 하는 새로운 디지털 자산 관리자 생태계를 조성하는 것을 목표로 합니다. 2022년에는 LDA Capital이 SingularityNET과 SingularityDAO를 지원하기 위해 자금을 투입하여 제품 로드맵을 가속화할 계획입니다. 2,500만 달러의 투자를 확보했으며, 탈중앙화 금융(DeFi)에 AI 도구를 통합하고 생태계를 확장하는 데 중점을 두고 있습니다.[1][2][11]

SingularityNET은 누구나 AI 서비스를 대규모로 생성, 공유 및 수익화할 수 있는 탈중앙화 플랫폼입니다. SingularityDAO는 SingularityNET 생태계 내의 별도 법인으로, AI 및 블록체인 기술의 금융 응용에 특히 중점을 둡니다. SingularityDAO는 AI를 활용하여 탈중앙화 금융(DeFi) 운영 및 포트폴리오를 관리하고, AI 기반 금융 도구 및 서비스를 제공합니다. SingularityNET에서 개발한 AI 전문 지식과 기술을 활용합니다.[9]

DynaSets V1

SingularityDAO는 세 가지 주요 DynaSet을 제공했습니다. "dynBTC"와 "dynETH"는 수수료 절감이라는 추가적인 이점과 함께 비트코인과 이더리움에 대한 노출을 제공합니다. "dynDYDX"는 Dynamic Asset Manager가 dYdX 파생 상품 솔루션을 활용하여 암호화폐 자산 관리를 향상시키는 혁신적인 접근 방식을 제공합니다. 이 다이내믹 프레임워크는 사용자에게 SingularityDAO 프로토콜 내에서 다재다능하고 효율적인 암호화폐 자산 관리 옵션을 제공합니다.

SingularityDAO 프로토콜 내의 DynaSet은 사용자 공유 볼트로 기능하여 맞춤형 전략을 통해 포트폴리오 수익을 극대화하는 것을 목표로 합니다. 주로 자산 재조정에 중점을 두고 있으며, 향후 수익 최적화 전략과 타사 프로토콜과의 상호 작용을 통합할 계획입니다. "Dynamic" 섹션은 동적으로 관리되는 자산 세트를 특징으로 하고, "DynaLab" 섹션은 사용자가 베타 테스트에 참여할 수 있도록 초대합니다. 2024년 초 현재 SingularityDAO는 dynBTC, dynETH 및 dynDYDX의 세 가지 DynaSet을 제공합니다.[2][4][6][12]

DynaSets V1 프로세스

초기 출시 단계에서 사용자는 본디드 스테이킹과 유사하게 Forge에 자금을 기여하며, 창이 닫힌 후 Forge는 토큰을 가중 자산으로 통합하여 DynaSet 거래를 시작합니다. 이후 거래 실행 레이어에서는 Dynamic Asset Manager가 가격을 모니터링하고 사전 정의된 기준에 따라 거래를 실행하며, 분석을 위해 스마트 계약을 활용합니다. 이는 사용자가 롤링 진입 창 동안 Forge에 토큰을 스테이킹하는 기여 단계로 이어지며, 완료 시 성과 및 관리 수수료가 발생합니다. DynaSet 프로토콜은 주요 단계를 포함하며, 사용자는 DynaSet 가중치에 맞춰 토큰을 기여하고 LP 토큰을 발행하는 기여 단계에 참여합니다. 이후 거래 창에서는 Dynamic Asset Manager가 선택한 탈중앙화 거래소 애그리게이터를 통해 LP 토큰을 할당하고 리밸런싱합니다. Redeem 기능을 통해 사용자는 LP 토큰을 소각하여 기본 자산을 얻을 수 있으며, DynaSet의 거래 창 동안 관리 및 성과 수수료를 포함하는 주기적인 수수료가 발생하여 DAM 및 DAO 참가자에게 분배됩니다. DAO에 관심 있는 사용자는 플랫폼 내에서 SDAO 토큰을 스테이킹할 수 있습니다.[12][4]

SingularityDAO Pv2

DynaVaults

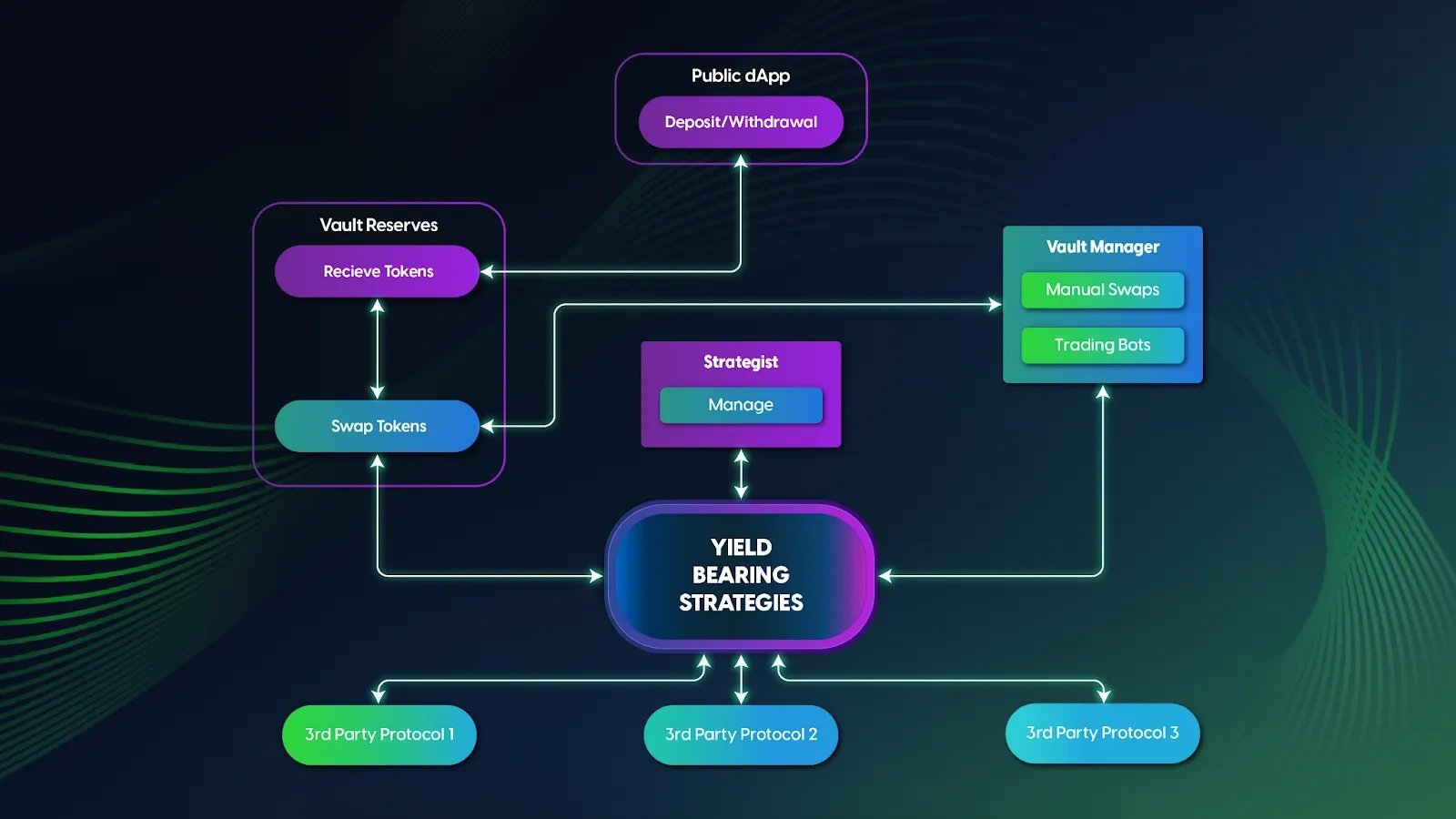

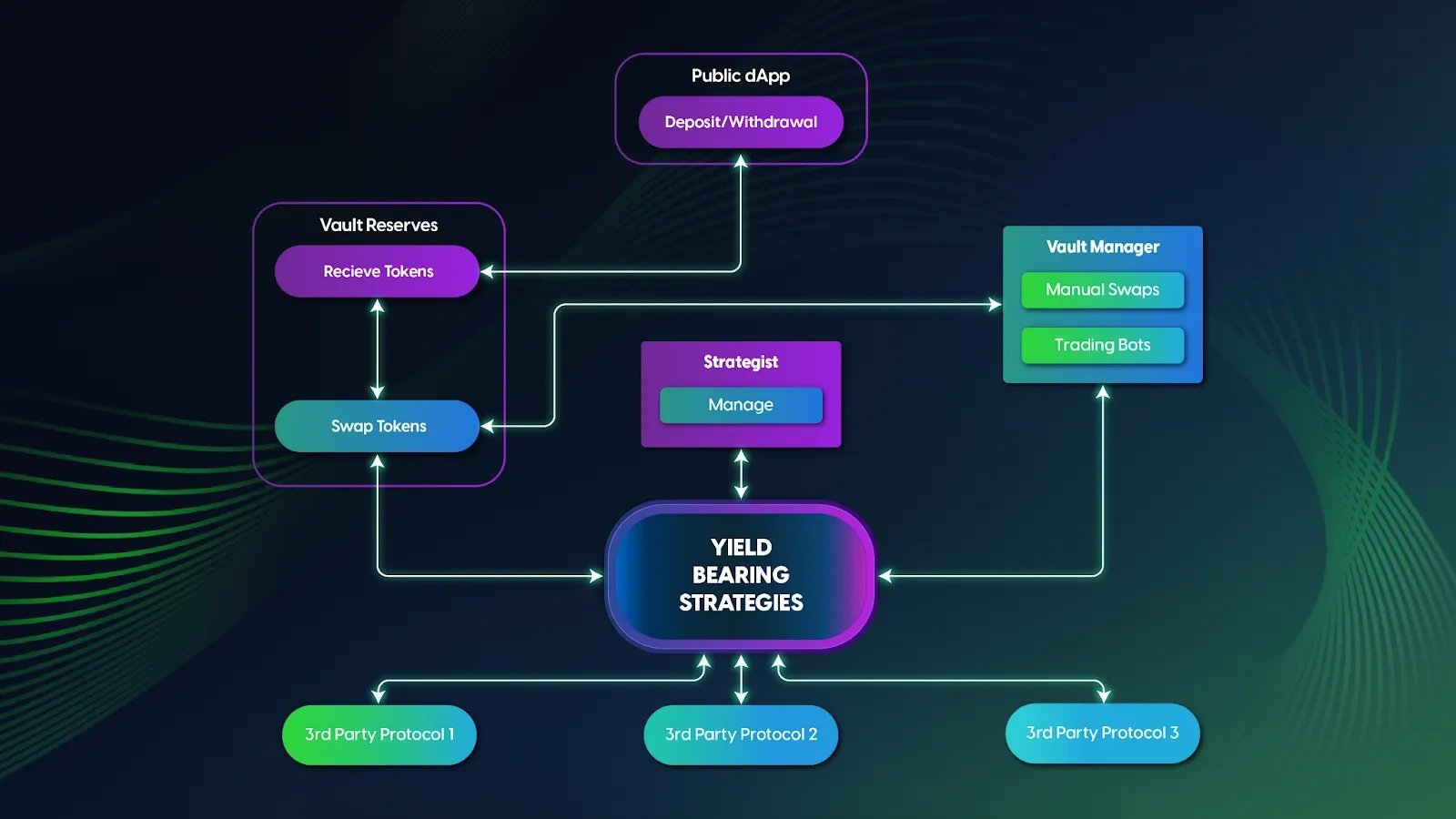

SingularityDAO의 Pv2 프레임워크 내에서 DynaVault는 AI 및 머신러닝 모델에 의해 구동되는 고급 자산 관리 시스템으로 기능하는 것을 목표로 합니다. 정적 DynaSet에서 동적 DynaVault로의 전환은 AI가 안내하는 전략을 실행할 수 있는 잠재력을 향상시키기 위한 것입니다. 이 볼트는 다양한 자산과 여러 전략을 수용하도록 설계되었으며, 가격, 볼륨, 위험 예측 및 감정 분석을 포함한 SingularityDAO의 AI 모델의 신호를 활용합니다. 유연성을 위해 DynaVault는 24시간 연중무휴 입출금 활동에 제한을 두지 않고 영향력 있는 전략에 자산을 할당합니다. 전략 전반에 걸쳐 생성된 수익은 LP 토큰 보유량에 따라 사용자에게 분배됩니다. 각 DynaVault에는 커뮤니티에서 승인한 지침에 따라 자본 및 위험 관리를 피하기 위해 볼트 관리자가 할당됩니다.[13]

미리 정의된 다이나볼트

SingularityDAO Pv2에서 미리 정의된 DynaVault는 이더리움 체인의 dynETH 및 dynBTC와 같이 롱온리 범주 내에서 현물 거래 및 수익 창출과 같은 전략을 구현하는 것을 목표로 합니다. 예를 들어, dynETH는 강세 시장에서는 $ETH를 보유하고 스테이킹하는 반면, 약세 시장에서는 $USDC 및 Aave와 같은 안정적인 전략으로 다각화합니다. BNB 체인의 dynBNB DynaVault는 $WBNB를 활용하여 롱온리 범주 내에서 유사한 전략을 사용하는 것을 목표로 합니다. dynL1BNB는 L1 토큰의 자동 재조정 인덱스 바스켓 역할을 하고, dynSING은 SingularityNET 생태계 토큰에 중점을 두며, 둘 다 현물 거래, 수익 창출 및 주기적인 재조정을 통합합니다.[14]

전략

전략

SingularityDAO는 자산 할당을 위해 DynaVault에 연결된 스마트 계약인 전략을 사용합니다. 이러한 전략은 개인 또는 AI 에이전트가 제안하고 관리하며, 자산이 DynaVault에 예치되면 자동으로 실행됩니다. 이들은 시장 상황과 위험 감수성에 따라 파밍 풀, 대출 프로토콜, 거래 포지션과 같은 금융 상품에 참여합니다.

DynaVault의 운영은 이러한 전략에 달려 있으며, 자산 관리에 유연성을 제공합니다. 프로세스에는 제안, 기술 감사 통과, 커뮤니티 승인 획득, DynaVault 통합이 포함됩니다. 예치된 자산은 하나 이상의 전략 계약에 배포되며, 최적의 수익을 위해 볼트 관리자가 모니터링합니다.

SingularityDAO의 전략은 기능적 전략과 볼트 리밸런싱 전략으로 나뉩니다. 전자는 수익 창출 및 파생 상품 전략과 같이 볼트 자본을 극대화합니다. 롱 온리 자동화 및 복잡한 양적 자동화와 같은 볼트 리밸런싱 전략은 특정 이벤트에 따라 리밸런싱 로직을 자동화합니다. SingularityDAO는 이러한 전략을 강화하기 위해 위험 엔진을 개발하고 있으며, 출구 유동성의 변화 및 급격한 가격 변동을 포함하여 블록체인의 사전 정의된 위험 이벤트에 대한 응답으로 자동으로 종료를 트리거합니다.[13][14]

LayerZero 브리지

SingularityDAO는 체인 간 통신을 강화하기 위해 LayerZero 프로토콜을 통합했습니다. 기존 브리지와 달리 LayerZero는 다양한 체인 간의 연결을 용이하게 하고 탈중앙화 및 보안 원칙에 부합하는 기본 레이어 역할을 합니다. 이 통합은 DynaVault 내에 OFT(Omnichain Fungible Token)를 도입하여 사용자가 여러 체인에서 자산 대출, 차입, 거래 및 스테이킹과 같은 활동에 참여할 수 있도록 합니다. LayerZero 브리지는 체인 간 자산 이동 프로세스를 단순화하여 사용자에게 LayerZero 생태계 내에서 보다 직접적이고 간소화된 경험을 제공하는 것을 목표로 합니다.[15]

토큰노믹스

SingularityDAO는 이더리움 블록체인에서 ERC-20 유틸리티 토큰인 SDAO 토큰에 의해 관리되는 탈중앙화 자율 조직(DAO)으로 운영됩니다. SDAO 토큰 보유자는 SingularityDAO 프로토콜 내에서 거버넌스 투표 이벤트에 참여할 권리가 있습니다.

SingularityDAO의 토큰 할당은 다양한 라운드와 범주에 걸쳐 분배됩니다.

- 시드 라운드: 가격은 0.15달러로, 50만 달러를 모금했으며 총 가치는 1,500만 달러입니다. 토큰은 20.0%의 베스팅 기간이 적용되며, 매월 6.67%의 비율로 해제됩니다.

- 프라이빗 라운드: 가치는 0.2달러로, 이 라운드에서 226만 달러를 모금했으며 총 가치는 2,000만 달러입니다. 시드 라운드와 유사하게 토큰은 20.0%의 베스팅 기간을 거치며, 매월 6.67%씩 해제됩니다.

- 퍼블릭 라운드: 가격은 0.3달러로, 이 라운드에서 40만 달러를 모금하여 3,000만 달러의 가치를 창출했습니다. 퍼블릭 라운드의 모든 토큰은 완전히 잠금 해제됩니다.

- 커뮤니티 라운드: 가격은 0.2달러로, 이 라운드에서 161만 달러를 모금하여 2,000만 달러의 가치를 기여했습니다. 토큰은 20.0%의 베스팅 기간이 적용되며, 매월 6.67%의 비율로 해제됩니다.

- 팀 및 어드바이저: 팀 및 어드바이저에게 할당된 토큰은 토큰 생성 이벤트(TGE) 시점에 베스팅 기간이 없으며, 매월 4.17%씩 해제됩니다.

- 에어드랍: TGE 시점에 25.0%를 나타내며, 매월 2.08%씩 해제됩니다.

- 보상: 보상 토큰은 TGE 시점에 8.33% 할당되며, 9일의 클리프 기간과 매월 8.33%의 해제율을 특징으로 합니다.

- 재단: 할당된 토큰은 TGE 시점에 베스팅 기간이 없으며, 매월 2.78%씩 해제됩니다.

- 파밍: TGE 시점에 2.5%를 차지하며, 토큰은 4일의 클리프 기간을 거친 후 매월 24.4%씩 해제됩니다.

- 생태계: 생태계 토큰은 TGE 시점에 베스팅 기간이 없으며, 12개월의 클리프 기간 후 매월 8.33%씩 해제됩니다.[2][8]

거버넌스

SingularityDAO는 분산형 거버넌스에 의존하여 커뮤니티 참여를 위한 포용적인 환경을 조성합니다. SingularityDAO 거버넌스 토큰(SDAO)을 사용하여 커뮤니티 구성원은 토론에 참여하고, 의견을 제공하며, 프로토콜 관련 제안에 투표할 수 있습니다.

제안은 DAO 내에서 소개되고 논의되며, 토론은 SingularityDAO Discord 및 포럼에서 진행됩니다. 제안에 대한 투표가 이어지며, SDAO 토큰 보유자는 저장 방법 또는 블록체인 네트워크에 관계없이 참여할 수 있습니다. 오프체인 멀티 거버넌스 클라이언트인 스냅샷을 사용하면 SingularityDAO 거버넌스 투표의 투명성과 검증 가능성이 보장됩니다. 이 프로토콜은 외부 개발자가 업그레이드를 제안할 수 있도록 점진적인 탈중앙화로의 전환을 약속합니다. 장기적인 목표는 프로토콜에 대한 완전한 통제권을 DAO로 이전하는 것이며, 이 프로세스는 활발한 커뮤니티 의견과 거버넌스 제안을 통해 해결되는 필요한 조정을 통해 관리됩니다.[10]

파트너십

Chainlink Labs

SingularityDAO는 Chainlink BUILD 회원들에게 런치패드 및 인큐베이션 서비스를 통해 향상된 기회를 제공하기 위해 Chainlink Labs와 파트너십을 체결했습니다. 탈중앙화된 AI 기반 암호화폐 자산 관리로 인정받는 SingularityDAO는 인큐베이션 프로그램을 통해 새로운 블록체인 프로젝트를 지원하고자 합니다. 이 협력은 BUILD 프로그램의 개발자들에게 혁신적인 Web3 애플리케이션을 만들 수 있는 유리한 조건을 제공하는 것을 목표로 합니다. 탈중앙화 컴퓨팅 플랫폼인 Chainlink는 업계에서 거래를 촉진하는 데 중요한 역할을 해왔습니다. [16]

잘못된 내용이 있나요?