위키 구독하기

Share wiki

Bookmark

GAIB AI Dollar USDC

0%

GAIB AI Dollar USDC

**GAIB AI 달러 USDC (AIDAUSDC)**는 GAIB AI 프로토콜 내에 예치된 USDC를 나타내는 스테이블코인 영수증 토큰입니다. 이 프로젝트는 인공 지능을 활용하여 알고리즘 수익률 및 위험 관리 전략을 통해 이러한 보유 자산을 관리하고 안정화하여 탈중앙화 금융 (DeFi) 부문을 AI 인프라 경제와 연결하는 것을 목표로 합니다. [1]

개요

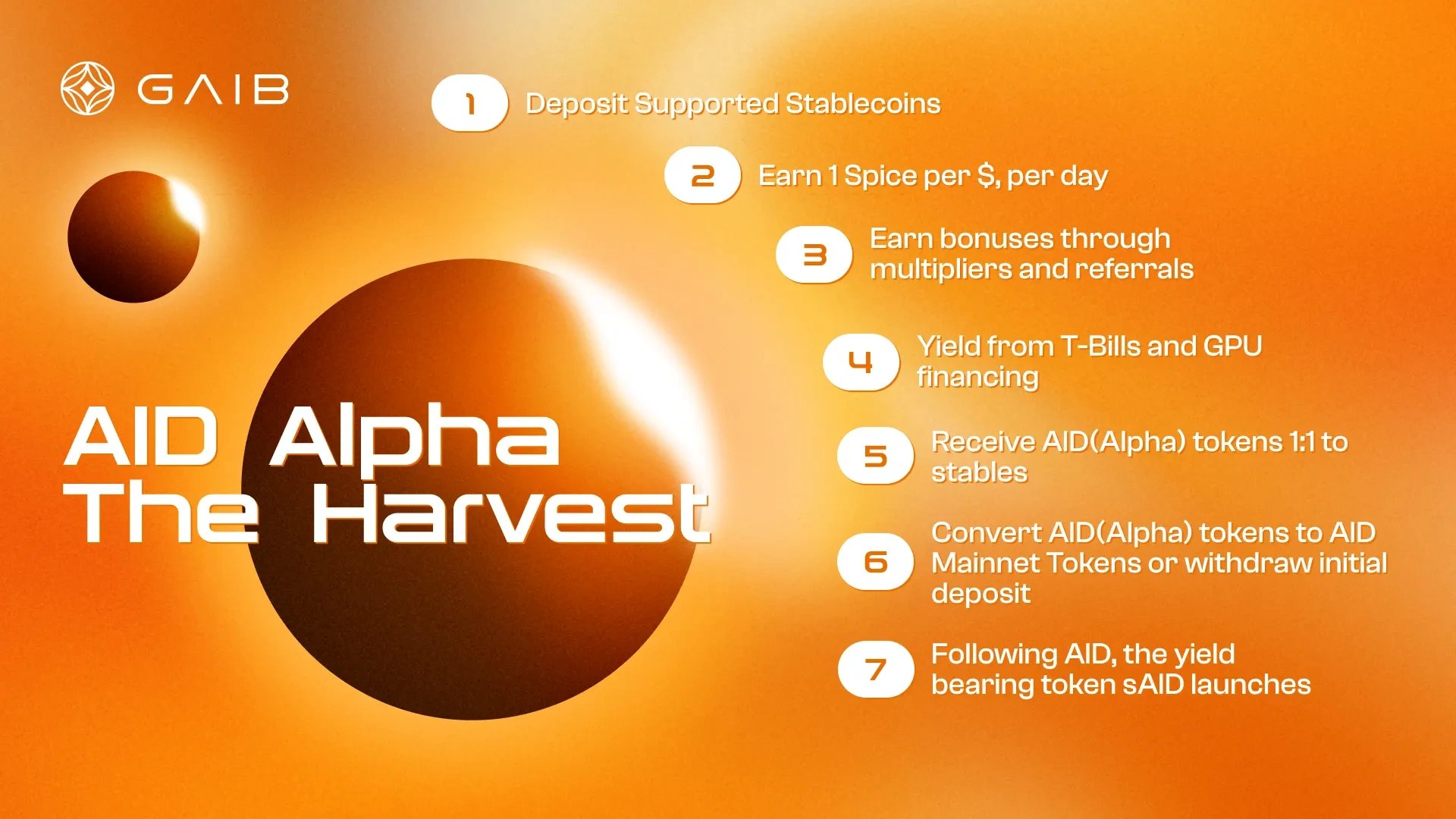

GAIB AI 달러 USDC(AID Alpha USDC라고도 함)는 GPU 기반 컴퓨팅 인프라를 수익 창출 디지털 자산 클래스로 전환하는 것을 목표로 하는 GAIB 생태계의 기본 구성 요소 역할을 합니다. 이 프로토콜은 엔터프라이즈급 컴퓨팅 성능의 가치를 토큰화하여 AI 관련 운영에서 수익을 창출하는 동시에 USDC에 고정된 토큰의 안정성을 유지하도록 설계되었습니다. AIDAUSDC는 GAIB의 "AID Alpha" 프로그램의 일부로 도입되었으며, 이는 계획된 합성 스테이블코인인 AI 달러 (AID)에 대한 초기 예금 이니셔티브입니다. 예금자를 위해 생성된 수익률은 미국 국채 및 고성능 GPU에 대한 금융 계약을 포함한 실제 자산의 조합에서 파생됩니다.

"The Spice Harvest"로 판매되는 AID Alpha 프로그램은 유동성 부트스트래핑 단계 역할을 합니다. 참가자는 USDC와 같은 스테이블코인을 예치하고 1:1 기준으로 AIDAUSDC 토큰을 받습니다. 이러한 영수증 토큰은 유동적이고 양도 가능하며 프로젝트의 공식 토큰 출시 시 미래 혜택을 결정하기 위한 포인트 기반 보상인 "Spice"를 축적합니다. 이 프로그램은 Spice 포인트에 대한 계층화된 승수 시스템을 통해 초기 참여를 장려합니다. GAIB 프로젝트의 장기적인 비전은 GPU와 미래 현금 흐름을 토큰화하여 AI 컴퓨팅 성능에 대한 거래 가능한 시장을 만들어 새로운 자산 클래스를 구축하는 것입니다.

DeFi 생태계 내에서 유틸리티를 향상시키기 위해 GAIB는 AID Alpha 토큰을 외부 프로토콜과 통합했습니다. AIDAUSDC와 USDT 대응 토큰은 수익률 토큰화 프로토콜인 Pendle Finance에서 사용할 수 있습니다. 이 통합을 통해 보유자는 고정 수익률을 고정하고, Spice 포인트 보상에 대한 레버리지 노출을 얻거나, 유동성을 제공하여 수익을 얻는 등 고급 금융 전략에 참여할 수 있습니다. 이 프로젝트는 대출, 차입 및 원금 및 수익 토큰 (PT/YT) 생성을 지원하기 위해 추가 통합을 계획하여 AID를 더 넓은 DeFi 환경 내에서 다재다능한 자산으로 자리매김합니다. 이 생태계에는 토큰 보유자가 유동성을 잠글 필요 없이 수동적 소득을 얻을 수 있도록 설계된 sAID라는 스테이킹 메커니즘에 대한 계획도 포함되어 있습니다. [4] [5]

The Spice Harvest

The Spice Harvest는 공식적으로 AID Alpha 프로그램으로 알려져 있으며, AI 달러 (AID)에 대한 GAIB의 초기 유동성 생성 이벤트 역할을 합니다. 그 목적은 AI 인프라 제공자에게 자금을 지원하는 동시에 암호화폐 사용자에게 AI 경제와 연결된 수익률에 대한 액세스를 제공하는 것입니다. 참가자는 Ethereum 및 지원되는 블록체인의 볼트에 USDC 또는 USDT와 같은 스테이블코인을 예치하고 그 대가로 AIDAUSDC와 같은 1:1 AID Alpha (AIDa) 영수증 토큰을 받습니다. 예치된 자금은 저위험 미국 국채 투자와 GAIB의 클라우드 파트너와의 금융 계약 간에 분배되어 엔터프라이즈급 GPU를 구매합니다. 3개월 미만으로 예상되는 캠페인이 끝나면 사용자는 AIDa 토큰을 1:1 비율로 AID로 변환하거나 원래 예금을 상환할 수 있습니다.

참여를 장려하기 위해 GAIB는 프로젝트의 토큰 생성 이벤트 (TGE)에 앞서 사용자 보상을 추적하는 Spice라는 양도 불가능한 포인트 시스템을 도입했습니다. Spice는 예치된 금액을 기준으로 매일 발생하며, 초기 참가자와 특정 DeFi 활동에 참여하는 사람들에게 더 높은 승수가 부여됩니다. 2단계 추천 프로그램은 네트워크 확장에 대한 사용자에게 추가 보상을 제공합니다. GAIB는 또한 AIDa 토큰을 Pendle Finance에 통합하여 기능을 향상시켰습니다. Pendle에서 AIDAUSDC는 예금을 나타내는 원금 토큰 (PT)과 미래 Spice 보상을 나타내는 수익 토큰 (YT)으로 분할할 수 있습니다. 사용자는 스왑 수수료, 고정 수익률, PENDLE 배출 및 지속적인 Spice 발생을 포함한 여러 소스에서 수익을 얻으면서 AIDAUSDC 풀을 거래, 보유 또는 유동성을 제공할 수 있습니다. 이 통합은 전통적인 금융 개념과 탈중앙화 금융 메커니즘을 결합한 다층 수익 구조를 만들었습니다. [2] [3]

잘못된 내용이 있나요?