Subscribe to wiki

Share wiki

Bookmark

Mantle Restaked Ether (cmETH)

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Mantle Restaked Ether (cmETH)

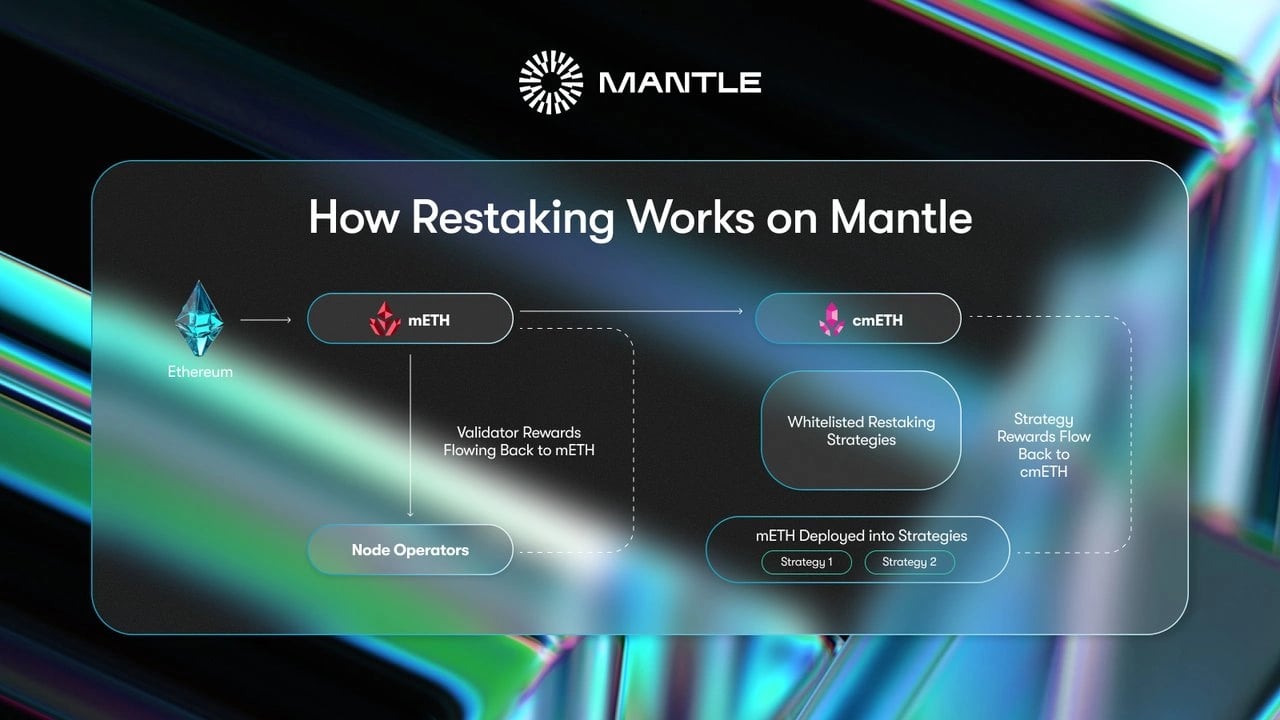

Mantle Restaked Ether (cmETH) is a liquid restaking token that serves as a 1:1 receipt for mETH restaked across a portfolio of positions, including EigenLayer, Symbiotic, Karak, and associated Actively Validated Services. cmETH enables users to participate in the risk-reward profile of restaking while maintaining liquidity and composability across multiple chains. [1]

Overview

cmETH is a value-accruing receipt token issued by the mETH Protocol for liquid restaking. It represents ETH restaked across platforms like EigenLayer, Symbiotic, Karak, and associated Actively Validated Services (AVSs). It functions as a composable liquid restaking token and typically trades slightly above the price of ETH due to accumulated yields.

Using the LayerZero OFT standard, cmETH supports cross-chain transfers without slippage. It has no fixed supply cap, with total circulation depending on the amount of ETH restaked through the protocol. AVSs involved in the process are actively managed services, distinct from fully automated blockchain mechanisms. [2] [3]

Features

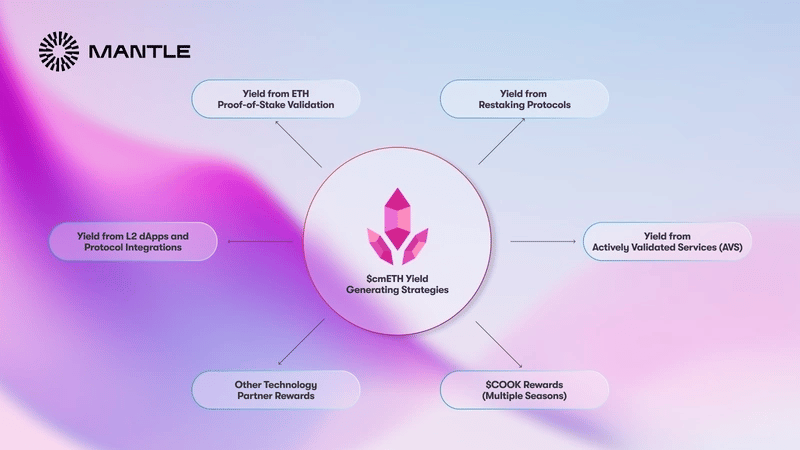

Within the Mantle ecosystem, cmETH serves as a yield-generating asset that combines multiple sources of returns. These include staking rewards from Ethereum’s proof-of-stake system (via mETH), restaking protocols like EigenLayer, Symbiotic, and Karak, as well as yields from Actively Validated Services (AVSs), Layer 2 applications, and partner incentives.

Designed for integration across Mantle’s decentralized applications, cmETH is positioned as a composable token within the ecosystem. It expands on the role of mETH by offering additional restaking-based yield opportunities, making it a utility asset for users seeking diversified on-chain returns. [4] [5]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)