Synthswap

Synthswap은 Base 생태계에 구축된 탈중앙화 거래소(DEX)로, 거래 및 수익률 파밍을 위해 자동화된 마켓 메이커(AMM) 모델을 활용합니다. 낮은 거래 수수료와 사용자 거버넌스 및 효율적인 유동성 관리에 중점을 둔 비수탁 프로토콜로 운영됩니다. [1]

개요

Synthswap은 Base 생태계 내의 탈중앙화 거래소(DEX)로, 자동화된 마켓 메이커(AMM) 모델을 활용합니다. 비수탁 프로토콜을 사용하여 사용자는 거래하고 수익률 파밍에 참여할 수 있습니다. Synthswap은 직접 거래를 실행하거나 청산 서비스를 제공하지 않지만, 프로토콜에 대한 정보를 제공하여 사용자가 운영 방식과 더 넓은 생태계를 이해하도록 보장합니다. [2][3]

이 플랫폼은 사용자의 암호화폐 자산을 통제하거나 관리하지 않으며 거래에 관여하지 않습니다. 또한 탈중앙화에 중점을 두고 제3자 리소스를 보증하지 않습니다. 주요 기능으로는 집중적이고 적극적인 유동성 관리를 통해 달성되는 낮은 거래 수수료가 있으며, 이는 효율성을 최적화하고 스테이킹 및 수익률 파밍으로부터의 보상을 향상시킵니다. [2][3]

Synthswap은 거버넌스 투표를 통해 커뮤니티 참여를 강조하여 사용자가 프로토콜 변경에 영향을 미칠 수 있도록 합니다. 낮은 수수료, 효율적인 유동성 및 커뮤니티 중심의 거버넌스에 중점을 둔 탈중앙화된 사용자 중심 경험을 제공하면서 순전히 정보 제공 역할만 유지합니다. [2][3]

특징

집중 유동성

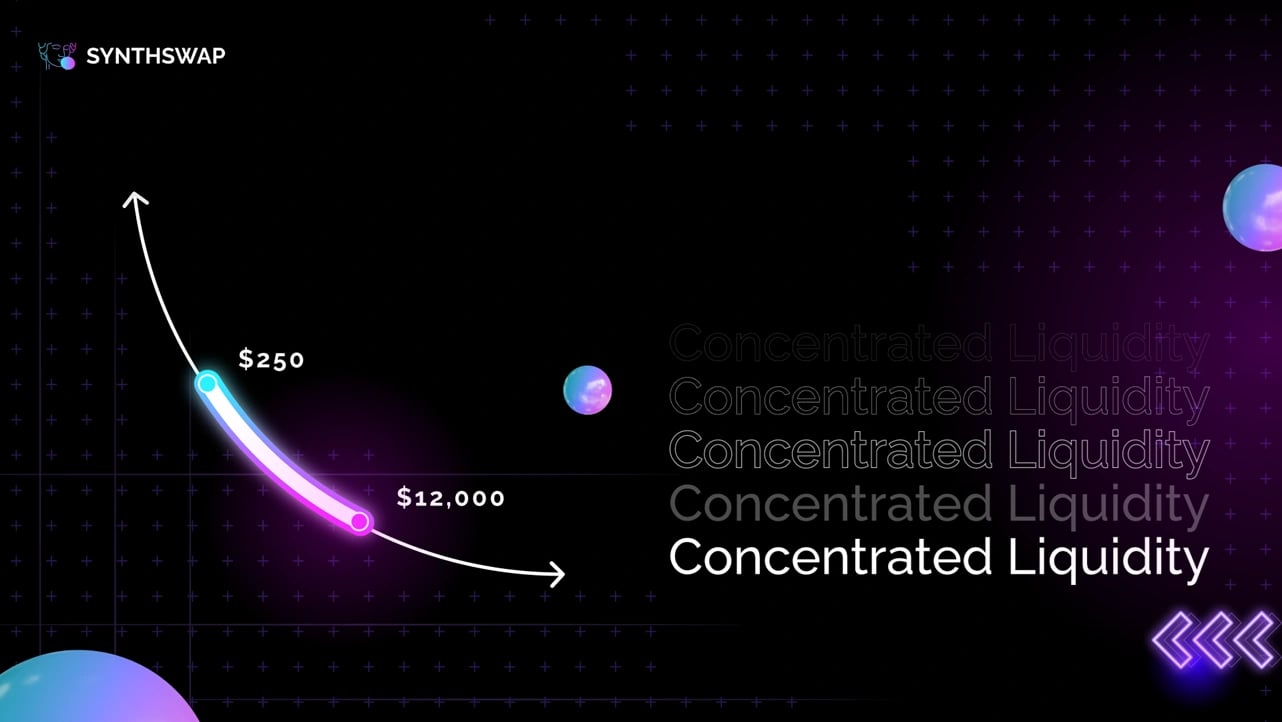

집중 유동성을 통해 유동성 공급자(LP)는 사용자 정의 가격 범위 내에서 자금을 할당하여 자본 효율성을 최적화하고 비영구적 손실을 최소화할 수 있습니다. 유동성이 모든 가격 범위에 분산된 XYK 공식과 같은 이전 모델과 달리 집중 유동성은 특정 간격 내에서 자금을 집중합니다. 이를 통해 LP는 가격이 지정된 범위에 들어갈 때 더 높은 거래 수수료를 얻을 수 있습니다. 이는 유동성이 거래에 적극적으로 사용되기 때문입니다. 이 접근 방식은 수수료 생성을 향상시키고, 거래자의 슬리피지를 줄이며, LP가 자신의 선호도에 맞게 포지션을 조정할 수 있도록 하여 유동성 관리를 보다 효율적이고 수익성 있게 만듭니다. [4]

감마

Gamma를 사용한 ALM(Active Liquidity Management)은 유동성 재조정 및 수수료 복리를 자동화하여 사용자 자본 효율성을 최적화합니다. Gamma는 재조정 및 포지션 설정과 같은 작업을 처리하여 집중 유동성 풀 관리를 단순화하는 비수탁 프로토콜로, 탈중앙화 금융에서 활성 유동성 관리의 복잡성을 줄입니다. 이러한 프로세스를 자동화함으로써 Gamma는 비영구적 손실 및 지속적인 감독의 필요성과 같은 집중 유동성의 문제를 완화하는 동시에 유동성 포지션의 ERC-20 표현을 통해 더 많은 구성 가능성을 허용합니다. [5]

선물

선물 계약을 통해 거래자는 기본 자산을 소유하지 않고도 암호화폐의 미래 가치에 대해 추측할 수 있습니다. 거래자는 상승 및 하락 시장에서 이익을 얻을 수 있으며, 롱 포지션은 가격 상승으로 이익을 얻고 숏 포지션은 가격 하락으로 이익을 얻는 것을 목표로 합니다. Synthswap에서 사용자는 최대 x50 레버리지로 선물 거래에 참여하여 시장가 또는 지정가 주문으로 롱 또는 숏 포지션을 열 수 있습니다. 이 플랫폼은 또한 가격 영향이 없는 스왑을 지원하여 거래 전략 관리에 유연성을 제공합니다. 주요 위험으로는 거래자의 포지션에 반하는 가격 변동이 있으며, 이는 잠재적 손실로 이어질 수 있습니다. [6]

SYNTH

Synthswap의 기본 토큰인 SYNTH 토큰은 분산화 및 공정성을 목표로 분배를 위한 공정한 출시 모델을 따릅니다. 팀이나 투자자에게 초기 할당이 없으며, 토큰은 시간이 지남에 따라 전체 공급량을 줄이기 위해 디플레이션 메커니즘과 함께 선형 배출을 사용하는 고정 공급량을 사용합니다. [7]

토큰노믹스

SYNTH의 최대 공급량은 250,000개이며 다음과 같이 할당됩니다. [7]

- 유동성 인센티브: 35%

- 핵심 기여자: 25%

- 개발/마케팅: 20%

- 생태계/파트너: 15%

- 프로토콜 유동성: 5%

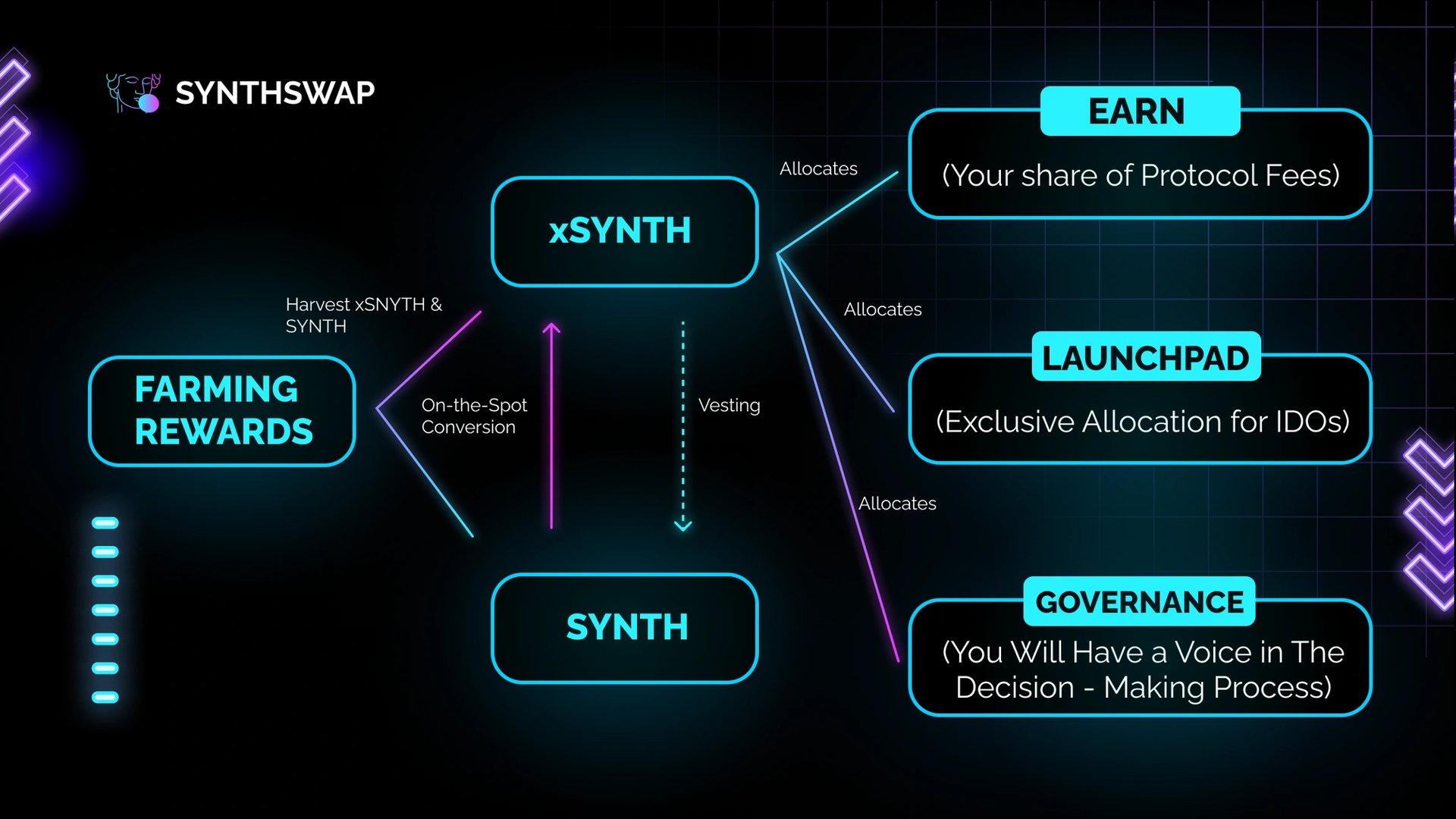

xSYNTH

xSYNTH는 SYNTH 프로토콜에 연결된 양도 불가능한 에스크로 토큰입니다. 스테이킹된 SYNTH를 나타내며 이익 공유, 거버넌스 및 런치패드 할당에 사용됩니다. xSYNTH를 스테이킹하면 사용자는 보상을 받고, 프로토콜 이익에 참여하고, 거버넌스 결정에 영향을 미칠 수 있습니다. 보상은 현재 주기 쌍에 따라 매월 다릅니다. 또한 xSYNTH를 스테이킹하면 플랫폼의 런치패드에서 프로젝트 할당 기회가 증가합니다. xSYNTH는 베스팅 기간 후에 SYNTH로 다시 전환할 수 있으며, 180일 후에 전체 전환이 가능하거나 14일 후에 부분 전환이 가능하며, 나머지 SYNTH는 소각됩니다. [8]

파트너십

- Algebra

- Axelar

- PeckShield

- Rabby Wallet

- Firebird Finance

- Kado

- Yahoo! Finance

- Bloomberg

- Cointelegraph