Subscribe to wiki

Share wiki

Bookmark

Convergence Finance

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Convergence Finance

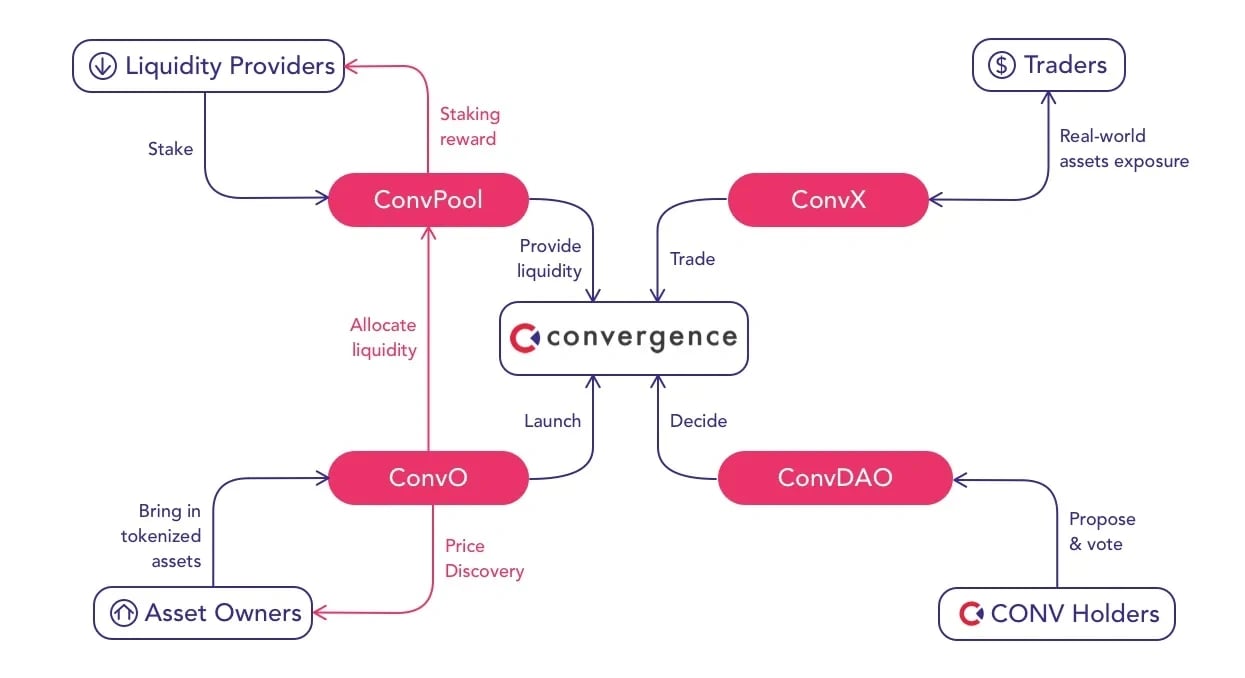

Convergence Finance is a decentralized finance (DeFi) platform that facilitates the trading and management of tokenized assets through an Automated Market Maker (AMM) and other tools. It enables asset owners and investors to access liquidity and investment opportunities within the DeFi ecosystem, bridging the gap between traditional finance and digital assets. [1]

Overview

Convergence introduces an Automated Market Maker (AMM) that allows private tokens to be fractionalized and traded within the DeFi ecosystem. This platform enables asset originators to access DeFi liquidity while DeFi users gain access to previously unavailable private assets. By lowering investment barriers and integrating DeFi's liquidity, automation, and transparency, Convergence expands access to exclusive investment opportunities for all DeFi participants. It also utilizes advanced AI to enhance trading algorithms, providing a secure and efficient solution for traders to optimize profitability while safeguarding their strategies. [1][2]

Products

Convergence Offering (ConvO)

Convergence Offering (ConvO) allows asset owners to conduct initial token offerings by setting token prices and creating a swap pool, with a portion of tokens reserved for Convergence Finance to support ConvX liquidity. As part of the Convergence dApps suite, ConvO facilitates the fractionalization of private assets through a user-friendly interface, enabling asset owners to leverage DeFi liquidity and providing DeFi users with access to various investment opportunities, including private-sale tokens and fractionalized NFTs. [3][4]

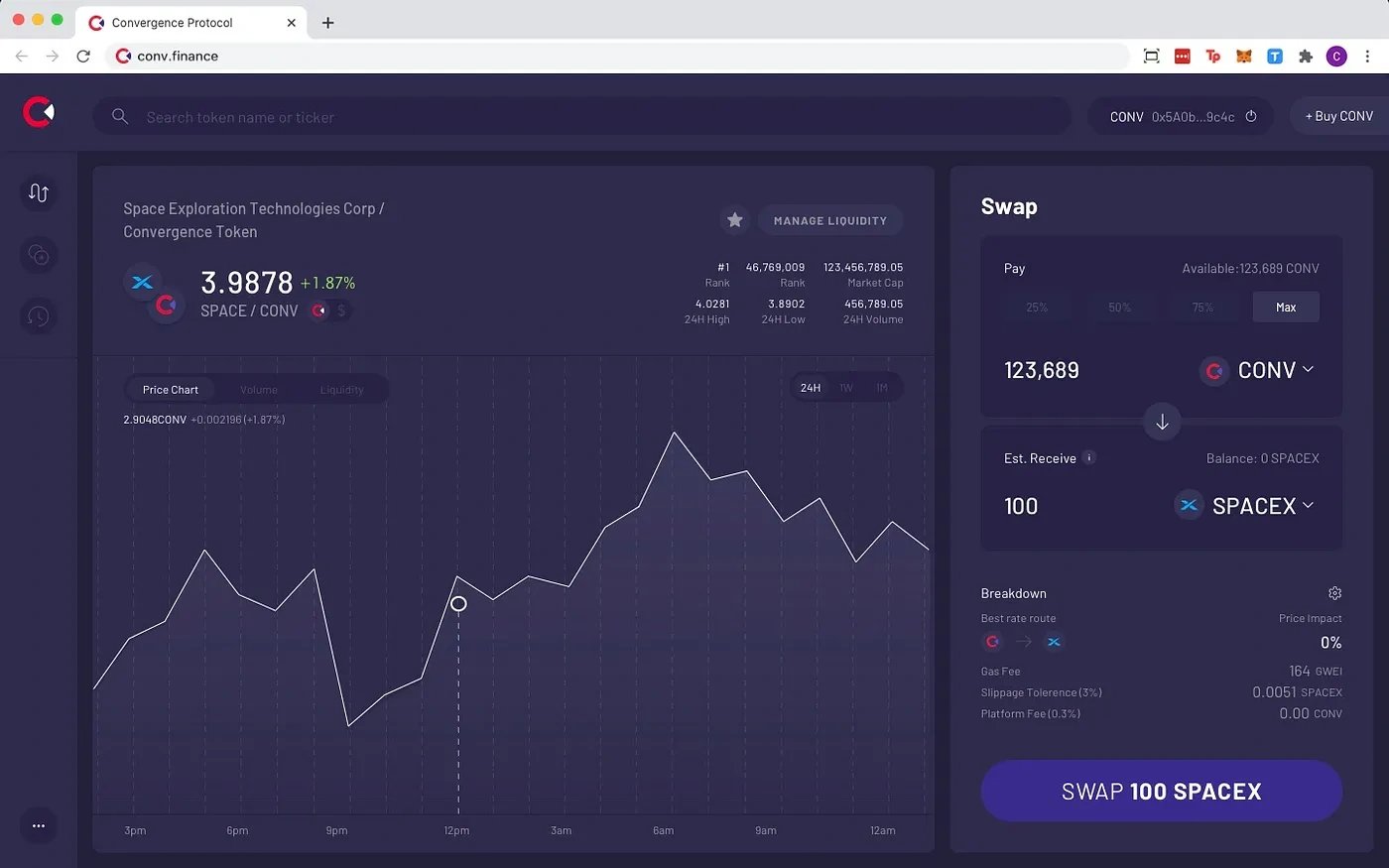

Convergence AMM (ConvX)

Convergence AMM (ConvX) facilitates 24/7 trading and price discovery of wrapped real assets. It optimizes order routing from aggregated liquidity sources to ensure the best prices for traders. ConvX simplifies access for retail investors, fund managers, and digital-native investors to provide liquidity and trade within pools. It operates on the Ethereum Chain with a 0.30% fee per trade, allocating 0.25% to liquidity providers and 0.05% to the protocol. [3]

Convergence Pools (ConvPool)

Convergence Pools allow asset owners to create and manage market-making strategies, facilitating initial offerings and providing liquidity for trading. This setup simplifies access for retail investors, fund managers, and digital-native investors to provide liquidity and trade within the pools. ConvPool incentivizes CONV and CONV-LP holders to stake their tokens, offering liquidity providers 0.25% of trading fees from Convergence X and the opportunity to earn CONV rewards based on the pool's rate. [3]

Convergence DAO

Convergence is governed by a decentralized community of CONV token holders and their delegates, who propose and vote on protocol upgrades. CONV holders with 2% of the total supply delegated to their address can submit governance proposals. [3]

Moonlit

Moonlit is a decentralized exchange (DEX) built on an Automated Market Maker (AMM) model, designed to work alongside Convergence Finance's existing product suite. It explores cross-chain compatibility with Moonbeam and Moonriver, while Convergence remains focused on making private-sale tokens and venture capital-style investments accessible within the DeFi space. Moonlit also broadens access to private-sale tokens and other novel assets, benefiting from low gas fees and enhanced performance on Kusama and Polkadot, ultimately increasing DeFi liquidity and democratizing access to exclusive investment opportunities. [5]

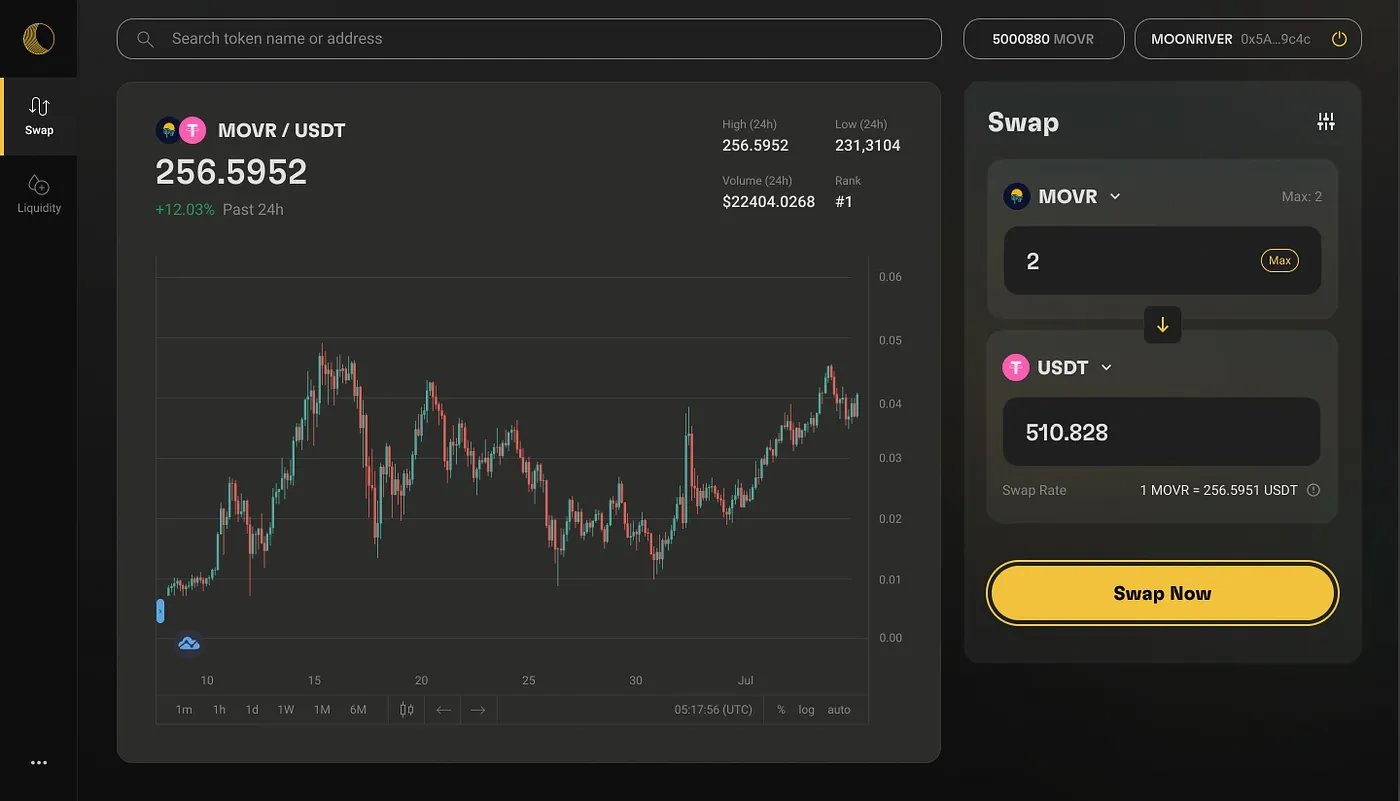

Moonlit Swap

Moonlit Swap is an Automated Market Maker (AMM) on the Moonriver Network (Kusama EVM Chain) that enables the exchange of crypto assets. Each swap incurs a 0.30% fee, with 0.25% allocated to liquidity providers and 0.05% to the protocol. [5]

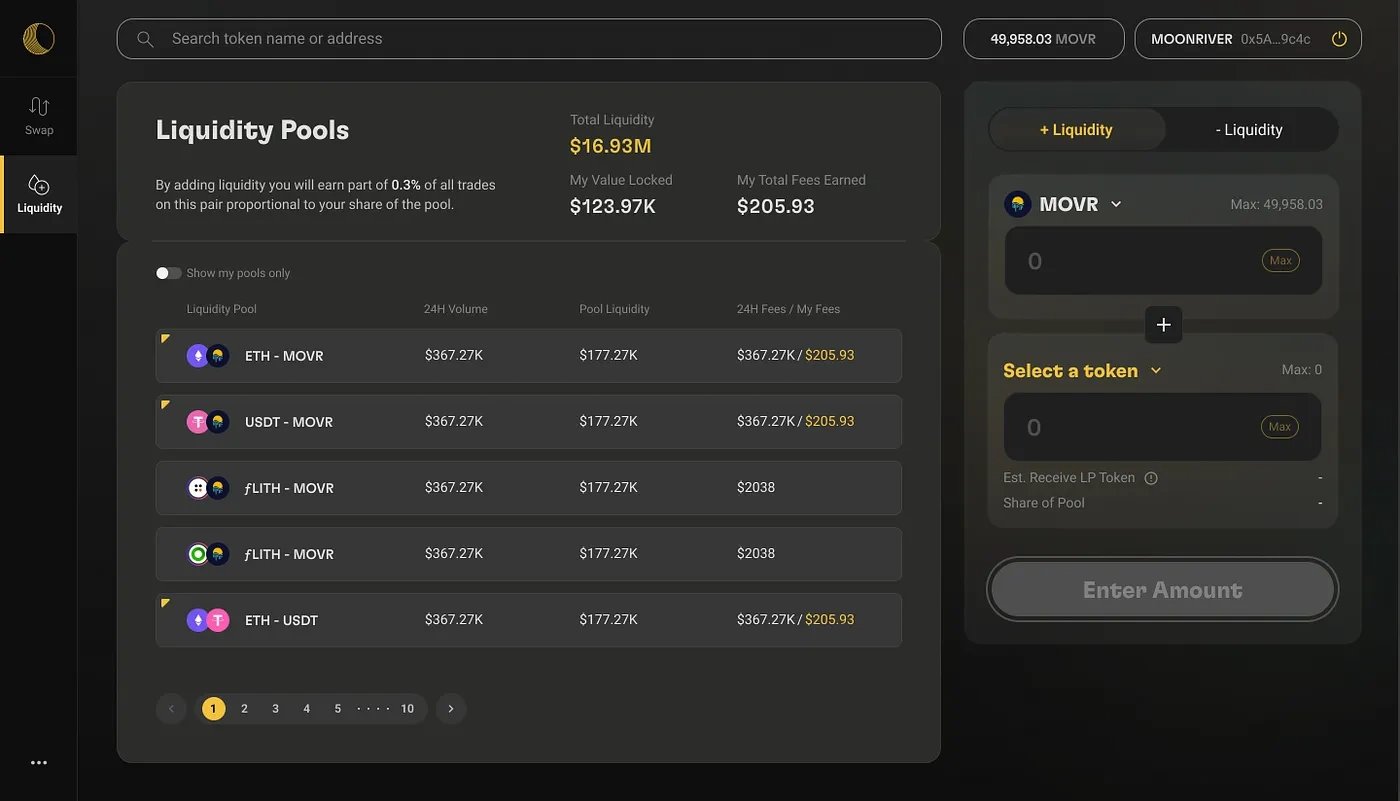

Moonlit Liquidity

Moonlit Liquidity enables liquidity providers to create and manage liquidity pools, which are collections of funds locked in a smart contract to facilitate swap transactions. Each swap in an Automated Market Maker (AMM) is executed against the liquidity in these pools. Liquidity providers receive 0.25% of the trading fees from swap transactions as an incentive. [5]

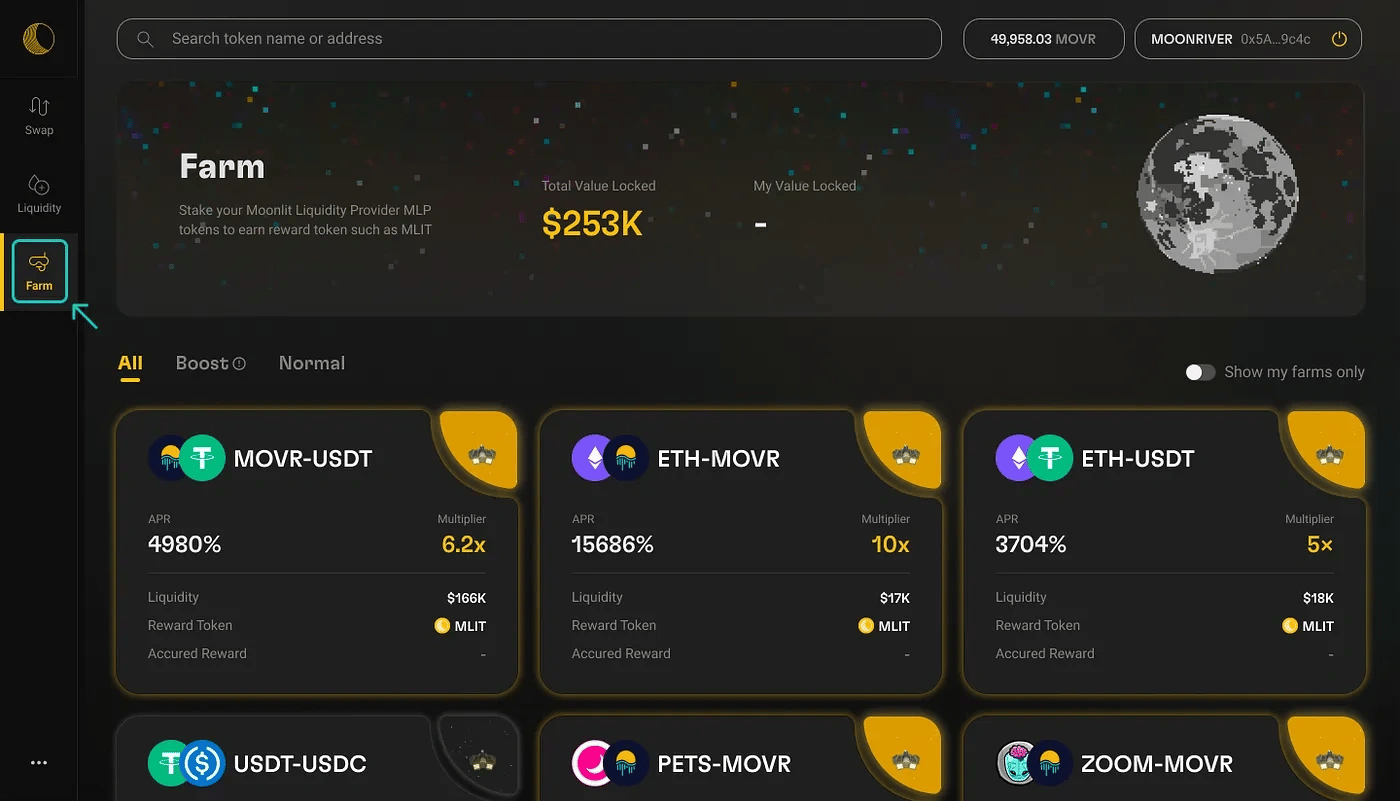

Moonlit Farm

Moonlit Farm offers yield-farming pools on Moonlit Finance, which is supported by the Moonriver Network and developed by Convergence Finance. It incentivizes liquidity providers with competitive APR in $MLIT when they stake their Moonlit LP tokens after adding liquidity to the pools. This approach is designed to stabilize liquidity and reduce slippage during token swaps. Additionally, Moonlit Farm aims to grow the Moonriver Ecosystem by introducing Community Farms in partnership with other Moonriver projects, offering double rewards where users can earn both $MLIT tokens and project-specific tokens. [6]

CONV

CONV is a multi-chain utility token available on Ethereum and Moonbeam Network. It provides access to premium launchpad subscription pools, offers staking rewards in AMM pools, grants governance rights for future protocol decisions, and serves as the base token for facilitating cross-chain swaps. [7]

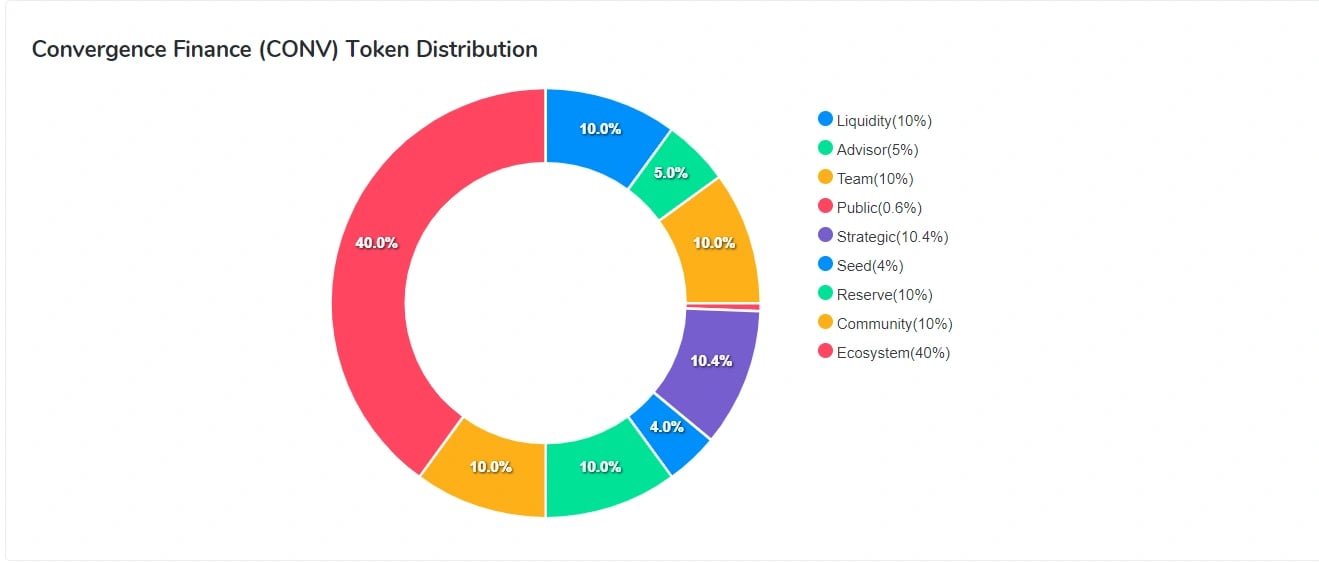

Tokenomics

CONV has a total supply of 10B tokens and has the following distribution: [8]

- Ecosystem: 40%

- Strategic: 10.4%

- Team: 10%

- Community: 10%

- Liquidity: 10%

- Reserve: 10%

- Advisors: 5%

- Seed: 4%

- Public: 0.6%

Partnerships

- DuckDAO

- Ellipti

- CertiK

- Hex Trust

- Moonbeam

- Lithium Finance

- Synaps

- 1inch

- Chainlink

- Cere Network

- Celer Network

- Biconomy

Investors

In February 2021, Convergence raised $2M in a seed funding round led by Hashed. Other investors included CMS, Kenetic, NGC Ventures, GBV, DuckDAO, Paul Veradittakit, and Alameda Research. [9]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)