Subscribe to wiki

Share wiki

Bookmark

Bifrost Network

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Bifrost Network

The Bifrost Network is a blockchain platform built on the Substrate framework, enabling seamless cross-chain communication and interaction. It supports decentralized applications with features like a unified token system, EVM compatibility, and a robust governance model for community-driven development. [1]

Overview

The Bifrost Network is a public blockchain built using the Substrate framework. It is compatible with the Ethereum API and provides developers access to extensive libraries and development tools. It adopts a multichain-first design, enabling decentralized cross-chain communication and interaction between blockchains through its protocol. Applications on the network can integrate cryptocurrencies from supported blockchains, facilitated by core validators that also act as relayers for transmitting cross-chain messages. This approach supports a multichain environment, allowing developers to create diverse and innovative applications. [2]

Technology

Cross-Chain Communication (CCCP)

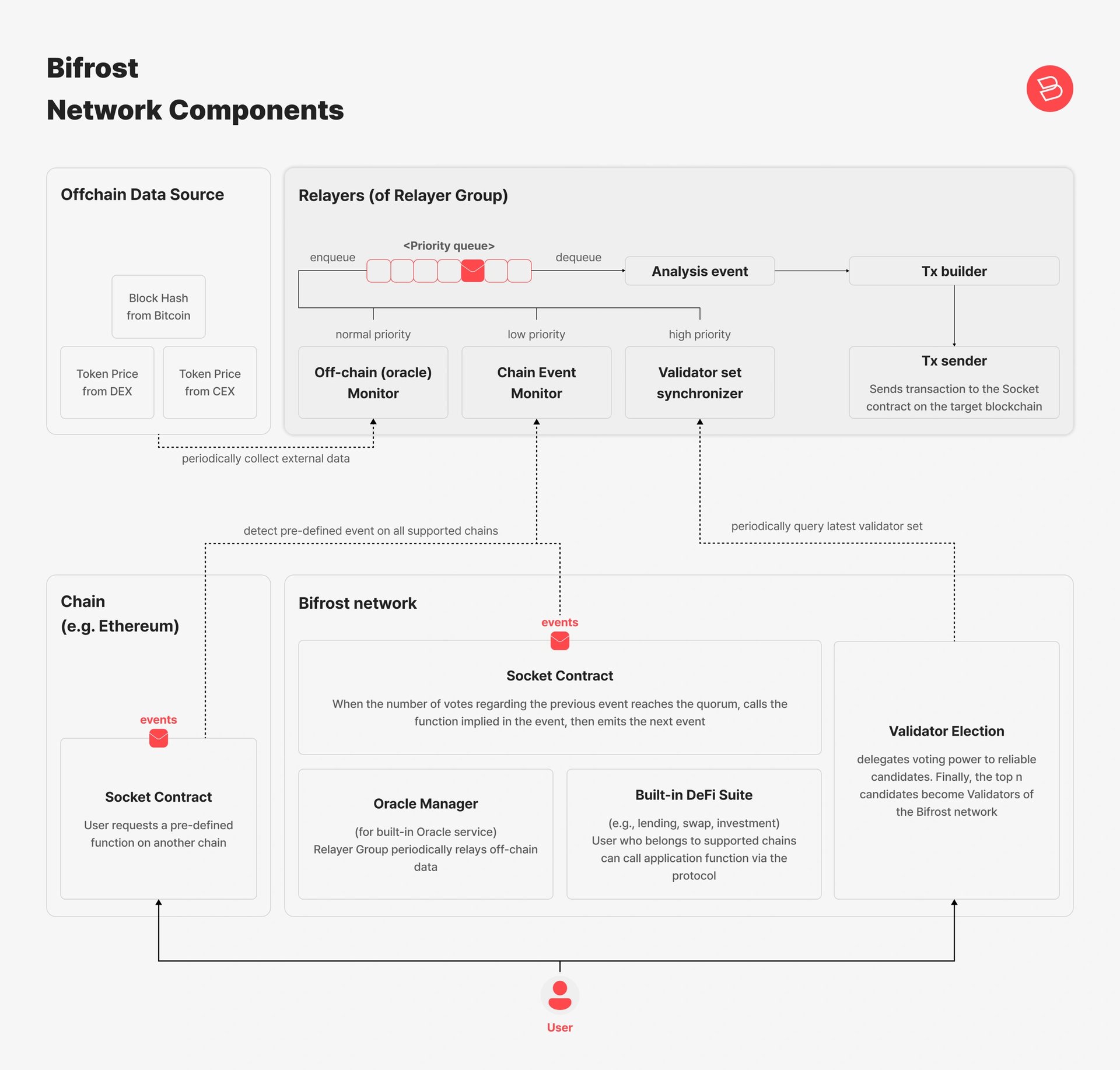

Bifrost's Cross-Chain Communication Protocol (CCCP) facilitates communication across blockchains through socket contracts and relayers, enabling users on one chain to access decentralized applications on others. Socket contracts, deployed on Bifrost and external chains like Ethereum, emit CCC events triggered by requests, with relayers ensuring these events are delivered between contracts until all required processes are completed. Multiple relayers transmit events to maintain reliability, ensuring protocol functionality even if some fail or are compromised. A timeout rollback mechanism prevents asset locking in case of complete relayer failure. Limiting the number of high-cost transactions sent to external blockchains reduces operational costs. [3]

Components

Bifrost's Cross-Chain Communication Protocol (CCCP) involves several key components working together to enable efficient cross-chain interactions. Users initiate requests by sending a CCC request to a socket contract, which collects the required cryptocurrency and calls designated functions on other blockchains. Relayers play a central role, delivering essential data such as updated validator lists for access control, off-chain information like price feeds or Bitcoin block hashes, and CCC events coordinating actions across blockchains.

The system relies on three main contract types. Socket contracts generate and process CCC events, executing protocol-defined actions such as minting or lending. A built-in DeFi suite abstracts financial operations as callable functions. The oracle manager contract aggregates off-chain data and provides on-chain oracle services for reliable, real-time data integration. [3]

Protocol Design

The Cross-Chain Communication Protocol (CCCP) incorporates specific design considerations to address the limitations of smart contract execution environments. Data storage constraints are managed by storing only data hashes in smart contracts, reducing costs by comparing hashes instead of saving full data. If a transaction fails, an additional transaction is sent to log its failed status, ensuring accurate tracking.

Since smart contracts lack efficient built-in functions like array sorting, transaction senders provide pre-sorted data to minimize computational overhead. Transactions to external chains, which can have high fees, are optimized by aggregating relayer signatures on the Bifrost Network before submission to the external chain, reducing the number of interactions.

The Validator Synchronization Protocol (VSP), a CCCP sub-protocol, ensures that the latest validator list from the Bifrost Network is synchronized across external chains. This process supports accurate access control, as validator changes are periodically reflected in socket contract operations. [3]

Pockie

Pockie is an advanced digital wallet created to streamline multichain activities while prioritizing user-friendliness and robust security. Designed to enhance the DeFi experience, Pockie includes gas token top-ups to prevent transaction disruptions, integrated transaction histories with detailed data, bulk wallet imports for efficient management, and scam detection tools to safeguard assets. Its functionalities cater to seasoned users seeking efficiency and newcomers exploring DeFi, ensuring accessibility and safety across blockchain networks. [4]

BTCFi

BTCFi is a decentralized finance platform enabling Bitcoin users to borrow, lend, and generate yields while retaining their BTC holdings. Built on Bifrost Network's cross-chain infrastructure, it operates as a decentralized collateralized debt position system using Bitcoin exclusively as collateral, eliminating reliance on centralized intermediaries. Users can borrow Bitcoin-backed stablecoin, BtcUSD, at competitive rates, with BtcUSD designed to offer stability and utility across various financial activities. BTCFi's cross-chain integration extends its functionality beyond the Bifrost ecosystem, allowing Bitcoin holders to engage with a wider array of DeFi services. [5] [6]

Governance

Bifrost incorporates a governance mechanism that enables token holders to participate in protocol decision-making processes. Governance includes voting on or creating proposals, with all changes to the network subject to a referendum. A governance forum allows broader community engagement, enabling discussions and idea-sharing even for non-token holders. The General Council, tasked with guiding the network, was initially appointed by the Bifrost Foundation. Over time, this structure will transition to an election-based system where BFC holders can vote on council membership, fostering alignment with the network's long-term objectives. [7]

Council

The Council oversees Bifrost Governance, including managing the treasury, selecting the technical committee, and canceling malicious referenda. In cases of limited participation, a prime member is designated to represent the Council. The prime member is chosen based on receiving the highest votes during the council round. Council members who do not vote on proposals automatically defer to the prime member's decision. [7]

Technical Committee

The Technical Committee, selected by the Council, plays a key role in managing Bifrost Governance and acting as a check against unilateral actions by the Council. Its responsibilities include canceling malicious proposals, invalidating Council-created proposals when necessary, and fast-tracking urgent proposals. Committee members hold veto power to prevent potential abuses; a single veto can nullify a proposal and temporarily blacklist it from resubmission. Like Council members, they cannot maintain their authority indefinitely and are required to possess BFC tokens. [7]

BFC

BFC serves as the native currency of the Bifrost Network and operates with an inflationary model tied to staking participation. The inflation rate adjusts based on the quantity of staked tokens, dynamically allocating rewards to validators and nominators to encourage staking. This model incentivizes network participation while creating an opportunity cost for holding unstaked BFC, resulting in gradual dilution over time. [8]

Tokenomics

BFC has a total supply of 2.37B tokens and has the following allocation: [9]

Private Round: 25%

Reserve: 20%

Ecosystem: 20%

Team: 20%

Marketing: 10.4%

Advisors: 4%

Public Sale (IDO): 0.6%

Unified Token

The Unified Token on the Bifrost Network consolidates tokens from multiple chains into a single token contract, simplifying liquidity management for developers. For example, DAI tokens from Ethereum and BNB Chain are merged into a Unified DAI token on Bifrost, reducing the complexities of managing fragmented bridge tokens and improving efficiency for DApp development. [10]

Partnerships

KICA

CODE

Japan Open Chain

THEPOL

Slash Vision Labs

JCBA

GemHUB

GAIA

Kanalabs

CUBE Entertainment

Theori

Ozys

Delight

Six Network

DeSpread

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)