Subscribe to wiki

Share wiki

Bookmark

Kujira

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Kujira

Kujira is a decentralized ecosystem founded by Slangdog, Dead Right Dove, and Codehans. Launched on November 20, 2021, the Kujira network focuses on the development of decentralized applications (dApps) for protocols, developers, and crypto users, aiming to create an efficient, secure, and risk-free environment within decentralized finance (DeFi). [1][2][3][4]

Overview

Kujira operates as a Layer 1 blockchain, offering a diverse suite of DeFi infrastructure and sustainable FinTech solutions for the broad spectrum of Web3 users. Built atop the Cosmos network, Kujira leverages Cosmos’ modular SDKs, forming its foundational architecture, and incorporates several natively built dApps. Kujira facilitates engagement in its ecosystem through different avenues: developers can create on its blockchain, validators aid in its security and decentralization, and community members can participate in governance through voting and other ecosystem features. Notable dApps include BLUE, the central hub; BOW, the liquidity engine; FIN, the DEX; GHOST, the money market; ORCA, DeFi liquidations; POD, cross-chain staking; SONAR, the multi-chain wallet; and USK, the stablecoin. The native token, KUJI, enables fee payments, staking, and governance participation, shaping the trajectory of the Kujira network. [5][6]

History

On November 20, 2021, Kujira started its operations within the Terra ecosystem. However, in May 2022, it announced its shift from Terra to the Cosmos ecosystem following Terra's collapse. This significant event influenced Kujira's direction, leading to the creation of a dedicated Layer 1 network and the establishment of a sustainable DeFi ecosystem. Users were offered yield-generating opportunities despite the absence of a highly inflationary native token. In July 2022, Kujira was established within the Cosmos ecosystem, utilizing the Tendermint BFT for consensus, the Inter-Blockchain Communication (IBC) protocol for cross-chain interoperability, and the Cosmos SDK for modules. Its accompanying stablecoin, USK, was launched in August 2022. [3][5][7][8]

Speaking about the shift from Terra to Cosmos, Dead Right Dove said, [29]

"I think we see the features available on Cosmos as really being like a clear winner." He added, "The fact that you can transfer IBC tokens from one blockchain to the other and not be using a bridge. That's a really big deal. Cosmos really does solve a lot of cryptos problems."

Features

Kujira has a range of features, including: [8]

- Revenue-Generating Products: The suite of ecosystem products—ORCA, FIN, BLUE, FINDER, USK, and more—demonstrates a commitment to revenue generation, enhancing the network’s value proposition.

- Staking and Cross-Chain Functionality: Kujira incentivizes user participation through its stake-based network and seamless cross-chain interactions via Cosmos' IBC.

- Community Governance: The ecosystem's community-driven approach, subject to community votes, helps foster quality control and sustainability.

- Efficiency and Native Token Generation: An on-chain scheduler and native Cosmos token generation contribute to network efficiency, simplifying contract entry points for a streamlined user experience.

- Robust Oracle and Randomness: Kujira's price Oracle, overseen by actively participating validators, guarantees consistent and dependable price information. With the integration of the entropy beacon, the platform ensures a secure on-chain source of randomness, crucial for trustless applications.

The Kujira Ecosystem

The Kujira ecosystem includes numerous dApps and infrastructure developments, allowing users to engage in a wide array of functions like bidding on liquidations, token swapping, governance participation, liquidity provision, and various other operations. [5][8]

ORCA

ORCA is Kujira’s first product, operating as a marketplace for liquidated collateral auctions. It enables users to acquire such assets at discounts of up to 30% via a Dutch auction format. Using a queueing system and an anti-bot mechanism, bids are prioritized from the smallest to the largest discount, aiding in determining the most favorable discount rate while deterring bot-driven direct sales. [7][9][10]

When liquidated assets on the ORCA marketplace are purchased by community members with a vested interest in the ecosystem's long-term stability, it notably decreases the probability of liquidity exiting the network. ORCA's utilization of a Dutch auction system for bid fulfillment establishes a robust and efficient community-driven marketplace, facilitating loan facilitation within the Kujira ecosystem and minimizing the risks associated with bad debt and network exposure. [5]

The ORCA lending markets comprise three types: USK-backed collateral, isolated FIN margin, and GHOST (perpetual) liquidation markets. USK acquisition methods include asset exchanges on FIN like axlUSDC, ATOM, wBNB, wETH, DOT, LUNA, and gPAXG, among others; minting through the BLUE USK mint UI; or borrowing against assets on GHOST, including KUJI. Isolated FIN Margin provides leveraged trading up to 2.5X on specific FIN pairs, while GHOST offers xAssets like xUSK, xaxlUSDC, xKUJI, and xATOM obtained through lending corresponding assets. In these markets, USK serves as the bid denomination, often required for bidding on discounted liquidated collateral. [10][11][12]

USK

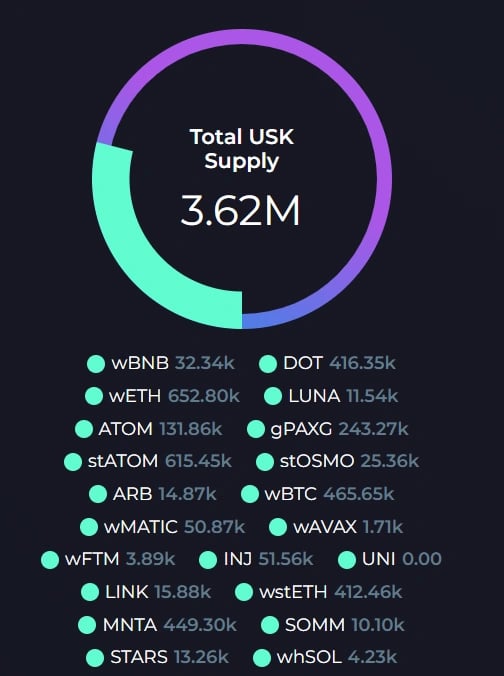

USK stands as Kujira’s decentralized stablecoin, maintaining a soft peg to the US dollar and secured by a selection of cryptocurrencies such as ATOM, wBTC, wETH, wstETH, wBNB, stATOM, wAVAX, DOT, gPAXG, MNTA, and LUNA. Its acquisition is possible through minting on BLUE or purchasing via FIN. Functioning as an over-collateralized stablecoin, USK ensures stability while mitigating liquidation risks. Within the Kujira ecosystem, USK is seamlessly integrated with platforms like BLUE, FIN, BOW, and ORCA. [5][13]

The total supply of USK as of November 28, 2023, is 3.62 million [14]

FIN

FIN, a decentralized platform on Kujira, operates as an order book trading system similar to centralized exchanges. Unlike automated market makers (AMMs), FIN's order book model doesn't depend on inflationary incentives, ensuring enhanced trade execution. [15][16]

GHOST

GHOST functions as Kujira's money market, utilizing users' assets for lending, interest accumulation, and maintaining operational liquidity through collateralization. Powered by ORCA as its liquidity engine, it enables community-driven asset addition through governance and offers three key features: leverage for lending or borrowing assets, community-driven asset inclusion, and a top-tier liquidation engine facilitating beneficial liquidations for the Kujira community. [17][18]

BLUE

BLUE is the central hub within the Kujira ecosystem, enabling network participants to engage in staking, minting, bonding, swapping, cross-chain transfers, and governance activities. It presents essential analytics for the Kujira blockchain, encompassing: [5][16][19]

- KUJI price

- Fully diluted value (FDV) of KUJI

- Total liquid supply of KUJI

- KUJI annual percentage rate (APR) over a 30-day period

- Current block height

- Average block time

- Total number of Kujira network transactions

- Inflation percentage

- Token release schedule

- Personal staked KUJI amount

- Graphical representation of total KUJI supply, including the treasury

- Graphical breakdown of total USK supply, with collateral backing breakdown

Developers

Developers have the capability to construct Rust-based smart contracts that interact with the Kujira blockchain, fully supported by CosmWASM v1.0 and IBC v3. Through the token factory, developers can establish their native denoms, acknowledged by the Cosmos SDK Bank Module. This protocol empowers developers to issue their tokens without adhering to the CW20 standard, ensuring compatibility of all tokens on the Kujira network for gas-fee payments, protocol revenue collection, and distribution among KUJI stakers. [20][21]

Validators

Validators on the Kujira chain set their specific commission rates, representing a portion of staking rewards intended for maintaining the validator and supporting the Kujira network. For instance, a validator with a 5% commission, 1 million KUJI in total delegations, and a projected annual percentage rate (APR) of 10% would generate around 5,000 KUJI annually, considering these consistent conditions. If a delegator stakes 1,000 KUJI with this validator, they would earn approximately 95 KUJI annually, factoring in the 10% rewards and the 95% not claimed as commission. [22]

Typically, a lower commission rate offers a larger portion of staking rewards to the delegator, whereas a higher commission benefits the validator. Nevertheless, the commission rate is only one aspect to contemplate when selecting a validator. It's equally vital to assess the validator's technical proficiency and any supplementary contributions they provide to the network. In instances of slashing, delegated tokens may be forfeited. [22]

Community members

Members of the Kujira community come from diverse backgrounds, aiming to foster various passionate subcommunities dedicated to expanding Kujira's reach, led by committed individuals. While official communications primarily use English, the Kujira Discord hosts numerous channels for speakers of different languages. Although the Discord community is relatively small, it remains active, facilitating discussions, advice-sharing, and deliberations on proposed changes to the blockchain. Meanwhile, the primary information source for the Kujira blockchain is its Twitter account, where news and future development plans are regularly announced. Additionally, Kujira publishes weekly reports on its Medium account. [7][23]

The KUJI token

KUJI is the native token on the Kujira Network with a total supply of 122,398,190.844391 (122.4 million) tokens. Initially set at 150 million tokens, the total supply was curtailed following a governance vote on January 18, 2022, which incited the burning of liquidity pool rewards. KUJI plays a pivotal role within the Kujira Network, facilitating transactions as it's utilized to cover network and dApp fees, with all accrued fees being disseminated among KUJI stakers. [24]

In November 2021, the KUJI token was introduced via a token generation event, adhering to a specific release schedule: [24]

- Private Sales: 27.975 million coins (12-month vesting)

- Team: 27 million coins (24-month vesting)

- Public Sale: 24 million coins (6-month vesting)

- Operational: 11.025 million coins (24-month vesting)

- Rewards: 8.648 million coins (adjusted after burn)

- Advisors: 7.5 million coins (12-month vesting)

- Initial Liquidity: 6 million coins

- Marketing: 6 million coins (24-month vesting)

- Treasury: 6.75 million coins (24-month vesting)

- Airdrops: 500 thousand coins (adjusted after burn)

By November 9, 2023, the release schedule had been completed, and all tokens had vested entirely. No additional coins will be introduced into circulation beyond that date. Instead, the Kujira blockchain will derive funds from users paying fees in KUJI, which will then be redistributed among validators and delegates. All KUJI coins are either in circulation or currently being minted, making them a non-inflationary coin. [7][24]

Total supply of KUJI coin as of 28 November 2023 [14]

Since KUJI is not an inflationary asset and relies on adoption of its decentralized applications and products to generate fees, it is sustainable. Stakers are rewarded based on KUJI (and other tokens) paid as fees on Kujira dApps such as FIN. This allows KUJI to be sustainable without needing to pivot its mechanism and developers can simply concentrate on building out the best products possible, fostering a strong community, and bringing high integrity to everything they do. [25]

Staking

Staking KUJI within the Kujira Network, particularly through a Kujira validator, allows users to gradually accumulate a diverse range of top assets. This staking process not only involves governance but also empowers users to influence the trajectory of the Kujira network. KUJI stakers hold the ability to vote on the selection of new Senators and participate in various aspects of KUJI governance in alignment with their beliefs and values. [26][27]

All network fees collected are directly distributed to stakers via validators, avoiding conversion to KUJI initially. This facilitates users in amassing a diversified staking yield beyond just accumulating more KUJI. Additionally, Kujira is considering introducing the ability to redeem staking rewards as KUJI based on community demand. [26]

Governance

KUJI serves as the governance token for the Kujira blockchain, enabling various functionalities such as staking, senatorial elections, validator rewards, and voting. Community members can propose changes to the blockchain, which are debated and then voted upon within the Kujira community. When voting, individuals utilize their staked KUJI tokens through their chosen validator, with the validator's vote aligning with the individual's choice if they don't vote themselves. [7]

Kujira's governance structure aims for greater decentralization. Although the largest validator holds around 5.95% of the coins (as of January 20, 2023), approximately 45% of all coins belong to the top 100 addresses out of approximately 38,200 addresses, while the remaining 48% are in a combined pool. The remaining 7% of coins are distributed among roughly 38,100 addresses, with approximately 16,500 addresses holding less than $1 worth of KUJI. [7]

Vote on proposals

Governance proposals within the Kujira community span various topics, encompassing updates, network parameter adjustments, and new services or features for the Kujira platform. These proposals undergo discussion and debate within the community before being subjected to a vote, allowing members to approve or reject them. Participants within the Kujira community have voting rights, empowering them to influence the network's governance and contribute to shaping its future trajectory. Therefore, active participation in these votes is essential for fostering robust community engagement and significantly influencing the network's development. [28]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)