위키 구독하기

Share wiki

Bookmark

ProtonTerminal

0%

ProtonTerminal

ProtonTerminal은 사용자가 자연어 명령을 사용하여 복잡한 작업을 실행할 수 있도록 함으로써 탈중앙화 금융(DeFi) 및 암호화폐 작업과의 상호 작용을 단순화하도록 설계된 시스템입니다. ProtonTerminal은 미래의 스마트 지갑, 즉 프롬프트만으로 승인, 브리징, 스왑에 이르기까지 모든 거래를 쉽게 처리할 수 있는 에이전트를 구축하고 있습니다. [1]

개요

ProtonTerminal은 암호화폐와의 상호 작용이 의도를 진술하는 것만큼 간단해야 한다는 원칙을 기반으로 구축되었습니다. 이 시스템은 자연어 요청을 이해하고, 다양한 체인과 프로토콜에서 필요한 단계를 계획하고, 자동으로 실행하도록 설계되었습니다. 이 접근 방식은 신규 사용자의 진입 장벽을 낮추고 숙련된 사용자의 운영을 간소화하는 것을 목표로 하며, ETH, SOL 및 BTC에서 작동합니다. [1]

에이전트

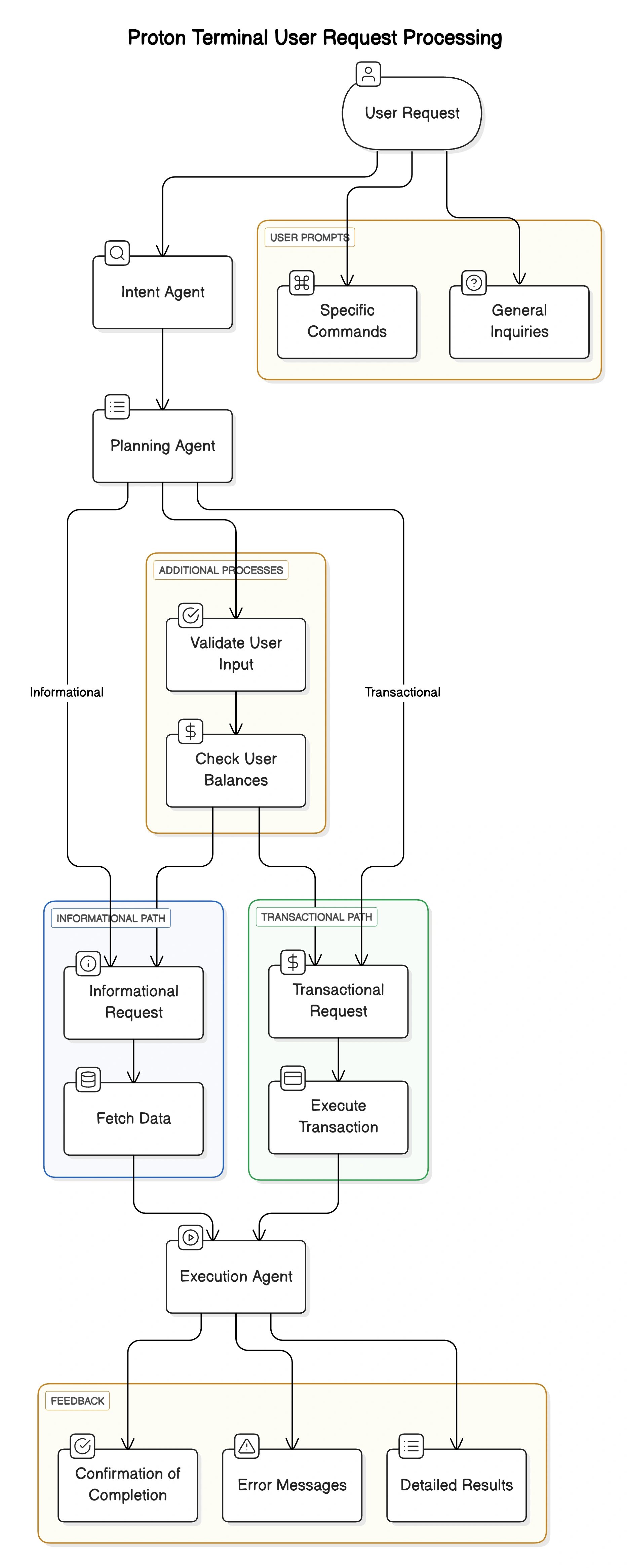

ProtonTerminal은 사용자 명령을 해석, 계획 및 실행하는 특화된 에이전트 시스템을 통해 작동합니다. Intent Agent는 먼저 사용자의 목표를 결정하고, Planning Agent는 기본 쿼리든 복잡한 다단계 거래든 요청을 구조화된 단계로 나눕니다. 그런 다음 이러한 단계는 통합된 채팅 인터페이스를 통해 작업을 수행하는 Execution Agent에 의해 처리됩니다. [2]

정보 제공

데이터 기반 쿼리의 경우 ProtonTerminal은 여러 소스에서 실시간 통찰력을 집계합니다. LlamaFeed는 에어드롭, 토큰 잠금 해제, 해킹 및 자금 조달 라운드에 대한 업데이트를 제공합니다. CoinGecko는 상장된 자산에 대한 토큰 가격, 시가 총액, 거래량 및 소셜 링크에 대한 자세한 정보를 제공합니다. DexScreener는 최신 또는 미상장 토큰에 대한 거래 데이터 및 차트로 이를 보완합니다. 이러한 통합을 통해 사용자는 단일 인터페이스 내에서 토큰 통계, 시장 동향 및 생태계 뉴스에 액세스할 수 있습니다. [3]

실행

정보 검색 외에도 ProtonTerminal은 직접적인 온체인 실행을 가능하게 합니다. 현재 기능에는 주요 EVM 및 Solana 네트워크에서 토큰 스왑, 체인 간 자산 브리징, 사용자 지정 매개변수로 토큰 출시, 모든 지갑으로 토큰 전송이 포함됩니다. 사용자는 하나의 프롬프트에서 브리징 및 스왑과 같은 다단계 흐름을 시작할 수도 있습니다. 향후 업데이트에서는 통합 DeFi 프로토콜을 통해 스테이킹, 대출 및 차입을 포함하도록 기능이 확장될 예정입니다. [4]

사용 사례

잘못된 내용이 있나요?