Subscribe to wiki

Share wiki

Bookmark

Polkadot (DOT)

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Polkadot (DOT)

DOT is the native token of the Polkadot network. It was created after the Web3 Foundation concluded a relatively successful ICO in October 2017 and raised over $140 million by selling 50% of the 10,000,000 DOT token supply. The sale was split between a private sale, which raised over $80 million, and a public sale, which raised the remaining. [1][2][3][4]

Overview

The DOT token is central to the Polkadot ecosystem and serves three primary functions: staking, governance, and bonding. Staking DOT helps secure the network by encouraging honest behavior among participants, who receive rewards for holding DOT as collateral. This proof-of-stake model ensures the integrity of network operations.

DOT also enables on-chain governance by allowing holders to vote on protocol upgrades and key decisions through a stake-weighted referenda system. Additionally, DOT is required for bonding, which reserves limited parachain slots. These slots are allocated in coretime units, and DOT is used to secure them in monthly increments, supporting the scalability of the Polkadot network. [6] [7]

History

On November 6, 2017, a vulnerability was exploited in the Parity multi-sig wallet containing over 500,000 ETH, including $98 million of the $140 million+ in ETH raised through the Polkadot ICO. These funds were frozen, and a debate among the Ethereum community determined whether these funds would ever be recovered. [1][2]

Despite the exploitation, Polkadot further conducted two private sales. In 2019, the foundation announced it had sold 500,000 DOT (old) tokens to an undisclosed group of private investors and successfully raised $60 million. The second private sale was held in the summer of 2020 and raised 3,982.07 bitcoin (BTC) worth an estimated $42.76 million upon completion. [1]

DOT tokens, by design, have an 8% inflation rate in the first year, after which validator and nominator staking dynamically determine the inflation. [1]

Distribution

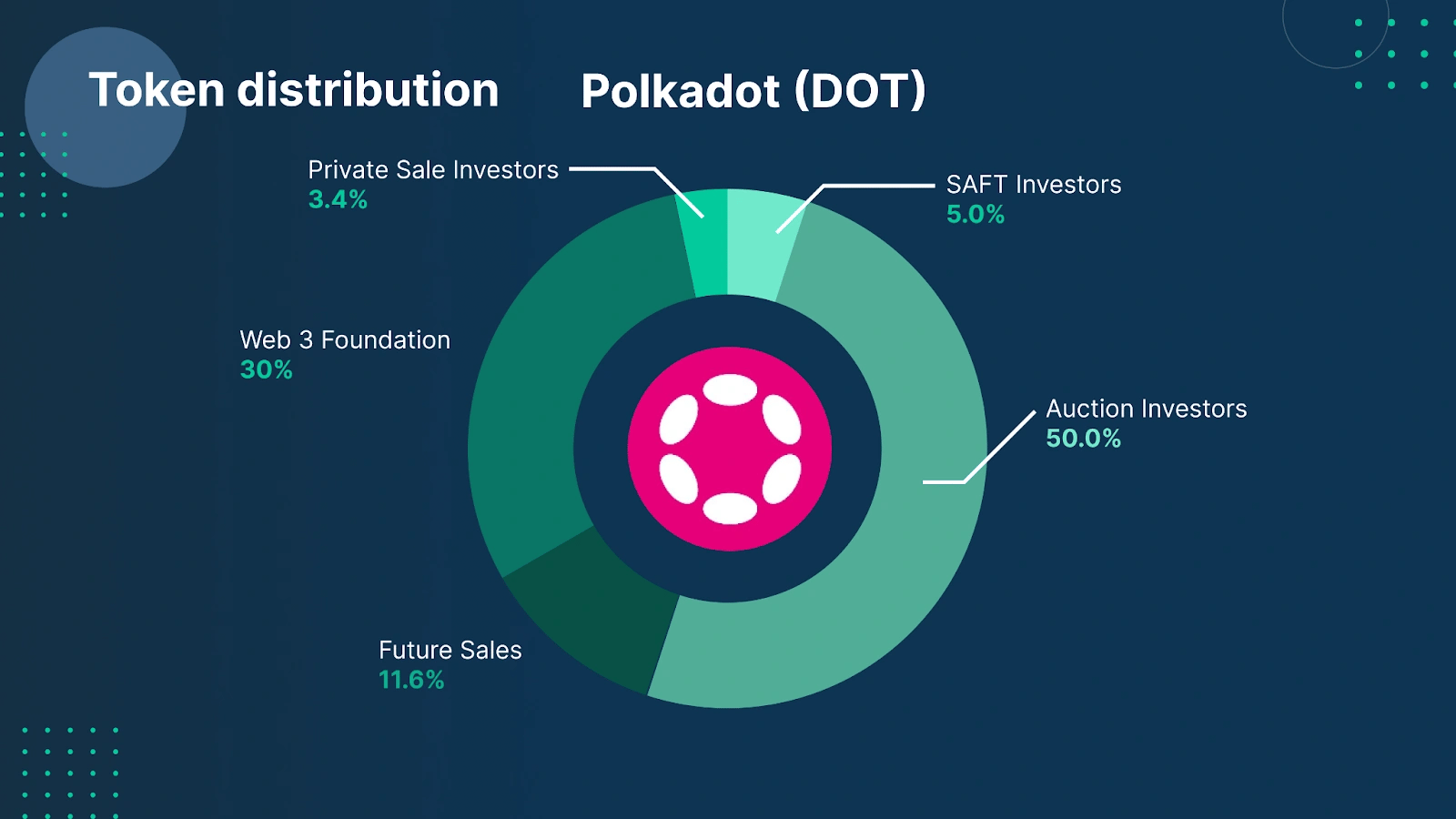

The initial token distribution of DOT is as follows:

- 3.42% is allocated to Private Sale Investors.

- 5.00% is allocated to SAFT Investors.

- 50.00% is allocated to Auction Investors.

- 11.58% is allocated to Future Sales.

- 30.00% is allocated to Web 3 Foundation. [3]

Funding Rounds

- $79,488,000 was raised in the Private Sale 1 on 14/10/2017 with an average price of $0.288

- $64,512,000 was raised in the Public Sale 1 on 15/10/2017 with an average price of $0.288

- $60,000,000 was raised in the Private Sale 2 on 27/06/2020 with an average price of $1.2

- $42,500,000 was raised in the Private Sale 3 on 24/07/2020 with an average price of $1.25. [3]

Utility

The DOT token serves three purposes: Governance over the network, staking for operations and security, and bonding tokens to connect para-chains.[5]

Governance

Polkadot’s OpenGov system, launched in 2023, enables any DOT holder to propose or vote on referenda, increasing decentralization beyond the network’s previous governance model. Alongside the Nominated Proof-of-Stake (NPoS) system, OpenGov contributes to Polkadot’s decentralized structure.

OpenGov supports multiple concurrent referenda, allowing for faster decision-making and quicker Treasury disbursements. It also introduces “conviction voting,” where users can lock tokens for longer to increase their voting weight, helping balance influence across different token holders.

DOT holders can participate directly or delegate their voting power to others. Voting and proposal discussions take place on platforms like Polkassembly and Subsquare. For those who prefer indirect participation, delegation dashboards provide a simple way to assign voting rights to trusted participants. Users can follow governance updates through Polkassembly, The Kusamarian, Referendum Roundup, and DotLeap. [5] [8]

Staking

Staking DOT supports Polkadot’s security and decentralization while allowing participants to earn rewards. Polkadot uses a nominated proof-of-stake (NPoS) system, where DOT holders—nominators—delegate their tokens to validators responsible for consensus and block production. Validators must act honestly, as poor behavior can lead to slashing for themselves and the nominators who supported them.

DOT holders can stake natively by joining a nomination pool or nominating validators directly. Pools require minimal effort and as little as 1 DOT, making them suitable for passive stakers. Direct nomination allows more control but requires active management and a higher minimum stake, currently around 450 DOT, to receive rewards. Nominators can also create their own pools if they are confident in selecting reliable validators.

Polkadot offers a Staking Dashboard with support for various wallets, such as Nova, Talisman, Fearless, and SubWallet, simplifying the staking process. Users can also stake through hardware wallets such as Ledger or Polkadot Vault for enhanced security.

Beyond native staking, DOT holders can also use third-party custodial platforms or participate in liquid staking on certain parachains like Bifrost, Acala, or Equilibrium. These alternatives offer added flexibility but come with distinct risks, and users are advised to conduct careful research before using them. [5] [8]

Bonding

DOT is inflationary, which means that, unlike Bitcoin, there is no maximum number of DOT. The inflation rate is not fixed: it is designed to be 10% in the first year. The DOT generated is used for validator rewards, with the remainder going to the Treasury. The smallest unit of account in the ecosystem is a Planck, equivalent to 0.0000000001 DOT. [5]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)