Subscribe to wiki

Share wiki

Bookmark

Overnight

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Overnight

Overnight is a decentralized finance (DeFi) asset management protocol focused on neutral-risk strategies and yield-generating stablecoins. [1] Launched in 2021, the protocol offers automated, fully collateralized tokens, such as its flagship product USD+, that are designed to provide passive income through daily yield distribution while maintaining a stable price peg. It operates across multiple blockchain networks, including Arbitrum, Optimism, Base, Linea, and Blast. [1]

Overview

Overnight is a DeFi protocol focused on stablecoins and strategies that generate yield while keeping risk exposure limited. Its main product, USD+, is a fully collateralized stablecoin pegged to USDC that distributes yield through a rebasing mechanism, allowing balances to increase while the price stays fixed. The platform also offers variants like USDT+ and wrapped assets, supports money markets and liquidity pools, and structures its investment approach around neutral-risk DeFi strategies. Overnight incorporates auditing, on-chain transparency, and governance features that allow participants to influence protocol decisions. [2]

Features

Swap

The Swap feature on the Overnight platform allowed users to convert various assets into Overnight tokens through Odos, a decentralized trading protocol that handled peer-to-peer routing and execution. It provided a direct method for transferring assets while maintaining decentralized transactions. The tool enabled quick exchanges with slippage-aware routing and typically lower fees than centralized platforms. Users retained control of their assets throughout the process and could rebalance or adjust positions efficiently, while their activity added liquidity to the broader ecosystem. [8]

Wrapped Tokens+

Wrapped Tokens+ are tokenized versions of assets like USD+ designed for DeFi protocols that require stable wallet balances. Instead of distributing yield by increasing the number of tokens, they capture rewards through a rise in the token’s price, providing a predictable balance while still allowing users to earn returns. This mechanism ensures compatibility with smart contracts and DeFi strategies that depend on fixed token amounts, while maintaining exposure to the underlying yield-generating assets. [7]

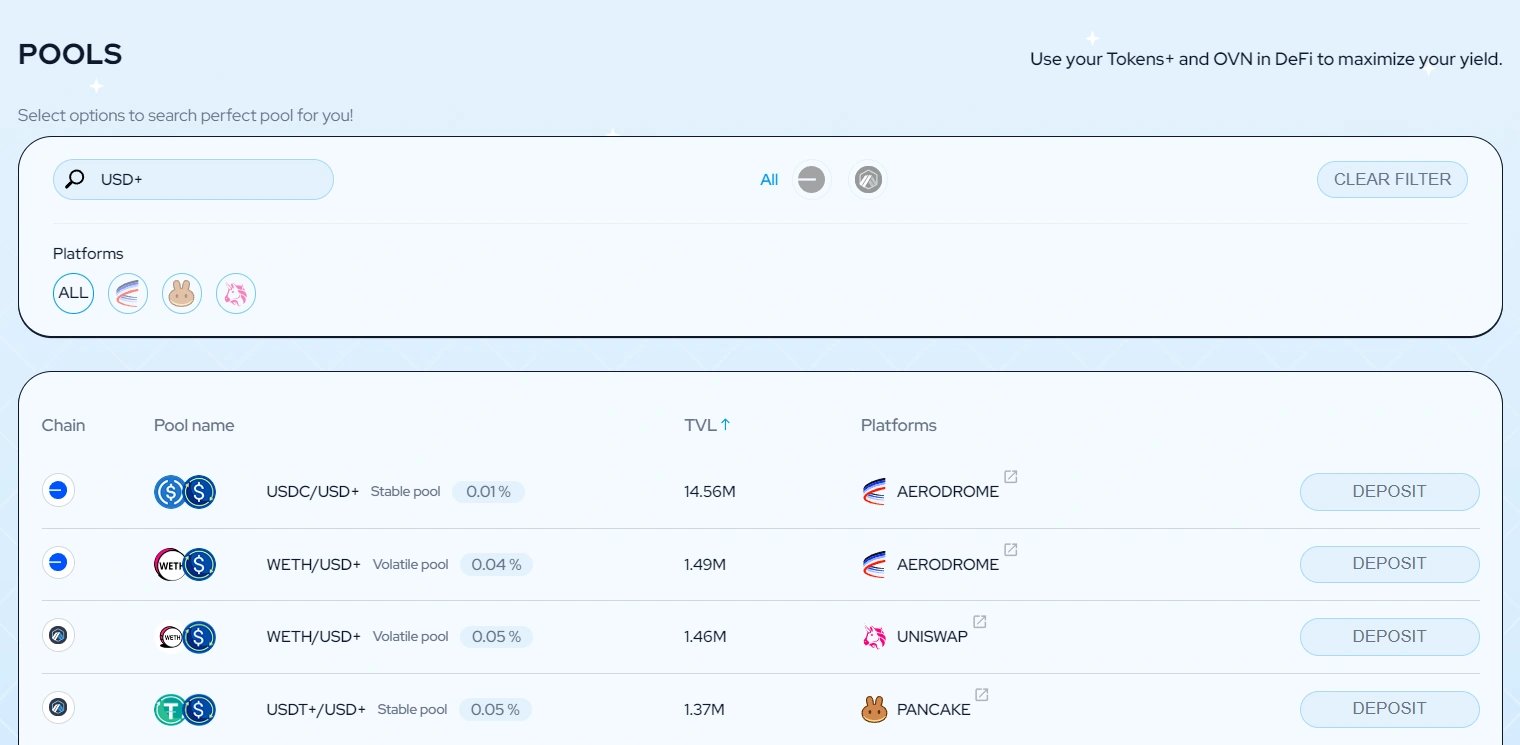

Pools

Pools on the Overnight platform let users supply assets to decentralized liquidity pools that power trading and other DeFi functions. By depositing into these pools, users act as liquidity providers and earn yields sourced from trading fees, interest, or external protocol rewards. The pools page displays options across supported chains, with filters available to narrow results by network. Each pool includes a Deposit button with Zapin support, allowing users to swap into the pool and provide liquidity in a single step. [9]

Zapin

Zapin is a smart-contract tool that lets users enter DeFi liquidity pools in a single transaction by automatically creating and depositing LP tokens, removing the need for multi-step interactions across different protocols. It streamlines the process for both beginners and experienced users by reducing friction, saving time, and consolidating what would otherwise be several manual transactions into a single transaction.

The Overnight Zapin NFT campaign rewards users who interact with platform features such as depositing through Zapin, swapping tokens, and adjusting positions. Participants earn a Level 1 NFT for completing an initial Zapin deposit. They can progress to a Level 2 NFT—limited each round—which grants access to a private Discord community with early feature access, direct communication with the team, and community events. [10] [11]

Tokens

Overnight Tokens+ are fully collateralized, yield-accruing assets pegged to the value of their underlying tokens, such as USD+, xUSD, and USDT+. Their balances increase through a rebasing mechanism that distributes yield directly into users’ wallets while keeping each token’s peg intact. [5]

OVN

The OVN token is used across the Overnight protocol for governance, incentives, and risk management, giving holders influence over strategy decisions and the ability to counterbalance overly aggressive approaches. It also underpins a recycling mechanism where a portion of liquidity pool rebase income is used to buy OVN and redistribute it as bribes, creating a feedback loop that encourages ongoing liquidity participation. [12]

Tokenomics

OVN has a total supply of 1M tokens and has the following distribution: [12]

- Treasury: 44%

- Team: 25%

- Insurance Fund: 20%

- Pre-seed Investors: 8.5%

- Pre-sale: 2.5%

OVN Staking

OVN staking allows users to lock OVN and receive OVN+ at a one-to-one rate, providing holders with a way to earn passive rewards while contributing to the protocol’s broader system. OVN+ accrued yield automatically through the same rebase mechanism used across Overnight’s Tokens+, with balances adjusting daily rather than requiring any manual action.

Rewards for OVN+ stakers were derived from a share of daily skims collected on USD+ pools on Base, with 20% of those skims used to purchase OVN on the market and convert it into OVN+. OVN+ was fully backed by staked OVN, and buybacks increased the collateral base, ensuring that backing always remained equal to or above the circulating supply. When accumulated OVN exceeded the required collateral, the OVN+ supply was adjusted through rebases to reflect the surplus. Users could view staking metrics—including total value locked, daily yield, and payout history—through the protocol’s statistics page. [14] [15]

USD+

USD+ functions as a stable, fully collateralized token that anchors many DeFi activities by providing dollar-pegged stability while generating yield through its rebase model. It supports strategies such as yield farming, lending, borrowing, and liquidity provision, giving users a predictable asset they can deploy across protocols without the volatility of typical crypto tokens. Built around conservative, real-yield strategies and daily profit distribution, USD+ helps smooth transactions, improve liquidity, and provide a flexible foundation for planning and executing DeFi investments. [6]

Rebase System

The rebase system distributes yield by increasing each holder’s token balance rather than changing the token’s price, keeping assets like USD+, Tokens+, and xUSD pegged while reflecting accrued returns. Yield is generated from selected strategies, converted to collateral (e.g., USDC), and then issued as newly minted tokens during a manual rebase, which adjusts balances according to each user’s share of the supply. [3]

xUSD

xUSD is a fully collateralized stablecoin pegged to USDC that distributes yield through a rebasing mechanism, increasing token balances directly in holders’ wallets. It is supported across multiple blockchains using Chainlink CCIP and can be minted on Arbitrum, offering a dollar-pegged asset that passively accrues returns without requiring staking or lockups. [4]

Investors

- Sandeep Naiwal

- Ryan Selkis

- HackVC

- FJ Labs

- Brian Tubergen

- Paul Holland

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)