위키 구독하기

Share wiki

Bookmark

1INCH

0%

1INCH

1inch 네트워크는 다양한 분산형 거래소(DEX)에서 거래를 최적화하도록 설계된 분산형 거래소 애그리게이터입니다. 여러 플랫폼에서 유동성을 확보함으로써 1inch는 사용자에게 가능한 최상의 환율을 제공하고 슬리피지를 최소화하는 것을 목표로 합니다. Sergej Kunz와 Anton Bukov는 1inch의 공동 창립자입니다. 2025년 10월 1일, 이 프로젝트는 핵심 DeFi 인프라 제공업체로의 진화를 반영하기 위해 포괄적인 리브랜딩을 발표했습니다. 리브랜딩에는 새로운 시각적 아이덴티티, DeFi와 전통 금융을 통합하려는 미션, 그리고 1inch.com의 새로운 기본 도메인이 포함되었습니다.[17][18]

개요

1inch 네트워크는 2019년 5월 ETHGlobal 뉴욕 해커톤에서 설립되었으며, DeFi 환경 내에서 효율적이고 빠르며 안전한 운영을 촉진하기 위해 분산 프로토콜을 통합합니다. 이 네트워크의 도구 모음에는 Aggregation Protocol v6, Liquidity Protocol, Limit Order Protocol, P2P 거래 및 1inch 모바일 지갑이 포함됩니다. 1inch dApp은 스마트 계약을 통해 지원되는 블록체인에 연결된 웹 기반 애플리케이션으로, 다양한 분산 거래소(DEX)에서 깊이 있는 통합 유동성과 경쟁력 있는 토큰 스왑 비율에 대한 액세스를 제공하며, 부분 채우기 및 여러 유동성 소스에서 최적의 스왑 경로 식별과 같은 고유한 기능을 제공합니다. [1]

1inch 네트워크의 중심에는 Pathfinder 알고리즘(1inch API v5)으로 구동되는 Aggregation Protocol이 있으며, 이는 시장에서 가장 유리한 가격으로 자산 교환을 용이하게 합니다. Liquidity Protocol은 이전에는 Mooniswap으로 알려졌으며, 자본 효율적인 유동성을 제공하면서 사용자를 선행 매매로부터 보호하도록 설계된 자동화된 마켓 메이커(AMM)입니다. Limit Order Protocol을 통해 사용자는 지정가 주문 및 RFQ 주문을 할 수 있으며, 가스 없는 지정가 주문 기능을 통해 유연성과 높은 가스 효율성을 제공합니다. [1]

1inch는 또한 제품을 더욱 강화하여 P2P 거래를 용이하게 하여 사용자가 ERC-20 토큰의 장외 스타일 거래에 참여할 수 있도록 합니다. iOS 및 Android에서 사용할 수 있는 1inch 모바일 지갑은 최적화된 스왑 비율과 원활한 Web3 브라우징 경험을 제공하는 비수탁 솔루션을 제공합니다. [1]

1inch 프로토콜은 Ethereum, BNB Chain, Polygon, Arbitrum, Optimism, Gnosis Chain, Avalanche, Base, Linea, Solana, Sonic, Unichain 및 zkSync Era를 포함한 수많은 블록체인 네트워크에 배포되어 DeFi 생태계 내에서 광범위한 접근성과 상호 운용성을 보장합니다. [1]

2025년 리브랜딩

2025년 10월 1일, 1inch는 싱가포르 Token2049 컨퍼런스에서 포괄적인 리브랜딩을 발표하며 개발의 새로운 단계를 열었습니다. 이 이니셔티브는 회사의 아이덴티티를 DEX 애그리게이터에서 핵심 DeFi 인프라 제공업체인 서비스형 소프트웨어(SaaS) 모델로의 진화에 맞춰 조정하기 위해 설계되었습니다. 리브랜딩 당시 플랫폼은 2,500만 명의 사용자에게 서비스를 제공하며 일일 거래량 5억 달러 이상을 기록했습니다.[18][19][20]

리브랜딩은 새로운 슬로건인 "We move forward as 1"과 파편화된 DeFi 생태계를 통합하고 전통적인 금융 시스템과 연결하려는 개선된 미션을 도입했습니다. 공동 창립자 Sergej Kunz는 "조만간 DeFi는 전통적인 금융과 구별할 수 없게 될 것이지만, 이는 중앙화를 의미하는 것이 아니라 전통적인 금융 시스템과 사용자가 온체인으로 들어오는 것을 의미합니다."라고 말했습니다. 프로젝트의 웹 존재는 새로운 도메인인 1inch.com으로 통합되었습니다. [20][19]

새로운 시각적 아이덴티티는 단순성, 정교함, 성숙함이라는 세 가지 원칙에 기반을 두고 있습니다. 이는 플랫폼을 구동하는 고급 기술을 전달하면서 DeFi를 보다 직관적이고 대중적인 채택이 가능하도록 만드는 것을 목표로 합니다. [18]

기관 중심 및 보안

전통 금융과의 통합이라는 목표를 지원하기 위해 1인치는 ISO 27001 인증과 SOC 2 (Type 1) 증명을 획득했습니다. Web3 보안 회사인 zeroShadow와 협력하여 2025년 10월에 발표된 ISO 27001 인증은 데이터 보호 및 위협 인텔리전스 프로세스를 포함한 1인치의 정보 보안 관리 시스템을 검증하는 세계적으로 인정받는 표준입니다. 이러한 성과를 통해 1인치는 Binance, Coinbase 및 Chainlink Labs와 같은 다른 인증된 업계 리더와 합류합니다. 이러한 인증은 기관 파트너의 엄격한 요구 사항을 충족하고 1인치를 전통 금융과 동일한 보안 표준을 충족할 수 있는 신뢰할 수 있는 엔터프라이즈 수준의 협력업체로 자리매김하는 데 목적이 있습니다. [19][20][21]

1inch 네트워크

1inch 네트워크는 1inch 재단, 1inch 핵심 기여자, 1inch DAO의 세 가지 주요 이해 관계자로 구성됩니다. 각 그룹은 분산된 성장이란 공동 목표를 향해 독립적으로 활동합니다. 목표는 같지만 자율적으로 운영됩니다. 예를 들어 DAO가 변경 사항을 제안할 수 있지만 재단이 이를 실행할 수 없는 경우 DAO는 독립적으로 변경 사항을 자금을 조달하고 구현해야 합니다. [1]

1inch 재단

1inch 재단은 독립적인 비영리 단체로서 1inch 네트워크의 성장 촉진과 커뮤니티에 유익한 프로젝트 지원에 전념하고 있습니다. 재단은 1INCH 토큰을 발행했지만, 토큰 스마트 계약 관리는 네트워크 내의 1inch DAO에 있습니다. 재단은 DAO 금고와 별도로 기금 조성 이니셔티브를 위한 자금을 관리합니다. [1]

2025년 6월, 1inch 재단은 2024년 10월에 발생한 공급망 취약점으로 인해 피해를 입은 사용자에게 보상하기 위해 DAO에 제안서를 제출했습니다. 제안서 1IP-80은 DAO 금고에서 조달한 총 768,026달러 상당의 USDC로 피해자에게 보상하는 계획을 설명했습니다. 제안된 계획에 따라 재단은 KYC(고객 알기) 인증 완료, 손실 증거 제공, 법 집행 기관에 보고서 제출을 요구하는 검증 및 배포 프로세스를 관리합니다.[22]

1inch 핵심 기여자

1inch 핵심 기여자는 1inch 네트워크 내의 분산된 팀으로, 주로 기술 개발에 중점을 둡니다. 특히 1inch Labs는 주요 기여자로서 다양한 측면을 전문으로 합니다. 여기에는 1inch 네트워크 및 외부 엔터티를 위한 소프트웨어 개발 서비스 제공이 포함됩니다. 또한 1inch Labs는 1inch Pathfinder 알고리즘 및 관련 API와 같은 중요한 구성 요소를 유지 관리합니다. 또한 이 팀은 특정 엔터프라이즈 고객에게 Pathfinder 알고리즘을 확장하는 SaaS(Software-as-a-Service) 제공업체 역할도 합니다. [1]

1inch DAO

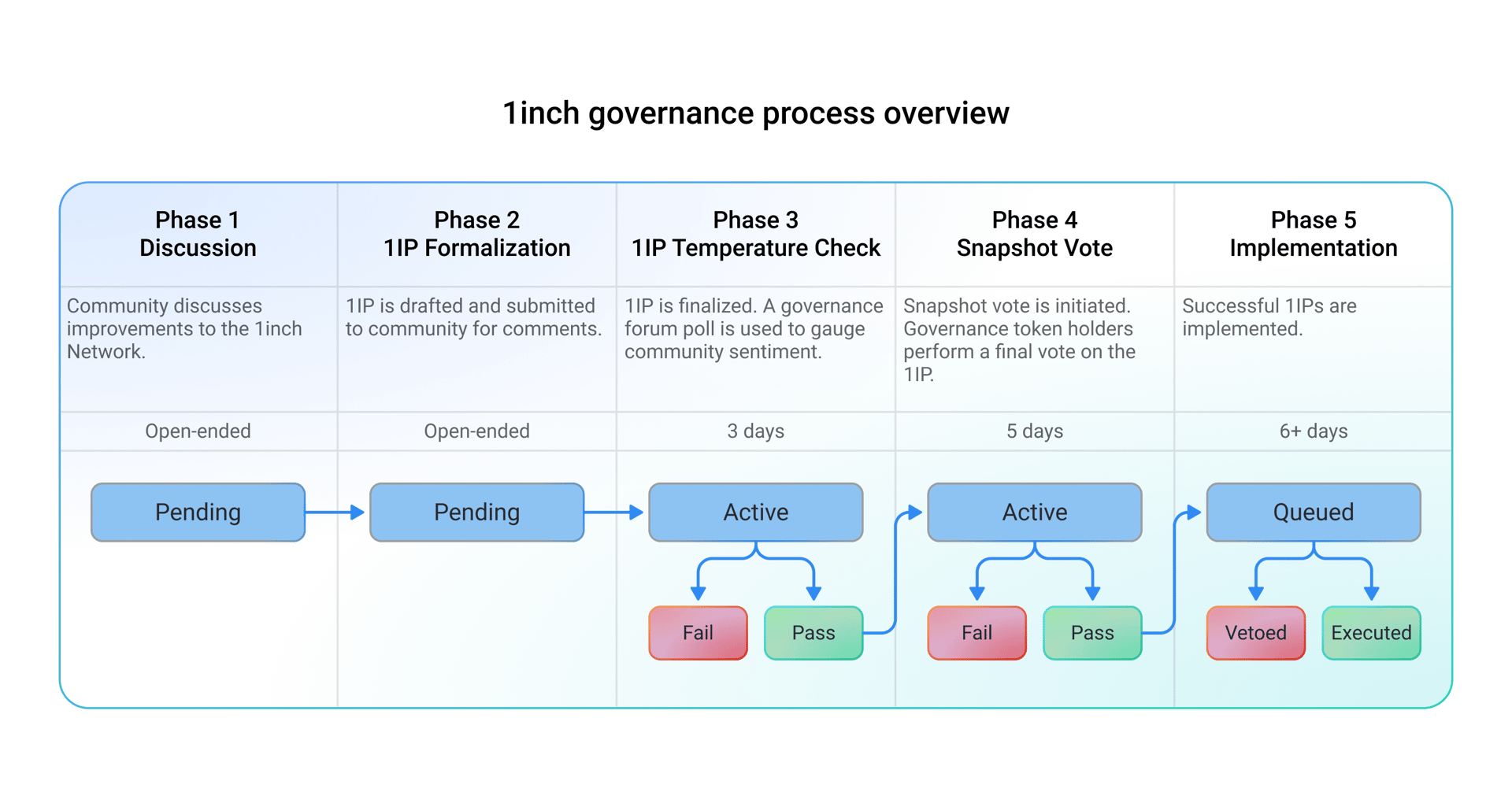

1inch DAO는 일련의 온체인 스마트 계약을 통해 1inch 네트워크 내의 거버넌스를 감독하는 분산형 자율 조직입니다. DAO 내의 결정은 1INCH 토큰을 통해 결정되며, 이 토큰은 2020년 말에 더 넓은 1inch 네트워크 사용자 커뮤니티에 배포된 거버넌스 토큰입니다. 1inch DAO는 유동성 프로토콜 즉시 거버넌스, 통합 프로토콜 즉시 거버넌스, 1INCH 토큰, 1inch 네트워크 수익 흐름 및 1inch 네트워크 DAO 재무를 포함한 다양한 핵심 측면을 제어합니다. [1]

또한 DAO는 온체인 자산 관리 외에도 추가 모듈 및 계약 개발에 자금을 지원하고 필요에 따라 배포할 수 있습니다. 여기에는 대체 프런트 엔드 플랫폼, 새로운 네트워크 배포 또는 새로운 API 통합과 같은 다양한 이니셔티브가 포함될 수 있습니다. 신뢰 최소화 구조를 감안할 때 1inch DAO가 수행하는 모든 조치는 1INCH 토큰 보유자의 투표를 통해 승인을 받아야 합니다. [1]

기술

Pathfinder

1inch API v5인 Pathfinder는 최적의 환율로 자산 교환을 용이하게 하도록 설계된 고급 검색 및 라우팅 알고리즘입니다. 토큰 스왑을 위한 가장 효과적인 경로를 효율적으로 식별하고, 다양한 프로토콜과 시장 심도 사이를 신속하게 탐색하여 신속한 실행을 보장합니다. [1]

Fusion Swap

1inch Fusion 모드를 사용하면 사용자는 가스 수수료를 내거나 선행 매매 위험에 직면하지 않고도 스왑을 실행할 수 있습니다. 개념적으로 사용자를 위한 스왑과 유사하지만 Fusion 모드는 기술적으로 변동 환율이 적용된 지정가 주문으로 작동하며, Resolver라는 제3자가 주문을 처리합니다. 주문의 환율은 네덜란드 경매 메커니즘을 통해 원하는 환율에서 최소 반환 금액으로 점진적으로 감소하여 Resolver가 주문을 처리하도록 유도합니다. 여러 Resolver가 환율이 최소 반환 금액에 도달하기 전에 주문을 처리하기 위해 경쟁합니다. 또한 Fusion 모드는 기존 브리지의 기술적 복잡성을 추상화하고 사용자가 직접 브리지와 상호 작용할 필요성을 없앰으로써 크로스 체인 스왑에 대한 사용자 경험을 단순화하도록 설계되었습니다.[1][23]

Limit Order Protocol

1inch Limit Order Protocol은 다양한 EVM 기반 블록체인과 호환되는 스마트 컨트랙트로 구성됩니다. 이 프로토콜은 일반 Limit Order와 RFQ (Request for Quote) Order라는 두 가지 주문 유형을 사용하여 유연성과 가스 효율성과 같은 주목할만한 기능을 제공합니다. 사용자는 이러한 주문을 오프체인에 배치하고 EIP-712 표준에 따라 서명한 후 온체인에서 체결할 수 있습니다. 이 접근 방식은 가스 사용량을 최적화하고 높은 유연성을 유지하면서 원활한 실행 프로세스를 보장합니다. [1]

스팟 가격 애그리게이터

1inch 스팟 가격 애그리게이터는 블록체인에서 탈중앙화 거래소(DEX)에서 거래되는 토큰의 가격 데이터를 추출하는 스마트 컨트랙트로 구성됩니다. 그러나 트랜잭션 내에서 가격 조작을 방지하기 위해 스팟 가격 애그리게이터를 오프체인에서만 사용하는 것이 좋습니다. 온체인에서 사용하면 바람직하지 않은 결과가 발생할 수 있습니다. [1]

Rabbithole

Rabbithole 기능은 Flashbots를 지원하지 않는 MetaMask 지갑에 대한 샌드위치 공격을 해결합니다. 2022년 10월 17일부터 Mainnet의 MetaMask 지갑에 처음 구현되었으며, MetaMask와 Flashbots를 연결하는 프록시 서버입니다. MetaMask 트랜잭션은 검증자에게 직접 보내는 대신 메모리 풀로 전송될 때 샌드위치 공격에 취약합니다. 이를 완화하기 위해 RabbitHole은 MetaMask를 Mainnet에서 RabbitHole이라는 임시 네트워크로 전환합니다. 이 네트워크는 Mainnet을 미러링하지만 ID는 "1"입니다. MetaMask는 Mainnet과 상호 작용한다는 인상하에 트랜잭션에 서명하지만 RabbitHole을 통해 전송합니다. RabbitHole 노드는 트랜잭션 목적지를 면밀히 조사합니다. 1inch Router인 경우 트랜잭션은 Flashbots로 전달되고, 그렇지 않으면 Mainnet으로 전달됩니다. 사용자는 dApp 내에서 아직 지원되지 않으므로 MetaMask에서 RabbitHole 네트워크로 수동으로 전환해야 합니다. [1]

토큰 경제

1INCH

1INCH는 ERC-20 토큰으로, 1inch 네트워크 내의 거버넌스 및 유틸리티 토큰입니다. 1inch DAO에서 거버넌스 권한을 부여하기 위해 처음 도입되었으며, 현재는 스테이킹 및 1inch Fusion 스왑 실행을 담당하는 1inch Resolver에 대한 위임 기능도 포함합니다. [1]

1INCH의 총 공급량은 1,500,000,000개이며, 2024년 말까지 분배가 완료될 예정입니다. 토큰의 초기 분배 계획은 다음과 같습니다. [1][3]

- 투자자: 30.7%

- 커뮤니티 인센티브 프로그램: 30%

- 핵심 기여자: 22.5%

- 성장 및 개발: 14.5%

- 소규모 투자자: 2.3%

Chi Gastoken

Chi Gastoken (CHI)은 사용자가 이더리움 네트워크에서 거래 비용을 줄이도록 1inch에서 만든 ERC-20 유틸리티 토큰입니다. 가스를 토큰화하여 사용자가 가스 가격이 낮을 때 CHI를 발행하고 가스 가격이 높을 때 이를 소각하여 거래 비용을 지불할 수 있도록 합니다. 이 토큰은 원래 GasToken 개념을 기반으로 하지만 효율성 향상을 위해 최적화되었습니다. [2]

Chi는 GasToken과 동일한 "스토리지 환불" 원칙으로 작동합니다. 사용자가 CHI를 발행하면 스마트 계약에 데이터를 저장합니다. 나중에 거래 중에 토큰이 소각되면 이 데이터가 지워지고 이더리움 네트워크는 스토리지 공간을 확보한 것에 대한 가스 환불을 제공합니다. 이 환불은 거래 비용의 상당 부분을 상쇄할 수 있습니다. Chi는 이전 버전보다 더 효율적으로 설계되었으며, 발행은 GasToken(GST2)보다 1% 더 가스 효율적이고 소각은 10% 더 가스 효율적입니다. [2]

자금 조달

2020년 8월, 1inch 팀은 첫 번째 투자 라운드를 마감하여 Binance Labs가 주도하고 Galaxy Digital, Greenfield One, Libertus Capital, Dragonfly Capital Partners, FTX, IOSG, LAUNCHub Ventures, Divergence Ventures, Loi Luu (Kyber Network 설립자), Illia Polosukhin (NEAR Protocol 공동 설립자) 등 최고의 기관 투자자로부터 280만 달러를 모금했습니다. [3]

2020년 12월, 1inch 팀은 Pantera Capital, ParaFi Capital, Nima Capital을 포함한 기관 투자자로부터 1200만 달러의 자금 조달을 성공적으로 마감했다고 발표했습니다. 이 자금은 다양한 1inch 제품을 추가로 개발하고, 추가 팀원을 고용하고, 프로젝트의 새로운 시장으로의 확장을 촉진하고, 마케팅 활동을 증폭시키는 데 사용되었습니다. 이 라운드의 전체 투자자 목록에는 Pantera Capital, ParaFi Capital, Nima Capital, LAUNCHub Ventures, Spark Capital, gumi Cryptos, Fabriс Ventures, Struck Capital, Rockaway Blockchain Fund, Spartan Group, Blockchain Capital, Josh Hannah, Kain Warwick, Alexander Pack이 포함됩니다. [3]

2021년, 1inch는 기관 투자자로부터 추가로 1억 7500만 달러를 모금했습니다. [3]

파트너십

xBTC

2020년 9월 17일, 1inch는 Social Capital의 첫 번째 토큰인 xBTC와의 파트너십을 발표했습니다. 이 협력의 일환으로 xBTC는 초기 Mooniswap 오퍼링(IMO)을 받았습니다. 이 파트너십은 xBTC의 노출을 더 넓은 청중에게 확대하고 1inch 사용자가 xBTC 거래량을 활용할 수 있도록 함으로써 양측 모두에게 상호 이익이 되는 것을 목표로 했습니다. [4]

“1inch의 IMO는 소위 프론트 러닝으로부터 보호를 제공하기 때문에 토큰 발행자에게 다른 플랫폼보다 더 매력적입니다. 결과적으로 1inch 유동성 공급자는 초기 단계에서 상당한 거래량이 발생하고 상당한 이자를 징수할 수 있으므로 xBTC IMO로부터 이익을 얻을 것입니다.” - Sergej Kunz, 1inch 공동 창립자.

Bitquery

2021년 3월 2일, 1inch는 블록체인 데이터 제공업체인 Bitquery.io와 파트너십을 맺어 차세대 거래 도구로 탈중앙화 거래소 시장 환경을 변화시켰습니다. 이 협력을 통해 Bitquery는 다양한 탈중앙화 거래소(DEX) 및 프로토콜에서 실시간 거래 데이터 피드를 1inch에 제공했습니다. 이 통합을 통해 1inch는 복잡한 DEX 거래 데이터를 표시하여 플랫폼 사용자의 전반적인 거래 경험을 향상시킬 수 있었습니다. [5]

Ren

2021년 3월 23일, 1inch 재단은 Ren과의 파트너십을 발표하고, 공동 유동성 채굴 프로그램을 통해 유동성 공급자에게 추가적인 혜택을 제공했습니다. 이 프로그램은 1INCH 토큰 2만 달러 상당과 renBTC 2만 달러 상당을 1INCH-renBTC 풀에 유동성 공급자에게 4주 동안 분배하는 방식으로 진행되었으며, 2021년 4월 21일에 종료되었습니다. [6]

Mercuryo

2021년 5월 27일, 1inch Wallet은 Mercuryo와 통합되어 사용자들이 법정화폐 온-램프 게이트웨이를 사용하여 DeFi 자산을 구매할 수 있게 되었습니다. 이 통합은 사용자들이 법정화폐로 암호화폐를 빠르고 쉽게 구매할 수 있도록 함으로써 DeFi 솔루션에 대한 진입 장벽을 낮추는 것을 목표로 했습니다. 이 업데이트를 통해 iOS용 1inch Wallet은 법정화폐 기능을 도입하여 Mercuryo 법정화폐-암호화폐 게이트웨이 솔루션을 통해 전 세계 수백만 명의 사용자에게 접근성을 제공했습니다. 결과적으로 1inch Wallet은 DeFi에 대한 포괄적인 진입점이 되어 단일 모바일 앱 내에서 풍부한 유동성과 안전한 스왑에 대한 사용자 액세스를 제공했습니다. [7]

Bitpay

2021년 8월 31일, 1inch 네트워크는 글로벌 비트코인 및 암호화폐 결제 서비스 제공업체인 BitPay와의 통합을 발표했습니다. 이 통합을 통해 BitPay Wallet 앱 사용자는 애플리케이션 내에서 직접 1inch DEX 애그리게이션 기능에 액세스할 수 있게 되었습니다. 사용자는 앱 간 전환 없이 1inch 네트워크에서 제공하는 경쟁력 있는 암호화폐 스왑 요금의 혜택을 누릴 수 있어 전반적인 사용자 경험을 향상시키고 암호화폐 애호가를 위한 BitPay Wallet 앱의 유용성을 확장할 수 있습니다. [8]

Hashflow

2021년 9월, 1inch 네트워크는 Hashflow와 통합되었습니다. Hashflow는 기관 유동성과 가격 책정 전략을 DeFi 공간에 도입하여 시장 효율성을 향상시키는 DeFi 거래소입니다. 이 협력을 통해 Hashflow는 가시성이 향상되고 더 넓은 고객 기반에 접근할 수 있게 되었으며, 1inch 사용자는 또 다른 중요한 유동성 공급자에 접근할 수 있게 되었습니다. [14]

Travala

2022년 5월 26일, 1inch Network는 유명한 암호화폐 친화적인 온라인 여행사 Travala.com과의 흥미로운 파트너십을 발표했습니다. 이 협력을 통해 Travala.com 플랫폼에서 1INCH 토큰을 결제 옵션으로 추가하여 사용자에게 여행 숙박 시설 예약 시 더 많은 유연성과 선택권을 제공합니다. [9]

“1inch 제품 및 솔루션의 대중적 채택은 항상 중요한 의제입니다. Travala.com과의 통합은 1INCH 토큰에 새로운 유틸리티를 제공하고 수많은 잠재 사용자에게 노출을 제공하므로 그 방향으로 나아가는 중요한 단계입니다.” - Sergej Kunz, 1inch 공동 창립자.

Wirex

2022년 8월 2일, 1inch 네트워크는 법정/암호화폐 결제 플랫폼인 Wirex와의 새로운 통합을 발표하며 또 다른 중요한 이정표를 세웠습니다. 이 통합은 1inch Aggregation API를 Wirex의 비수탁 지갑에 추가하여 사용자가 1inch의 고급 알고리즘으로 구동되는 토큰 교환 기능에 액세스할 수 있도록 합니다. 이 통합을 통해 Wirex 사용자는 1inch의 Pathfinder 알고리즘으로 촉진되는 유리한 토큰 교환 비율의 이점을 누려 플랫폼 내에서 거래 경험을 향상시킬 수 있습니다. [10]

UnstoppableDomains

2022년 10월 4일, 1inch 네트워크는 NFT 도메인 이름 및 디지털 신원 솔루션 제공업체인 Unstoppable Domains와의 흥미로운 협력을 발표했습니다. 이 파트너십은 1inch Wallet 사용자에게 새로운 기능을 도입하여 거래 시 사람이 읽을 수 있는 도메인 이름을 활용하여 암호화폐 자산 구매 또는 전송 프로세스를 단순화합니다. [11]

Burrito Wallet

2023년 2월 9일, 1inch 네트워크는 한국 암호화폐 거래소인 빗썸이 개발한 Web3 지갑인 Burrito Wallet과의 전략적 협력을 발표했습니다. 이 파트너십은 빗썸 사용자에게 탈중앙화 거래소(DEX)에서 최적의 토큰 가격에 원활하게 액세스할 수 있도록 지원하는 것을 목표로 합니다. 이 통합을 통해 빗썸 사용자는 다양한 DEX에서 광범위한 유동성 풀을 활용하여 암호화폐 거래 시 비용 절감 또는 수익 기회를 얻을 수 있습니다. [12]

Revolut

2023년 2월 27일, 1inch 네트워크는 글로벌 금융 슈퍼 앱인 Revolut와 협력하여 암호화폐 'Learn & Earn' 과정을 시작했습니다. 이 파트너십은 전 세계 개인에게 DeFi 지식을 효과적으로 전파하여 매우 유익한 것으로 입증되었습니다. [13]

Lighter.xyz

2023년 6월 30일, 1inch 네트워크는 탈중앙화 현물 주문장 거래소인 Lighter.xyz와의 파트너십을 발표했습니다. Lighter의 주문장은 1inch의 Arbitrum 거래량의 30~50%를 차지하며, 시장 효율성과 최적의 가격 발견을 제공하는 능력을 더욱 강화합니다. [15]

“활성 트레이더는 온체인 주문장을 활용하는 이점을 높이 평가하며, 이는 WBTC 및 WETH와 같은 유동성이 높은 시장에서 적용될 때 더욱 증폭됩니다. Lighter는 탁월한 거래 실행을 제공하는 데 전념하는 동시에 1inch와의 파트너십을 더욱 강화하고 있습니다. 1inch가 시장을 선도하는 집계 경험을 유지하도록 지원할 수 있는 추가 기회를 모색하기를 간절히 기대합니다.” - Vladimir Novakovski, Lighter.xyz CEO.

Ground X

2023년 8월 2일, 1인치 네트워크는 한국 인터넷 대기업 카카오의 계열사인 Ground X와의 파트너십을 발표했습니다. 이번 협력에는 1인치 스왑 API를 Ground X가 출시한 멀티체인 모바일 지갑인 Klip에 통합하는 내용이 포함되었습니다. [16]

Coinbase

SaaS 사업 부문 확장의 일환으로 1inch의 스왑 API가 Coinbase 앱에 통합되었으며, 이는 1inch의 가장 중요한 미국 고객 중 하나로 강조되었습니다. 이 통합은 Coinbase 사용자에게 1inch의 집계 기술을 통해 다양한 온체인 자산에 대한 직접적인 접근을 제공하며, 이전 중앙 집중식 환경에서 제공되었던 제한된 코인 세트를 넘어 확장됩니다. 이 파트너십은 중앙 집중식 암호화폐 및 TradFi 기업에 비수탁 스왑 솔루션을 제공하는 1inch의 전략의 핵심 사례입니다. 스왑을 위해 1inch의 인프라를 활용하는 다른 주요 플랫폼으로는 Binance, Ledger, MetaMask 및 Trust Wallet이 있습니다. [19][18]

Ledger

1인치가 Ledger의 직접 연결 기능을 통합하여 최초의 dApp이 되었습니다. 이를 통해 사용자는 Ledger 하드웨어 지갑을 데스크톱의 1인치 dApp에 한 번의 클릭으로 연결하여 안전한 토큰 스왑 프로세스를 간소화할 수 있습니다. 이 통합은 사용자의 개인 키를 오프라인으로 유지하고 하드웨어 장치에서 모든 거래에 대한 물리적 확인을 요구함으로써 Ledger의 보안 표준을 유지합니다. 이 기능은 Chrome 및 Brave와 같은 Chromium 기반 브라우저에서 사용할 수 있도록 출시되었으며 EVM 호환 체인에서 사용할 수 있습니다.[24]

Blockscan

2025년 12월 15일, 1inch는 이더스캔 팀의 크로스체인 부문인 Blockscan과의 협력을 발표하여 크로스체인 거래를 위한 전용 탐색기를 출시했습니다. 이 도구인 1inch 크로스체인 스왑 스캐너는 1inch의 크로스체인 스왑에 대한 최초의 탐색기 등급 보기를 제공합니다. 스캐너는 사용자가 전체 트랜잭션을 엔드 투 엔드로 볼 수 있도록 하여 투명성과 추적성을 개선하는 것을 목표로 하며, 이는 보다 효율적인 디버깅 및 통합자 지원에도 도움이 됩니다.[25]

잘못된 내용이 있나요?