Subscribe to wiki

Share wiki

Bookmark

XT.COM

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

XT.COM

XT.COM is a global cryptocurrency centralized exchange that incorporates social features. As of September 2025, it supports over 1,000 tokens and 1,300 trading pairs, offering spot trading, futures trading, margin trading, OTC trading, and crypto purchases with credit cards.[1][31][33]

Overview

XT.COM is an international centralized exchange founded in 2018 by Weber Woo and Ada Too, both of whom are no longer with the company, and registered in Seychelles. The platform is operated by Fibtc Ltd, a Seychelles-registered company, and maintains operational entities in other regions, including Poland. The current CEO is Albin Warin. As of September 2025, XT.COM serves over 7.8 million registered users, with more than 1 million monthly active users and over 40 million users within its broader ecosystem. The exchange's slogan is “Xplore Crypto, Trade with Trust.” The platform supports over 1,000 tokens and more than 1,300 trading pairs, offering services such as spot trading, futures trading, margin trading, OTC trading, and cryptocurrency purchases with credit cards. XT.COM aims to provide secure, efficient, and professional digital asset investment services. The exchange's headquarters are in Dubai, and it maintains a significant presence through multiple international communities in various languages.[1][32][33][3][44]

History

XT.COM was established in 2018 and has since grown to become a global cryptocurrency trading platform.[1]

2024 Security Incident

In November 2024, XT.COM experienced a security breach involving an unauthorized transfer of assets from a platform wallet. Reports on the amount stolen varied, with some sources indicating a loss of approximately $1 million USDT, while others reported a higher figure of $1.7 million. The exchange responded by temporarily suspending withdrawals and isolating the affected systems to prevent further unauthorized activity. XT.COM's official statement clarified that the incident involved platform-owned assets and that user funds were not affected, citing its policy of maintaining reserves 1.5 times greater than user assets. The company launched a full investigation and gradually restored services after confirming the platform was secure.[34][35][36]

2025 Events and Growth

Throughout 2025, XT.COM hosted several community and promotional events to engage its global user base. In January and February, the exchange held its "Year of the Snake Celebration," which included a giveaway with a prize pool of $1,000,000. In April, during the Hong Kong Web3 Festival, XT.COM hosted the "HK VIP Party #BeyondTrade," an exclusive event for investors, key opinion leaders, and community members.[37][38]

On September 24, 2025, XT.COM announced its largest brand and user interface overhaul, guided by the new mission, “Xplore Crypto, Trade with Trust.” The refresh was built on the principles of Clarity, Inclusivity, and Confidence, featuring a redesigned, simpler logo, updated typography for better readability, and a new color palette. The UI/UX improvements focused on creating a more intuitive and inclusive trading experience, introducing a streamlined onboarding process, chart-based trading, simplified order flows, and visible in-app security cues. To mark the occasion, the exchange launched a community celebration campaign titled "Built Together, Celebrated Together," which included interactive challenges, airdrops, and themed events for users to explore the new features.[33][44]

Regulation

In May 2025, Thailand's Securities and Exchange Commission (SEC) announced its intention to block access to several unlicensed cryptocurrency exchanges operating in the country. XT.COM was among the platforms cited for allegedly operating without a license in violation of the Digital Asset Business Act. The Thai SEC requested that the nation's Ministry of Digital Affairs block access to these platforms starting from June 28, 2025.[39][40]

Future Developments

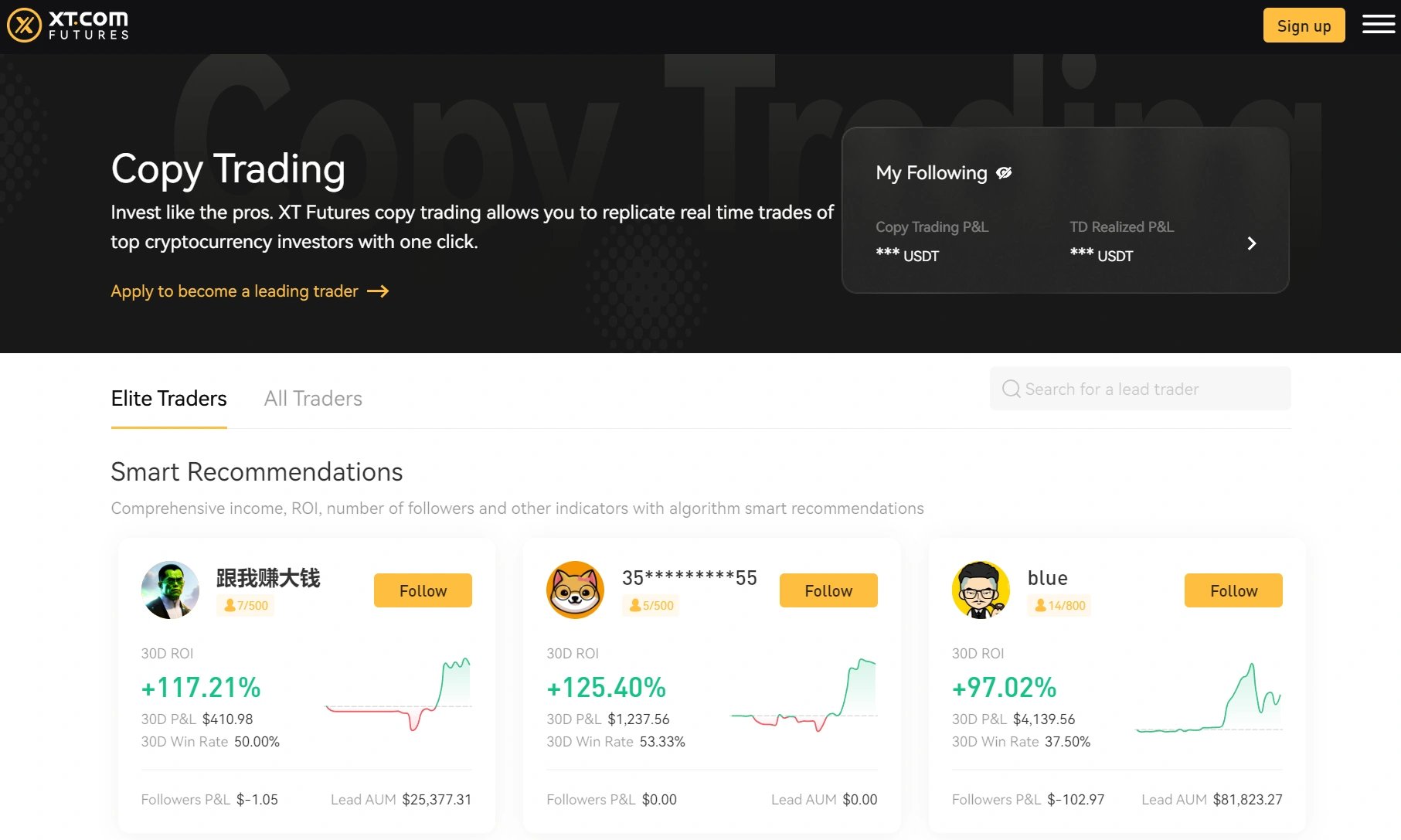

Following its brand overhaul in September 2025, XT.COM announced plans for further platform enhancements as part of a broader development plan. The company stated its intention to continue investing in design, usability, and product innovation. The future roadmap includes expanded features for purchasing cryptocurrencies, upgrades to copy trading functionalities, the introduction of new strategy and wealth management tools, and the continued development of its 'earn' products. The company also plans deeper integration across the entire XT.com ecosystem.[33][44]

Products

Spot Trading

XT Exchange's spot market aims to enhance trading with an advanced API, a matching engine capable of handling one million transactions per second, and various order types like limit, stop, market, post-only, and iceberg. It supports over 1,000 tokens and 1,300 trading pairs, aiming to maintain high liquidity and competitive spreads. The platform provides up to 20x leverage for major cryptocurrencies and multiple fiat gateways for purchasing crypto. XT Exchange also aims to offer high-yield financial services and a competitive fee structure. Users can act as market makers or takers, facilitating immediate transaction settlement at current market prices. The September 2025 UI overhaul enhanced this experience by integrating chart-based trading capabilities and simplifying the order flow process to be more intuitive for all users.[2][41][4][5][6][7][33][44]

Margin Trading

XT Exchange aims to facilitate margin trading, allowing users to trade with borrowed funds, which can amplify both profits and losses. Borrowed funds must be repaid in the same currency, with interest repayments prioritized.

Longing involves buying assets expected to rise in value, while shorting involves selling borrowed assets to repurchase at a lower price. The platform supports up to 20x leverage to expand trading capacity.

Margin trading carries significant risks, including potential losses exceeding the initial investment. XT Exchange uses a forced liquidation mechanism at a 30% margin rate with the intend of managing these risks. [2][8][9][10][11][12]

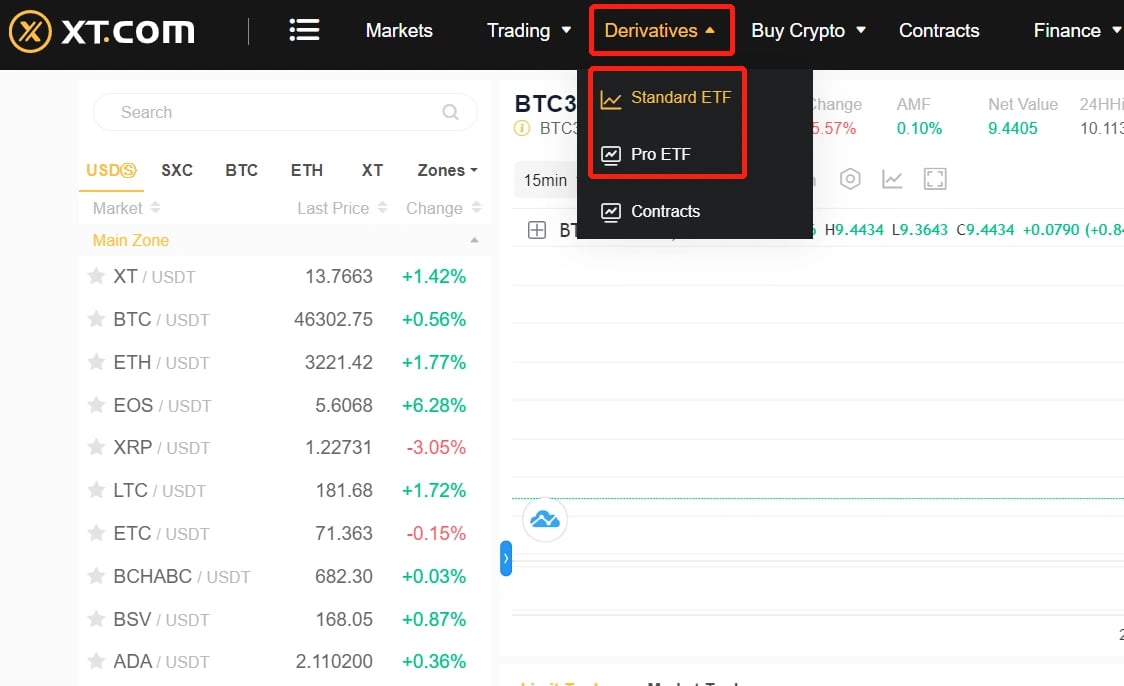

Future & Derivatives Trading

XT.COM offers a platform for futures and derivatives trading, including USDT-margined and coin-margined perpetual and quarterly contracts. It includes tools such as copy trading and futures grid trading.

- Cryptocurrency Futures: XT.COM facilitates speculation on future cryptocurrency prices, allowing traders to take long or short positions without owning the asset. This method enables control over large positions with a small margin, potentially leading to higher returns.

- Futures Contracts: XT's futures contracts, settled in USDT, BTC, and ETH, differ from perpetual contracts with fixed delivery dates and no funding fees. Trading fees include maker and taker fees. The settlement price is determined by a weighted average index to reduce manipulation risks.

- Reverse Position Feature: The Reverse Position feature enables users to close existing positions and open opposite positions at market price, aiding transitions between long and short positions, subject to sufficient funds and market conditions.

- Grid Trading: Futures grid trading employs automated bots to execute trades based on predefined parameters, assisting in risk management and maintaining stability in volatile markets.

- Funding Rates: Funding rates adjust long and short positions by crediting or debiting trader accounts, aligning perpetual contract prices with spot market prices.

- Insurance Fund: XT Exchange's insurance fund aims to protect traders from significant losses due to forced liquidations, ensuring that profitable trades are secured even in volatile conditions.

- Trading Process: To trade futures on XT.COM, users need to open a futures trading account, enable 2FA, and fund their futures wallet. They can choose between USDT-margined and coin-margined futures, select leverage, and place orders. A demo trading environment is available for practice.[13][14][15][16][17][18]

Copy Trading

Copy trading on XT enables users to replicate trades from experienced investors seamlessly. The platform provides real-time data and automated operations for informed decision-making. Top traders undergo vetting for reliability and stability, potentially earning bonuses from followers' success. The one-click feature simplifies trading for both professionals and novices, eliminating manual processes. It benefits lead traders with loyal followers and potential profit sharing.[20][21]

ETF Zone

XT ETFs, offered by XT, function as financial instruments tracking asset prices via derivatives such as futures, aiming to amplify returns by a fixed multiple through managed rebalancing. Margin-free trading aims to maximize capital efficiency, resembling spot trading in its streamlined process. Compound interest, beneficial in unilateral trends, and manageable risk, ensured by the absence of liquidation, are notable features. Prices are determined by net asset value (NAV), calculated from spot prices and leverage multiples. While suitable for one-sided trends, caution is advised in oscillating markets to mitigate potential capital loss.[19]

Ecosystem

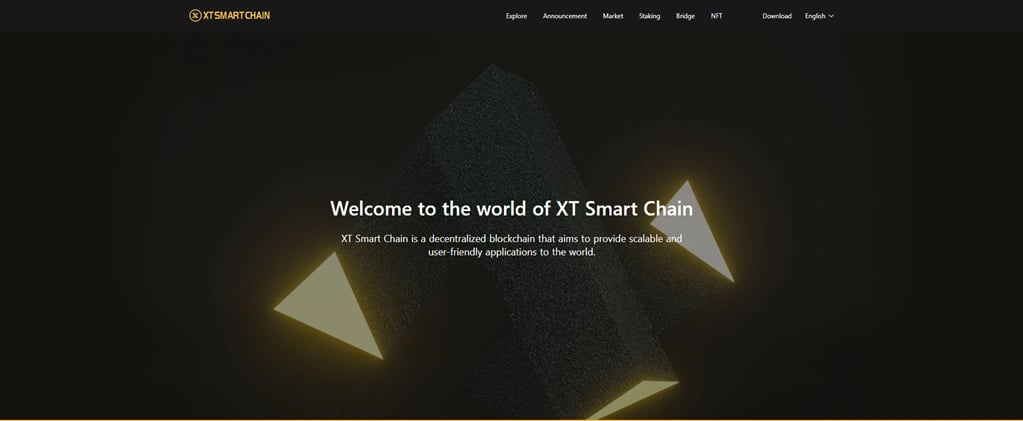

XT Smart Chain

XT Smart Chain functions as a decentralized public chain designed for compatibility with smart contracts and optimized for high-performance transactions. Employing the HPoS consensus mechanism, it intends to offer reduced transaction costs, low latency, and increased concurrency. In addition to its role as a public chain, XT Smart Chain aims to foster innovation by supporting developers and projects within its expansive trading ecosystem.

Key features include an open and decentralized network for enhanced security, support for EVM programmability and smart contracts, meta-transaction functionality to minimize fees, and the capability for cross-chain asset transfers.[41][22][23][24]

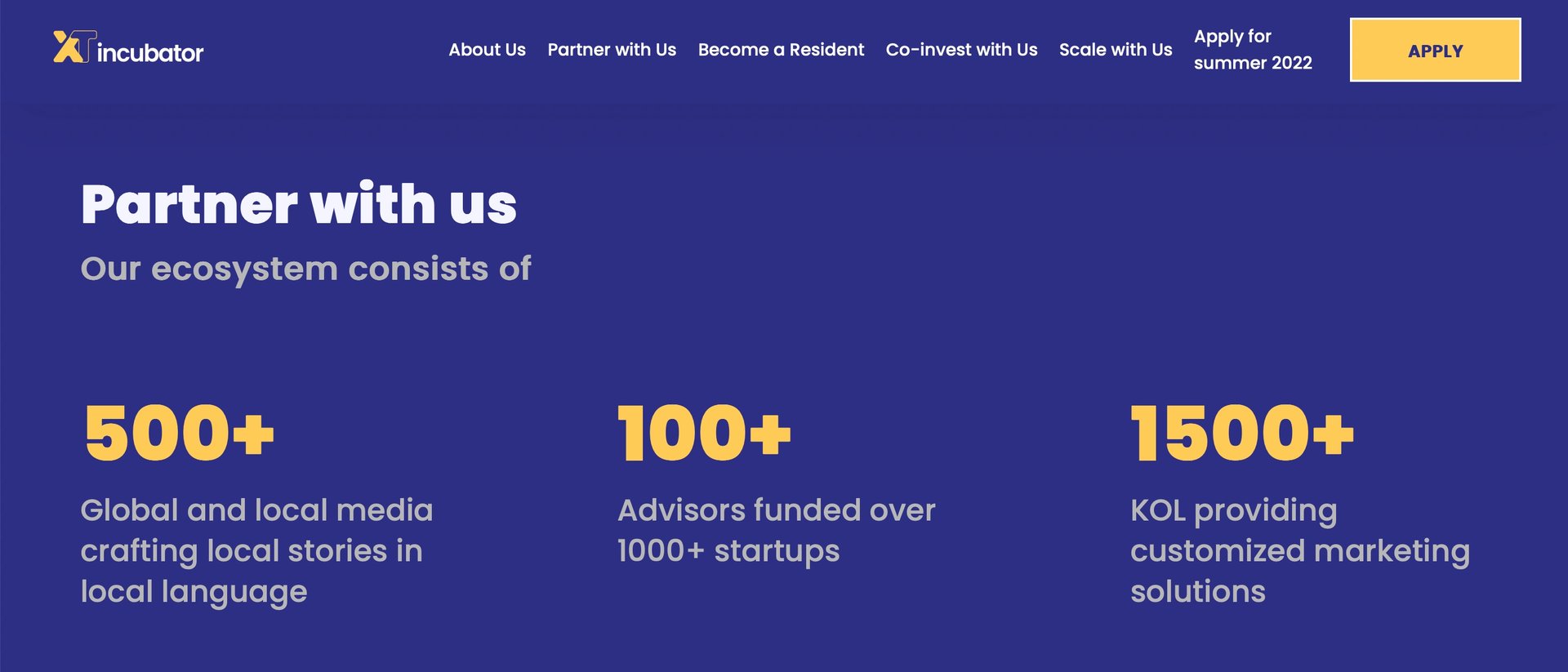

XT Incubator

XT Incubator is a program designed to accelerate and nurture early-stage projects, providing support in market entry, strategy, legal, and development areas. Through advisors and service providers like Brightnode, it aims to empower startups to collaborate effectively and foster innovation. Key resources include access to marketing professionals, developers, crypto lawyers, data aggregators, media outlets, and mentors, creating an environment conducive for startups to thrive.[41]

XT Labs

XT Labs functions as the venture capital division of XT.com, specializing in blockchain, digital assets, and cryptocurrencies. With a focus on facilitating long-term, sustainable growth, XT Labs aims to invest diverse industrial resources to support startups. Through its team of investment and operating professionals, XT Labs collaborates closely with portfolio companies to cultivate exceptional value. The firm concentrates on assisting projects in both Asian and overseas markets to flourish and achieve enduring success.[25][41]

XTStarter

XT Starter functions as a fundraising launchpad, facilitating Initial DEX Offerings (IDO) and discount flash sales, with the aim of enhancing project visibility and token liquidity through active user engagement.

XT Starter employs rigorous screening to select projects not yet listed on major exchanges. It offers early token access at rates below market prices, accommodating both retail investors and institutions. The absence of lock periods and an inclusive approach aim to reduce market volatility risks.[41][42]

Polaris Combinator

Polaris Combinator operates as an investment firm specializing in various sectors within the crypto industry. It invests across different stages and sectors, with a particular focus on Web3.0 technologies. The firm aims to enhance the influence of projects through investment, incubation, branding, and community operations. Serving as a connector between Web2.0 and Web3.0, Polaris Combinator seeks opportunities in areas such as Web3.0, DeFi, Gamefi, Metaverse, and Layer 2 technologies.[41]

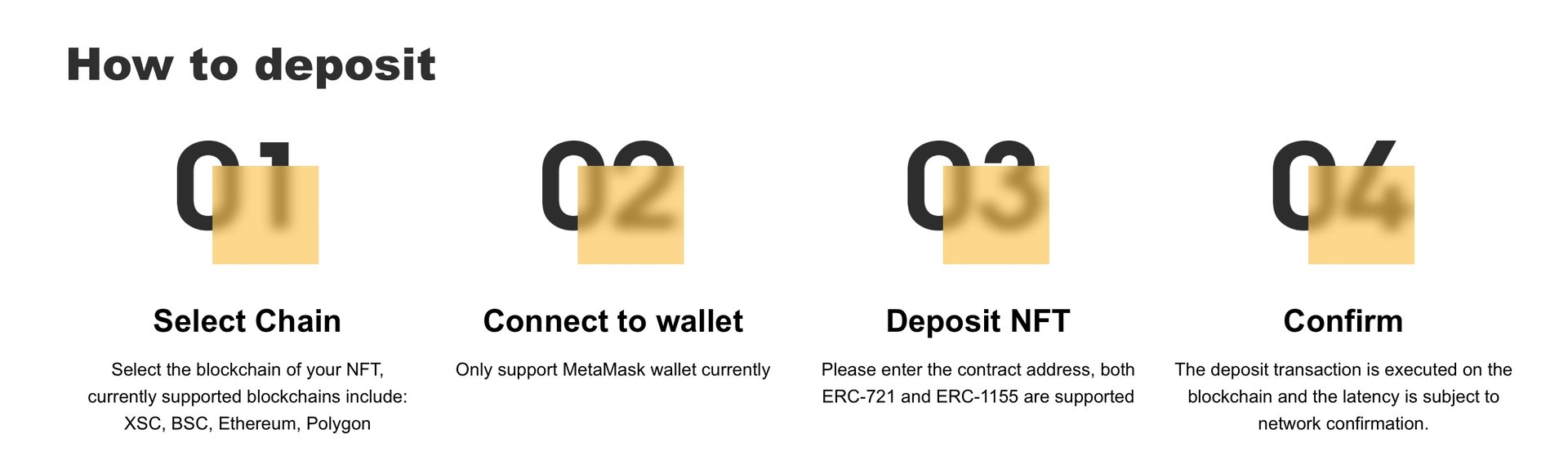

XT NFT

XT NFT functions as a centralized platform for aggregated NFT trading, facilitating IGO/INO blind box transactions, initial launches, and NFT staking for NFTFi. Depositing NFTs involves selecting the blockchain, connecting to a MetaMask wallet, depositing the NFT using the contract address, and confirming the transaction.

In XT's context, the NFT channel emphasizes centralization and aggregation, addressing challenges in decentralized NFT ecosystems such as protocol disparities and high transactional costs. XT NFT aims to simplify NFT purchases, provide cost-efficient transactions, and offer benefits like copyright fees for creators and enhanced exposure opportunities. Users can register an XT account, access the NFT platform, bid for desired NFTs, and withdraw assets using the provided wallet address.[41][26][27]

XT Academy

XT Academy is designed as an open-access platform, providing a broad spectrum of fundamental and advanced knowledge for individuals interested in cryptocurrencies. It aims to cater to both beginners and those with existing knowledge, offering educational resources free of charge. Additionally, the platform aims to offer opportunities for users to earn cryptocurrencies through their participation in educational activities.[41][28]

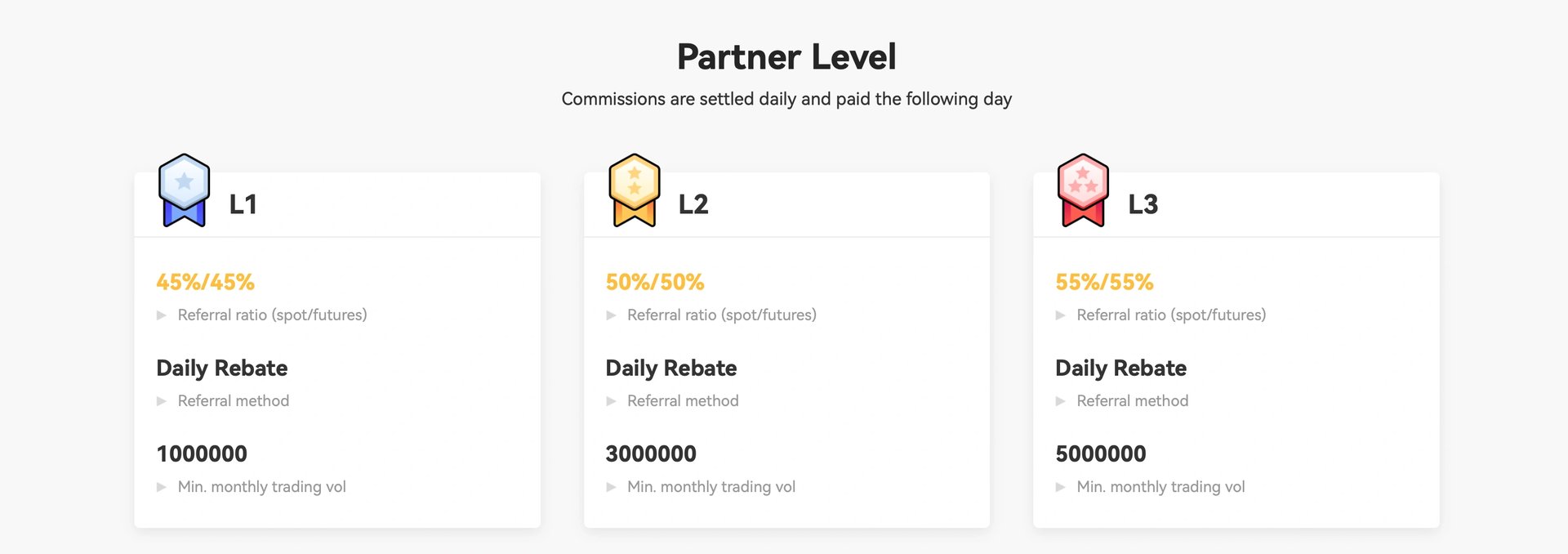

XT Partner Program

The XT Partner Program is designed for those aligned with XT's values to promote the platform through unique referral links. Partners earn commissions on trades made by their referrals, with adjustable ratios for both XT Spot and Futures. Eligible participants include content creators, cryptocurrency websites, and promotional entities.

Partners share their referral links, earning commissions from their referrals' transaction fees. They can also customize referral links with different fee discounts for more effective invitations.[29]

Bug Bounty Program

XT.COM has introduced a Bug Bounty Program with the goal of strengthening the security and reliability of its crypto trading services. The initiative invites individuals to identify and report vulnerabilities on the platform, aiming to promptly address potential threats and prevent malicious attacks.

Open to all, the Bug Bounty Program offers rewards for eligible vulnerability reports, with the amount ranging from $50 to $2,000 USD based on the severity of the issue and the quality of the report.[30][43]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)