Subscribe to wiki

Share wiki

Bookmark

Michael Terpin

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

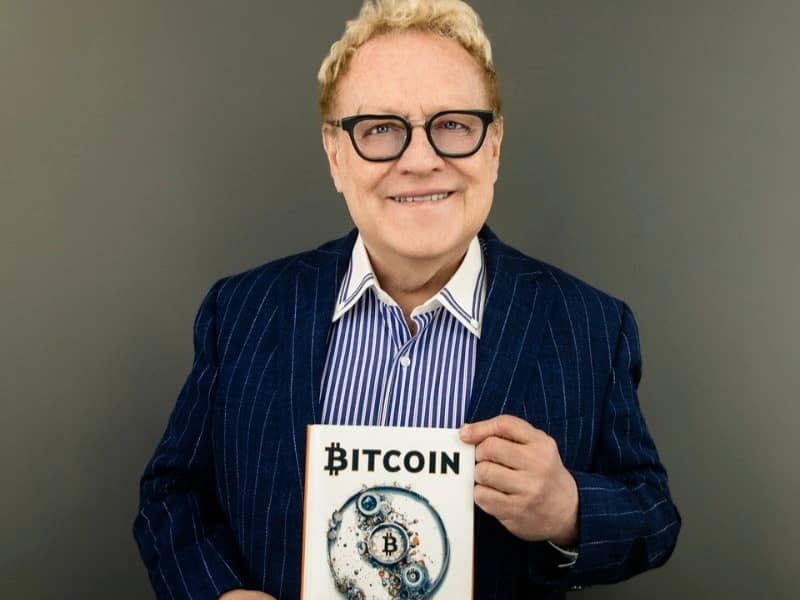

Michael Terpin

Michael Terpin is an entrepreneur and investor who is the founder and chief executive officer of Transform Ventures, a blockchain advisory and venture studio. He is known for his early and extensive involvement in the cryptocurrency sector, where he has advised numerous projects since 2013. [1]

Education

Michael Terpin earned a dual Bachelor of Arts degree in Newspaper Journalism and English Literature from Syracuse University, completing his studies between September 1975 and May 1978. He later obtained a Master of Fine Arts in Creative Writing from SUNY at Buffalo, attending from September 1981 to May 1982. [2]

Career

Michael Terpin has built a diverse career spanning over three decades, primarily in entrepreneurship, investment, and communications focused on blockchain, cryptocurrency, and emerging technologies. Since November 2024, he has been the author of Bitcoin Supercycle. He currently serves as CEO of Transform Ventures (January 2021–present), a venture advisory and incubator firm, and managing partner at Transform Capital (April 2018–present), a family office investing in digital assets and technology. He founded and leads Transform Group (May 2013–present), a communications firm representing over 300 blockchain companies, and co-founded OpenCarbon (September 2022–present), an NFT marketplace for carbon credits. Terpin also established CoinAgenda (January 2014–present), a global blockchain conference series, and BitAngels (May 2013–present), an angel investor group for digital currency startups. Between July 2014 and June 2018, he was a partner at bCommerce Labs Flight.VC, an angel syndicate investing in crypto companies, and briefly served as general partner of BitAngels Fund (March–May 2014). His earlier career includes founding Terpin Communications, Inc. (1990–2013), a PR firm for new media and technology; founding and chairing Marketwire and Internet Wire (1994–2006), the first internet-based press release newswire; and launching bCommerce Labs (July 2015–present), an incubator for blockchain startups. Additionally, he chairs CommPro Global (October 2013–present), a digital platform for communications professionals, and leads SocialRadius (August 2006–present), a social media marketing firm now part of Transform Group. [2]

Involvement in Cryptocurrency

Early Ventures and Transform Group

Michael Terpin founded Transform Ventures in 2013, establishing it as a venture studio and advisory firm focused on the emerging blockchain and cryptocurrency industry. Through this company, Terpin has been involved in the early stages of hundreds of crypto-related projects, including Ethereum, Tether, Brett, and Shiba Inu. Due to his long-standing presence and influence in the field, Terpin has been described by CNBC as "the godfather of crypto" for his role in launching and advising iconic crypto projects. His first book, Bitcoin Supercycle, was published in November 2024. [1] [4]

Advisory Roles

Michael Terpin is a prolific advisor in the cryptocurrency and blockchain space. His advisory work includes some of the most recognized names in the digital asset space, such as the smart contract platform Ethereum, the stablecoin Tether, and newer projects like Brett and Shiba Inu. [1]

In 2025, Terpin took on several new advisory positions. In January, he was appointed to the advisory board of CPAI, an artificial intelligence-powered platform for crypto tax reconciliation, preparation, and filing. [7] In March, he joined Lendr.fi, a platform focused on real-world asset (RWA) tokenization, as a Key Advisor. [4] In July, he was appointed Strategic Advisor for GOAT Network, a company developing Bitcoin-native yield generation products. [5]

Bitcoin Market Analysis

Bitcoin Supercycle: How the Crypto Calendar Can Make You Rich

Michael Terpin, recognized as a pioneer in the cryptocurrency industry, authored Bitcoin Supercycle: How the Crypto Calendar Can Make You Rich, published in November 2024. The book presents Terpin’s “Four Seasons of Bitcoin” model, which illustrates Bitcoin’s price movements through predictable cycles akin to those in traditional markets like real estate and stocks. The model highlights key market phases and events, such as Bitcoin’s fourth halving in 2024 and the introduction of crypto ETFs, which Terpin suggests may drive significant wealth creation. The book provides data, charts, and strategies aimed at helping investors understand and potentially benefit from Bitcoin’s long-term market cycles. [3] [6] [1]

Price Predictions

Drawing from his "Four Seasons of Bitcoin" model, Terpin has made public predictions about Bitcoin's future price. He has stated that Bitcoin could reach a price between $150,000 and $250,000 by the end of 2025. Looking further ahead, he projects that Bitcoin could approach or surpass $1 million by 2033. [6] His model is based on the idea that Bitcoin follows reliable, four-year cycles, with prices hitting new highs in the year following each halving event. The primary drivers he identifies for this growth are the asset's increasing scarcity due to the halving mechanism and growing institutional demand, which was bolstered by the approval of spot Bitcoin ETFs. [6]

Bitcoin Supercycle Genesis Fund

On May 28, 2025, Michael Terpin shared with David Lin his perspective on Bitcoin’s price cycles, describing them as four distinct seasons. He projected that Bitcoin could reach a valuation of $1 million by 2033, attributing this growth to factors such as scarcity and increasing institutional adoption. During this discussion, he also introduced his Bitcoin Supercycle Genesis Fund, aimed at capitalizing on the anticipated market dynamics.

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)