Subscribe to wiki

Share wiki

Bookmark

Lodestar Finance

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Lodestar Finance

Lodestar Finance is an algorithmic money market protocol built on Arbitrum that enables users to borrow and lend assets. [1][2][3][4]

Overview

Lodestar Finance is an algorithmic borrowing and lending protocol designed to introduce decentralized money markets to Arbitrum communities. The protocol offers several key features, including the ability to earn interest on assets like MAGIC, DPX, and plvGLP by supplying them, collateralizing deposits for borrowing crypto assets, accessing liquidity without triggering taxable events, employing leveraged trading strategies, and unlocking the liquidity of yield-bearing assets without sacrificing the underlying yield. [1][4]

Lodestar Finance's mission is to extend decentralized lending services to emerging Arbitrum communities, in order to create added value for token holders and DAOs. As the Arbitrum ecosystem evolves, the protocol aims to identify more communities for collaboration and contribute to the growth of layer 2 native communities that require essential DeFi infrastructure. [1]

Lodestar Finance Utility

Lodestar Finance offers users to engage in traditional borrowing and lending, as well as offering users to leverage their strategies further with the opportunity for leveraged yield. [9]

Lodestar Finance allows users to take Long Positions. When a user believes that an asset's value will increase in comparison to USDC, they can execute a long position by depositing their asset in Lodestar Finance and borrowing USDC with their collateral. They can then use the borrowed USDC to buy the same asset until the moment they decide to close their position. [4]

At that point, they must repay the loaned USDC amount and retrieve their assets. The profit from this position is the difference between the value of the excess asset (due to its appreciation relative to USDC) and the net accumulated interest (interest costs for borrowing USDC less interest income for depositing the collateral). [4]

Lodestar Finance also offers a Short Position option for its users. If a user believes that Bitcoin will decrease in value against Ether, they can execute a short position. They need to deposit ETH in Lodestar Finance and borrow wBTC using their collateral. Afterward, they can sell the wBTC for ETH until they decide to close their position. [4]

At that moment, they can buy back the wBTC at a lower price and repay their loan. The profit from this position is equivalent to the value of excess ETH (due to the depreciation of wBTC against ETH), minus the net accumulated interest costs (interest costs for borrowing wBTC minus interest income for depositing ETH). [4]

Main Functions

Supplying Assets

To earn interest on a position in Lodestar Finance, users must supply assets by depositing tokens into the protocol. In return, they receive a derivative representing their underlying deposit. For instance, if they deposit USDC, they will obtain an equivalent amount of lUSDC. The exchange rate for lUSDC/USDC consistently increases at a rate matching the supply interest rate of the underlying asset on a per-block basis. Interest accumulates per block and adjusts dynamically with the pool's utilization. If USDC suppliers earn a 2% annual percentage rate (APR) on a specific block, the lUSDC/USDC exchange rate also increases by 2% annually for that block. When users withdraw their tokens from the platform, they are essentially exchanging their lUSDC for USDC. Due to the rising exchange rate, users receive more USDC than their initial deposit, including the principal and accrued interest. [14]

Collateralizing Assets

After supplying assets to the protocol, users begin earning interest automatically, but their tokens cannot be used as collateral without specific activation. To enable an asset to be used as collateral, users need to toggle the collateral slider in the market dashboard and approve the contract. Borrowing against these assets is based on the supplied principal amount and the collateral factor, which denotes the maximum amount users can borrow for a given supplied asset. For example, if a user supplies 100 USDC with an 85% collateral factor, they can borrow up to 85 USDC worth of other assets. If a user supplies multiple assets, the borrowing limit is calculated based on a weighted average. If they supply $50 USDC with an 85% collateral factor and $50 worth of WBTC with a 75% collateral factor, they could borrow up to $80 USD. [15]

Account Liquidity

To determine account liquidity when multiple assets serve as collateral, users can visit the Unitroller contract address found in the section and enter their address into the getAccountLiquidity method. This method returns information regarding current liquidity, which represents the maximum USD value available for borrowing before reaching liquidation. If an account enters liquidation, the shortfall reflects the USD value equivalent to abs((USD value of principal x collateral factor) - borrow balance). [15]

Price Accuracy

Price accuracy in Lodestar is achieved through verified and secure price feeds for all offered assets, except for plvGLP. Accurate prices are crucial for calculating the maximum borrow rate and identifying account insolvency. [15]

Collateral Factors

| Asset | Collateral Factor |

|---|---|

| USDC.e | 0.82 |

| USDC | 0.82 |

| GMX | 0.7 |

| wstETH | 0.75 |

| ARB | 0.7 |

| USDT | 0.7 |

| FRAX | 0.75 |

| DAI | 0.75 |

| ETH | 0.8 |

| BTC | 0.75 |

| MAGIC | 0.5 |

| DPX | 0.15 |

| plvGLP | 0.75 |

Borrowing Assets

The process of creating and managing debt positions within Lodestar Finance is referred to as borrowing. After supplying collateral, users can borrow assets up to the limit set by their account's collateral factors. The total borrow balance is calculated as the sum of the currently borrowed amount and the accrued interest. It is essential to avoid borrowing the entire account liquidity, as doing so may result in immediate liquidation. [16]

Borrow Rate

The borrow rate in Lodestar Finance represents the prevailing interest rate of the asset a user borrows. Every block that a loan is initiated, the borrow rate per block is used to calculate the user's borrow balance for the following block. This continuous compounding of borrow balance occurs on each Ethereum block. Borrowers have the flexibility to repay any portion of their borrow balance whenever they choose. Repayment is not mandatory unless their account's health factor approaches 1.0, at which point they must either repay a portion of the balance or face liquidation. [16]

Repaying Borrowed Assets

Users can repay borrowed assets through the platform's front-end or directly via the lToken contract's repayBorrow function. Upon repayment, a user's collateral can be fully redeemed by exchanging the existing lTokens for the underlying asset. It's important for borrowers to monitor their account's health since price fluctuations on both the supply and borrow sides can impact the overall health and risk liquidation. [16]

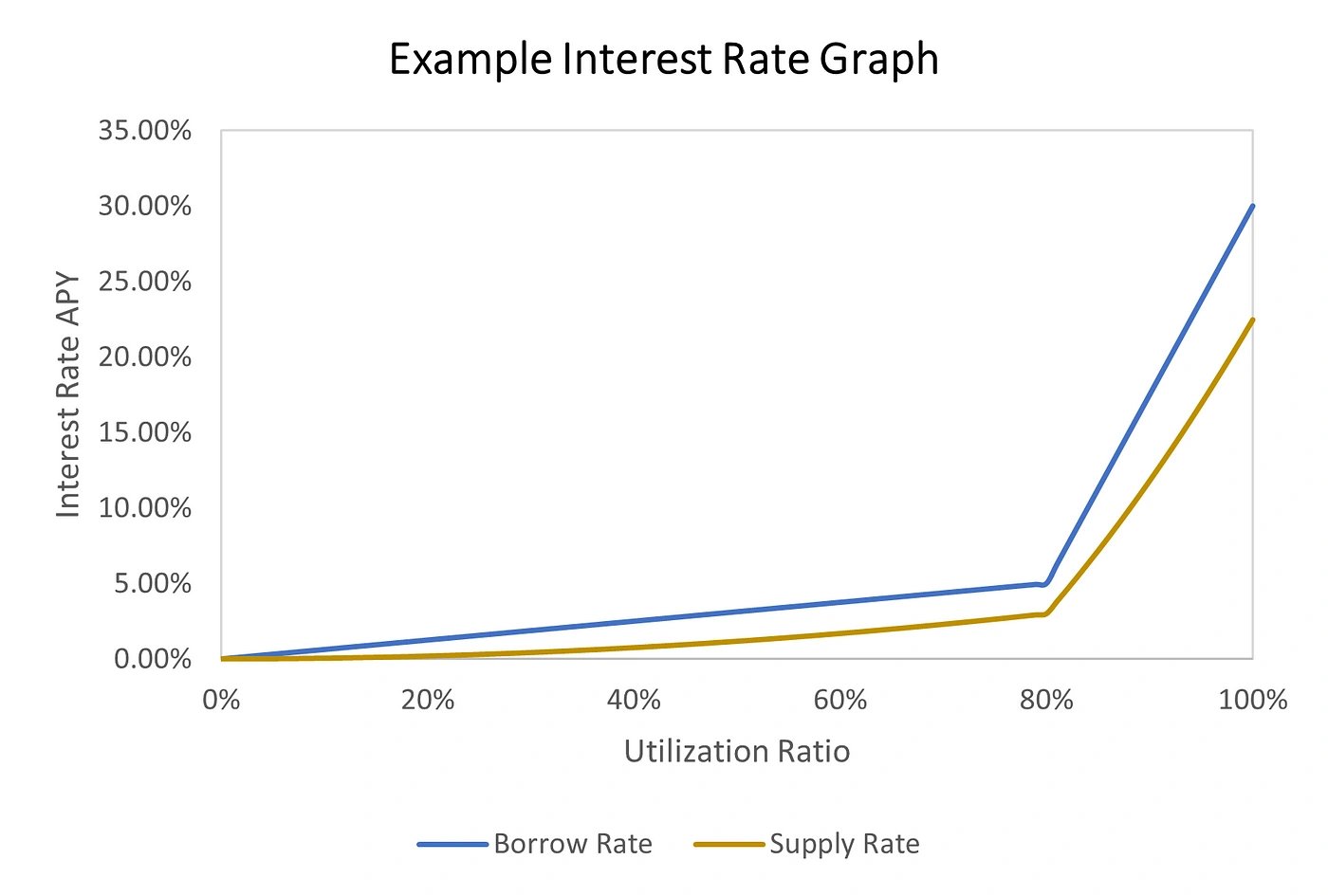

Interest Rate Models

Lodestar Finance utilizes its distinct interest rate models, inspired by Compound's jump rate model. The platform employs five models, each featuring unique parameters based on underlying market risk factors. These models are categorized according to the overall risk associated with the respective underlying assets. [17]

Interest Rate Model 1: Minimal Risk

Interest Rate Model 1 is tailored for USDC, aiming to optimize stablecoin liquidity for efficient money market operation. Lodestar's goal for Model 1 is to establish a vibrant yield ecosystem in Arbitrum, making stablecoin liquidity a key focus.

- Suppliers: USDC suppliers are offered competitive interest rates that align with or exceed leading DeFi protocols. Rates remain attractive across various utilization levels.

- Borrowers: Borrowers face slightly higher interest rates, reflecting the risk taken by suppliers when dealing with potentially riskier assets.

Interest Rate Model 2: Low Risk

Interest Rate Model 2 focuses on Ethereum, which requires a tailored approach to incentivize its use within the protocol.

- Suppliers: Ethereum suppliers experience higher returns over the utilization curve compared to other DeFi protocols. They can borrow more against their collateral with a collateral factor of 80%.

- Borrowers: Borrowers encounter a marginally higher rate due to the risk suppliers face when dealing with potentially riskier assets.

Interest Rate Model 3: Medium Risk

Interest Rate Model 3 includes assets like wBTC, plvGLP, DAI, and FRAX, considered prime collateral but subject to moderately adjusted interest rates to account for specific risks.

- Suppliers: Suppliers can earn a yield on these assets, providing prime collateral.

- Borrowers: Borrowers face higher rates, but many of the assets in this model are usable for Arbitrum ecosystem farming. Borrowing these assets at high utilization levels can be profitable.

Interest Rate Model 4: High Risk

Interest Rate Model 4 governs USDT and MIM, two popular stablecoins, with higher risk-adjusted interest rates compared to USDC and FRAX.

- Suppliers: Supply rates on these assets closely align with USDC rates within a utilization ratio of 0-80%. Beyond 80% utilization, rates increase significantly to attract more suppliers.

- Borrowers: Borrowers face exponentially higher interest rates when utilization exceeds 80%, strongly incentivizing prompt loan repayments.

Interest Rate Model 4 introduces sharper rate increases above 80% utilization due to the higher risks associated with these tokens. De-pegging events or extreme market volatility can lead to unhealthy utilization levels and a potential liquidity crisis. [21]

Interest Rate Model 5: Maximum Risk

Interest Rate Model 5 pertains to DPX and MAGIC, utility and governance tokens with the highest associated risks.

- Suppliers: Suppliers in these markets are offered supply rates that correspond to the risks of the underlying assets. These assets carry risks greater than those in Model 4.

- Borrowers: Borrowers of these assets can farm them profitably up to high utilization levels. Borrowing and staking DPX and MAGIC are viable over a large portion of the utilization curve.

Above 80% utilization, these curves scale exponentially, reflecting the shallow liquidity pools and potential extreme price swings in these tokens. Lodestar employs strong incentive measures to ensure liquidity is supplied and debts are repaid in high utilization scenarios, reducing the risk of a liquidity crisis. [22]

Reserves

A fraction of the interest payments goes toward Lodestar's reserves, acting as a safeguard for the protocol and an insurance pool for specific markets. These reserves are funded by a portion of the interest earned from borrowers and are determined by Lodestar as a parameter. The reserved funds are stored within the respective lToken contracts. Reserves play a vital role in enhancing protocol liquidity during periods of high utilization and help mitigate the risk of accumulating bad debts. They also facilitate the charging of protocol fees. [23]

Reserve Factors

The reserve factor determines the proportion of interest accrued for an asset that is allocated to the respective asset's reserve pool. Lodestar employs default reserve factors, and they are summarized in the table below: [24]

| Asset | Reserve Factor |

|---|---|

| USDC.e | 0.07 |

| USDC | 0.07 |

| GMX | 0.33 |

| wstETH | 0.2 |

| ARB | 0.2 |

| USDT | 0.07 |

| FRAX | 0.07 |

| DAI | 0.07 |

| ETH | 0.2 |

| BTC | 0.2 |

| MAGIC | 0.33 |

| DPX | 0.33 |

Protocol Rake

The protocol imposes a rake on all funds deposited into the market reserves. This rake, equivalent to 50% of the reserve funds, generates a revenue stream benefiting $LODE stakers. Until staking becomes active, 100% of the reserves remain within the pool. The protocol can withdraw funds from the reserves through the reduceReserves function. [25]

Liquidation

Account Health

Lodestar assesses account health through a parameter known as "health." This parameter is calculated using the formula: ( (Total Collateral Value in ETH) / (Total Borrow Value in ETH) ). [26]

Account health represents the overall standing of an account, taking into account both the total collateral value and the total borrow value, denominated in ETH. The collateral value is determined by the combined value of the supplied collateral for each asset, while the borrow value is derived from the borrow balance of each asset, converted to ETH. A borrower's account becomes insolvent when their health factor falls below 1. [26]

Maintaining Account Health

To avoid insolvency and potential liquidation, it is crucial for borrowers to maintain an account health factor above 1.0. If an account becomes insolvent, other users can repay a portion of the outstanding borrow balance in exchange for some of the account's collateral. Liquidators receive an 8% discount on the borrower's collateral, and 2.8% of the liquidated collateral is allocated to the protocol reserves, incentivizing liquidators to support the platform's health. [26]

Liquidations and Liquidators

Liquidators are responsible for running the LiquidateBorrow function to liquidate insolvent accounts. Liquidators specify the borrower's address, the amount of the borrowed asset to be repaid and converted into collateral, and the address of the lToken held as collateral by the borrower. The maximum amount that can be liquidated in a single transaction is 50% of the user's current borrow balance in a particular asset, as dictated by the protocol's Close Factor set at 0.5. If the account remains insolvent, it can undergo further liquidations until solvency is restored. [26]

LODE

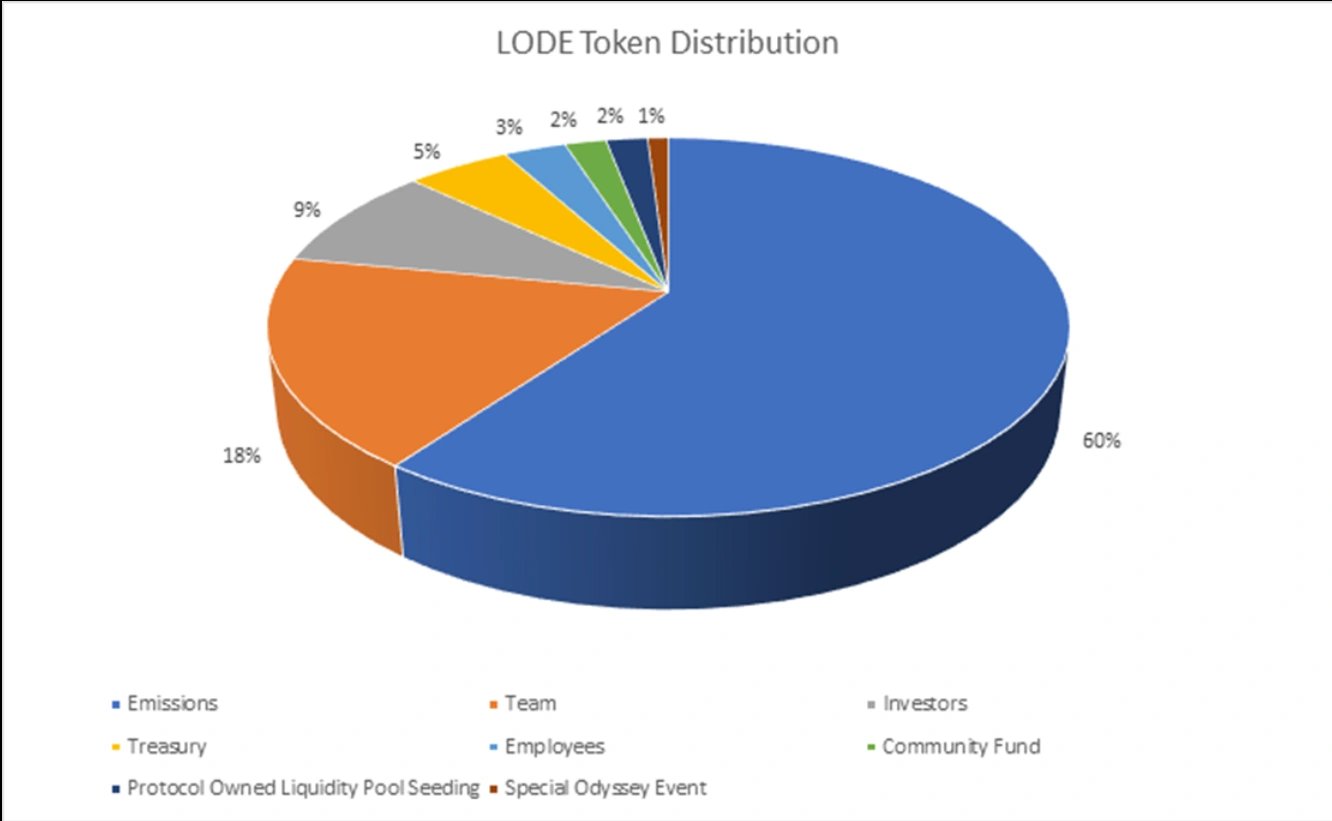

$LODE is the governance token of Lodestar Finance and it has a total token supply of 20 million. [5]

Tokenomics

At launch, 60% of the total supply was distributed to Emissions, 18% to Team (30 months vest, 1-year cliff), 9% to Investors (Community Presale), 5% to Treasury, 3% to Employees, 2% to Community Fund, 2% to protocol Owned Liquidity Seeding, and 1% to Special Arbitrum Odyssey Event. [5]

Utility

LODE is a governance token that represents a holder's share of the DAO. Token holders can vote on proposals governing the platform, and voting power is proportional to the token share. Proposals must be discussed among DAO members before going on-chain for a vote. [5]

LODE token holders can stake their tokens for a proportional share of protocol fees, paid in ETH. The protocol will distribute to LODE stakers 50% of all tokens allocated to the reserves of the markets. [5]

LODE is also used in weekly gauge voting for emissions whereby LODE stakers gain governance power that can be used to vote on emissions allocation to the markets for the following week. [5]

Staking

Staking on Lodestar Finance allows users to lock their $LODE tokens into a staking contract. By staking their tokens, users gain staking power, which allows them to earn a portion of the protocol's revenues and influence the protocol’s emissions through a weekly gauge. [10]

Optional locking

Part of Lodestar's staking module allows users have the option to lock their tokens to earn additional staking power. By choosing to lock their tokens for 3 months, users can increase their staking power by a factor of 1.4x. For a 6-month lock, the staking power is doubled (2x multiplier).

Relocking Multiplier

Users can also choose to relock their tokens at the end of an epoch to earn a further multiplier on their staking power. The multiplier gained from relocking depends on the duration of the relock period:

- Relocking 3 months grants a 0.05x multiplier

- Relocking 6 months grants a 0.1x multiplier

These multipliers compound over time, meaning users who consistently relock their tokens, especially over 6 months, can accumulate significant staking power over time. [10]

Lodestar Finance Hack

On December 10, 2022, Lodestar Finance was exploited in a flash loan attack. The attacker manipulated the price of PlutusDAO's plvGLP token before borrowing all platform liquidity using the inflated token. [6]

In a Twitter thread[7], Lodestar explained the attack flow. The attacker first manipulated the exchange rate of the plvGLP contract to 1.83 GLP per plvGLP, "an exploit that by itself would be unprofitable", said the company. Then, the attacker supplied plvGLP collateral to Lodestar and borrowed all available liquidity, cashing out part of the funds "until the collateralization ratio mechanism prevented a full liquidation of the plvGLP."

Following the hack, "several plvGLP holders also took advantage of the opportunity and also cashed out at 1.83 glp per plvGLP." The hacker was able to burn a little over 3 million in GLP, making a profit on the "stolen funds on Lodestar - minus the GLP they burned.", noted the DeFi platform.

The attacker made around $5.8 million in profit. Lodestar stated that nearly 2.8 million of the GLP (about $2.4 million) was recoverable, which would be used to repay depositors. The company also tried to negotiate a bug bounty with its exploiter:

"If you are the hacker, reach out to us so we can find a white-hat agreement and move on. Recovering the funds of our users is the main priority and we will generously reward your collaboration." - Lodestar Finance tweeted[8]

As of October 2023, Lodestar was able to pay back approximately a third of the losses to the victims of the hack using the GLP left in the plvGLP vault, and and additional 750,000 esLODE was allocated to repay the victims. [28]

Staking esLODE

Users who were affected by the December 2022 exploit were able to claim esLODE. [10]

esLODE can be staked to earn protocol revenue and converted to LODE linearly over a period of 1 year. Once staked, it cannot be unstaked. Once esLODE is converted into LODE it is added to the staking balance.

If LODE is locked for 3 or 6 months, converted LODE will also benefit from the locking bonuses, but it will also be locked for the remainder of the lock period. [10]

Lodestar on Arbitrum

On April 8, 2023, Lodestar Finance went live on Arbitrum blockchain. The protocol attracted over $30 Million in TVL (Deposits + Borrows) while generating over $23,000 in revenue from the interest paid. [11][12]

Following the launch of the protocol, a governance proposal was submitted on May 1, 2023, to deploy $ARB on Lodestar Finance. The majority of LODE holders voted in favor, and as a result, ARB deposits were enabled on May 7, 2023. [12]

"$ARB deposits are now live on @LodestarFinance. Head to http://app.lodestarfinance.io to start providing liquidity. Borrows will be enabled in the next hours." - Lodestar tweeted[13]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)