Subscribe to wiki

Share wiki

Bookmark

Swell Network

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Swell Network

The Swell Network is a decentralized and non-custodial Ethereum (ETH) staking protocol designed to enhance yield within the decentralized finance (DeFi) landscape. Users can earn passive income by staking ETH with Swell, receiving blockchain and restaked AVS rewards in exchange for yield-bearing liquid tokens (LST or LRT) usable in the DeFi ecosystem. Daniel Dizon is the CEO and founder of Swell. [1]

Overview

The Swell Network, a decentralized Ethereum (ETH) staking protocol, aims to enhance yield within the decentralized finance (DeFi) sector while offering users the flexibility to access their staked ETH. With a community-driven governance model, Swell empowers its users to shape the protocol’s future through voting on important decisions. It prioritizes security, conducting continuous audits, and offering bug bounties to ensure robust development. [1][2]

Swell simplifies the staking process, allowing users to stake ETH and receive swETH, an interest-bearing token while retaining liquidity for other DeFi opportunities. The platform’s user-friendly interface facilitates easy participation in staking: users stake ETH directly through the platform, start earning rewards immediately, and can further maximize returns by depositing swETH into upcoming yield-optimized vaults. Additionally, the Swell DAO fosters community involvement, enabling users to contribute to the ecosystem’s development and governance through collaborative decision-making. [1][2]

Swell DAO

The Swell DAO was established to develop a liquid staking protocol that allows Ethereum (ETH) holders to earn yield from staking without locking up their capital. Swell aims to foster a more secure, decentralized, and transparent financial future that promotes economic freedom without discrimination or censorship. Swell focuses on advancing liquid staking as an important component of decentralized finance (DeFi), ensuring it is fully integrated with the Ethereum ecosystem and adaptable for composability. [1]

Swell Voyage

In May 2023, Swell Labs launched the Swell Voyage campaign, representing Swell’s progression from its inception to a mature state. The campaign consists of four chapters: Sunlight Zone, Twilight Zone, Midnight Zone, and Swell City, during which governance rights will be gradually decentralized and extended to early community participants. Users can gather pearls corresponding to portions of the $SWELL airdrop during the campaign. These pearls will grant holders governance tokens upon reaching the final chapter of the Voyage. Each Voyage chapter has different objectives, but participants can continue staking and providing liquidity throughout the journey to maximize pearl collection. As the journey progresses, individuals can contribute to developing a liquid staking token benefiting Swell Aquanauts, Swell’s Discord community, DeFi, and the broader Ethereum ecosystem. [3][4]

Swell L2

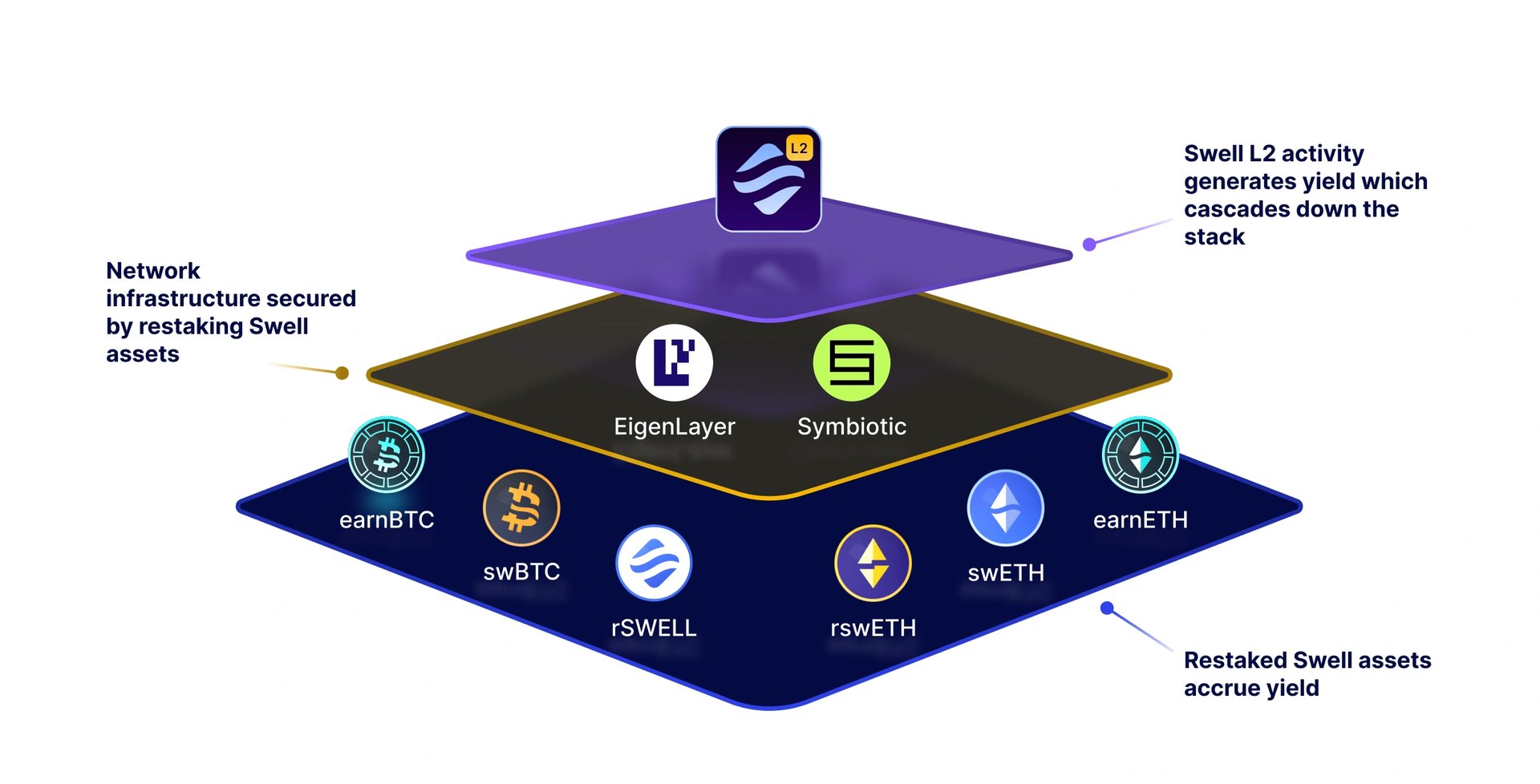

Swell L2 is a ZK-validium built on the Polygon CDK, focusing on restaking. Inspired by the rise of restaking protocols like EigenLayer and Symbiotic, Swell launched rswETH, its own restaked liquid representative token (LRT), following the strong adoption of swETH on EigenLayer. Swell realized that the security behind its LRT could be used to decentralize and scale an L2 modularly, where specialized providers manage each component. This L2 is secured by three tokens—SWELL, swBTC, and rswETH—driving value toward Swell’s liquid staking and restaking products while supporting the next generation of DeFi on Layer 2. [15]

Proof of Restake

Proof of Restake (PoR) is designed to increase the utility of staked assets within and beyond Swell's L2 ecosystem. Using liquid restaked tokens (LRTs) to secure the infrastructure supporting the rollup and the chain, PoR enhances capital efficiency and allows stakers to contribute to network security while participating in the ecosystem. PoR aligns incentives across validators, node operators, builders, and users, deepening liquidity and boosting security. [16]

Stakers deposit assets tokenized into LRTs that generate staking rewards and remain liquid for use in infrastructure services, DeFi, and cross-chain protocols. On-chain activity generates revenue and supports validators, relayers, node operators, and sequencers while accruing yield to Swell assets. As network activity grows, liquidity deepens, and crypto-economic security strengthens, benefiting dApps and attracting more builders and users. [16]

PoR’s modular architecture allows Swell L2’s infrastructure to evolve, making it more decentralized and efficient. Securing key components with restaked assets, the network remains aligned with Ethereum's security, avoiding issues tied to centralized infrastructure. PoR also maximizes asset productivity by passing network-generated revenue to users as restaking yield, fostering innovation, and unlocking liquidity for dApps that leverage Swell L2’s decentralized services and Ethereum's security. [16]

Swell Tokens

swETH Token

Swell Ether (swETH) is a liquid staking token (LST) on the Swell protocol, representing ETH staked on the Ethereum network. Chainlink Proof of Reserves validates the underlying ETH. swETH functions as a repricing token, increasing in value over time as staking rewards accumulate. [5]

rswETH

Launched January 29, 2024, rswETH, or Restaked Swell ETH, is an ERC-20 Liquid Restaking Token (LRT) designed to offer liquidity to users looking to “restake” their ETH in restaking protocols like EigenLayer without locking their restaked ETH. It functions as a repricing token, representing a user’s yield-bearing ETH utilized by validators to validate transactions on the Ethereum blockchain. [1][6][7]

Announced on April 17th, 2024, rswETH v2 introduces composability between supported Liquid Staking Tokens (LSTs) and rswETH. With this update, swETH and other LSTs like stETH can be used as collateral for minting rswETH. This allows swETH holders to obtain rswETH efficiently without relying on the secondary market. [12]

rswETH v2 will automatically delegate ETH and LSTs restaked via rswETH to EigenLayer AVS Operators. This ensures reputable operators manage assets, and restakers earn rewards from across the ecosystem, including real restaking yield (once enabled), potential AVS airdrops, and additional rewards from depositing rswETH in Swell L2. Users can withdraw rswETH through the Swell app at the primary market rate, reducing dependence on the secondary market and enhancing its stability. Until this feature is live, rswETH can be swapped back to ETH on a DEX or aggregator. The staked assets backing rswETH can be verified using Chainlink Proof of Reserve. [12]

The enhanced rswETH will be an important component of Tri-Staking on Swell L2, allowing SWELL, ALT, and rswETH to secure Swell L2 AVS via AltLayer’s AltVault. rswETH will also serve as the native gas token of Swell L2, providing increased utility and optimizing user experience and gas expenditure as holdings appreciate through staking and restaking rewards. [12]

SWELL Token

SWELL is the native token of Swell and serves three main purposes: governance over the Swell DAO, restaking to secure Swell L2 applications and infrastructure, and paying for gas on the network. Users can restake their SWELL to receive rSWELL, earning rewards for securing Swell L2. rSWELL, the liquid restaking token, maintains 1:1 governance power with SWELL and can be deployed in DeFi for additional yield or deposited on Swell L2 for ecosystem airdrops. Governance allows SWELL and rSWELL holders to submit and vote on proposals in the Swell DAO, with responsibilities including decisions on liquidity incentives, protocol parameters, grant distribution, and node operator onboarding. SWELL also functions as the gas token for Swell L2 transactions. SWELL has a total supply of 10B tokens, with 8.5% allocated to the Voyage airdrop. [1][14]

Partnerships

Bunni

In May 2023, Swell launched their swETH-ETH pool on Bunni, a project that tackles liquidity incentives in DeFi. As Swell was still new to the LST space, the opportunity existed to bootstrap liquidity without a governance token. The decision to collaborate with Bunni was influenced by factors such as its status as a newer protocol and the relatively lower valuation of veLIT. This strategic partnership allowed for a more prominent position to be maintained with emissions directed back, thereby enhancing liquidity without needing a governance token. [8]

Chainlink

On May 16, 2023, Swell integrated Chainlink Proof of Reserve (PoR) on Ethereum, ensuring that swETH tokens were fully backed by staked ETH on a 1:1 basis. The integration of Chainlink PoR offered a monitoring service for the ETH reserves backing swETH, providing users with reliable and timely updates. This initiative aimed to enhance user confidence and transparency regarding the full backing of Ethereum’s Beacon chain reserves. Users were able to access the Proof of Reserve feed for verification purposes. [9]

“Chainlink Proof of Reserve helps us provide our users with unmatched transparency into the reserves backing swETH. Users now have a one-stop destination for checking near real-time updates on swETH reserve balances, providing peace of mind that every token is backed 1:1 by staked ETH” -Daniel Dizon, Co-Founder and CEO of Swell Network.

In February 2024, Swell joined Chainlink’s BUILD program to leverage Chainlink’s oracle infrastructure, aiming to enhance security and reliability. As a member of BUILD, Swell Network gained access to various benefits, such as Chainlink’s Cross-Chain Interoperability Protocol (CCIP) for secure cross-chain transfers, Chainlink Proof of Reserve for validating cross-chain reserves, Automation for smart contract triggers, Price Feeds for accurate market data, Functions for off-chain data and custom compute, and early access to new Chainlink product releases. In return for these services, Swell Network committed to gradually making a portion of its native token supply available to Chainlink service providers, including stakers. This reciprocal arrangement facilitated mutual support between both communities. [10]

“We’re excited to join the Chainlink BUILD program as the Chainlink Network’s industry-standard services are essential to helping Swell support the adoption of liquid staking in DeFi. We look forward to continuing our collaboration together and we welcome the passionate Chainlink community into the Swell Network ecosystem.” -Daniel Dizon, Co-Founder and CEO of Swell Network.

AltLayer

On March 13th, 2024, Swell partnered with AltLayer and EigenDA to launch its Layer 2 rollup for restaking. Swell's L2 will focus on liquid restaked assets on EigenLayer, differing from classical rollups by utilizing the "restaked rollup" framework from AltLayer. This framework includes Actively Validated Services (AVS) like decentralized sequencing, verification, and faster finality through EigenLayer’s restaking mechanism. [11]

The rollup will provide Swell ecosystem participants with native restaking yield, increased scalability, lower fees, and new DeFi primitives. The native gas token will be rswETH, and the governance token will be SWELL. Chainlink will support the L2, built on Polygon’s zkEVM technology on EigenDA with AltLayer. [11]

“Expanding Swell’s liquid restaking offerings into the L2 for restaking is the next logical step for the Swell community and DAO. It extends on the existing vision of the protocol to deliver the best liquid restaking experience for DeFi. Swell’s L2 will drive step-change for the Swell community and deliver fresh innovation to DeFi, along with EigenLayer and its growing ecosystem of Actively Validated Services (AVS’s).” - Daniel Dizon, Co-Founder and CEO of Swell Network.

OKX

On March 29, 2024, Swell announced it was deepening its collaboration with OKX to support the growth of its recently launched Layer 2 and restaking on OKX’s native Layer 2 network. This partnership aimed to create synergies between Swell’s restaked rollup and OKX’s Layer 2, both built on Polygon’s CDK. These networks were designed to interoperate within a broader network of ZK-powered Layer 2s through the Polygon AggLayer. [13]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)