订阅 wiki

Share wiki

Bookmark

Frax Ether (frxETH)

0%

Frax Ether (frxETH)

Frax Ether (frxETH) 是一种 流动 ETH 质押 衍生品和 稳定币 系统,旨在简化和保护 以太坊 质押 过程。它利用 Frax Finance 生态系统,为用户提供一种 DeFi 原生的方式,以便在最大化其质押收益的同时,赚取 ETH 持有量的利息。 [1][2]

概述

Frax Ether 系统包含三个主要组件:Frax Ether (frxETH)、质押 Frax Ether (sfrxETH) 和 Frax ETH Minter:

Frax Ether (frxETH)

frxETH 充当与 ETH 宽松挂钩的稳定币,因此 1 frxETH 始终代表 1 ETH,并且流通中的 frxETH 数量与 Frax ETH 系统中的 ETH 数量相匹配。当 ETH 发送到 frxETHMinter 时,会 铸造 等量的 frxETH。单独持有 frxETH 没有资格获得 质押 收益,应被视为类似于持有 ETH。 [3] [2]

质押 Frax Ether (sfrxETH)

sfrxETH 是一个符合 ERC-4626 的金库,用于捕获 Frax ETH 验证器生成的 质押 奖励。用户可以将 frxETH 存入金库以换取 sfrxETH,这代表金库 frxETH 总持有量中的比例份额。随着 质押 奖励的累积,新的 frxETH 会被 铸造 并添加到金库中。这会导致 sfrxETH 和 frxETH 之间的汇率随着时间的推移而增加,从而允许用户赎回比最初存入的更多的 frxETH。该设计与其他自动复利生息代币(例如 aUSDC 或 cUSDC)类似,根据持有者在 sfrxETH 总供应量中的份额分配 质押 奖励。 [7]

Frax ETH Minter (frxETHMinter)

Frax ETH Minter 能够将 ETH 兑换为 frxETH。它将 ETH 带入 Frax 生态系统,并 铸造 与发送的 ETH 数量相等的新 frxETH。该平台还会根据需要设置新的验证器节点。 [2] [8]

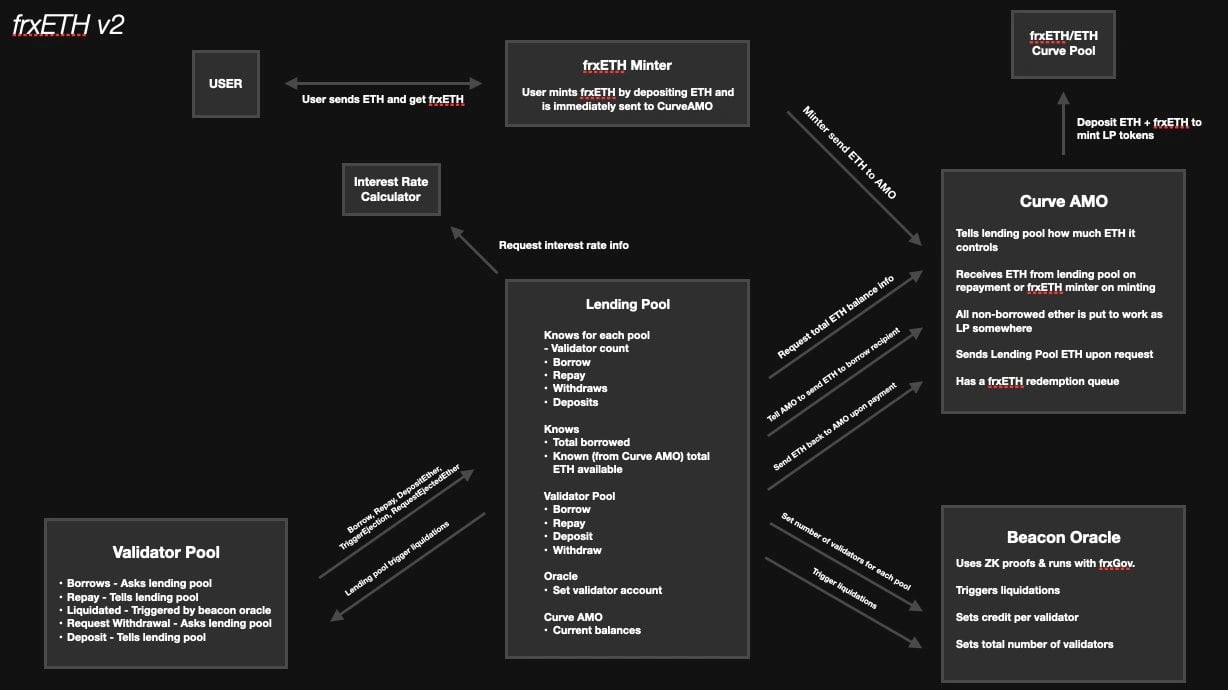

FrxETH v2

frxETH v2 协议由创始人 Sam Kazemian 于 2023 年 6 月推出,允许用户借出和借入 ETH。根据 Kazemian 的说法,FraxETH v2 旨在比其他协议更高效和去中心化。 [4]

在 X 帖子中,Kazemian 解释说,FraxETH v2 的工作原理是创建一个点对池借贷市场:想要借出 ETH 的用户可以通过将其存入 FraxETH v2 池来实现,而想要借入 ETH 的用户可以通过以其 ETH 抵押品获得贷款。 [4]

借入 ETH 的利率由市场力量和利用率决定。没有硬编码的费用或佣金。这表明具有竞争力的利率和对 ETH 的高需求。 [6]

“如果你把它看作一个借贷市场,[frxETH v2] 基本上是最有效的 LSD(借贷-质押-去中心化)协议,因为每个擅长运行验证器的人都希望以最低的利率借用我们的 ETH。” - Sam Kazemian 在一次采访中说[6]

相比之下,frxETH v1 允许用户存入 ETH 并接收 frxETH 代币。这些 frxETH 代币可以被质押以赚取 sfrxETH 代币作为质押奖励。或者,用户也可以在 Curve Finance 上将他们的 frxETH 代币与 ETH-frxETH 配对,以参与 CRV 挖矿。

在 frxETH v2 中,用户可以根据其贷款价值比 (LTV) 借用验证器。要“借用”验证器,用户需要提供特定数量的 ETH 作为抵押品,该抵押品可以超过 8 ETH。此抵押品赋予用户在 Frax Finance 上借用和运营验证器的权利。同时,贷款利息直接从用户的 ETH 和验证器奖励中扣除。

发现错误了吗?