위키 구독하기

Share wiki

Bookmark

TimeSwap

TimeSwap

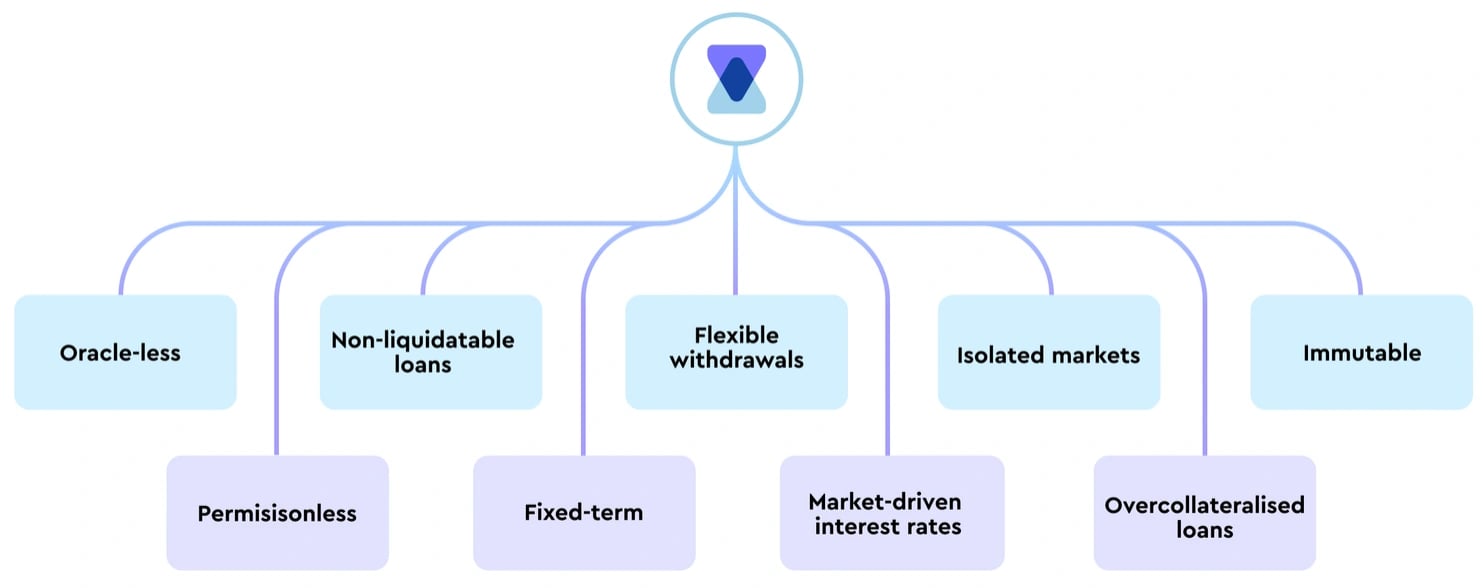

TimeSwap은 오라클(oracle)에 의존하지 않고 대출과 차용을 위한 프로토콜로, 다양한 ERC-20 토큰을 위한 머니 마켓을 생성합니다. 완전 비허가형(fully permissionless), 오라클(oracle)리스(oracle-less), 비청산(non-liquidatable) 플랫폼으로서 고정 만기 대출 및 차용 시스템을 도입한 최초의 플랫폼입니다.[1][2][3]

개요

2020년 Ricsson Ngo(릭슨 응고), Ameeth Devadas(아미스 데바다스), Harshita Singh(하르시타 싱)에 의해 설립된 TimeSwap은 완전히 권한 없는, 오라클리스 대출 및 차용 프로토콜을 개척하는 것을 목표로 합니다. Arbitrum, Mantle, Polygon PoS, Polygon zkEVM, 그리고 Base와 같은 다양한 플랫폼에서 운영되는 TimeSwap은 오라클에 의존하지 않고 모든 ERC-20 토큰에 대한 머니 마켓 생성을 용이하게 하여 오라클 조작과 관련된 DeFi의 위험을 완화하는 것을 목표로 합니다.

이 프로토콜은 오라클리스 운영 및 시장 생성과 대출, 차용, 유동성 제공 참여에 대한 권한 없는 접근을 포함한 여러 가지 주요 기능을 제공합니다. 비청산 가능 대출 및 고정 기간 거래를 통해 보안을 확보하여 사용자에게 확실성과 예측 가능성을 제공하고자 합니다. 사용자는 유연한 인출, 시장 주도형 이자율, 격리된 시장 및 초과 담보 대출의 이점을 통해 보안 및 안정성을 향상시키는 것을 목표로 합니다.

TimeSwap은 오라클이나 거버넌스 없이 운영되는 완전히 분산된 프로토콜을 제공하여 보안 및 분산화를 유지하면서 유동성과 자본 효율성을 높이는 것을 목표로 하며, DeFi 환경에 상당한 변화를 가져올 것을 목표로 합니다.

또한 2023년 2월 Polygon 메인넷에서 출시된 TimeSwap V2는 권한 없음 및 오라클 독립성과 같은 핵심 속성을 유지하면서 자본 효율성을 높이는 것을 목표로 합니다.[2][3][4][5][6][7][8]

역사

2021

In 2020, TimeSwap was established with the aim of developing a fully decentralized money market protocol, spearheaded by Ricsson Ngo, Ameeth Devadas, and Harshita Singh. Throughout 2021, the team took significant steps towards realizing this vision, including closing a seed round, launching an Alpha Testnet, and initiating a Gamified Testnet.

The Alpha Testnet drew substantial community participation, with over 64,000 transactions recorded within the first three days. Subsequently, the Gamified Testnet offered participants a simulated market environment to devise strategies and optimize yield. Despite minimal promotional efforts, the community experienced growth, with Discord membership surpassing 30,000 and Twitter followers exceeding 22,000.[9]

2022

In 2022, TimeSwap continued its efforts to develop a decentralized money market protocol. The team achieved milestones such as launching the V1 AMM on mainnet and introducing NFTs. The V1 mainnet witnessed substantial activity, with over 45,000 transactions and $2.5 million in lending and borrowing, underscoring the demand for a market-driven and oracle-less system.

The Supernova upgrade facilitated permissionless liquidity addition, with Time Travelers contributing over $2.7 million. Partnerships with Biconomy and QiDAO aimed to improve user experience and asset options. Community engagement remained robust, with initiatives like meme battles and educational threads.[10]

2023

2023년, TimeSwap은 탈중앙화 머니 마켓 프로토콜을 구축하려는 노력을 계속했습니다. TimeSwap V2 출시는 사용자 경험과 자본 효율성을 향상시키는 것을 목표로 했습니다. 암호화폐 시장의 어려움에도 불구하고 TimeSwap은 강력한 커뮤니티 지원으로 회복력을 보여주었습니다.

7개 체인으로의 확장은 더 넓은 시장을 공략하기 위한 것이었으며, 대출/차입 규모는 5천만 달러를 넘었습니다. 다양한 프로젝트와의 전략적 파트너십은 TimeSwap의 사용자 기반을 다양화하는 데 목적이 있었습니다. Arbitrum의 STIP에 선정되고 $TIME 토큰 프리마이닝을 도입한 것은 커뮤니티 참여를 높이기 위한 조치였습니다. 이러한 발전은 보안과 독립성을 우선시하면서 DeFi 대출에 혁신을 가져오려는 TimeSwap의 의지를 보여줍니다.[11]

시장 참여자

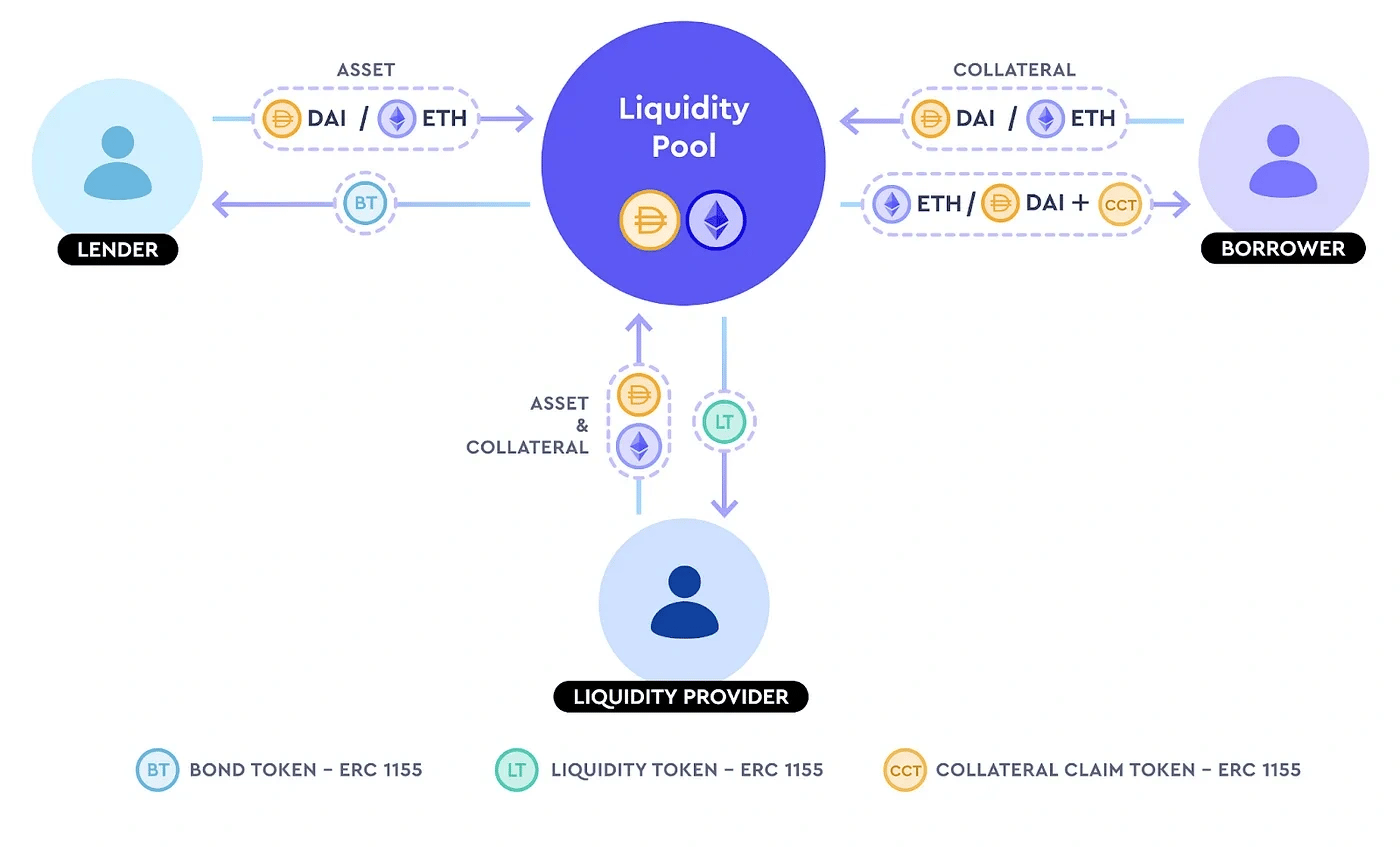

TimeSwap에는 대출자, 차용자, 그리고 유동성 제공자 (LP) 세 가지 주요 시장 참여자가 있습니다. 단순화된 모델에서 대출자는 TimeSwap 풀에 자금을 기여하여 차용자가 대출받을 수 있도록 하고, 고정 이자를 얻습니다. 차용자는 이러한 풀에 접근하여 담보로 대출을 받고 이자와 함께 상환합니다. 유동성 제공자는 풀에 유동성을 공급하여 대출자와 차용자로부터 거래 수수료를 얻습니다.[12]

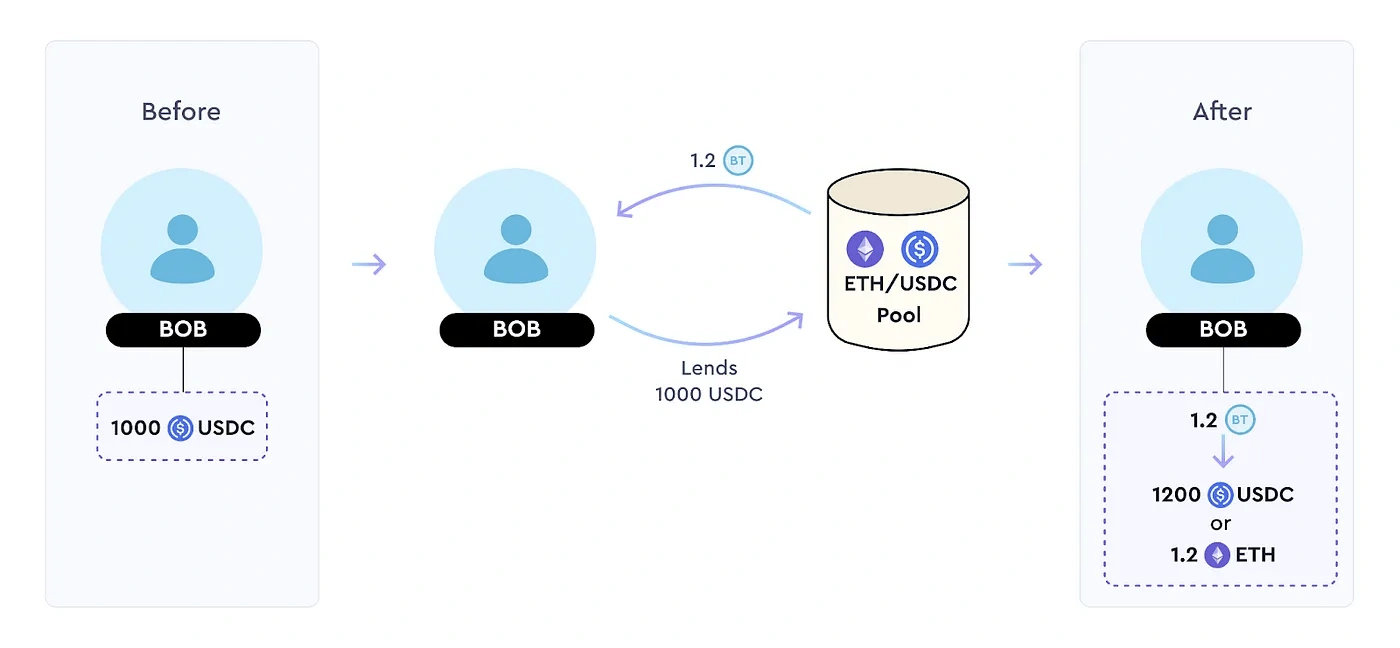

대출자

대출자는 TimeSwap에서 차용자를 위한 풀에 자금을 지원하고 고정 이자를 얻는 중요한 역할을 합니다. 다이어그램은 USDC/ETH 풀과 같은 풀과의 상호 작용을 보여줍니다. 차용자는 ETH 담보를 예치하여 USDC에 접근할 수 있습니다.

TimeSwap에서는 대출이 고정 기간이며 청산 불가능합니다. 만기 시 대출자는 차용자의 행동에 따라 공급 자산(예: USDC) 또는 담보 자산(예: ETH)을 받습니다. 대출자는 항상 고정 이자를 미리 받습니다. 기존의 DeFi 대출과 비교하여 TimeSwap 대출자는 위험 프로필이 다르며 비율을 적극적으로 관리합니다.

대출 기간이 고정되어 있지만 대출자는 슬리피지 가능성이 있는 조건 하에 조기에 투자를 회수할 수 있습니다. 대출자는 공급 자산을 제공하고 ERC-1155 Bond Token (BT)을 받습니다.[13]

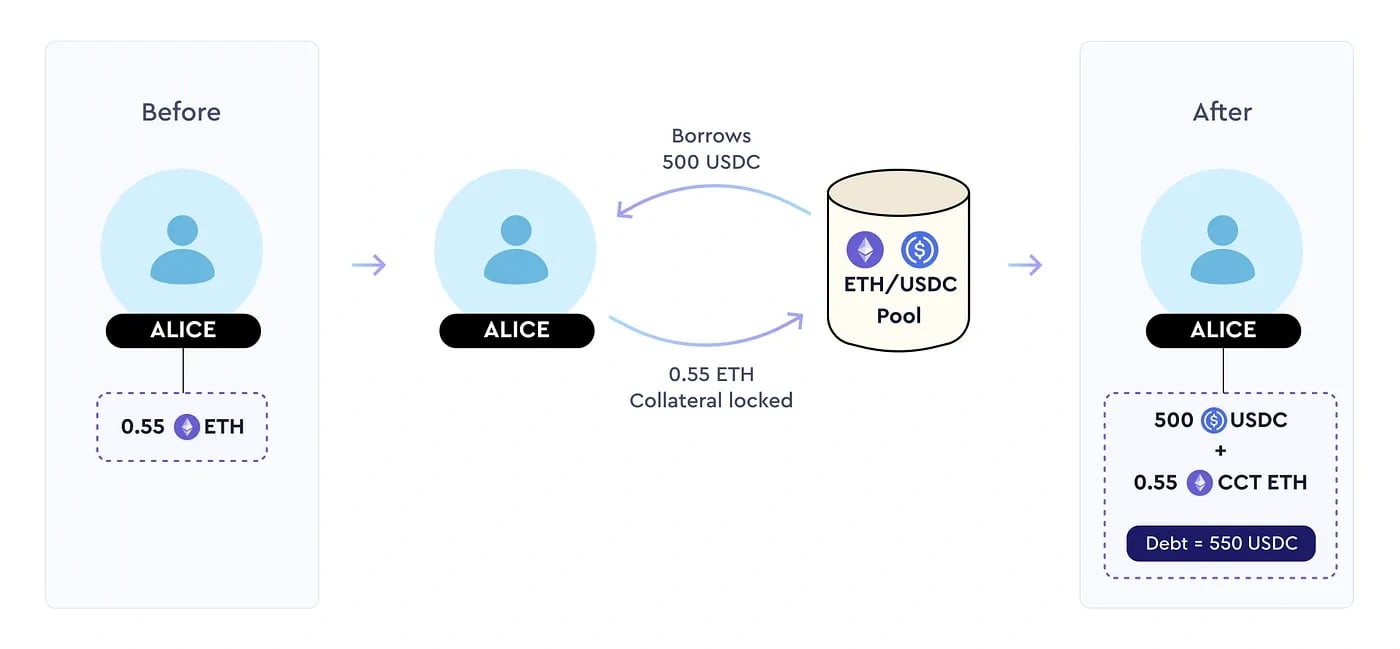

차용자

TimeSwap에서 차용자는 대출자와 유동성 제공자가 시딩한 풀에서 차용합니다. 이 시스템에서 대출은 기간이 정해져 있으며 청산이 불가능합니다. 만기 시 차용자는 가치에 따라 부채를 상환하거나 담보를 몰수할 수 있습니다. 이자는 전환 가격(TP)이 최적의 행동 지점을 나타내는 대출자와 유동성 제공자에게 따라 지급됩니다.

기존 DeFi 프로토콜과 비교하여 TimeSwap의 차용자는 청산이 없기 때문에 다른 위험 프로필에 직면합니다. 만기 시 상환 여부를 결정할 수 있으며, 잠재적인 슬리피지가 있더라도 조기 부채 상환 옵션이 있습니다.

차용자는 차용 자산(예: USDC)과 ERC-1155 담보 청구 토큰(CCT)을 받기 위해 담보(예: ETH)를 잠급니다.[14]

유동성 제공자

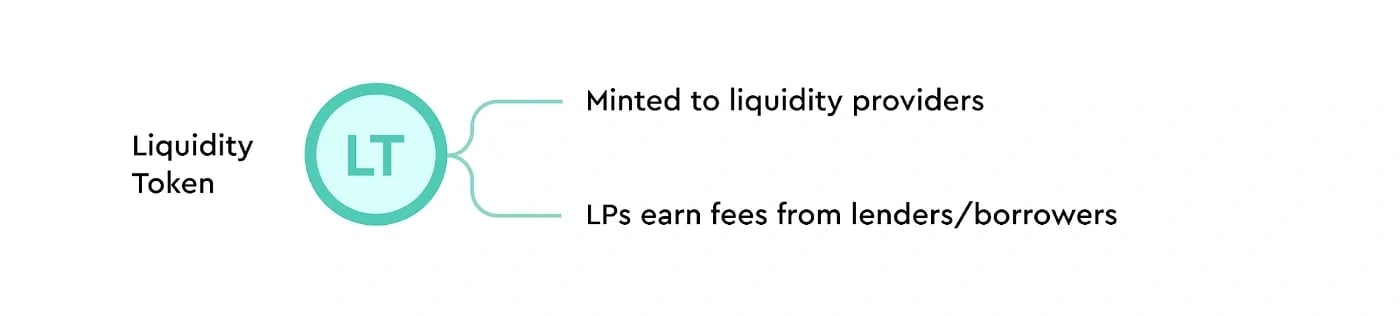

유동성 제공자 (LPs)는 TimeSwap 풀에 유동성을 제공하고 대출자와 차용자의 상대방 역할을 합니다. Uniswap의 LPs와 유사하게 거래 수수료를 통해 수익을 창출합니다.

TimeSwap에서는 고정 수익이 제공되므로, LPs는 총 이자 지급액을 맞추는 데 중요한 역할을 합니다. LPs는 만기 시 차용자의 결정에 따라 자산을 받게 되며, 이자율 차이에 따른 손실 위험(divergence loss)에 노출됩니다.

포지션의 고정 기간에도 불구하고, LPs는 조기 인출이 가능하지만, 슬리피지(slippage)가 발생할 수 있습니다. 참여에 대한 대가로 LPs는 각 거래에 대한 수수료를 받고 ERC-1155 유동성 토큰(LT)을 받습니다.

풀의 초기 LP인 풀 생성자는 Uniswap과 유사하게 풀의 초기 매개변수를 설정합니다.[15]

기술

AMM (자동 시장 조성자)

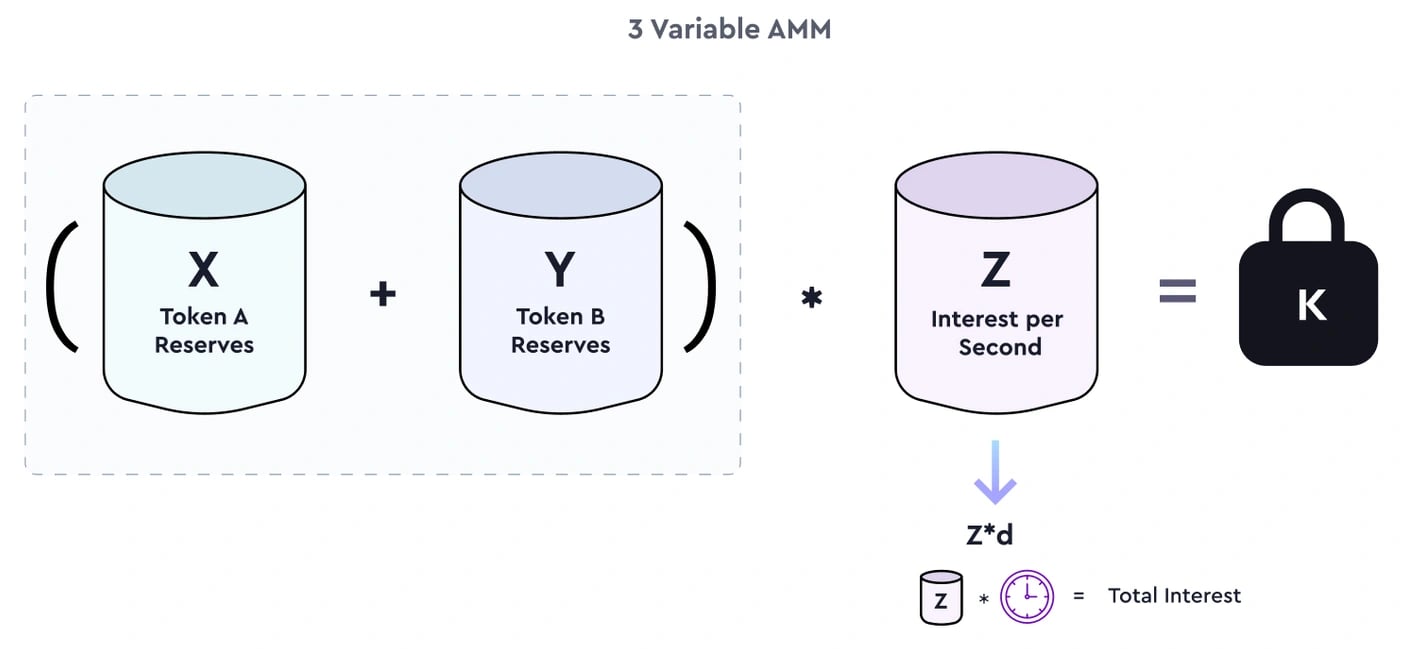

타임스왑은 DW-CSPMM을 활용하여 ERC-20 토큰에 대한 허가 없는 대출/차입 풀을 제공합니다. 참여자는 이 AMM과 상호 작용하여 이자율을 확인합니다.

수식에는 X, Y, Z, K 변수와 d가 포함되며, d는 AMM의 동작에 영향을 미칩니다. TP는 차입 비율을 결정하여 시장 역학에 영향을 미칩니다.

타임스왑의 AMM은 기간 가중 방식으로, 이자 지급이 상호 작용 중에만 적용되도록 합니다. 이는 두 가지 주요 구성 요소로 구성됩니다. 상수 합 성분((X+Y))과 상수 곱 성분((X+Y)*Z)이며, 이를 통해 과담보 및 이자율 발견을 용이하게 합니다.

유연성을 통해 사용자는 위험-수익 프로필을 조정하여 대출 또는 차입에 대한 APR에 영향을 미칠 수 있습니다. 일시적 손실을 방지하기 위해 시간 감소가 고려됩니다.

이자율과 담보 요소를 나타내는 Y 및 Z 풀은 시간이 지남에 따라 안정적으로 유지되어 유동성 제공자의 손실을 완화합니다.[16][17]

토큰 경제학

TimeSwap 토큰 ($TIME)

TIME 토큰은 Timeswap 프로토콜 참여자(대출자, 차용자 및 유동성 제공자 포함)를 위한 인센티브 메커니즘 역할을 합니다. 총 공급량은 1,750,000,000개입니다.

사용자는 프리마이닝 단계에서 양도 불가능한 TIME 토큰을 받게 되며, 토큰 생성 이벤트(TGE) 기간 동안 TIME 토큰으로 교환할 수 있습니다. 2024년 1분기로 예정된 TGE 기간 동안에는 1:1 비율로 청구할 수 있으며, 베스팅 일정은 없습니다.[18][19]

네이티브 토큰

타임스왑은 프로토콜 내에서 정확한 회계를 위해 단순화된 네이티브 토큰 시스템을 사용합니다. 타임스왑 V2에는 계약의 단순성과 사용자 경험을 개선하기 위해 ERC-1155 NFT로 표준화된 세 가지 네이티브 토큰이 있습니다.[20]

담보 청구 토큰 (CCT)

타임스왑은 차용자의 담보를 추적하는 수단으로 담보 청구 토큰(CCT)을 사용합니다. 차용자는 자산을 얻기 위해 담보를 사용할 때 영수증으로 CCT를 받으며, 부채가 상환될 때까지 잠긴 담보의 증거 역할을 합니다. 그러나 CCT는 대출 만기일 이전에만 사용할 수 있습니다. 대출 만기일이 지나면 CCT는 무효가 되고 가치가 없습니다.[20]

본드 토큰 (BT)

본드 토큰(BT)은 대출자의 원금과 수익률을 나타냅니다. 만기 전이나 후에 상환할 수 있으며, 조기 상환 시 수익률이 약간 감소합니다. 담보 청구 토큰(CCT)과 BT를 모두 보유하면 중립적인 포지션을 나타냅니다.[20]

유동성 토큰 (LT)

유동성 토큰(LT)은 풀의 유동성에 대한 유동성 제공자의 지분을 나타냅니다. 풀에서 나가려면 LT를 소각해야 하며, 이로 인해 조기에 나갈 경우 수익률이 감소합니다. 그러나 만기 후에 인출하는 경우에는 수익률 감소가 발생하지 않으므로, 제공자는 자유롭게 나갈 수 있는 옵션을 가지고 풀에 유동성을 유지하도록 장려합니다.[20]

잘못된 내용이 있나요?