Binance DEX

Binance DEX (launched in 2019) is a decentralized exchange (DEX) built on BNB Chain that allows exchanging digital assets issued and listed on it. The matching happens within the blockchain nodes and all of the transactions are recorded on-chain, therefore forming a complete, auditable ledger of activity[1][2].

Overview

Binance DEX is a decentralized exchange and an extension of the largest cryptocurrency exchange by daily volume, Binance. Binance DEX is built on BNB Chain.

The testnet was launched on February 24, 2019, and this is what founder Changpeng Zhao said at the time of launch:

"Binance DEX is a decentralized exchange with a decentralized network of nodes, where you hold your own private keys and manage your own wallet,” said Changpeng Zhao (CZ), ex-CEO of Binance. “With Binance DEX, we provide a different balance of security, freedom and ease-of-use, where you take more responsibility and are in more control of your assets."[2][14][15]

After two months of testnet, a period involving nearly 8.5 million transactions across a simulated trading competition, coding competition, bug bounty program, and new updates and enhancements, the first version of mainnet was released on April 23, 2019. The mainnet was released along with the launching of BNB Chain and so Binance Coin (BNB) migrated from ERC20 standards to BEP-2 to become the native asset on BNB Chain, and also Binance DEX, where it is used as a base token to assist network transactions. The users were allowed to create wallets using Binance's official Trust Wallet and also third-party wallets like Enjin Crypto Wallet, Magnum Wallet, Coinomi Wallet, Atomic Wallet, ZelCore Wallet, Infinito Wallet, Math Wallet, Ellipal Wallet, Guarda Wallet, Exodus Wallet, and also hardware wallets, Ledger and CoolWallet. The users also gained access to the Binance Chain Explorer, web wallet, public data nodes, and APIs, but actual trading began later[1][21].

CZ believed that this would start a new era for financial systems and he also asked the community to come forward and give input for the same. This is what he stated:

“We believe decentralized exchanges bring new hope and new possibilities, offering a trustless and transparent financial system,” said CZ (Changpeng Zhao), ex-CEO of Binance. “With no central custody of funds, Binance DEX offers far more control over your own assets. We hope this brings a new level of freedom to our community. We will work closely with projects and teams to grow the entire ecosystem.”[16][17]

On September 1, 2020, BNB Chain, a parallel chain to Binance main chain was launched. It enabled the creation of smart contracts and the staking mechanism for BNB. It helps the whole Binance ecosystem to grow because of cheaper transaction fees with a high-performance network (with a block every 3 sec), increasing cross-chain interoperability by using DeFi mechanisms, bootstrapping and investing in many DeFi projects, and collaborating with many blockchain and crypto projects. So currently, Binance DEX is powered by a dual-chain system and because of BSC, it will get more and more volume using cross-chain interoperable mechanisms and decentralized applications (DApps)[18][19].

The Dual Chain Model

Binance DEX is first developed on a Binance Chain (BC) that allowed anyone to create, issue, and trade assets on the Binance Smart Chain and Binance DEX. Binance Smart Chain (BSC) enabled the writing of smart contracts which help to develop a decentralized application (DApp) and bring liquidity to Binance DEX using interoperable mechanisms from other blockchains like Ethereum, Bitcoin and others. The BC and BSC are compatible and can communicate with each other[20][32].

| Parameter | Binance Chain | Binance Smart Chain |

|---|---|---|

| Type | Main Chain | Parallel Chain |

| Consensus Mechanism | Dpos (Delegated-Proof-Of-Stake) | Proof of Staked Authority (PoSA) |

| Number of block validators | 11 | up to 21 |

| Mean Block Time | < 1 second | < 5 seconds |

| Programmability | Non-Compatible to EVM | Supports Ethereum Virtual Machine smart contracts |

| Token creation | Can only issue token (BEP-2) on Binance Chain | Can create a tokenized form for foreign assets (BEP-20 = Cross-chain BEP-2) on Binance Chain |

| Cross-chain | BEP3 introduces 'Hash Timer Locked Contract' functions and further mechanisms to handle inter-blockchain tokens peg. | BSC comes with efficient native dual chain communication; Optimized for scaling high-performance dApps that require a fast and smooth user experience. |

Features

Functionality

Binance DEX has a very similar user interface to Binance centralized exchange and it utilizes a web-based trading platform. It has also integrated TradingView charts which offer a full range of technical indicators for traders. The core function of the platform that it allows users to create their own wallets and hold their own private keys along with support to alternative third-party software and hardware wallets including popular wallets like Atomic Wallet, Ledger, and others.

Technology

The exchange is built on the Binance Chain therefore it has advantages like one-second block time with near-instant transaction finality. As a result, it can support similar trading volumes as cryptocurrency exchanges like Binance, although it uses a different order matching engine. It uses a periodic auction technique to match all available orders, and as the match happens simultaneously for all orders with the same price in every auction, it put an end to the role of market makers and takers.

Security

Similar to other decentralized exchanges, Binance DEX doesn’t take custody of user funds, and the users and traders maintain control of their wallets, private keys, and their funds. Binance Chain runs on Byzantine fault tolerance (BFT) and Proof-of-stake (PoS) based consensus mechanism that involves a series of qualified block validators and makes use of a number of anti-front running mechanisms to maintain the treading integrity of the exchange.

Binance DEX vs Binance

Binance is a centralized exchange and it is hosted on servers while Binance DEX is a decentralized exchange built on Binance Chain. Apart from this primary difference, there are many additional key differences.

| Type | Binance | Binance DEX |

|---|---|---|

| Nature | Hosted on centralized servers | Decentralized exchange built on a Binance public blockchain |

| Fund Control | The exchange wallet controls the funds of the user. | The user can create wallet or use any preferable third party wallet to control and use funds. The is user is responsible for the funds. |

| Type of Orders | The user can trade using both market order or limit order. | Only limit order is accepted as order are processed every block. |

| KYC | Requires KYC for large withdrawals (over 2 BTC per day). | Doesn't require KYC. |

| Order Matching | Order matches up bids and offers to complete trades. It is continuous like on most of the centralized exchanges. | Order matching is done using periodic auction matching for all the existing open orders received in the past and the latest blocks. |

| Market Makers and Takers | They play a big role. The market makers create an order that provides liquidity, which is useful for market takers to buy or sell instantly. | There is no role for maker makers and takers as orders are processed at once. |

Order Matching

Matching Logic

As blocks are produced at the regular interval, order matching takes place using periodic auction matching for all open orders received in the past up to the latest block. It uses a discrete matching engine. The orders are collected every block and all open orders up to the latest block are matched at the end of that block.

Principles of the Matching Engine

- Matching is attempted 1 time each block.

- Matching occurs when the highest bid price is higher than the lowest ask price.

- Only 1 price is selected in each block, determined as the fill price among all the fillable orders.

- Order matching is prioritized first by price aggressiveness, then second by time (block height) that they are accepted.

Order Matching Process

Every matching attempt occurs after a block is recorded on the chain (mined and verified). The matching attempt follows the below steps determining block fill price from the following factors:

Determining block fill price*from the following factors

- Maximum executable volume

- Minimum surplus

- Market pressure

- Reference price

Allocating order fills using rules

- Orders with the highest bid price will match with the orders with the lowest ask price.

- If all bids or asks at the block fill price cannot be fully-filled by the respective asks or bids, orders from the earliest blocks are selected and filled first.

- If all bids or asks at the block fill price cannot be fully filled by the respective asks or bids, and arrive in the same block, allocated execution will be in proportion to their quantity (floored if the number has a partial lot). If the allocation cannot be divided equally, a deterministic algorithm will guarantee a fair selection using a random order ID.

Trading

To log in and trade on Binance DEX, a user needs a BNB Chain-compatible wallet. The wallet can be created on the website itself or any compatible third-party wallet like Trust Wallet, SafePal, CoolWallet S, Math Wallet, Meet.one, Equal, Atomic Wallet that can be used via the WalletConnect interface. The users can also use hardware wallets like Ledger. Since it is a non-custodial decentralized exchange, the user is in control and responsible for the funds[35][40].

The Binance DEX currently has two different interfaces, one for BEP-2 assets and one for BEP-8 (mini BEP tokens). The user doesn't need a different wallet and can log in using the same wallet for both interfaces. Both interfaces are very similar to the Binance exchange.

Token Standards

Binance Chain and Binance DEX have their own native token Binance Coin (BNB), but anyone can issue and implement tokens on the BNB Chain and make them available for trading. These tokens generally follow one of the standards mentioned below.

BEP-2

The BEP-2 token technical standard on Binance Chain is similar to Ethereum's ERC20. Examples of BEP-2 tokens are Thorchain (RUNE), Fantom (FTM), and Atomic Wallet (AWC). The other major cryptocurrencies like Cardano (ADA) and Polkadot (DOT) and many others also have their tokenized BEP-2 form.

BEP-8

These are created for many small, promising projects. These are also called mini BEP-2 tokens as they require lesser fees to mint. Examples of BEP-8 tokens are FUTSWAP, JPIN, VRTN, and others.

BEP-20

The BEP-20 is a token standard on BNB Chain that extends ERC-20. Due to its similarity to BEP-2 and ERC-20, it’s compatible with both. This represents a tokenized form of assets created on other blockchains. (e.g. LINK, XRP). Because of compatible architecture, BEP-2 tokens can be swapped for their BEP-20 equivalent. To move tokens from one chain to another (i.e., BEP-2 to BEP-20 or vice versa), it is possible to use the Binance Chain Wallet, available on Google Chrome and Firefox.

Binance Bridge

The Binance Bridge is a cross-chain bridging service that aims to increase interoperability between different blockchains. It allows users to exchange assets between different blockchains. The users can convert crypto assets into (and back from) BNB Chain wrapped tokens. By using it, the users can bring their digital assets such as BTC, ETH, USDT, LTC, XPR, LINK, ATOM, DOT, XTZ, ONT, and more to the BNB Chain ecosystem. It can support the cross-chain conversion of other cryptocurrencies and tokens to Binance BEP-2 or BEP-20 standards. Currently, the Binance Bridge supports ERC-20 and TRC-20 cross-chain transfers. By using Binance Bridge, the users can convert any digital asset to its BEP-2 format and then trade it on Binance DEX.

In January 2021, Binance Bridge added a new feature of buying BNB as gas. When users swap their tokens to the BEP-20 equivalents on Binance Smart Chain, they could choose to buy some BNB to pay for gas at the same time. The supported tokens list includes BTC, ETH, USDT, BUSD, and the total of a user's swap order has to be greater than 2BNB.

Trading Interface

Once a user signs in using any of the mentioned wallets, they can trade BEP-2, and BEP-8 tokens going to their respective portals. If a user doesn't have any funds in their wallet, they have an option to purchase either BNB or BUSD to fund their wallet using their party fiat to crypto gateway provider - MoonPay. The users can also swap other cryptocurrencies like Ethereum (ETH), Bitcoin (BTC), Polkadot (DOT), and others using Binance Bridge to get corresponding BEP-2 tokens. Users can also change the connected node if they want.

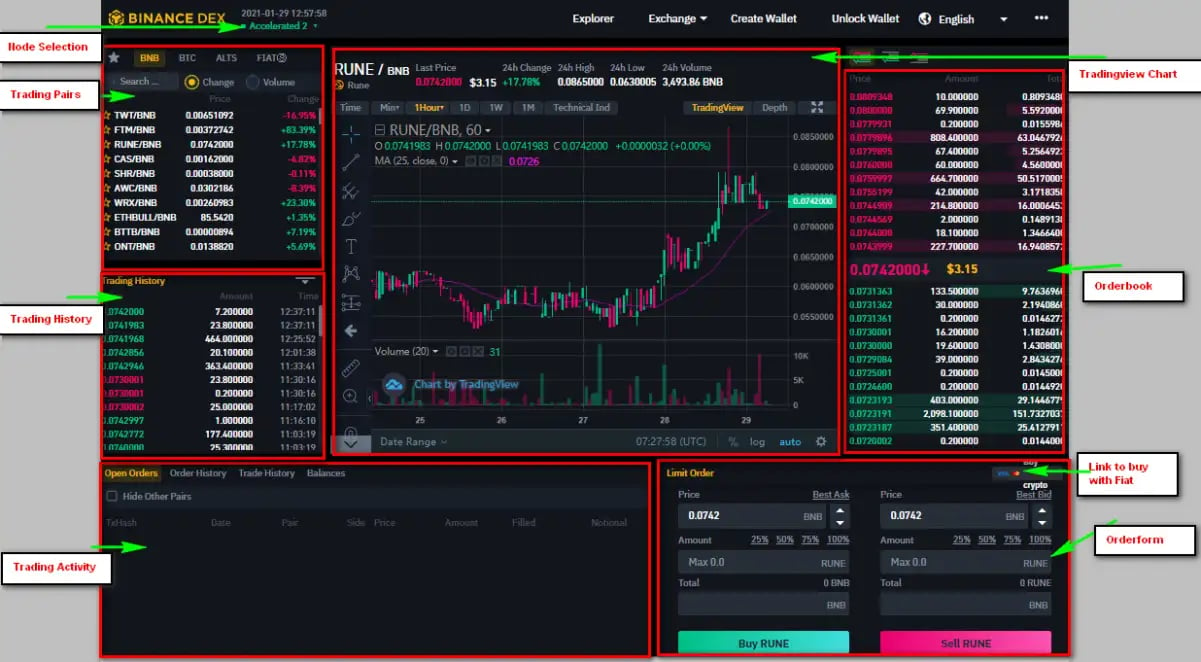

The Binance DEX trading page is designed to provide a user-friendly trading interface and it is composed of the following parts:

- Trading Pairs Info: the tokens are paired similarly to the Binance exchange. BEP-2 tokens are paired with native token Binance Coin (BNB) and a few BEP-2 tokens are also paired with BTC, ALTS (ETH and DAI), and fiat (mostly fiat-backed stablecoin like Binance USD (BUSD), TrueUSD (TUSD), etc). The users can switch between the markets by using tabs and can select their desired market.

- Trading View Chart: once the user selects the desired pair, they can see the TradingView chart, which displays information and price action of the selected pair. The chart allows the trades to display indicators such as the RSI, moving average, etc., and also use tools available on the TradingView portal. The 'depth' tab shows market depth, i.e. the overall level and breadth of open orders, and usually refers to trading within individual trading pairs. The number of levels can be zoomed in and out. The key indicator of this market depth is the spread. The spread is the gap between the bid and the ask prices. If the bid price of a token is $19 and the asking price for the same is $20, then the spread for the token in question is 1 divided by the lowest ask price to yield a bid-ask spread of 5% (1 / $20 x 100).

- Trade History and Orderbook: the order book shows a list of open orders on the exchange The top half shows sell orders and the bottom half lists the buy orders for the selected pair. The trading history shows all the trades executed for particular selected pair.

- Trading Activities: this is the section where users can check their open orders, order history, trade history, and balances. The open orders show orders which are not filled in their entirety and are still currently open. The order history shows the user placed orders which are filled, unfilled, or canceled. The trade history shows user-executed trades and the balances show the current available balance in the user's wallet. The users can view all of the orders on the blockchain by looking at their transaction hash.

- Order Form: Binance DEX currently only supports limit orders. The limit order section allows a user to define the bid/ask price and the quantity they wish to trade.

Tokenomics and Fees

Binance Coin (BNB) is the native currency of BNB Chain and also Binance DEX. It has a total supply of 170,532,785 BNB[39][41].

All the fees on Binance DEX are charged in BNB. The fees on Binance DEX are designed with complex logic because of the block-based order-matching engine. It means that individual trades are not charged exactly by the rates mentioned below, but between them instead. There are two types of fees, Trading Fees and Fix Fees.

Trading Fees

Trading Fees are applied for trading activity on Binance DEX and the current fee for trades, applied on the settled amount, is as follows:

| Transaction Type | Pay in Non-BNB asset | Pay in BNB |

|---|---|---|

| Trade | 0.1% | 0.04% |

Fix Fees

The difference between Binance Chain and Ethereum is that there is no notion of gas. As a result, fees for the rest transactions are fixed. Anyone can create and issue tokens on Binance Chain, therefore there will be fees for issuing, minting, or burning the tokens. Similarly, all the other activities like listing tokens, transfers, and multi-send are charged with fees in BNB. The DEX-related fixed fees are tabularized below.

| Transaction Type | Pay in Non-BNB asset | Pay in BNB |

|---|---|---|

| New Order | 0 | 0 |

| Cancel Order (No Fill) | Equivalent 0.00025 BNB | 0.00005 BNB |

| Order Expiry (No Fill) | Equivalent 0.00025 BNB | 0.00005 BNB |

| IOC (No Fill) | Equivalent 0.0001 BNB | 0.000025 BNB |