订阅 wiki

Share wiki

Bookmark

Venom Foundation

0%

Venom Foundation

Venom基金会是一个构建区块链平台的组织,专注于为去中心化应用程序(dApps)和数字资产提供可扩展、安全和高效的解决方案。通过解决现有区块链技术的局限性,Venom旨在通过区块链技术的应用,支持包括金融、供应链和医疗保健在内的广泛行业。[3][4]

概述

Venom Foundation是一家专注于区块链的实体,在阿布扎比全球市场(ADGM)运营,ADGM是阿联酋的国际金融中心。作为首家在ADGM获得许可的加密货币基金会,Venom在中东和北非(MENA)地区区块链基础设施的开发中发挥着关键作用。

该基金会的重点还包括支持政府和企业采用Web3技术。Venom提供基于区块链的解决方案,可用于安全交易、NFT平台和法币支持的稳定币,所有这些都符合ADGM的监管框架。通过这种方式,Venom旨在以合规且易于访问的方式支持区块链技术的更广泛实施。 [9][10]

Venom 区块链

Venom 建立在独特的共识机制之上,旨在增强安全性和可扩展性,使其能够处理每秒大量交易(TPS)。该平台还强调互操作性,允许与其他区块链网络和传统系统无缝集成。这种适应性使其适用于企业级应用程序和较小的去中心化项目。Venom 还支持智能合约功能,使开发人员能够构建利用区块链固有安全性和透明性的去中心化应用程序。

该生态系统包括 Venom Wallet、Venom Scan 和 Venom Pools 等工具,有助于创建和管理去中心化应用程序 (DApps) 并支持各种区块链功能,包括质押和交易验证。[1][4][11]

历史

Venom 区块链 的概念起源于 2018 年,由 克里斯托弗·路易斯·苏 和凯-乌韦·施特克博士发起。两人与来自阿拉伯联合酋长国的投资集团合作,旨在构建一个能够扩展以处理大型工作负载的区块链。经过多年的发展,Venom 网络于 2022 年 4 月首次亮相封闭测试网,并于 2023 年 4 月向公众开放。2024 年 3 月,Venom 的 主网 上线,并在主要交易所上市,标志着一个重要的里程碑。该项目的核心优势在于其可扩展性、低 交易费用 和快速处理能力。

Venom 现在作为 Layer 0 和 Layer 1 区块链 运行,使开发人员能够构建可扩展的 Web3 应用程序并参与全球支付。Venom 的架构利用动态分片和 Mesh 技术来提供适应性强的多区块链系统,以满足各种用例,包括 去中心化金融 和企业应用程序。 [5][6][7][8]

技术

Venom平台利用多项技术创新,旨在提高可扩展性和安全性。其中包括:

- 线程虚拟机(TVM): TVM通过使用Actor模型来隔离和并行处理进程,从而实现高效的账户交互。这种结构支持动态分片,提高了平台的可扩展性。

- 共识机制: Venom的共识机制有助于降低诸如双重支付和51%攻击等风险,确保交易的完整性。

- 账户抽象: 此功能允许开发者通过智能合约定义账户行为,从而在dApp设计中提供更大的灵活性和模块化。

- 外部消息传递: Venom促进链下和链上系统之间的通信,允许外部数据触发区块链网络内的操作。

- 工作链: 该平台支持创建专门的Layer 1区块链,即工作链,可以对其进行自定义以满足各种安全性、隐私性和合规性需求。

- T-Sol: 一种源自Solidity的开发者友好的语言,T-Sol简化了具有C、C++和JavaScript等其他编程语言经验的开发者的入门过程。[3][4]

主要特点

- 高吞吐量: Venom能够处理每秒超过100,000笔交易,使其成为大规模应用的理想选择。

- 低交易费用: Venom上的交易成本保持在最低水平,费用通常低于0.0002美元。

- 互操作性: 该平台旨在与其他区块链网络和传统系统无缝协作,从而促进数据交换和协作。

- 零排放政策: Venom的运营以零排放方法为指导,以最大程度地减少环境影响。[1][4]

使用案例

Venom平台在多个行业都有应用,包括:

- 去中心化金融 (DeFi): 通过智能合约提供安全高效的金融服务。

- 供应链管理: 增强透明度和可追溯性,确保整个供应链中产品的真实性。

- 医疗保健: 安全地存储和共享医疗记录,以改善患者护理,同时保护数据隐私。[3][4]

Venom 生态系统

Venom 已经开发了一个不断增长的去中心化应用程序 (dApps)、工具和服务生态系统:

- Venom Wallet: 一个非托管钱包,允许用户安全地管理他们的资产,可作为浏览器扩展程序和移动应用程序使用。

- Venom Scan: 一个区块链浏览器,使用户能够在 Venom 网络上搜索和验证交易、区块和其他数据。

- 资助和质押: Venom 为在其平台上进行开发的开发者提供资助计划,并为用户提供质押解决方案,通过锁定他们的代币来赚取奖励。[3][4]

治理和 DAO 集成

Venom 将去中心化自治组织 (DAO)纳入其治理模型中。通过 DAO,代币持有者可以参与影响网络的决策过程,从而实现去中心化治理,而无需依赖中央机构。Venom 生态系统中的 DAO 可用于各种目的,例如管理社区项目和监督去中心化投资基金。[3][4]

Venom Token (VENOM)

VENOM代币是Venom区块链的原生加密货币,Venom区块链是一个高度可扩展的平台,旨在支持去中心化应用程序(dApps)、去中心化金融(DeFi)服务和其他Web3计划。作为TIP-3标准代币,VENOM无缝集成到Venom的分布式系统中,为其费用模型提供经济高效的解决方案。该代币在Venom生态系统中发挥着核心作用,支持支付交易费用、质押和参与去中心化金融应用程序等各种功能。[2][3][4][5]

作为Venom网络的核心组成部分,VENOM使用户能够参与平台的去中心化应用程序,并作为生态系统内的主要价值单位。这包括参与质押、流动性池和其他Web3活动。

代币经济学

VENOM代币初始供应量为72亿,通过支付交易费用、质押和参与治理来支持网络活动。VENOM代币可以细分为更小的单位:NanoVENOM、MicroVENOM和MilliVENOM,从而增强其在不同交易中的效用。 [12][13][14][15]

初始供应和分配

在主网启动时,总供应量中只有15.6%(11.16亿)将被解锁,剩余的84.4%(60.84亿)将被锁定。这部分锁定的代币包括为验证者预留的代币,其中10%(7.2亿)被指定为初始验证者权益。

VENOM代币的预计年通货膨胀率设定为-1%,相当于大约-7200万个VENOM代币。

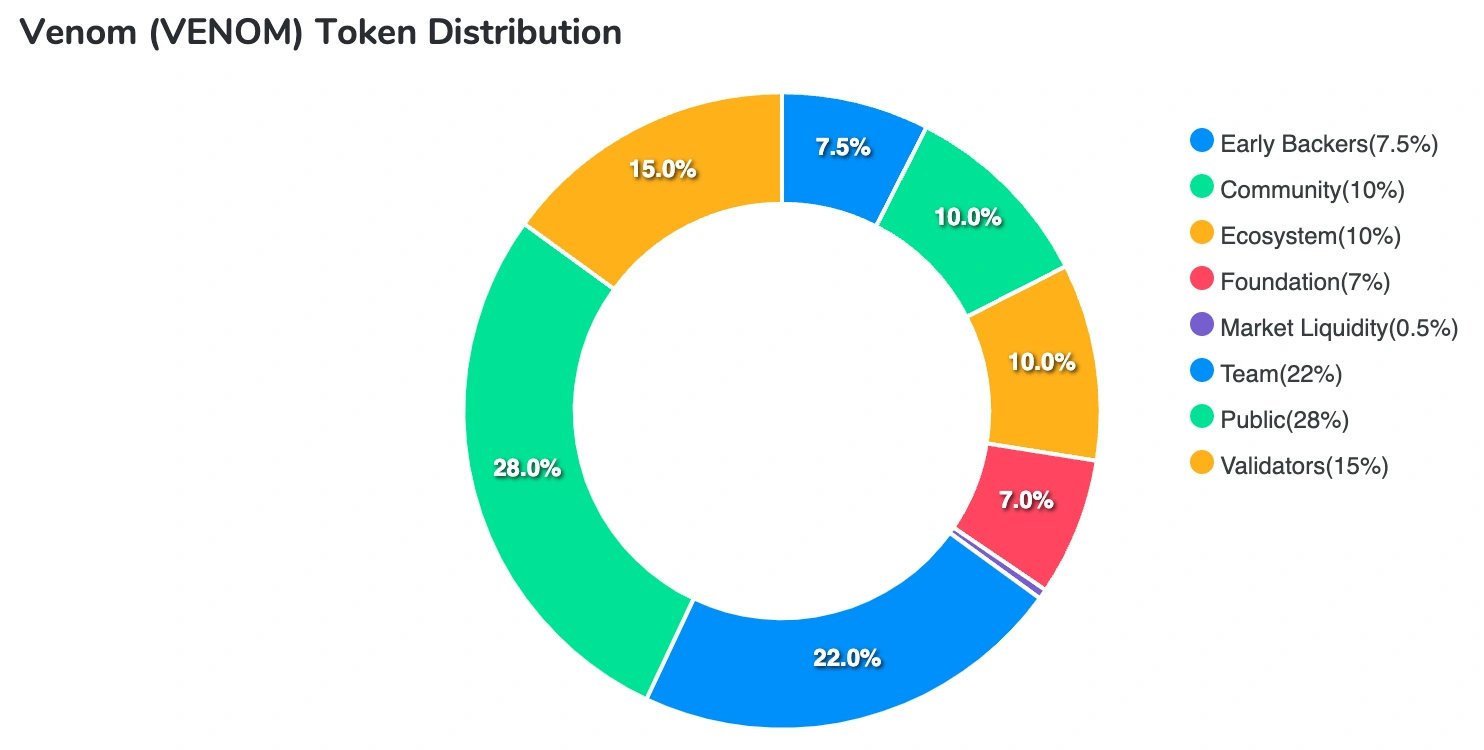

VENOM代币的分配结构旨在确保对生态系统不同部分的平衡支持:

- Venom生态系统:28%

- Venom社区:22%

- Venom基金会:15%

- 市场流动性:10%

- 验证者:10%

- 早期支持者:7.5%

- Venom团队:7%

- 公众:0.5%

未来供应模型:从通货膨胀到通货紧缩

Venom代币目前遵循通货膨胀的供应模型,总供应量没有硬性上限。然而,Venom基金会正在探索转向通货紧缩模型的可能性。正在考虑的一个选择是“费用燃烧”,即将一部分交易费用永久性地从流通中移除,发送到一个无法访问的地址。这种转变旨在平衡生态系统内的供需关系,同时保持网络的稳定性和可持续性。

VENOM 的用例

VENOM 在 Venom 生态系统中作为一种多功能的实用代币运行。其主要功能包括:

- 交易费用: VENOM 用于支付 Venom 网络内的交易费用,确保去中心化应用程序的顺利运行。

- 质押和治理: 代币持有者可以通过 DePools 参与质押,从而保护网络并获得奖励。此外,VENOM 还可以通过去中心化自治组织 (DAO)参与治理过程,从而影响网络的方向。

- DeFi 和资产交易: 该代币在 Venom 的去中心化金融生态系统中发挥着关键作用,使用户能够在去中心化交易所 (DEX)上进行质押、流动性提供、资产交换和收益耕作活动。

- 游戏和 NFT: 用户可以使用 VENOM 参与基于区块链的游戏,交易非同质化代币 (NFT),并与其他去中心化应用程序进行交互。

代币标准

Venom的代币基础设施建立在两个核心标准之上:

- TIP-3(同质化代币标准): 此标准管理VENOM等同质化代币的发行和管理。与以太坊的ERC-20类似,TIP-3允许用户转移代币、查询余额、铸造和销毁代币,以及跟踪供应。

- TIP-4(非同质化代币标准): 此标准促进NFT的创建和交换,允许用户在Venom区块链上铸造、交易和管理独特的资产。[2][3][4][5]

WVenom (Wrapped Venom)

Wrapped Venom (WVENOM) 是一种 TIP-3 标准代币,旨在促进去中心化金融 (DeFi)协议内的兼容性。虽然 VENOM 作为 Venom 区块链的原生货币运行,但许多 DeFi 应用程序需要代币的包装版本,以便于使用和与智能合约互操作。

WVENOM 作为 VENOM 的 1:1 表示,允许用户包装其原生代币以在 DeFi 平台中使用。此过程在与去中心化交易所 (DEX)或其他 DeFi 协议交互时自动发生。例如,当将 VENOM 交换为其他资产(如 USDT)时,该代币首先转换为 WVENOM,然后将其交换为所需的资产。

虽然用户可能不需要直接与 WVENOM 交互,但它在确保 Venom 的 DeFi 生态系统与智能合约和其他去中心化协议保持兼容方面发挥着重要作用。[2][3][4][5]

发现错误了吗?