Subscribe to wiki

Share wiki

Bookmark

Spectra (prev. APWine Finance)

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Spectra (prev. APWine Finance)

Spectra Finance (formerly known as APWine) is a protocol to trade future yield where DeFi users can deposit their interest-bearing tokens of other protocols during defined future periods and trade in advance the future yield that their funds will generate[1][2].

The protocol rebranded from APWine Finance to Spectra Finance on July 10, 2023. [20]

Overview

Spectra Finance was founded by Antoine Mouran[12] and Gaspard Peduzzi[13] and it is headquartered in Île-de-France, Paris.[10] The project was started in August 2020, during the DeFi summer craze, when yield farming was still being introduced to the ecosystem.[3]

Spectra differs from fixed-rate lending protocols (e.g. 88mph, Yield) in that its primary purpose is not to offer fixed interest rates but to allow the trade of future yield[3].

The Spectra Protocol lets anyone create a pool for any interest-bearing token compatible with ERC-4626, and this will be the leading feature where users or DAOs can create interest rate derivatives environments tailored to their needs. [21]

Funding Round

In March 2021, Spectra Finance (fka APWine Finance) raised $1 million in seed funding with a round led by Delphi Ventures that was also backed by The Spartan Group, DeFi Alliance, Rarestone Capital, and many prominent builders and angels in the DeFi space including Julien Bouteloup and Marc Zeller from Aave. [11]

“We are very excited to be moving forward with a new round of investors that will help us bootstrap the technical components and products that we have been building for a year now, and that will bring APWine to the next stage” said Gaspard Peduzzi, CEO and Co-Founder of Spectra Finance.

In November 2022, Spectra Finance raised $2.6 million in a seed extension round led by Greenfield Capital, a European crypto investment firm. [11][14]

Tech

Spectra works by placing Interest Bearing Tokens (IBT) or any yield-bearing asset for a fixed duration of time in a smart contract and issuing Future Yield Tokens (FYT) in return. [2]

The yield generated by these assets is directly received by the smart contract, and only the holder of the FYTs can redeem the corresponding underlying yield at the end of the period. [2]

As FYTs are regular ERC20 tokens, they can be traded, opening up a new market for future yield. For instance, users can deposit their aDAI on APWine for one month, receive their FYTs, and directly sell them through the AMM to get their yield upfront. [1][2]

Primary Tokens (PTs) & Yield Tokens (YT)

Principal Tokens (PT) and Yield Tokens (YT) are the core components of the Spectra protocol. Principal Token represents the initial deposit (also known as the principal) while Yield Token represents the right to future yield. [17]

Principal Tokens and Yield Tokens are financial derivatives on top of interest-bearing tokens. [17]

Future Yield Tokens (FYTs)

Future Yield Tokens (FYT) allow users to break down Yield Tokens (YT) into smaller, more precise time chunks. Yield Token has a predetermined maturity date whereby holders of these tokens are exposed to and entitled to yield accruals, which can vary in volatility. [19]

Future Yield Tokens encapsulate a specific time segment of a Yield Token. Depending on a user's needs, the duration of an FYT can vary from months to a single day. [19]

APW Token

The APW token is an ERC-20 token, with a primary focus on protocol governance through the APWine Finance DAO. The $APW token was first distributed through a Liquidity Bootstrapping Event. It is now deployed at the following addresses and available to trade on SushiSwap on mainnet and Comethswap on Polygon. [4]

| Network | $APW Address |

|---|---|

| Mainnet | 0x4104b135DBC9609Fc1A9490E61369036497660c8 |

| Polygon (PoS) | 0x6C0AB120dBd11BA701AFF6748568311668F63FE0 |

The token follows a Curve-like form of voting escrow (veAPW) with a Lock capability. Locking APW for up to 2 years will yield an increased voting weight and share of protocol rewards. [4]

Tokenomics

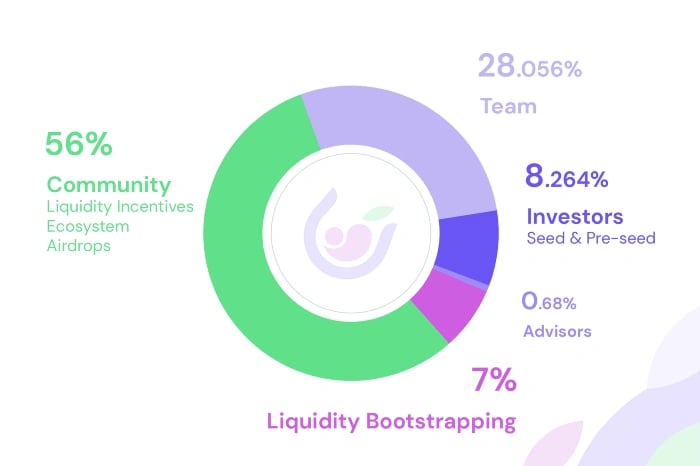

$APW has a maximum supply of 50,000,000 APW. 56% of the supply was allocated to the Community which is a combination of Liquidity Incentives, Ecosystem funds, and Airdrops. 28.06% was allocated to the Team, 8.94% to Investors and Advisors, and 7% to Initial Bootstrapping. [4]

These tokens are distributed through a liquidity mining program on $APW pairs, along with incentives for liquidity providers on the APWine AMM. The team and the DAO reserve the right for these tokens to be dynamically allocated to specific incentives, depending on the current needs of the project. [4]

veAPW

veAPW means voting escrow APW. They are APW locked for voting. veAPW weight gradually decreases as escrowed tokens approach their lock expiry. The veAPW has a lock capability of up to 2 years. The liquidity mining rewards emission is controlled by veAPW holders, which can redirect more rewards to their favorite pools by voting on the gauges. [18]

Locking APW for veAPW gives access to Boosted proposal power, Gauge weight power (liquidity mining redirection), Yield, and Reward boosting power which is yet to be implemented. [18]

APWine Finance 2.0

On October 31, 2022, APWine introduced the next iteration of the protocol code-named 2.0 which is a comprehensive redesign that takes key learnings from previous versions, making it a modular and inertial protocol for interest derivatives. [15]

Core advancements on the 2.0 version of the protocol & the flagship app:

- Yield Token

- L2 P2P Yield Market

- Supercharged Liquidity Provision

- Built-in Zaps & Bridges

- ERC-4626, 2616 & EIP-5095

- Revenue models

- UI Revamp. [15]

Rebrand to Spectra Finance

On July 10, 2023, APWine Finance announced its rebrand to Spectra Finance and opened the Spectra homepage & Beta to all users. [2][20]

"We began as a French student's idea for a tool to speculate on DeFi interest rates. It then quickly became a full-scale company focused on an advanced interest rate derivatives protocol. However, the name APWine no longer reflects the nature of the solutions we're building." - Spectra announced. [20]

"Spectra better represents the open protocol and long-term vision, which is also easier to remember." [20]

Spectra Finance also announced its vision for the new era which includes a permissionless protocol architecture, a journey towards decentralization, financial possibilities, and a flagship app that lets DeFi users use all the features that the protocol unlocks such as:

- Fixed Interest Rates (Discounted Tokens)

- Variable Rates (Yield Trading)

- Supercharged Liquidity Provision with up to 4 fee streams

- Yield Marketplace (Buying/Selling of specific yield tranches)

- Upfront Yield

- Lending/Borrowing[21]

The $APW token still remains the primary token of the protocol with the only change to it being its look. [21]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)