Subscribe to wiki

Share wiki

Bookmark

Bunni

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Bunni

Bunni was a liquidity engine designed to incentivize Uniswap v3 liquidity provision. It comprises two key components: a protocol that transforms Uniswap liquidity positions into fungible ERC-20 tokens and a vetokenomics system for encouraging Bunni liquidity. [1]

On October 23, 2025, the Bunni team announced its permanent shutdown via X (formerly Twitter) after suffering a major security breach in which approximately US$8.4 million was drained from its smart contracts. [17]

Overview

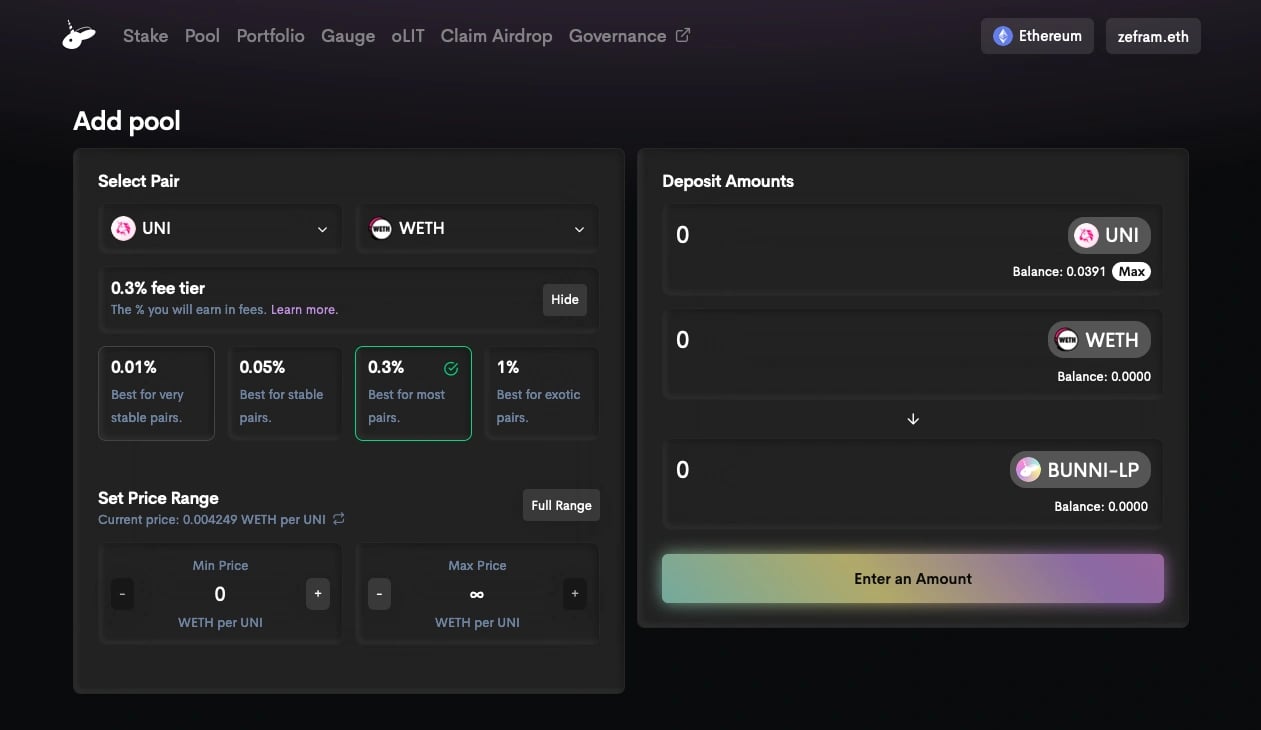

Bunni was created by Timeless Finance, the same team behind Timeless, a yield market protocol. Bunni's functionality revolves around its Uniswap wrapper, a contract that represents Uniswap positions as ERC-20 tokens, instead of using non-fungible tokens (NFTs). This approach aims to provide enhanced gas efficiency, as liquidity providers (LPs) who share the same price range and pool can hold the same ERC-20 token, thus reducing overall gas costs. Moreover, this is designed to promote easy composability with existing financial applications, as these applications are typically tailored for tokens rather than NFTs. [2][3][13][14]

Bunni's native token, the Liquidity Incentive Token (LIT), played a central role in incentivizing liquidity. The platform's vetokenomics system, inspired by Curve, leveraged Balancer LP tokens to lock votes for obtaining veLIT, offering LPs an increased maximum boost of 5x. Bunni also employs call option tokens as rewards for LIT, allowing the protocol to accumulate cash reserves irrespective of market conditions and providing loyal holders with the opportunity to purchase LIT at a discount. Bunni combines these two main systems in an attempt to layout an efficient and appealing solution for incentivizing liquidity in the decentralized exchange (DEX) space. [2][4]

Tokenomics

LIT (Liquidity Incentive Token)

LIT (Liquidity Incentive Token) is Bunni's native token, used as an instrument for incentivizing liquidity provision. [5]

LIT Distribution

With a total supply of 1 billion LIT, its distribution is structured as follows:[6]

- Community (72%): This allocation involves various distributions, including 45% set for gauges on a 4-year halving schedule, 11% held in the protocol treasury for purposes such as grants and audits, 10% sold through a Liquidity Bootstrapping Pool (LBP), and 5% distributed to veMPH holders over 4 years via a staking pool.

- Team (25%): This allocation is vested over 4 years.

- Investor (3%): These proceeds are directed to the protocol treasury with a 6-month cliff, followed by a 1-year vesting.

- Airdrop (1%): A 1% airdrop, with 0.25% to early Timeless & Bunni users and 0.75% to active Uniswap v3 LPs.

oLIT (Call Option Token for LIT)

oLIT is a call option token for LIT that allows holders to purchase LIT at a discount without an expiration date. As of December 2023, the discount stands at 50%, subject to governance adjustments. Bunni liquidity providers receive oLIT as an incentive for their participation. To obtain oLIT, users need to provide liquidity on Bunni and stake in gauges. oLIT enables users to acquire LIT at a discount by visiting the oLIT page on the Bunni website. This mechanism allows loyal holders to purchase LIT at a reduced cost. [7]

veLIT (Vote-Escrow LIT)

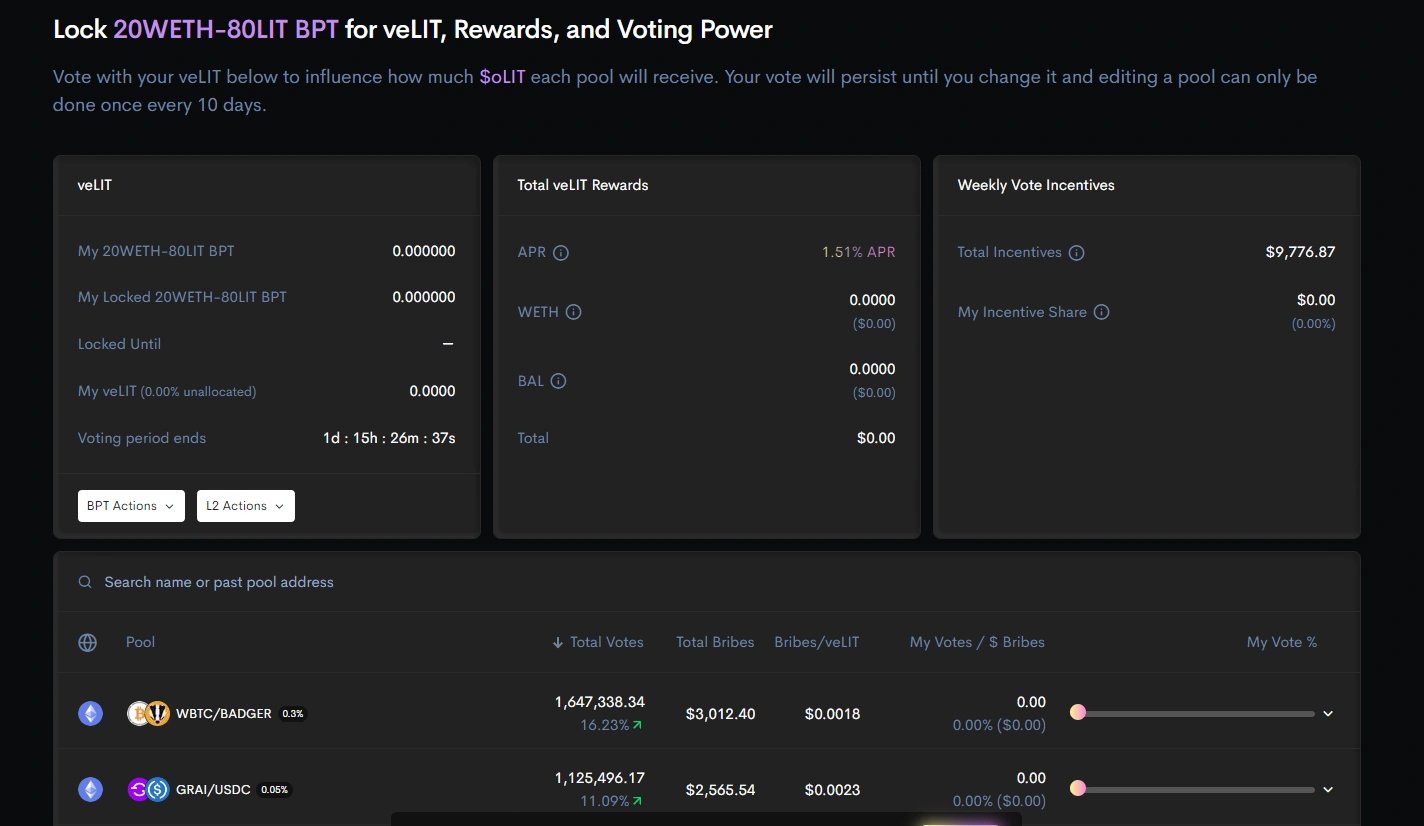

veLIT serves as a voting tool for governance proposals and gauge weight decisions, following a model inspired by Curve's veCRV. To obtain veLIT, users are required to lock Balancer 80LIT-20WETH LP tokens. The duration of the lock influences the veLIT acquired, and veLIT balances decrease over time. veLIT offers utility in multiple aspects, including governance voting, gauge weight decisions, boosting gauge rewards, receiving rewards for voting, and a share of the protocol's revenue. [8]

Gauges

Similar to Curve gauges, Bunni gauges are used to distribute oLIT incentives. LPs can stake their LP tokens in gauges to receive oLIT rewards and these gauges. To earn oLIT rewards from gauges, users need to provide liquidity to a Bunni pool with an associated gauge, stake their LP tokens in the gauge, and claim the rewards from the gauge contract. Holding veLIT can also enhance the rewards received from gauges. The more veLIT held, the greater the rewards (up to a certain limit). [9]

Boosting

Boosting is a component of LIT tokenomics that rewards LPs for holding veLIT by increasing their oLIT rewards. Bunni's model enhances this boosting mechanism by raising the maximum boost from 2.5x to 5x, making veLIT ownership more attractive and influential. The amount of boosting received not only depends on one's veLIT balance but also on the veLIT balances of others in the same gauge. Boosting is a relative concept, where LPs compete for a share of rewards. [10]

FOO Model

The FOO model is another tokenomics model that is set to go live in the future, aimed to further incentivize LPs and token holders to participate actively in the protocol. In this model, LPs without veLIT receive no rewards, fostering a symbiotic relationship between farmers and LPs. [11]

Protocol Revenue

Fee Structure

Bunni currently imposes a 10% protocol fee on swap fees generated by Bunni LPs, with governance possessing the authority to increase this fee up to 50%. [12]

Fee Collection Mechanism

Bunni can collect fees as its LPs provide liquidity through the Bunni smart contract, which holds all liquidity positions. Upon claiming swap fees from Uniswap, a portion is allocated to the protocol as a fee, with the remainder distributed to LPs. [12]

Usage of Protocol Revenue

As of December, the collected revenue is channeled into the protocol treasury. The share of the revenue that veLIT holders receive, which includes redemption revenue and protocol fees, is set to be reduced from 50% to 25% on November 2, 2023, following a governance proposal. [12][16]

Partnerships

Bunni x Gravita Protocol

On June 17, 2023, Bunni announced their strategic partnership with Gravita Protocol, known for enabling the minting of GRAI, a low-volatility algorithmic stablecoin using crypto assets. This partnership aimed to offer several key benefits to users:[15]

- Yield Maximization: Enhance users' yield-generating assets by capitalizing on Gravita's collateralized loans and Bunni's liquidity optimization. This dual approach allows users to earn on their collateral as well as on the debt, boosting overall earnings.

- Enhanced Liquidity and Integration: Bunni's ERC-20 wrapper simplifies the liquidity provision process for Uniswap positions, creating opportunities for integration with Gravita.

- Governance and Incentivization: Pooling LIT with ETH on Bunni and locking it for veLIT enables users to participate in governance decisions. They become eligible for additional rewards, including ETH and BAL. Moreover, they gain influence over yield distribution in their respective pools.

- Added Capital Efficiency: The Gravita and Bunni collaboration enhances capital efficiency, allowing users to explore new strategies for a more diversified and efficient allocation of capital.

Bunni Shutdown and $8.4 Million Exploit

In early September 2025, Bunni DEX suffered a major security breach in which approximately US$8.4 million was drained from its smart contracts across both the Ethereum and UniChain networks. The exploit targeted Bunni’s custom Liquidity Distribution Function (LDF), taking advantage of a “logic-level” vulnerability that enabled attackers to manipulate internal calculations and extract funds using flash loans and rounding-error attacks. [17]

Following the exploit, Bunni’s total value locked (TVL), which had surged to tens of millions of dollars, collapsed and the team announced on 23 October 2025 that the protocol would shut down permanently.

In their public statement, the team cited that the cost of a secure relaunch — involving audits, development, monitoring and business development effort — would run into the six

- to seven-figure range, capital which they stated they no longer had. [18]

Despite the shutdown decision, Bunni announced that withdrawals remain open for users for the time being and that the remaining treasury assets will eventually be distributed to holders of BUNNI, LIT and veBUNNI tokens based on a snapshot. In a final act, the Bunni team relicensed its version 2 smart-contracts from a restrictive BUSL license to the open-source MIT license, thereby allowing other developers to build upon its technologies.

The Bunni DEX closure highlights the persistent challenges in the decentralized finance (DeFi) sector, where high-growth protocols incorporating novel mechanics can become vulnerable to subtle contract flaws. The incident reinforces the importance of robust security architecture, sufficient treasury reserves and crisis readiness in sustainable DeFi design. [17] [18]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)