위키 구독하기

Share wiki

Bookmark

L3X Protocol

L3X Protocol

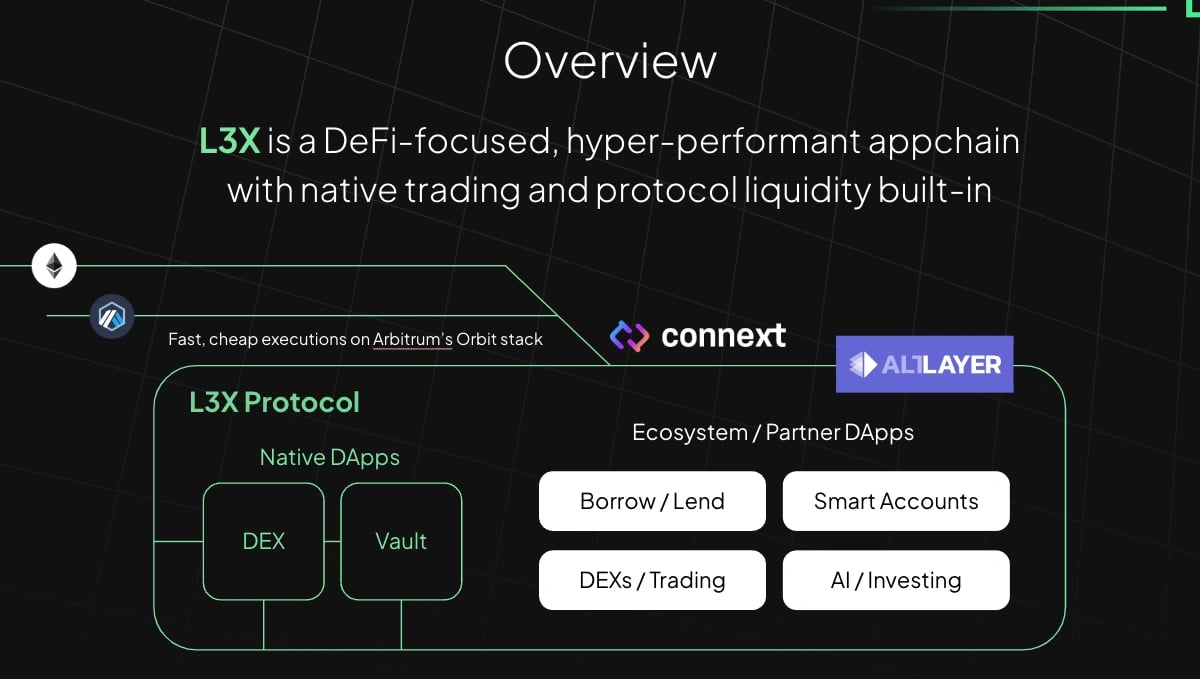

L3X Protocol is a Layer 3 blockchain platform for institutional-grade leveraged trading and decentralized finance applications. Leveraging robust partner integrations and advanced technologies like Chainlink and AltLayer, L3X aims to provide high-performance infrastructure and secure cross-chain capabilities within its ecosystem. [1]

Overview

The L3X Network is a trading-optimized blockchain operating on its proprietary L3 architecture, leveraging Arbitrum Orbit and powered by the Renzo Protocol and AltLayer. It aims to deliver high-performance capabilities tailored for institutional-grade trading and specific decentralized finance applications. L3X focuses on assets such as ETH, USDC, USDT, and major LRTs like ezETH. Utilizing Vela Exchange's perpetuals architecture and Arbitrum's Orbit chain, L3X aims to enhance asset utility, offer a robust trading environment with ample liquidity, and provide sustainable yield options for users. [1][2]

L3X Exchange

The L3X Exchange will utilize the Vela Exchange core engine as its primary DEX platform. Initially, it will launch with a focus on its leveraged trading exchange. Future plans include integrating a broader ecosystem of exchanges and DeFi applications onto the L3X Network. As part of its offerings, the exchange will support Eigenlayer LRTs such as Renzo and ezETH for collateral and liquidity purposes. [2]

The Native Vault

The Native Vault of L3X provides immediate liquidity from its inception, enabling seamless integration with various dApps within the ecosystem. It ensures users can access liquidity instantly, maximizing opportunities within the L3X network from day one. [3]

3LP Token

3LP provides liquidity for traders to engage in leveraged positions. The profitability for 3LP holders depends on traders' performance: losses benefit 3LP holders, while gains may result in losses for them. L3X Exchange's smart contracts undergo audits, yet inherent risks remain. There is counterparty risk as profits earned by traders come from the 3LP pool. 3LP is exposed to LRT risk, including potential impacts from exploits or depegging events of assets like ezETH. The platform's open interest is limited by the total USDC reserves of 3LP, with new positions restricted if the open interest exceeds the total TVL in 3LP. [2]

Partnerships

The L3X Protocol collaborates with a strong partner ecosystem to enhance user experience. Chainlink provides highly accurate data streams, making L3X the first L3 platform to integrate them. AltLayer is an infrastructure partner offering extensive deployment and sequencing customization capabilities. Connext offers a secure cross-chain bridge, ensuring reliable staking across different chains. Goldsky contributes as a specialized indexer, ensuring high performance and reliability from day one. Renzo acts as a liquidity provider for L3X and enhances the utility of its assets, particularly ezETH. [1]

잘못된 내용이 있나요?