Subscribe to wiki

Share wiki

Bookmark

Fraxtal

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Fraxtal

Fraxtal is an EVM-compatible layer 2 rollup chain, launched on February 8th, 2024, for Frax Finance reducing congestion on Ethereum. Roll-ups bundle transactions off-chain, compressing data before sending it back to Ethereum. [2] [7]

Overview

In a January 2024 interview, Sam Kazemian announced the launch of Fraxtal, Frax Finance's layer 2 blockchain. The release was scheduled for the first week of February, with Etherscan providing support on day one through Fraxscan. [3] Fraxtal processes transactions off-chain and submits compressed data to Ethereum, improving efficiency and reducing fees. It uses FRAX as its native gas token and features a unique incentive mechanism called Flox. Flox rewards users and developers for spending gas and interacting with any smart contract on the network. Every epoch, users who spend gas and developers that deploy contracts where gas is spent earn FXTL points that can later be converted into tokens. For the first time, users are able to earn more rewards than gas they spend and developers can earn more than the gas their dApps use. [5] [12] [13]

North Star Hard Fork

The North Star Hard Fork is a landmark upgrade for Frax Finance, reshaping its governance and tokenomics to enhance decentralization, sustainability, and long-term protocol growth. Originally proposed in late 2023 and refined through extensive community feedback, the hard fork shifts Frax away from its dual-token system toward a streamlined model. This upgrade aims to resolve governance inefficiencies, align stakeholder incentives, and build a more durable economic foundation as part of Frax's 2025 roadmap.

Key goals include simplifying governance processes, redesigning tokenomics to support protocol sustainability, and empowering broader stakeholder participation. The proposal evolved significantly between its initial draft (v1.0) and the final version (v2.0), incorporating clear migration mechanisms, improved incentives, and phased implementation plans. Technically, the upgrade includes new governance contracts, a token consolidation process, and enhancements across Frax's architecture, including smart contracts and security systems.

The hard fork's rollout follows a three-phase strategy: preparation, transition, and stabilization—ensuring a secure and minimally disruptive implementation. Founder Sam Kazemian emphasized that the North Star Hard Fork is the result of key lessons learned, positioning Frax to thrive in the next decade of DeFi evolution.

FRAX as Gas Token

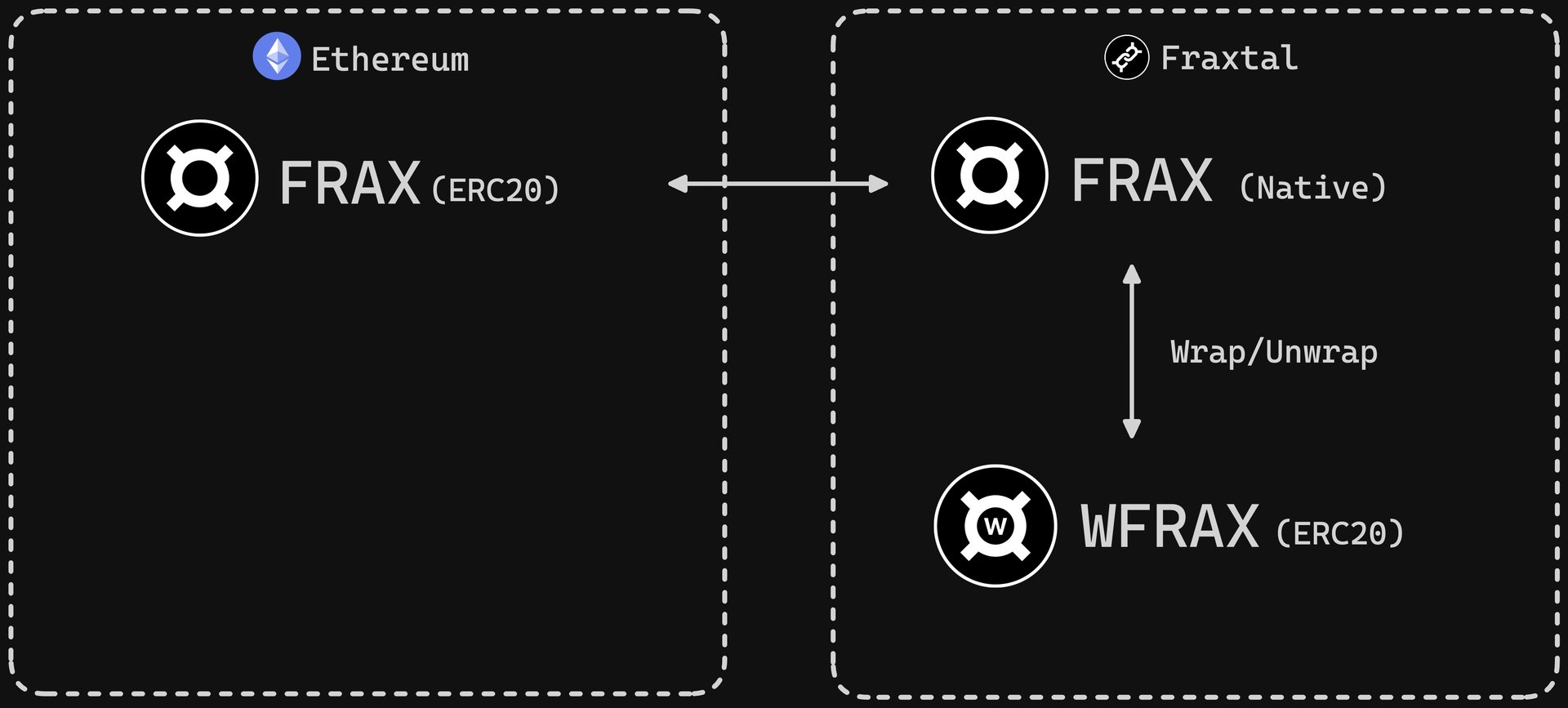

Fraxtal uses FRAX as its native gas token, enabling users to pay for transaction fees directly with the asset. FRAX can be acquired on Fraxtal through the protocol’s native Layer 2 bridge by transferring FRAX from Ethereum mainnet. When bridging assets back to Ethereum, users receive the ERC-20 version of FRAX on mainnet. [15]

frxETH V2

frxETH V2 went live on January 11, 2025, with V2 further boosting yield while decentralizing validators. [10]

"$sfrxETH is the highest-yielding major liquid staked ETH, with hundreds of millions in TVL earning significantly more than competitors." - the team tweeted

"Our mission is to become the decentralized central bank of crypto. To do that, we need everyone to participate, both on the supply and demand side. We built V2 completely from scratch to allow any ETH validator to join permissionlessly"

frxETH V2 allows the possibility for anonymous / external validators to enter the frxETH system. All of their ETH staking rewards will flow directly to a ValidatorPool smart contract under their control and thus no frxETH will be minted for them. They will however receive credit which can be used to borrow ETH that entered through the V1 mint mechanism. The collateral for this borrowing is an escrowed exit message, which can be executed by the frxETH protocol if their borrow position becomes unhealthy. The exited funds only go to the ValidatorPool and become "trapped" their until all loans are paid off. [11]

Fraxtal Point System (FXTL)

The Fraxtal Point System uses FXTL as a non-transferable unit to track user engagement within the Fraxtal network. Participants earn FXTL points by interacting with smart contracts, using new protocols, and holding designated assets or tokens. Point balances and earning activity are recorded in the FraxtalPoints contract, which functions as the central ledger. FXTL is expected to be tokenized within 12 months of Fraxtal’s launch, though details regarding its final form—whether as a standalone staking token, a conversion to FXS, or a combination—remain to be announced. [6]

Fraxtal Incentives Delegation

Fraxtal allows delegation of FXTL incentives to addresses capable of claiming them, addressing limitations with smart contracts that cannot directly interact with the incentives system. This is managed through the DelegationRegistry, where addresses can assign a delegate, such as an externally owned account (EOA), smart account, or multisig wallet, to receive and manage earned rewards.

Delegation is non-recursive, meaning incentives are directed only to the directly assigned delegate, regardless of any further delegations that delegate might make. EOAs can register delegations directly via the DelegationRegistry on both Fraxtal mainnet and testnet.

For smart contracts, delegation can be set during deployment using specific function calls to register the delegate and disable further changes. Additional security measures are recommended for contracts capable of arbitrary calls to prevent unauthorized changes to delegation settings. These precautions help ensure incentives are allocated securely without increasing contract complexity post-deployment. [14]

Fraxtal blockspace incentives (Flox)

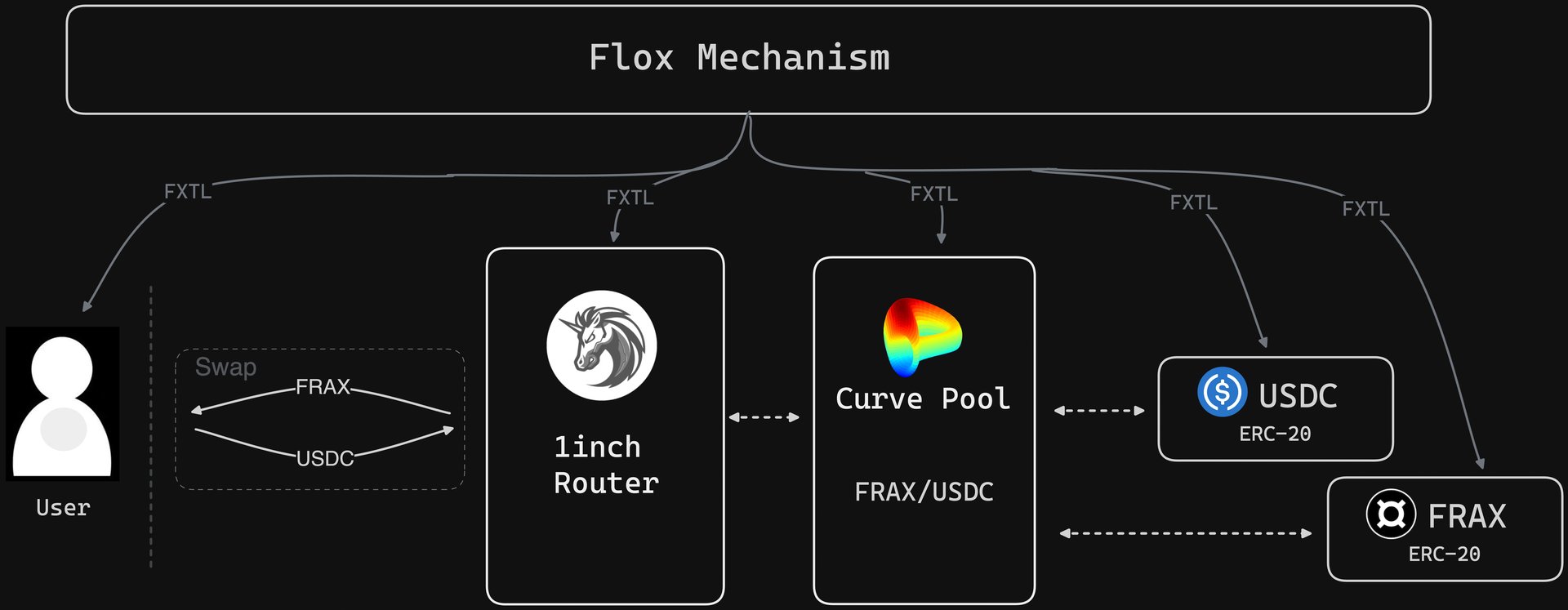

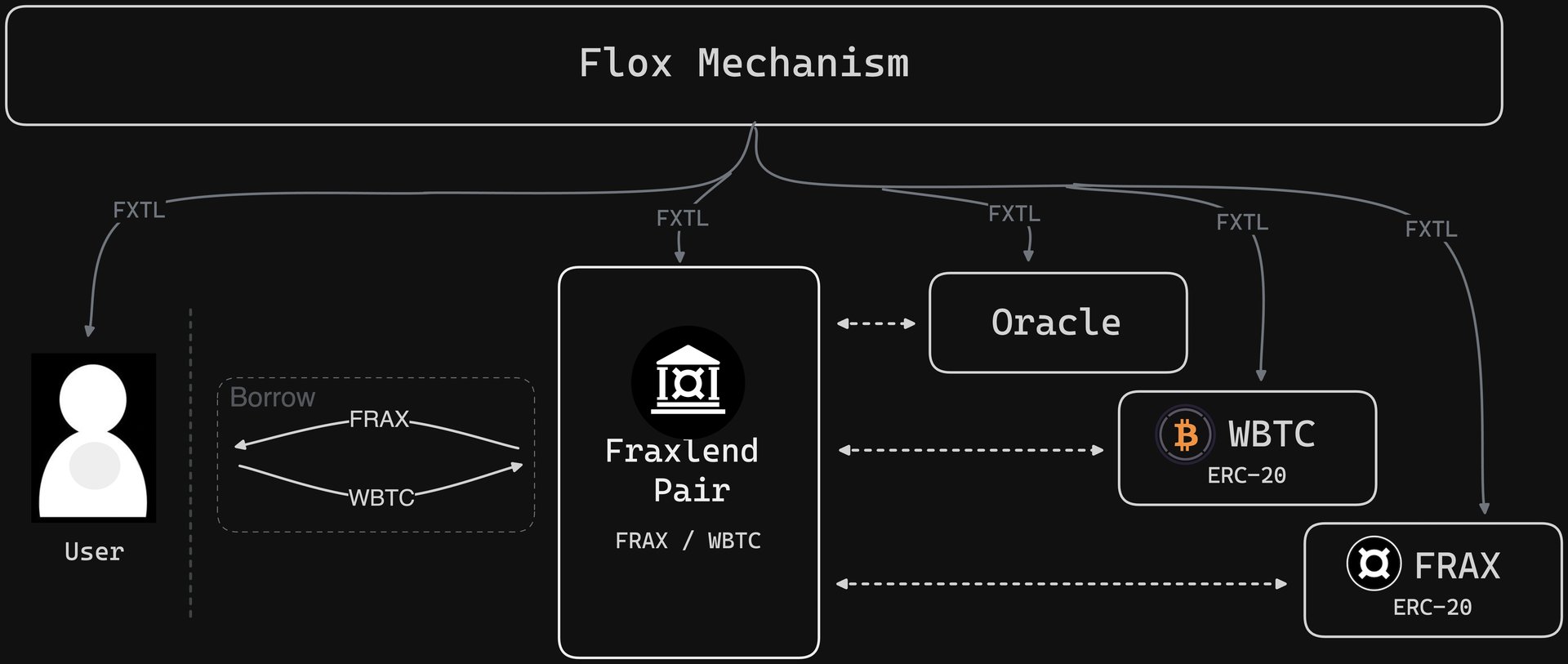

The Fraxtal Blockspace Incentives system (Flox) rewards users and smart contract developers on Fraxtal. Gas spenders and gas-using smart contracts receive FXTL points based on the Flox Algorithm every epoch (initially 7 days).

The Flox system offers higher incentives for gas usage compared to previous attempts. It rewards both users and contracts, calculates transaction traces, and ranks contract importance based on various criteria.

Flox program uses FXTL as incentive currency to distribute value to users and developers. It goes beyond early transaction fee-sharing models and aligns with sustainable revenue sharing.

Example 1: A swap from USDC to FRAX through a Curve pool using 1inch. Incentives are distributed to 1-inch router contract, Curve pool contract, USDC contract, and FRAX contract.

Example 2: Borrowing FRAX from a Fraxlend pair against WBTC. Incentives go to Fraxlend Pair contract, WBTC contract, FRAX contract, and Chainlink oracle contract. [15]

veFRAX

veFRAX is a non-transferable, time-locked representation of staked FRAX (formerly FXS), used within the Frax ecosystem for governance and protocol utility. Users can lock their FRAX for periods ranging from 1 week to 208 weeks (4 years). The veFRAX balance is determined by the amount of FRAX locked and the duration of the lock, with longer commitments yielding higher balances. For example, staking 1 FRAX for 4 years generates 4 veFRAX, which decays linearly as the unlock date approaches.

Initially limited to Ethereum mainnet, veFRAX staking is now also supported natively on Fraxtal through an updated contract. A unified view of a user’s veFRAX holdings is maintained via the veFRAXCounter contract, which aggregates balances from both Ethereum and Fraxtal. This combined balance is used for governance, incentive programs like Flox, and other protocol functions on Fraxtal. [17]

Frax Name Service (FNS)

The Frax Name Service (FNS) is a modified implementation of the Ethereum Name Service (ENS), adapted to operate within the Frax ecosystem. It preserves the core functionality of ENS, such as linking human-readable names to blockchain addresses and metadata, while introducing adjustments to the payment system to support Frax-native assets.

FNS allows users to register and manage names specific to Fraxtal, functioning similarly to ENS by enabling both forward and reverse resolution. The primary difference lies in its integration with the Frax economic model, using Frax-based tokens for registration and renewal processes. This adaptation is intended to streamline naming operations within the Fraxtal network. [9]

Curve Partnership

The decentralised stable-coin focused exchange, Curve Finance, has shown its interest in Fraxtal. Curve intends to deploy its exchange functionalities on the new layer 2 blockchain, further solidifying the project's collaborations.[1]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)