Subscribe to wiki

Share wiki

Bookmark

Delta Trade

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Delta Trade

Delta Trade is a multi-chain decentralized trading protocol designed to provide users with advanced on-chain trading strategies.[1][2]

Overview

Delta Trade, announced on X (formerly Twitter) in January 2024, is a multi-chain decentralized trading protocol. It aims to provide advanced on-chain trading strategies such as Grid Trading, Dollar-Cost Averaging (DCA), Rebalancing Grid, MultiChain Support, Order Book, Full Platform Market Making, and AI-Powered Strategies, with a focus on ease of use for retail traders.

The alpha version, released on February 26, 2024, enabled NFT holders to test GridBot. The beta version, launched on April 29, 2024, on the mainnet, and the stable version in June 2024 introduced the DCA feature.

Delta Trade seeks to offer a transparent and decentralized trading platform, initially targeting the Near ecosystem. Future plans include expanding across various blockchains to broaden its reach and capabilities in decentralized finance.[1][2][3][4]

Products

Trading Vault

Delta Trade aims to enhance user strategies through its advanced trading tools available in the Trading Vault, which includes Grid Trading, Swing Trading, Dollar-Cost Averaging (DCA), and Rebalancing Grid Trading. Grid Trading is designed to automatically place buy and sell orders within a set price range to capitalize on market fluctuations, while Swing Trading focuses on single-sided operations, allowing users to buy or sell based on market movements.

Dollar-Cost Averaging (DCA), set to launch soon, involves investing fixed amounts at regular intervals to spread investment risk over time. Rebalancing Grid Trading, also coming soon, aims to combine Grid Trading with automatic asset rebalancing to maintain portfolio ratios and optimize returns. All these strategies use smart contracts to ensure transparency and security, offering users structured trading options.[5]

MultiChain

Delta Trade's Trading Vault includes Grid Trading, Swing Trading, Dollar-Cost Averaging (DCA), and Rebalancing Grid Trading. Grid Trading aims to leverage market fluctuations by placing orders within a set price range. Swing Trading focuses on single-sided operations based on market trends. DCA, planned for future release, involves regular investments to spread risk. Rebalancing Grid Trading, also upcoming, combines grid trading with automatic asset rebalancing.

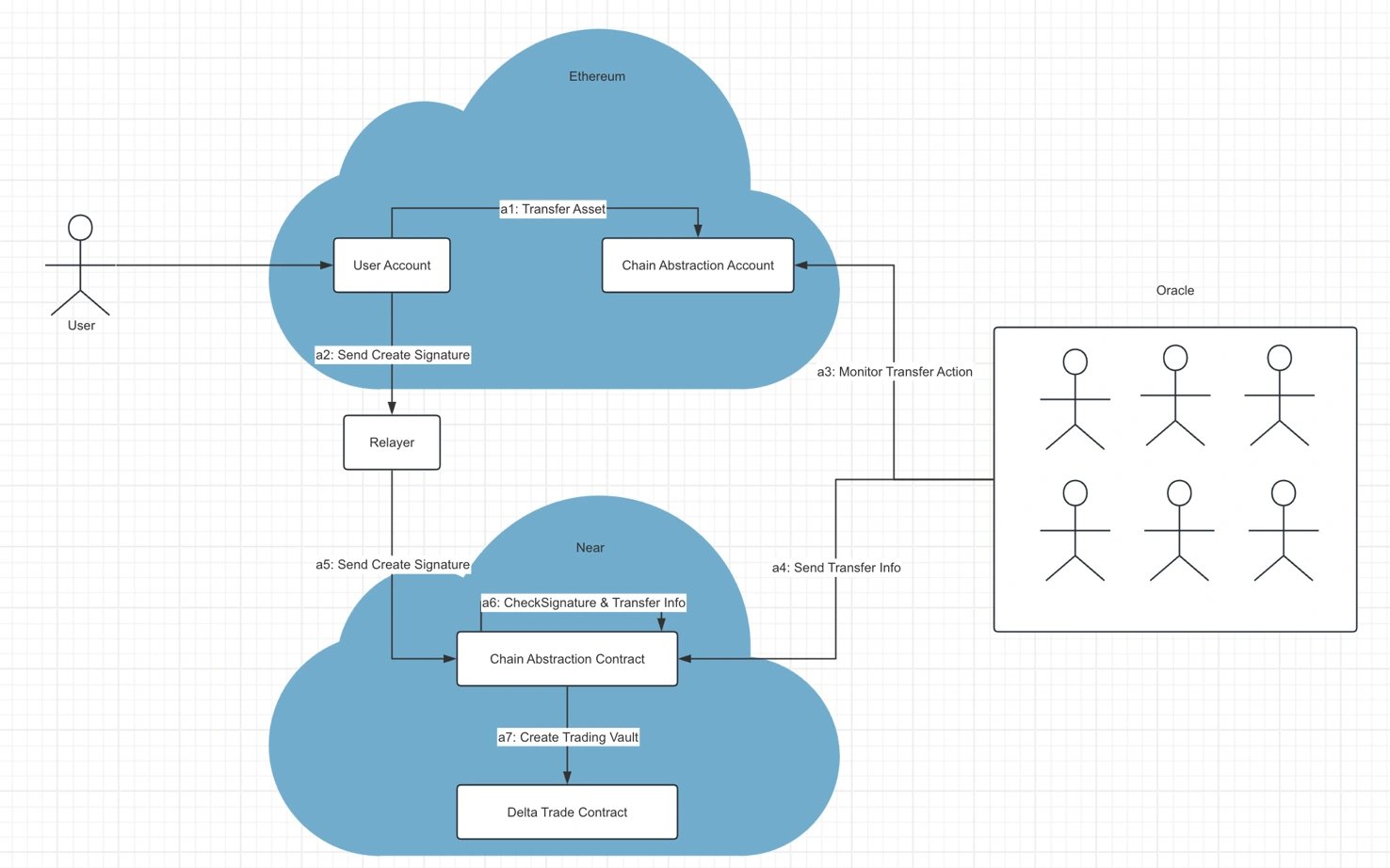

Delta Trade plans to support multi-chain functionality using Near's Chain Abstraction technology. This approach aims to facilitate seamless asset transfers and trading across multiple blockchains without requiring a Near account.[6]

Orderbook

Delta Trade provides various trading tools designed to improve user strategies and experience. The OrderBook (coming soon) records all user orders on the blockchain, ensuring transparency and fairness in the trading process.

The Market Maker Scheme aims to reduce on-chain costs by allowing market makers to create short-lived orders. Traders can execute these orders on-chain if valid, maintaining liquidity and efficiency.

Delta Trade seeks to enhance security and transparency by enabling direct on-chain order execution without the need for centralized exchanges, aiming to offer a user experience similar to that of a centralized exchange.[7]

Full Platform Market Maker

The Full Platform Market Maker aims to ensure liquidity by utilizing both centralized and decentralized exchanges, supporting a stable trading environment through proactive hedging.

Key features include maintaining adequate liquidity for confident trading and creating TradingVaults, as well as aiming to stabilize prices by reducing extreme market fluctuations.[8]

AI-Powered Strategy

The AI Powered Strategy (coming soon) aims to assist users in making informed decisions. It analyzes market data in real-time to provide predictive insights and recommendations, helping users optimize trading strategies and improve risk management.[9]

Reward Mechanisms

Delta Points

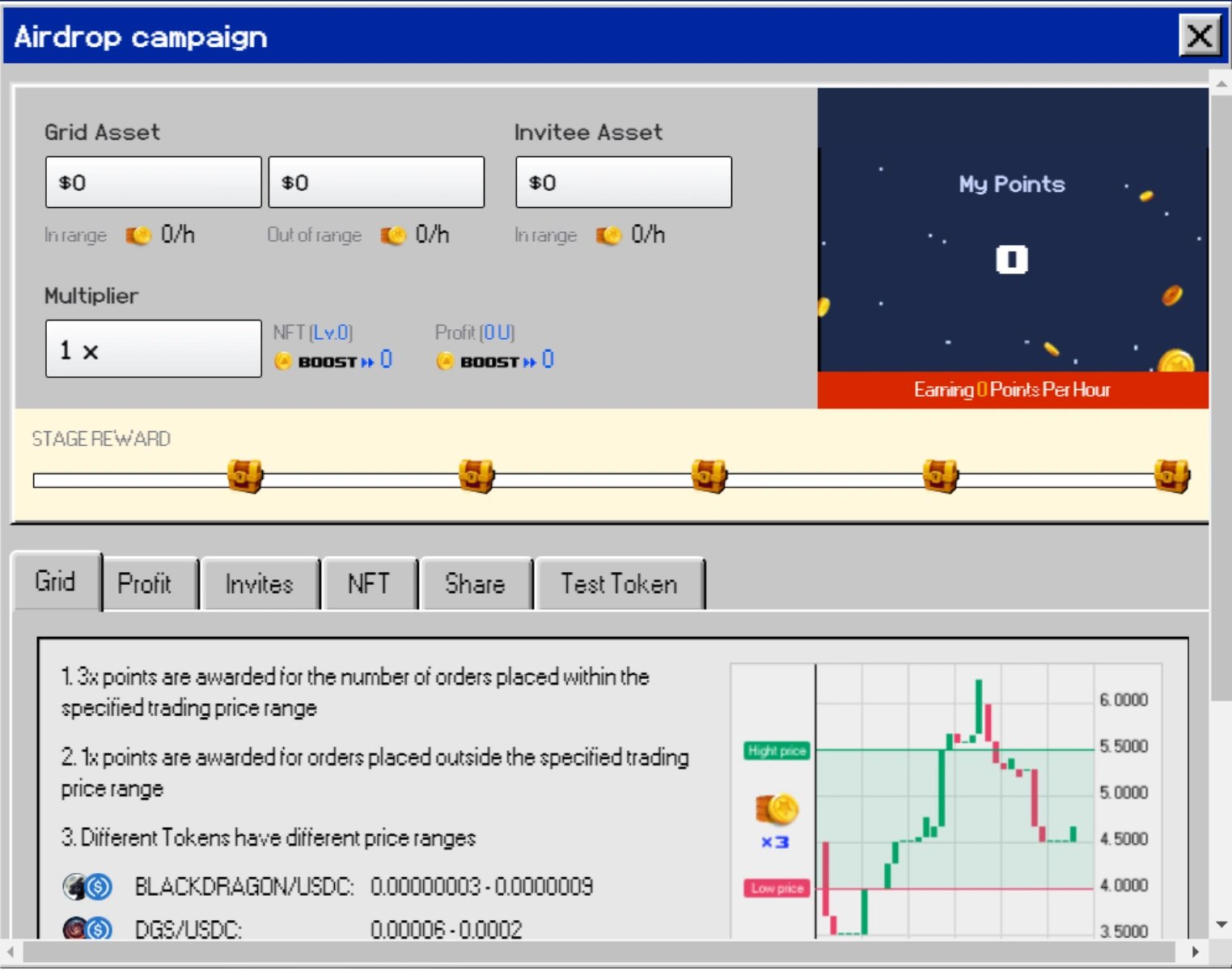

Delta Points aims to reward participation in Delta Trade's grid trading. Users accumulate points through trading, inviting others, ranking competitions, and daily tasks. Grid orders generate 0.2 points per U per hour, with triple points for orders in specified price ranges.

Multipliers can be obtained by holding DeltaDisk NFTs or achieving trading profits. These NFTs offer multipliers from 0 to 0.18, with higher trading profits leading to larger multipliers. Points from grid trading and user invitations are eligible for these multipliers, which are updated hourly.

Points are calculated hourly using real-time multipliers. For example, a user with a 1.15 multiplier earning 556 points per hour would receive 639.4 points. As trading profits increase, additional multipliers further enhance point calculations.[11]

Gachapon

Delta Trade includes a Gachapon feature for users who bind their wallets. Participants can engage in the lottery twice a day for a chance to win various mainnet tokens. Available tokens include DGS, NEARVIDIA, LONK, BEANS, SLUSH, NEKO, GEAR, MARMAJ, and others. The token prize pool consists of substantial quantities, such as 2,500,000 DGS and 3,050,000,000 NEARVIDIA, among others. This feature aims to provide additional incentives for user engagement on the Delta Trade platform.[12]

Fee Referral Rebate Mechanism

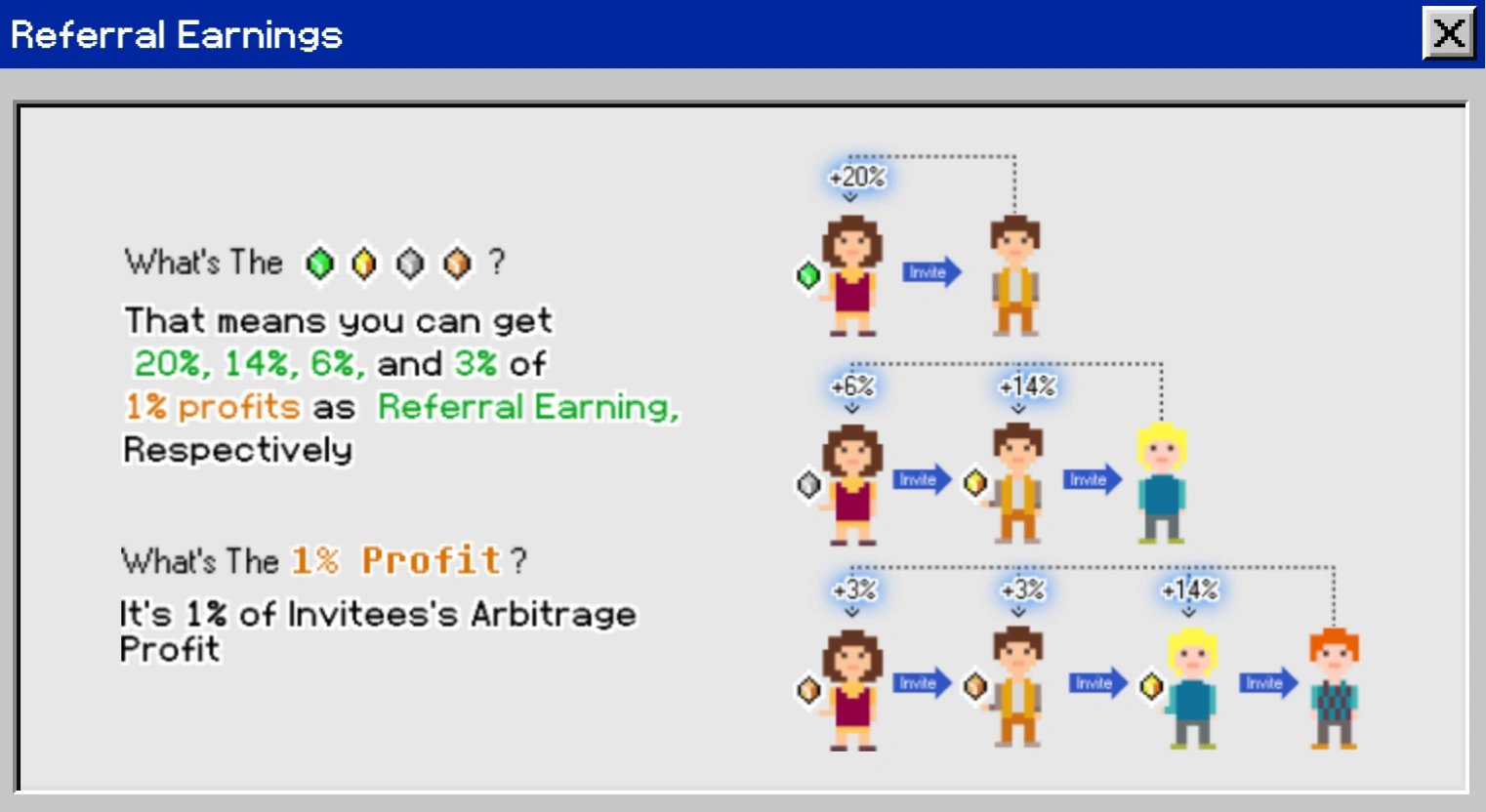

Delta Trade features a fee referral rebate mechanism that aims to incentivize user referrals.

When user A invites user B, who then invites user C, and user C invites user D, rebates are distributed based on the profits generated. If user D's bot generates profit, users C, B, and A receive a rebate. Similarly, if user C's bot generates profit, users B and A receive a commission. The referral is recorded only after the invited user creates a bot or copies a strategy.[10]

Partnerships

Delta Trade x Burrow Finance

Delta Trade collaborates with Burrow Finance, aiming to enhance user returns. Users can stake tokens on Burrow, borrow NEAR or USDC at low interest rates, and use these funds to create Grid or DCA vaults on Delta Trade for potentially higher returns. Eligible vaults may receive mining rewards and Delta Points, which will be significant for future airdrops.

Users can participate by supplying assets on Burrow to earn passive interest, then borrowing NEAR or USDC. These borrowed funds can be utilized on Delta Trade to create grid or swing vaults. Participants aim to earn Delta Points and may qualify for future mining rewards.[13]

Delta Trade x Edge Video AI

Delta Trade has partnered with Edge Video AI to integrate its trading platform with Edge Video AI's community. This partnership aims to facilitate $FAST token trading on DeltaTrade and streamline the distribution of delta disk NFTs on NEAR. Additionally, the collaboration plans to introduce $FAST trading competitions and airdrops on DeltaTrade following the token generation event (TGE), with further updates anticipated.[14]

Delta Trade x Pyth Network

Delta Trade uses Pyth Price Feeds to utilize real-time prices for trading bot creation, aiming to manage slippage and support unactivated trading vaults and automated setups. This multi-chain protocol seeks to enhance decentralized trading with strategies like Grid Trading and Dollar-Cost Averaging (DCA). Initially developed for the NEAR ecosystem, it is expanding to offer a more accessible platform for retail traders across multiple blockchains.[2][15]

Delta Trade x Meteor Wallet

Delta Trade collaborates with Meteor Wallet to facilitate user trading. Meteor Wallet's token, $GEAR, will be listed on Delta Trade, with additional trader rewards planned for the following week. This partnership seeks to enhance the trading experience and ecosystem.[2]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)