위키 구독하기

Share wiki

Bookmark

Convergence Finance

0%

Convergence Finance

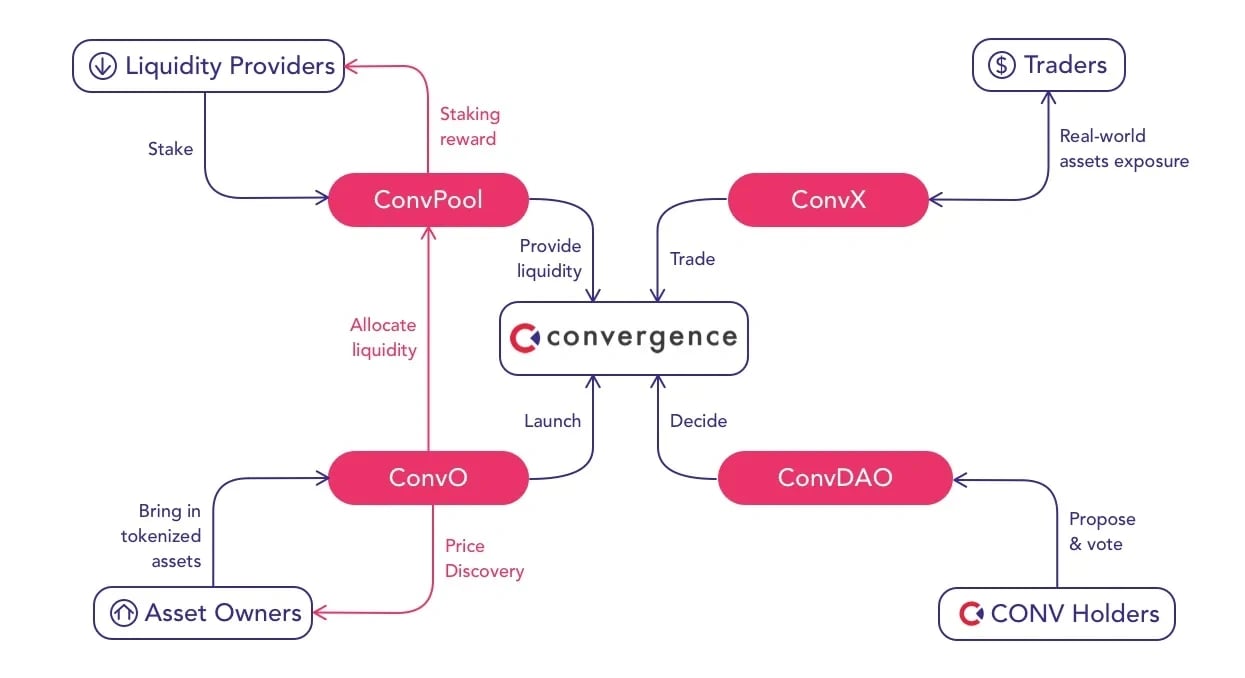

Convergence Finance는 탈중앙화 금융(DeFi) 플랫폼으로, 자동화된 마켓 메이커(AMM) 및 기타 도구를 통해 토큰화된 자산의 거래 및 관리를 용이하게 합니다. 자산 소유자와 투자자가 DeFi 생태계 내에서 유동성 및 투자 기회에 접근할 수 있도록 지원하여 전통 금융과 디지털 자산 간의 격차를 해소합니다. [1]

개요

Convergence는 자동화된 마켓 메이커(AMM)를 도입하여 프라이빗 토큰을 분할하고 DeFi 생태계 내에서 거래할 수 있도록 합니다. 이 플랫폼은 자산 생성자가 DeFi 유동성에 접근할 수 있도록 지원하는 동시에 DeFi 사용자는 이전에 사용할 수 없었던 프라이빗 자산에 접근할 수 있습니다. 투자 장벽을 낮추고 DeFi의 유동성, 자동화 및 투명성을 통합함으로써 Convergence는 모든 DeFi 참가자를 위한 독점적인 투자 기회에 대한 접근성을 확대합니다. 또한 고급 AI를 활용하여 거래 알고리즘을 개선하고, 거래자가 수익성을 최적화하는 동시에 전략을 보호할 수 있는 안전하고 효율적인 솔루션을 제공합니다. [1][2]

제품

Convergence Offering (ConvO)

Convergence Offering (ConvO)를 통해 자산 소유자는 토큰 가격을 설정하고 스왑 풀을 생성하여 초기 토큰 제공을 수행할 수 있으며, 토큰의 일부는 ConvX 유동성을 지원하기 위해 Convergence Finance에 예약됩니다. Convergence dApps 스위트의 일부인 ConvO는 사용자 친화적인 인터페이스를 통해 프라이빗 자산의 분할을 용이하게 하여 자산 소유자가 DeFi 유동성을 활용하고 DeFi 사용자에게 프라이빗 세일 토큰 및 분할된 NFT를 포함한 다양한 투자 기회를 제공할 수 있도록 합니다. [3][4]

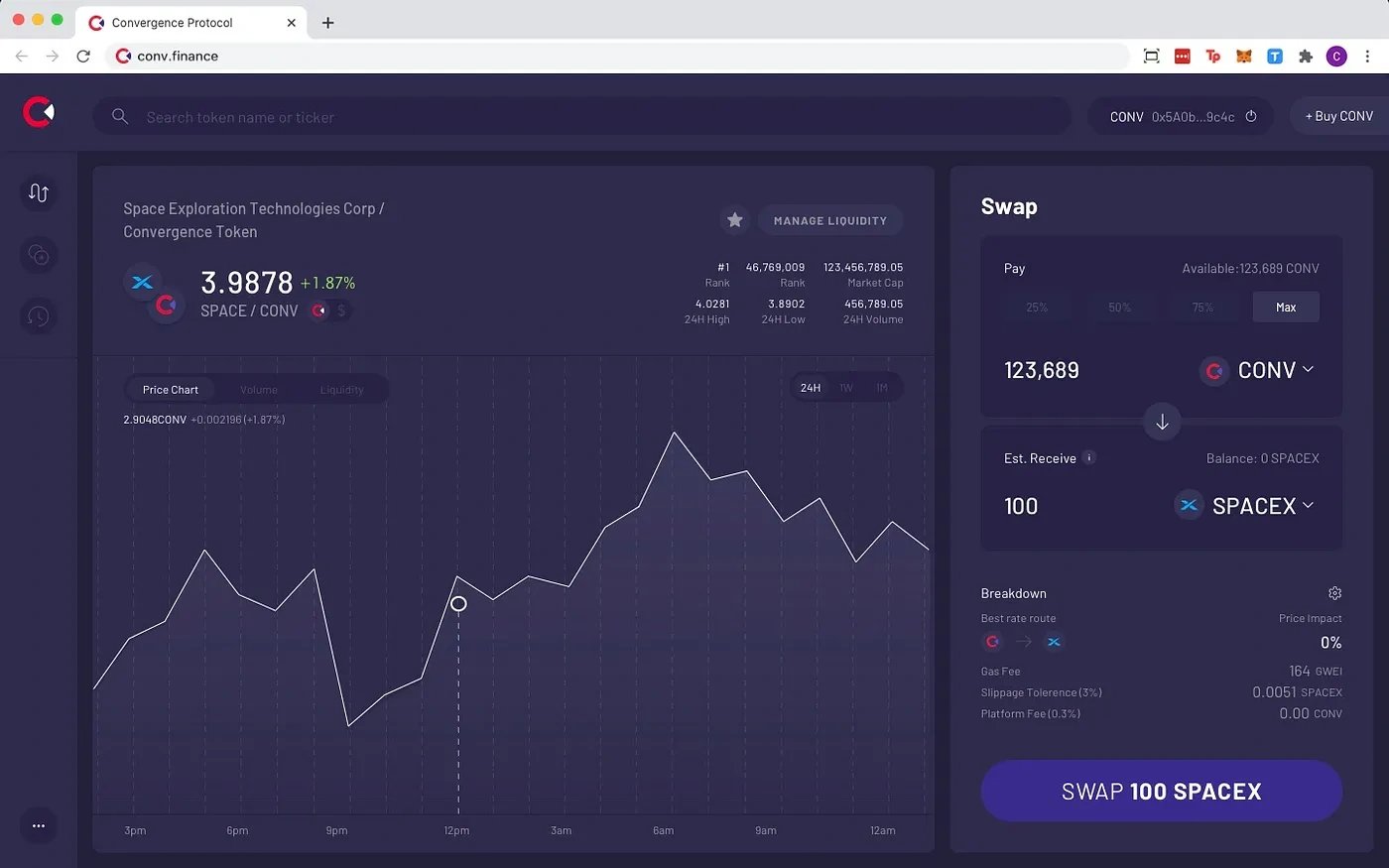

Convergence AMM (ConvX)

Convergence AMM (ConvX)는 래핑된 실제 자산의 24시간 거래 및 가격 발견을 용이하게 합니다. 집계된 유동성 소스에서 주문 라우팅을 최적화하여 거래자에게 최상의 가격을 보장합니다. ConvX는 소매 투자자, 펀드 매니저 및 디지털 네이티브 투자자가 풀 내에서 유동성을 제공하고 거래할 수 있도록 접근성을 간소화합니다. 이더리움 체인에서 거래당 0.30%의 수수료로 운영되며, 0.25%는 유동성 공급자에게, 0.05%는 프로토콜에 할당됩니다. [3]

Convergence Pools (ConvPool)

Convergence Pools를 통해 자산 소유자는 마켓 메이킹 전략을 생성하고 관리하여 초기 제공을 용이하게 하고 거래를 위한 유동성을 제공할 수 있습니다. 이 설정은 소매 투자자, 펀드 매니저 및 디지털 네이티브 투자자가 풀 내에서 유동성을 제공하고 거래할 수 있도록 접근성을 간소화합니다. ConvPool은 CONV 및 CONV-LP 보유자가 토큰을 스테이킹하도록 장려하여 유동성 공급자에게 Convergence X의 거래 수수료의 0.25%와 풀의 비율에 따라 CONV 보상을 받을 수 있는 기회를 제공합니다. [3]

Convergence DAO

Convergence는 CONV 토큰 보유자 및 그들의 대리인으로 구성된 탈중앙화된 커뮤니티에 의해 관리되며, 이들은 프로토콜 업그레이드를 제안하고 투표합니다. 총 공급량의 2%가 주소에 위임된 CONV 보유자는 거버넌스 제안을 제출할 수 있습니다. [3]

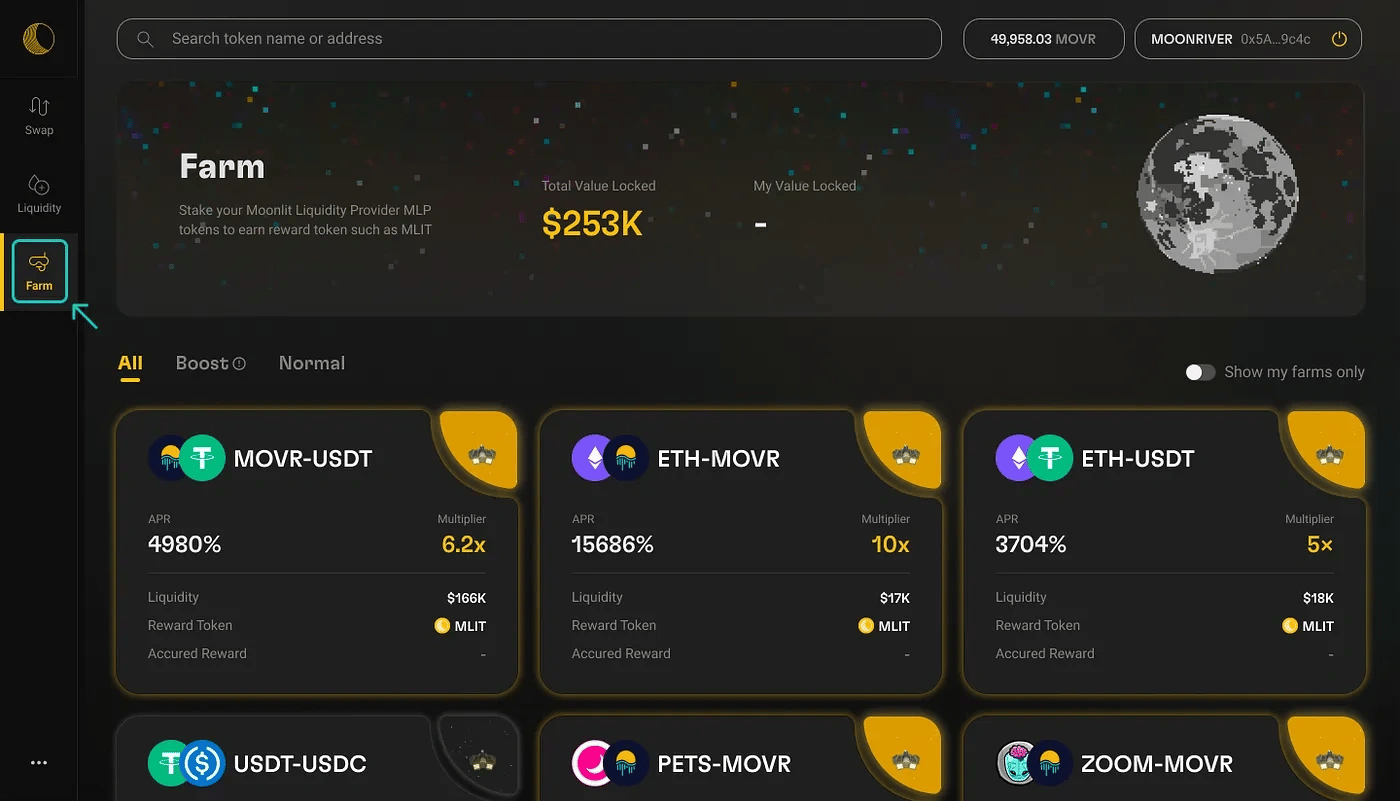

Moonlit

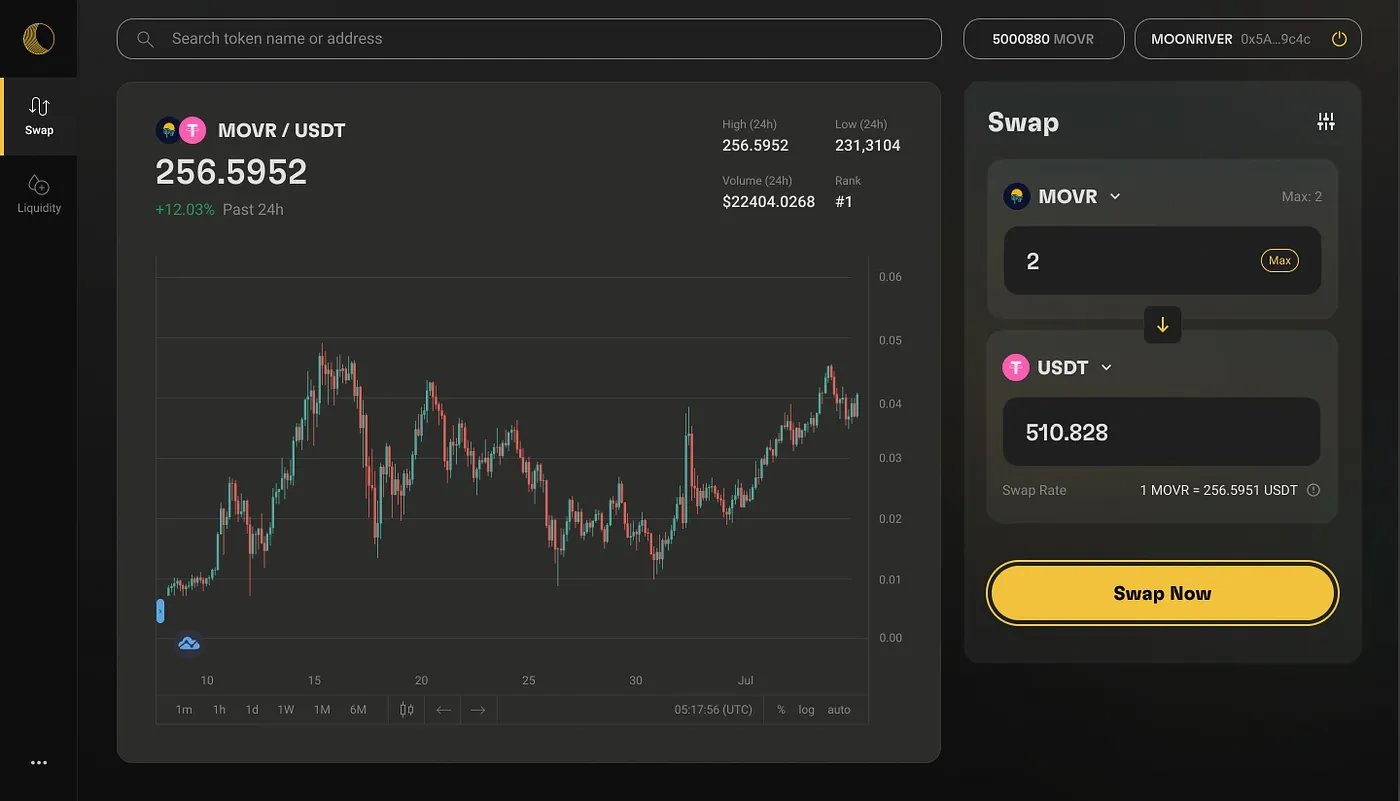

Moonlit은 자동화된 마켓 메이커(AMM) 모델을 기반으로 구축된 탈중앙화 거래소(DEX)로, Convergence Finance의 기존 제품군과 함께 작동하도록 설계되었습니다. Moonbeam 및 Moonriver와의 크로스 체인 호환성을 탐색하는 동시에 Convergence는 프라이빗 세일 토큰과 벤처 캐피털 스타일 투자를 DeFi 공간 내에서 접근 가능하게 만드는 데 계속 집중하고 있습니다. Moonlit은 또한 낮은 가스 수수료와 Kusama 및 Polkadot에서의 향상된 성능의 이점을 누리면서 프라이빗 세일 토큰 및 기타 새로운 자산에 대한 접근성을 확대하여 궁극적으로 DeFi 유동성을 늘리고 독점적인 투자 기회에 대한 접근을 민주화합니다. [5]

Moonlit Swap

Moonlit Swap은 Moonriver Network(Kusama EVM 체인)의 자동화된 마켓 메이커(AMM)로, 암호화폐 자산의 교환을 가능하게 합니다. 각 스왑에는 0.30%의 수수료가 부과되며, 0.25%는 유동성 공급자에게, 0.05%는 프로토콜에 할당됩니다. [5]

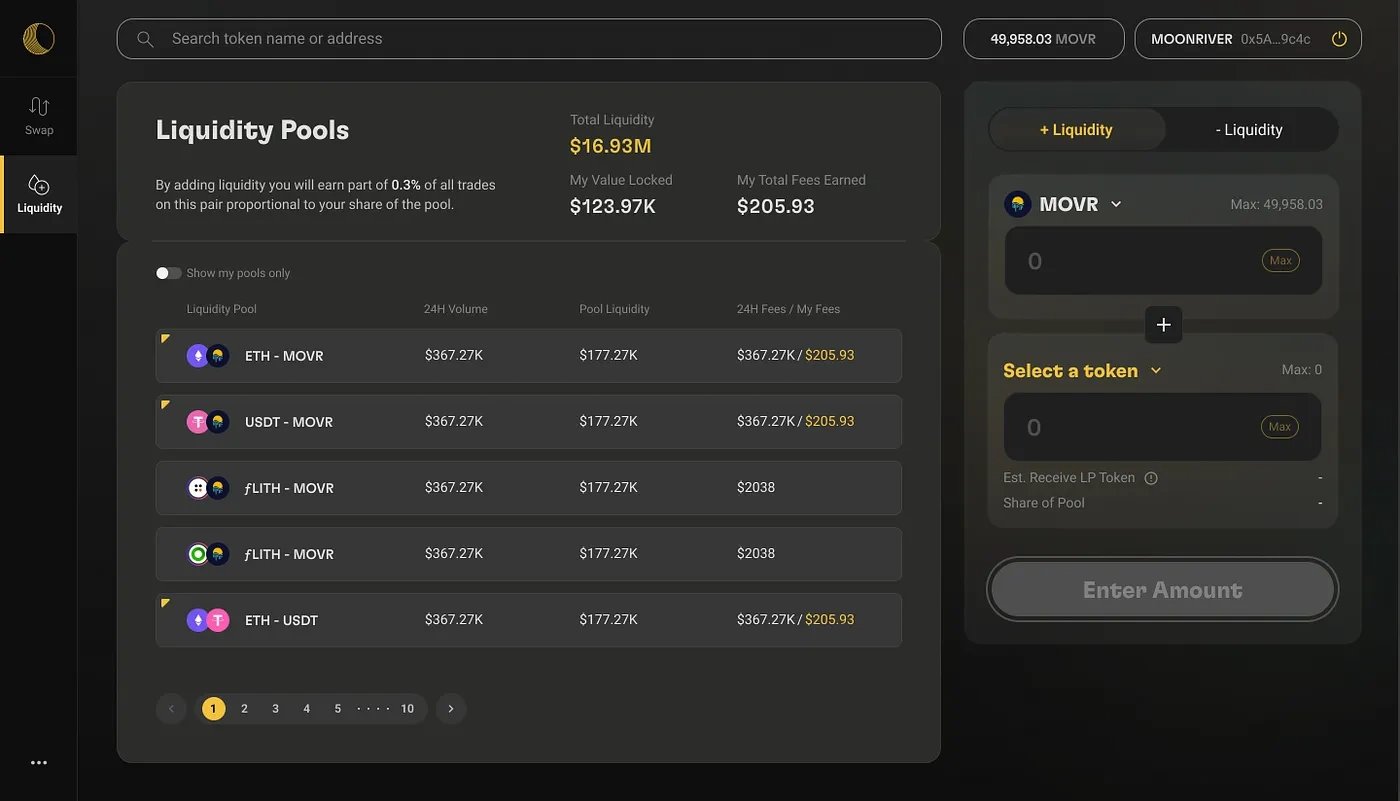

Moonlit Liquidity

Moonlit Liquidity는 유동성 공급자가 유동성 풀을 생성하고 관리할 수 있도록 지원하며, 이는 스왑 거래를 용이하게 하기 위해 스마트 계약에 잠긴 자금의 모음입니다. 자동화된 마켓 메이커(AMM)의 각 스왑은 이러한 풀의 유동성에 대해 실행됩니다. 유동성 공급자는 인센티브로 스왑 거래에서 발생하는 거래 수수료의 0.25%를 받습니다. [5]

Moonlit Farm

Moonlit Farm은 Moonriver Network에서 지원하고 Convergence Finance에서 개발한 Moonlit Finance에서 수익률 파밍 풀을 제공합니다. 유동성 공급자가 풀에 유동성을 추가한 후 Moonlit LP 토큰을 스테이킹할 때 경쟁력 있는 APR로 $MLIT를 제공하여 유동성 공급자를 장려합니다. 이 접근 방식은 토큰 스왑 중 유동성을 안정화하고 슬리피지를 줄이도록 설계되었습니다. 또한 Moonlit Farm은 다른 Moonriver 프로젝트와 협력하여 커뮤니티 팜을 도입하여 Moonriver 생태계를 성장시키는 것을 목표로 하며, 사용자가 $MLIT 토큰과 프로젝트별 토큰을 모두 얻을 수 있는 이중 보상을 제공합니다. [6]

CONV

CONV는 이더리움 및 Moonbeam Network에서 사용할 수 있는 멀티 체인 유틸리티 토큰입니다. 프리미엄 런치패드 구독 풀에 대한 액세스를 제공하고, AMM 풀에서 스테이킹 보상을 제공하고, 향후 프로토콜 결정에 대한 거버넌스 권한을 부여하고, 크로스 체인 스왑을 용이하게 하기 위한 기본 토큰 역할을 합니다. [7]

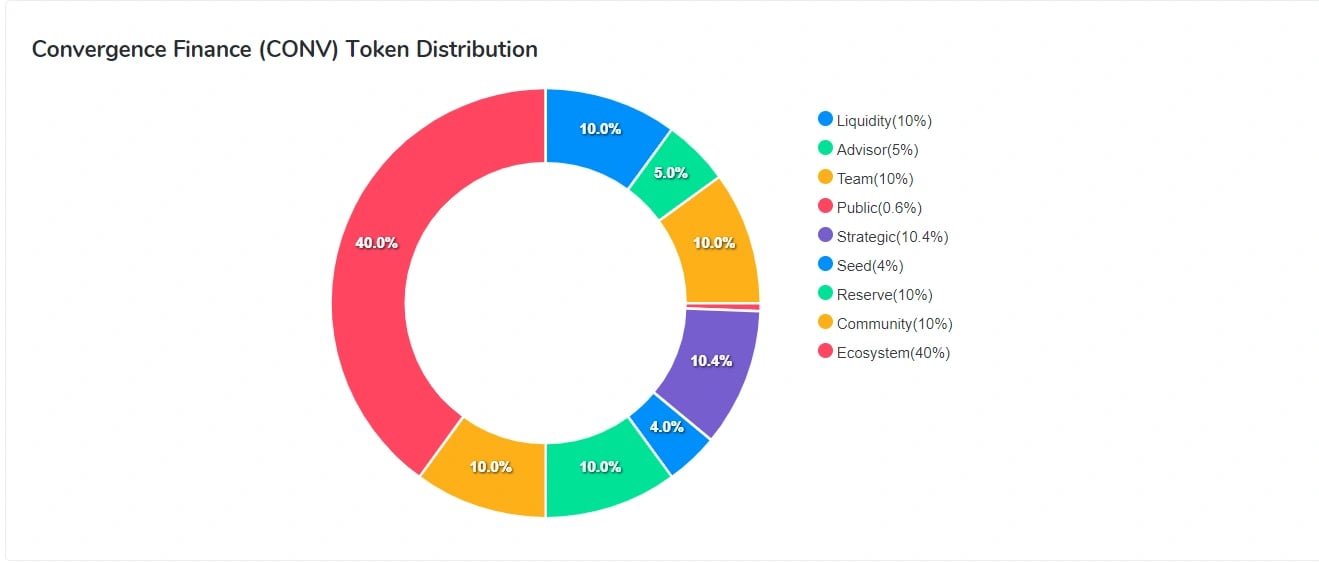

토큰노믹스

- 생태계: 40%

- 전략적: 10.4%

- 팀: 10%

- 커뮤니티: 10%

- 유동성: 10%

- 예비: 10%

- 어드바이저: 5%

- 시드: 4%

- 공개: 0.6%

파트너십

- DuckDAO

- Ellipti

- CertiK

- Hex Trust

- Moonbeam

- Lithium Finance

- Synaps

- 1inch

- Chainlink

- Cere Network

- Celer Network

- Biconomy

투자자

2021년 2월, Convergence는 Hashed가 주도한 시드 펀딩 라운드에서 2백만 달러를 모금했습니다. 다른 투자자로는 CMS, Kenetic, NGC Ventures, GBV, DuckDAO, Paul Veradittakit 및 Alameda Research가 있습니다. [9]

잘못된 내용이 있나요?