Read

Edit

History

Notify

Share

New Order

New Order is a community led venture DAO focused on DeFi projects. They provide incubation and acceleration to build startups through resources and expertise, and offer themselves as Co-Founders. The venture capital was founded with the goal of being a decentralized platform for edge-of-the-edge DeFi projects.

Overview

A fully decentralized incubator allows for community members to democratically allocate funding and resources to projects that they choose. The primary criteria used to guide decisions are a focus on the web3 ecosystem, introduction of new asset classes, and multi-chain operability. This is intended to ensure that the most disruptive technologies are at the forefront of DAO resource allocation.[1]

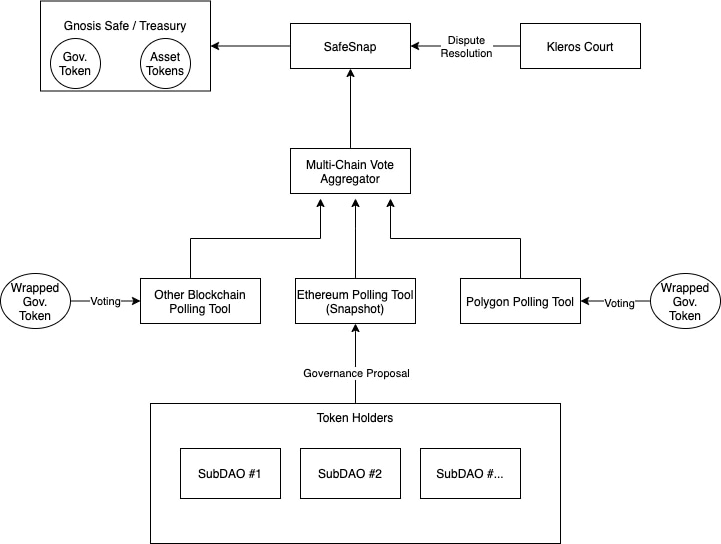

Governance

Governance is supervised by their own governance token, which allows participation in a distributed voting platform for allocating resources and responsibly distributes project funding and rewards to community members. Marketers and influencers will be chosen as members and rewarded for building awareness of launched projects.[2]

The treasury assets and revenue generated from launched projects are stored in a treasury vault that is managed through a voting mechanism. Stakeholders such as researchers and strategists are rewarded for creating new investment opportunities, uncovering promising projects, performing due diligence, and ensuring that the assets in the DAO are well positioned for long-term success. The tokens can also be utilized in the ecosystem through staking in liquidity mining programs or native DAO vaults, allowing for additional yield to be earned by the holders through an alignment of incentives with the protocol. [2]

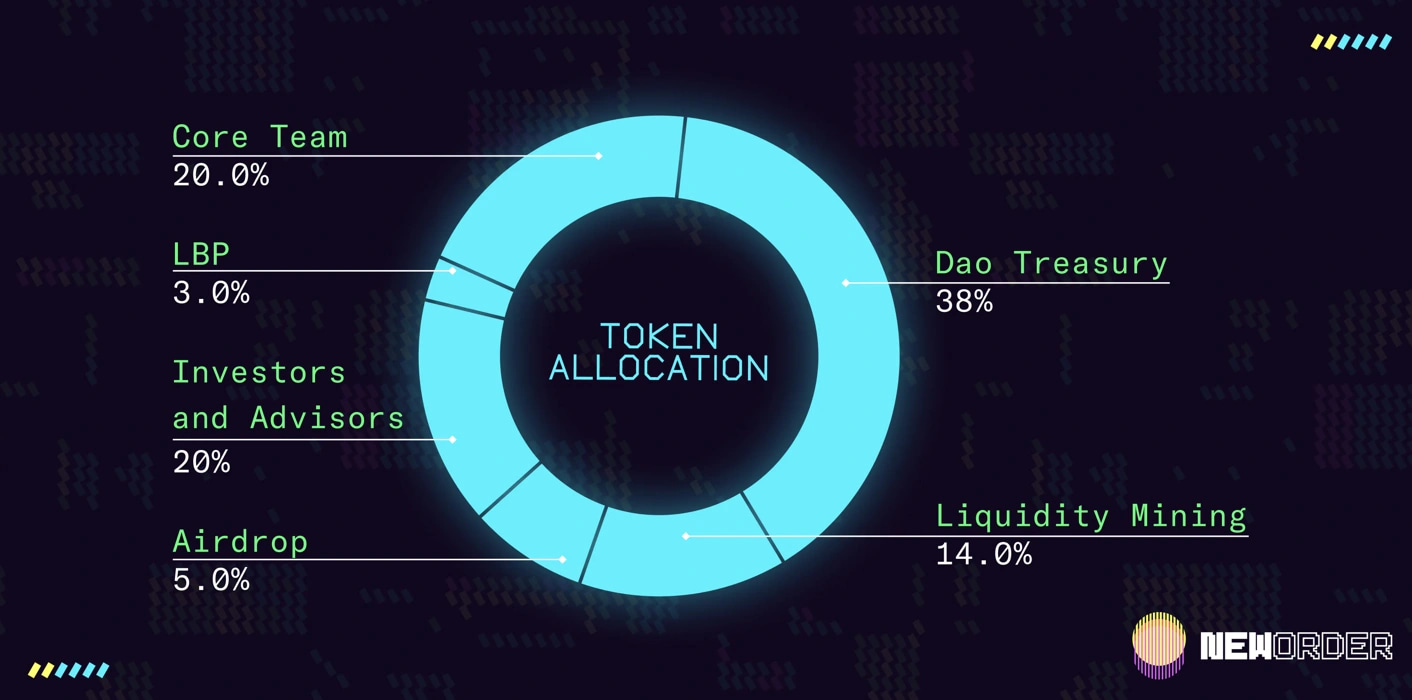

Tokenomics ($NEWO)

veNEWO

NEWO follows the vote-escrowed (ve) token model, which was firstly introduced by Curve and then followed by other protocols such as Frax and Balancer. In this system, users lock their tokens for a set period, and depending on the duration, its corresponding governance powers and rewards will be given. [4]

In New Order, there are five ways in which value will be generated for holders of veNEWO. These mechanisms increase the utility of the protocol for those who hold the token.[4]

- Governance Power: governance power is granted to veNEWO holders to incentivize engagement with incubation projects and protocol modifications. The longer the locking time, the higher the governance power the user holds

- Protocol Emissions: emission of veNEWO will be distributed to both holders and LP stakers, and they will also have the opportunity to receive an additional reward for holding their tokens in a locked state, with the amount of the reward varying

- Treasury Rewards: eNEWO holders have the opportunity to be eligible to earn rewards from the treasury, while LP stakers will not. The rewards are correlated to the yield generated by the tokens held in the treasury, and the yield sharing will be conducted on a monthly basis following the structure below:

- Airdrops: any project that is incubated by New Order will have airdrops that are exclusive to veNEWO holders. The amount of tokens that a holder will receive will depend on the length of time they have locked their tokens and the total number of tokens they have locked

- Whitelists: the same logistics applied to airdrops will work with whitelists of any incubated project

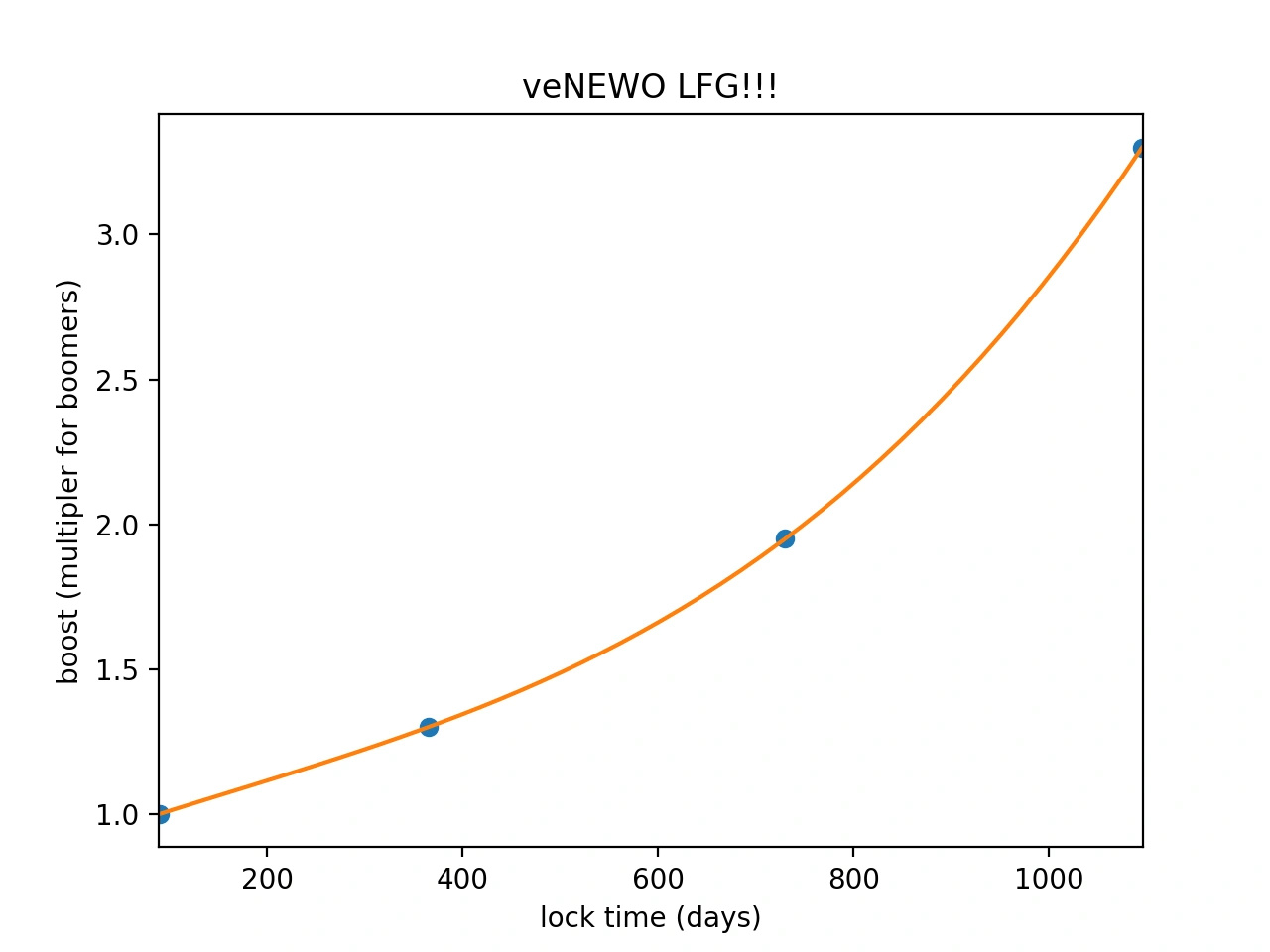

Locking details

Holders of NEWO will have the option to lock up their tokens for a period of time to receive a boost in veNEWO tokens. The minimum lock-up period is 3 months, which will result in a 1x boost, while the maximum lock-up period is 3 years, which will result in a 3.3x boost.

Portfolio

Portfolio

Redacted

Frogs Anonymous

Y2K Finance

H2O

OptyFi

Kima

Obey

Identdefi

Bright Union

Summeria Labs

Lazy Trade

New Order

Commit Info

Edited By

Edited On

January 28, 2023

Feedback

Average Rating

How was your experience?

Give this wiki a quick rating to let us know!

Twitter Timeline

Loading

REFERENCES

[1]

[2]

[3]

[4]

[5]

[6]

[7]

[8]

[9]

[10]

[11]

[12]

[13]

[14]

[15]

[16]