Subscribe to wiki

Share wiki

Bookmark

Jellyverse

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Jellyverse

Jellyverse is an ecosystem dedicated to advancing DeFi 3.0, which focuses on building a sustainable and yield-oriented ecosystem. Within this framework, users gain access to diverse protocols, each serving specific use cases and integrating synthetic RWA. The platform provides several utilities designed to meet a variety of financial needs, all governed by its native token, JLY. [1][2]

Overview

Jellyverse officially launched on the Sei blockchain in June 2024. The platform incorporated all popular Sei ecosystem wallets into its platform: Compass, Seif and Tailwind. These integrations allow users to navigate swaps, manage liquidity, create pools, and establish staking chests. [12]

Jellyverse incorporates various decentralized finance (DeFi) tools and introduces DeFi 3.0 with the introduction of jAssets, an economic system facilitating the trading of decentralized synthetic assets, thus offering new avenues for portfolio diversification. [12]

Products

Jelly Token

$JLY is the primary governance and utility token for the Jellyverse ecosystem. JLY Stakers can participate in critical decision-making processes and influence key parameters across various protocols and decentralized applications (dApps) within the Jellyverse platform. As a unique utility, fees generated across all protocols are partially distributed to JLY Stakers. [3]

$JLY is used for governance, revenue share, liquidity mining, staking, and collateral. [3]

Tokenomics

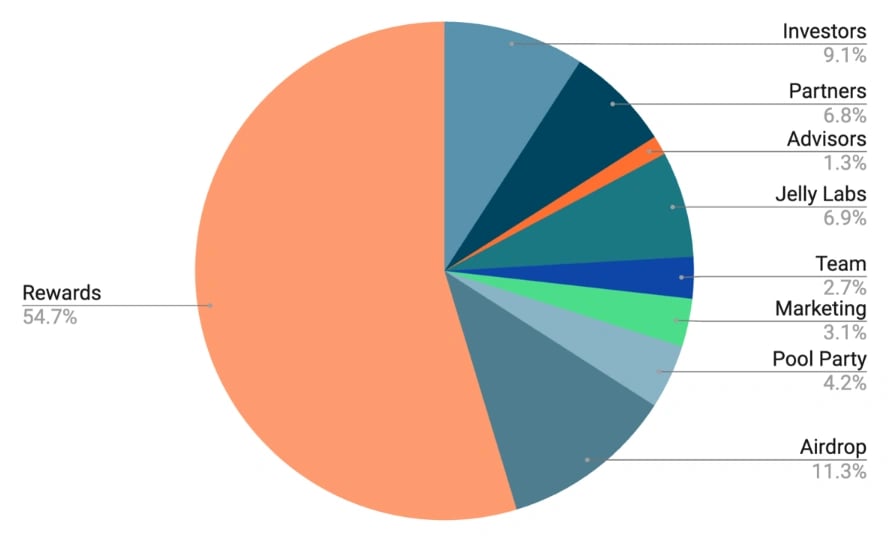

The total supply of JLY is fixed at 800 million JLY tokens. 70.08% of the total token supply is allocated to the community over time, while 29.92% of the tokens have been allocated for the initial development, long-term growth, and future success of Jellyverse. [11]

JellyStake

Jellyverse Staking introduces a novel approach to staking by allowing users to create multiple staking positions, each represented as a staking chest. These chests provide users with the flexibility to deposit, withdraw, or lock varying amounts of JLY tokens. Each staking position is embodied as a Non-Fungible Token (NFT), which stores essential parameters such as staking balance, timestamps, freezing periods, and other relevant details directly on the blockchain. [9]

This system enables users to manage their staking positions easily and enhances their ability to lock specific portions of their JLY holdings to increase their voting influence and annual percentage rate (APR). [9]

jAssets

The jAsset system is an economic system that enables the trading of decentralized synthetic assets (referred to as jAssets). The system is being developed to combine the trade of decentralized assets with the benefits of blockchain technology. The focus is on ensuring that the synthetic assets follow the price development of real assets (as oracles) in traditional markets, thus enabling users to anticipate their price movements. Due to the potentially very volatile oracle prices, the emphasis is on the security of the system to avoid underinsurance. [3]

The system is based on Liquity, a lending protocol established on numerous EVMs. This has been extended to include a multi-collateral and debt mechanism, allowing users to use multiple ERC20 standard tokens as collateral. [3]

JellySwap

JellySwap is a friendly fork of Balancer V2, an automated market maker (AMM) developed by Balancer Labs and deployed on the Ethereum network in February 2020. [4]

JellySwap which went live on the Sei mainnet on June 10, 2024, operates as a dynamic, self-balancing portfolio manager, offering a unique twist on the traditional index fund model. Rather than paying fees to a portfolio manager for rebalancing, JellySwap collects fees from traders who balance the portfolio through arbitrage opportunities. [4]

JellySwap is built on an N-dimensional surface that outlines the cost function for exchanging any pair of tokens in a JellySwap pool. This results in an innovative pool architecture, allowing for the creation of pools with varying weights, such as 70-30 pools and pools with up to 8 tokens. [4]

Vaults

At the core of JellySwap is the Vault, a smart contract that manages the tokens in each JellySwap pool. It handles tasks such as swaps, joins, and exits, making it a central component of the system. The Vault separates the responsibility of tracking tokens from the pool's operational logic, simplifying the complexity of the pool contracts. This allows pools to focus on accurate calculations for swaps, joins, and exits, rather than active asset management. [5]

This design unifies different pool types and ensures the Vault remains neutral, not favoring any specific pool's calculations. The Vault's flexibility allows it to adapt to various systems that meet specific requirements. Innovators with new swapping methods can integrate their custom pools into JellySwap's existing liquidity system, eliminating the need to build a decentralized exchange from scratch. [5]

Pool Types

- Weighted Pools: These are the primary pools that users encounter on the DEX. They can be further categorized into:

- Classic pools: Pools with up to 3 tokens

- Portfolio Pools: Pools with more than 3 tokens

- Composable Stable Pools: Also known simply as the "stable pool".

- Boosted Pools

- Liquidity Bootstrapping Pools (LBPs)

- Managed Pools

- Protocol Pools

Relayer

A relayer acts like a trusted middleman in the JellySwap ecosystem. By granting permission to a relayer, users can let it execute certain tasks (like swaps, joins, or exits) on their behalf. [6]

Preminted JPT

Preminted JPT is a concept introduced in JellySwap pools to simplify and reduce the cost of transitions from a token in a pool to its JPT (JellySwap Pool Token). This is particularly useful for complex pool setups like nested pools, where such transitions, known as "joins," can be complex and gas-intensive. [7]

Key aspects of Preminted JPT:

- At pool creation, the maximum amount of JPT (2^(111)) is minted immediately.

- This JPT is treated as a regular token within the pool.

- The pool’s calculations disregard the minted JPT, focusing instead on the "virtual supply," which is the JPT amount actually held by users outside the Vault.

Preminted JPT is like a pre-loaded gift card for JellySwap pools. Instead of minting new JPT tokens every time a user adds liquidity to a pool, the maximum JPT balance is minted upfront, making entrances into the pool cheaper. [7]

Smart Order Router

The Smart Order Router (SOR) in JellySwap functions like a personal assistant for token swaps, ensuring users get the best deal by comparing prices across different pools. It optimally searches for the best price whenever users want to swap tokens, scanning all available JellySwap pools. The SOR determines whether the best price is found in a single pool or requires routing through multiple pools to maximize value. This process is entirely automatic, providing users with the best route for their swaps every time. [8]

Governance

The Jellyverse Governance model is designed to give users the power to steer protocols within the Jellyverse ecosystem. It also offers new projects the opportunity to become part of Jellyverse. This approach has several advantages, as Jellyverse is recognized for its sustainable, strong, and expandable system. [10]

This system enables fair distribution of protocol revenues to stakers, making it an appealing option for projects aiming for success. When new projects choose to join the ecosystem, certain adjustments may be needed, especially in areas such as reward distribution. It's important to understand that governance authority is limited to configurable parameters only. [10]

Here you can find a full read of the docs: docs.jellyverse.org

Q&A

Q: How to buy $JLY Tokens?

A: You can buy $JLY on the JellySwap DEX (app.jellyverse.org/jellyswap/swap) with $SEI, $USDT or $USDC

Q: How can I bridge USDC and USDT to Sei?

A: To bridge stablecoins as USDC or USDT to Sei, multiple ways are possible. An easy way would be to use an aggregator such as symbiosis (app.symbiosis.finance/swap), be aware of slippage. For larger transactions you can use the native way and utilise Kava for USDT and Noble for USDC.

Q: Where can i buy Sei?

A: $SEI can be bought on most of the big exchanges like Coinbase, Kraken and Binance, of which Binance has the most liquidity and lowest trading fees.

Q: How is the APR calculated on Jellyverse?

A: The annualized percentage rate (APR) is determined by the annualized pool incentives and swap commissions divided by the total liquidity within a given pool.

Q: How often are rewards paid out and how can i claim them?

A: The rewards are distributed on a 7-day cycle. Before each cycle, a governance proposal is published detailing the reward allocation for each protocol and wallet address. Upon its completion, users can start claiming their rewards. Rewards are subject to a 30-day claim period, which begins when the user initiates a new claiming cycle. At the start of the cycle, users can instantly claim 50% of their rewards, but this will forfeit the remaining rewards. The longer a user waits within the cycle, the more rewards they can claim, with rewards growing linearly over time. After 30 days, the user can claim the full amount without burning any rewards.

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)