Bribes

贿赂是协议为增加其代币流动性而提供的激励奖励。贿赂的主要目标是吸引更多用户到特定的流动性池。 [1]

概述

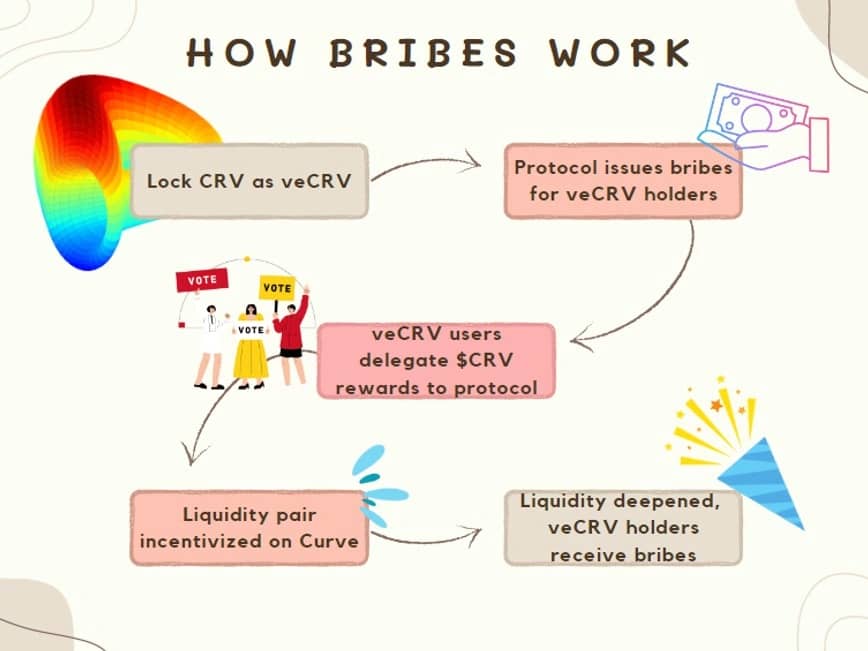

“贿赂”一词在 DeFi 的语境中,确实是由 Curve Finance 的用户普及的。贿赂是给予 DeFi 平台的治理代币持有者的,这些平台上协议的代币存在于流动性池中。这些代币持有者有权投票支持他们的流动性池,更多的投票意味着池获得更多的排放,从而带来更高的奖励。 [1]

治理代币持有者,例如持有 Curve 的 CRV 代币的人,有权投票决定哪些流动性池获得更多的排放。对一个池的更多投票会导致更高的排放,从而为那些向该池提供流动性的人带来更高的奖励。寻求提高其池流动性的协议向这些投票者提供贿赂,以确保获得更多的排放。通过提供这些贿赂,协议可以有效地确保其流动性池吸引更多的流动性,因为增加的排放会导致更高的 年化百分比率 (APR),这对流动性提供者具有吸引力。[3]

本质上,gauges 允许一些用户通过向在特定时期内承诺该行为的任何人提供贿赂,来激励其他用户在特定时期内的某种行为。例如,Thena 是 BNB 链上一个流行的 DEX,它使用 gauges 的概念来吸引更多流动性到其池中。Frax finance 是 Thena 上的一个主要的 DEFI 协议,它拥有最突出的 FXS、FRAX 和 frxETH 池。在每个周期(每周),Thena 像 Sushiswap 一样,根据每个池的重要性,向每个池的 流动性提供者 (LP) 提供新的代币排放。每个池的重要性是通过前一个周期的社区投票决定的。Frax finance 通过向投票支持其池重要性的任何人分配贿赂(以 FXS 代币的形式)来影响这个社区决策。从而希望吸引更多的 LP 到其池中。[8]

DeFi 贿赂示例

MIM - Abracadabra

在 牛市 期间,一个值得注意的贿赂使用者是 $MIM,它是 Abracadabra 的原生稳定币,Abracadabra 是由 Daniele Sesta 创建的货币市场协议。$MIM 的主要目标是成为领先的跨链 稳定币,需要深厚的流动性对和广泛的使用。为了实现这一目标,Abracadabra 大力激励 $veCRV 持有者投票支持使用 $MIM 的 流动性池 (LP)。这一策略产生了两个显著的影响:

- 增加流动性:涉及 $MIM 的交易变得极具流动性,这在链上活动高峰期至关重要。这种高流动性确保交易者不会遭受滑点,并帮助 $MIM 维持其挂钩。

- 有利可图的 LP-ing:为 $MIM 对提供流动性变得非常有利可图且几乎没有风险,不仅提供交易费用,还提供来自定向排放的大量奖励。[2]

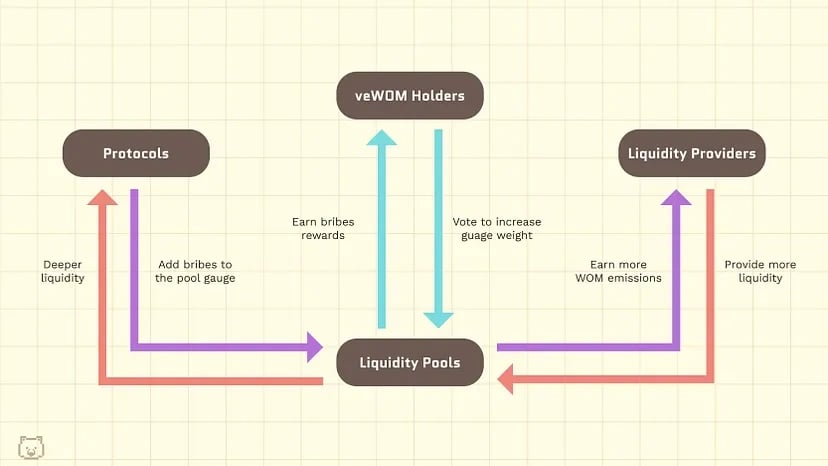

veWOM - Wombat Exchange

在 2023 年 12 月,Wombat Exchange 和 Frax Finance 联手增加 FRAX 在 BNB 链 上的使用,旨在增加 FRAX 稳定币在 BNB 链上的采用和流动性,同时为 Wombat 用户提供更多的收益机会和选择。合作之后,FRAX 被纳入 Wombat 的创新池,WOM 排放将作为流动性激励来支持该池。一旦投票 gauge 激活,用户可以通过投票支持 FRAX gauge 来获得贿赂。[5]

Fraxtal 激励计划

在 2024 年 3 月 11 日,由 Frax Finance 构建的 Layer 2 Fraxtal 向公众推出了他们的 主网 桥,标志着 Fraxtal 向成为 Superchain 的转型迈出了重要一步。Fraxtal 是一个模块化 Rollup,于 2024 年 2 月 7 日推出。

Fraxtal 建立了一些独特的激励计划。Fraxtal Blockspace 和 faxtal 积分系统。

- Fraxtal Blockspace 激励系统 (Flox): Frox 是主要的自动化、循环方法,用于奖励 Fraxtal 上的用户和 智能合约 开发人员。每个 epoch(最初为 7 天),在 Fraxtal 上花费 gas 的 EOA 地址和使用 gas 的智能合约都会获得奖励。FXTL 积分与“Flox 算法”成比例。

- Fraxtal 积分系统 (FXTL): Fraxtal 还推出了自己的积分系统,这是一个独特的代码,代表 Fraxtal 生态系统中的积分。它奖励和激励生态系统中的参与者,包括创建和与 智能合约 交互、利用部署到链上的新协议以及持有特定类型的代币。FXTL 积分将在 Fraxtal 链创世后的 12 个月内进行代币化。FXTL 积分是否将代币化为链的单独质押代币,或者以指定的比例转换为 FXS 代币,将在未来揭晓。[6][7]