Subscribe to wiki

Share wiki

Bookmark

Unizen

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Unizen

Unizen is an advanced operating system for Web3 applications, offering users a seamless and secure environment for interaction within the Web3 space. It aims to deliver a unified user experience, allowing individuals to effortlessly engage with diverse Web3 applications and assets, irrespective of the underlying blockchain technology. [1]

Overview

Unizen is an advanced operating system tailored for Web3 applications, offering users a seamless and secure environment for interaction within the Web3 space. It provides a unified user experience, irrespective of the underlying blockchain technology, by integrating a custom-built, cross-chain enabled DEX aggregator and the Unizen Interoperability Protocol (UIP). This integration allows users to conveniently engage with Web3 innovations without relying on third-party bridges or unfamiliar exchanges, thus mitigating associated risks. [1]

Through Unizen, users can swap digital assets at optimal prices and transfer them across supported blockchains within a single action. Additionally, they can access Web3 applications hosted on the Unizen platform as operating system modules, facilitating seamless swaps and interoperability operations within the same interaction. [1]

Unizen's approach aims to streamline the utilization of Web3 technologies, making them more cost-effective and accessible to a broader audience. By harnessing cross-chain interoperability aggregation and decentralized liquidity, Unizen offers users a secure, reliable, and user-friendly means to participate in the Web3 ecosystem. [1]

Technology

Unizen Liquidity Distribution Mechanism (ULDM)

The Unizen Trade Engine serves as a decentralized platform facilitating the trading of digital assets across various blockchains and decentralized exchanges (DEXs), streamlining the complexities associated with different protocols and platforms. A notable feature of the platform is the Unizen Distributed Liquidity Mechanism (ULDM), a liquidity aggregation and routing system designed to reduce slippage in decentralized trading. ULDM addresses slippage through Smart Liquidity Routing and a tailored "trade splitting" algorithm, which work together to identify optimal liquidity across multiple DEXs and execute trades at favorable prices. Supported by a team of researchers collaborating with Unizen, ULDM aims to refine the algorithm and enhance performance, providing traders with a more efficient trading experience across blockchains and DEXs within the Unizen platform. [2]

Unizen Interoperability Protocol (UIP)

The Unizen Interoperability Protocol (UIP) is a decentralized protocol designed to facilitate the seamless transfer of digital assets across diverse blockchains. It functions as an interoperability aggregator, prioritizing efficiency, speed, transparency, and security in interoperability operations. UIP identifies the most suitable interoperability provider based on speed, asset support, and cost. Currently, UIP is integrated with several providers, including cBridge, Axelar, Stargate, THORChain, and LayerZero, each employing various methods such as cross-chain bridging, atomic swaps, and token wrapping to enable interoperability. [3]

UIP comprises three primary layers: [3]

- UIP Core: This layer oversees the protocol's resources, including managing interoperability providers' allocation.

- UIP Registry: A decentralized database housing details about interoperability providers and their functionalities. This includes information on supported assets, their addresses on blockchains, and associated fees.

- UIP Client: The UIP Client interacts with the UIP Core and UIP Registry to kickstart interoperability operations. It utilizes methods like cross-chain bridging, atomic swaps, and token wrapping to facilitate these operations seamlessly.

Interoperability providers integrated with UIP facilitate the movement of digital assets across various blockchains, chosen based on criteria like speed, asset support, and cost. These providers ensure secure asset transfers between blockchains and support multiple assets, including cryptocurrencies and stablecoins. Transaction fees for interoperability operations vary across providers, assets, and networks, with the UIP Core determining the lowest fees based on operation complexity. [3]

UIP integrates multiple providers to ensure redundancy, enabling continuous asset transfer even if one provider faces issues. The UIP Core monitors provider performance and adjusts resource allocation accordingly. UIP's decentralized and trustless nature ensures seamless asset traversal without user intervention. [3]

Unizen Omni-Chain Data Pool

The Unizen Omni-Chain Data Pool is a comprehensive repository of on-chain data spanning all supported blockchains within the Unizen ecosystem, facilitating seamless access to developers and users. Composed of data from numerous sources, it offers a sturdy infrastructure for swift and accurate queries, enabling users to explore various transaction types, wallets, NFTs, and more. The data pool ensures efficient functionality by leveraging diverse technologies, including data integration, storage, indexing, and retrieval. Normalizing data from different blockchains and employing distributed databases for storage ensures scalability and constant availability. Indexing techniques accelerate queries, while a user-friendly API offers versatile search and retrieval methods for different data types. [4]

A key advantage of the Unizen Omni-Chain Data Pool is streamlining cross-chain interactions, negating the reliance on external block explorers. This simplifies engagement with diverse blockchains, providing users with a seamless experience. The Unizen Omni-Chain Data Pool is an important element within the Unizen ecosystem, furnishing developers and users with convenient access to on-chain data across multiple blockchains. [4]

Features

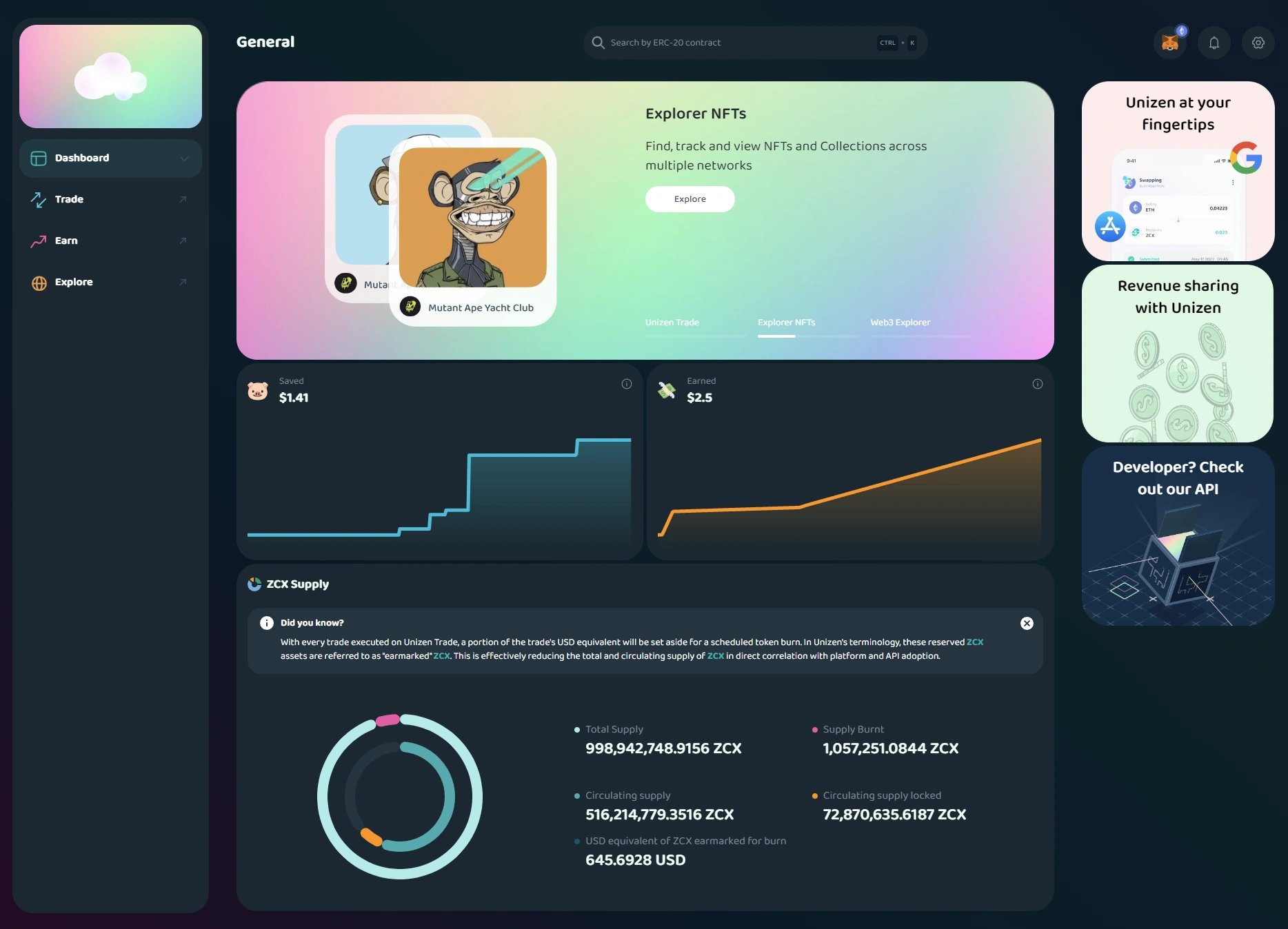

Unizen Dashboard

The Unizen Dashboard provides users a centralized platform to track and manage their assets, trades, and transaction history across supported blockchains. Utilizing data from the Unizen Omni-Chain Data Pool, it presents information in an easily digestible format, including visual aids like graphs and diagrams. Supported by a reliable backend infrastructure, the dashboard ensures swift and accurate data retrieval, simplifying the monitoring and management of cross-chain portfolios. Integration with the Unizen Trade Engine allows users to monitor and manage their assets from a single interface seamlessly. [5]

This dashboard offers users extensive visibility into the Web3 ecosystem, enabling them to monitor NFTs, DeFi assets, and more across different blockchains. They can explore new and existing NFTs, view trending assets, or curate custom lists to suit their preferences. By eliminating manual data entry and the need for multiple block explorer visits, the Unizen Dashboard streamlines asset tracking, facilitating informed investment decisions. [5]

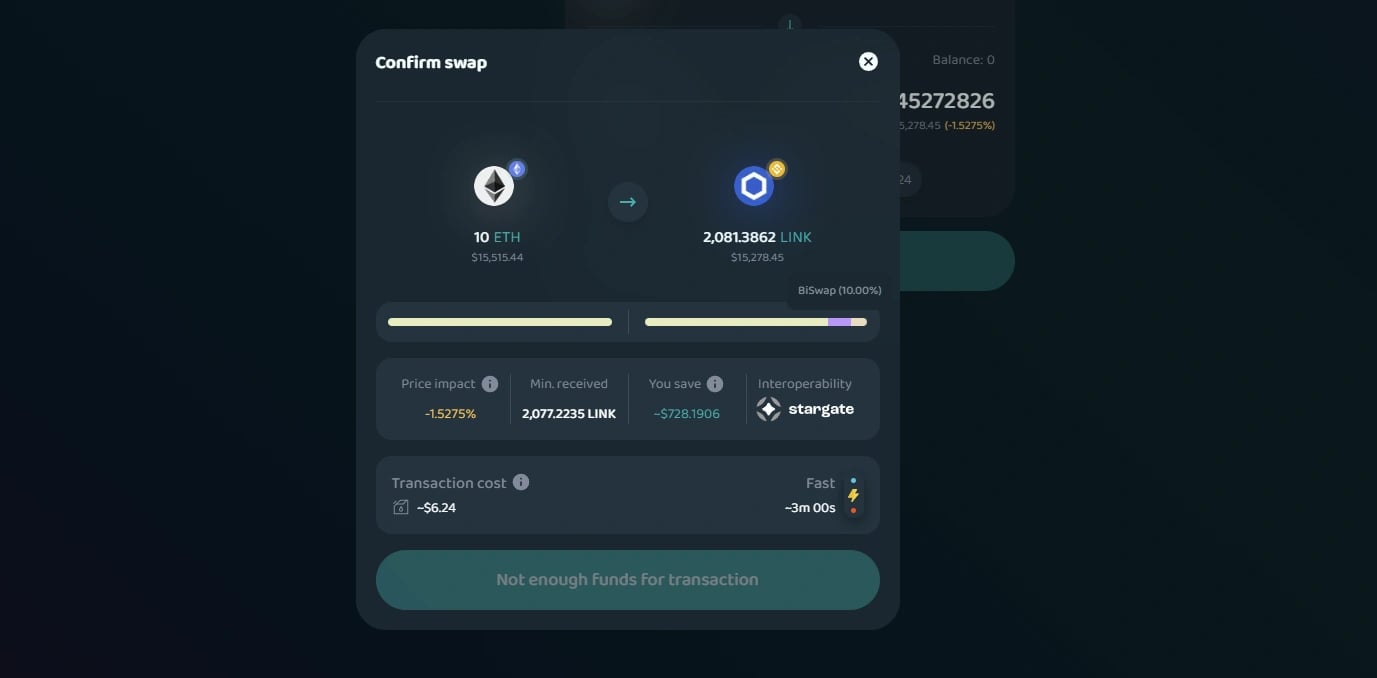

Unizen Trade

Unizen Trade offers decentralized trading with access to liquidity from numerous decentralized exchanges (DEXs) deployed across supported blockchains. The Unizen Liquidity Distribution Mechanism (ULDM) minimizes slippage for assets across all supported blockchains and DEXs. By dividing trade orders and routing them through various liquidity sources, ULDM optimizes trade execution. [6]

Integrated with the Unizen Interoperability Protocol (UIP), the trade engine allows seamless access to assets on supported blockchains without manual intervention. UIP handles conversions between assets on different chains, simplifying trading for users. Additionally, Unizen Trade supports fiat-to-crypto conversions via credit card, Apple Pay, and Google Pay, optimizing returns by selecting the best on-ramp provider for fiat purchases. The Unizen Trade Engine's architecture is non-custodial, ensuring users control their assets during trading. This enhances security and reliability, giving users confidence in their trading activities. [6]

Unizen Explore

Unizen Explore is a versatile block explorer that offers users seamless access to on-chain data across multiple blockchains within the Unizen ecosystem. Powered by the Unizen Omni-Chain Data Pool, it integrates deeply with eight blockchains, eliminating the reliance on external block explorers. With an intuitive interface, users can effortlessly search and explore various on-chain data, including cross-chain trades and bridge operations across supported blockchains. [7]

Integrating with the Unizen Omni-Chain Data Pool ensures continuous access to on-chain data across the ecosystem, removing fragmented trails and simplifying data accessibility. By eliminating the need for third-party block explorers, Unizen Explore enhances the interaction of multiple blockchains. [7]

Unizen Earn

Unizen Earn, available on the Polygon blockchain and the Unizen platform, offers users a flexible and rewarding staking application. Unlike traditional staking platforms, Unizen Earn allows users to stake their ZCX and earn rewards in multiple cryptocurrencies from carefully vetted projects with high growth potential. ZenX Labs oversees this selection process, ensuring quality and growth prospects. [8]

Designed for convenience, Unizen Earn boasts a simple interface for staking ZCX and tracking rewards. Importantly, staked ZCX remains accessible at all times, allowing users to deposit or withdraw without penalties. The platform offers competitive APR rates, is transparently displayed, and provides users with tools and analytics to optimize their staking strategies. These tools include real-time data, performance charts, and customizable alerts accessible via the Unizen Dashboard. [8]

Moreover, Unizen Earn extends additional benefits to stakers, such as exposure to upcoming projects and joint marketing ventures. Participating projects gain visibility on the Unizen platform, potentially enhancing brand awareness and growth opportunities. This collaborative approach has historically contributed to increased visibility and growth potential for participating projects. [8]

ZCX

ZCX serves as the native utility token on the Unizen platform, operating as an ERC-20 token on the Ethereum Network. Its utility spans various functionalities: [9]

- Hyper-Deflationary Mechanism: ZCX implements a hyper-deflationary model, where a portion of the USD equivalent from each trade on Unizen Trade or through SDK integrations is reserved for scheduled token burns. Referred to as "earmarked" ZCX, these assets are set aside based on trading volume. For instance, 0.5% of the value of single-chain trades and 1% of cross-chain trades are earmarked for burning. The timing of burns is randomized to comply with regulations. Additionally, a buy-back-burn mechanism further contributes to token deflation, utilizing fees from SDK integrations to purchase and burn ZCX from the open market.

- Staking on Unizen Earn: Users stake ZCX on Unizen Earn to earn rewards in various cryptocurrencies sourced through ZenX Labs, Unizen’s incubator. Higher staking levels yield increased rewards, creating a chain-agnostic rewards program.

- Pro Membership Purchases: To acquire a Pro membership on Unizen, users must spend $50 worth of ZCX. This membership unlocks advanced trading features, and the ZCX spent is subsequently sent to a burn address, reinforcing the token's deflationary nature.

- Profit Return: Token holders and stakers receive a profit return based on the quantity of ZCX held and the chosen storage method. Stakers receive a higher percentage, with returns generated from positive slippage during trades. Half of this profit is allocated to Unizen, while the remaining half is granted to the end-user, ensuring a fair distribution of profits.

Tokenomics

ZCX has a total supply of 1 billion and has the following allocation: [10]

- Private Sale: 16%

- Foundation: 28.5%

- Partners/Advisors: 5.5%

- Team: 20%; locked

- Ecosystem Reserve: 30%; locked

Partnerships

Skynet Trading

On February 22nd, 2023, Unizen partnered with Skynet Trading to offer boutique solutions to market-making and liquidity challenges. [11]

DWF Labs

On March 31st, 2023, Unizen announced a strategic partnership with DWF Labs, a global digital asset market maker and multi-stage Web3 investment firm. This collaboration aimed to advance Unizen's mission of tackling the challenges encountered by Web3 technology. It sought to create a seamless user experience by consolidating third-party blockchain projects from different networks, utilizing top interoperability and aggregation frameworks. [12]

Celer Network

On April 11th, 2023, Unizen announced a strategic partnership with Celer Network. [13]

“We are really happy to be announcing today that Unizen has integrated Celer’s cBridge technology to further strengthen Unizen’s Interoperability Protocol (UIP). This integration will have a particularly positive impact on the speed and cost of seamless interoperability operations enabled by UIP as a fundamental technology on the Unizen platform.” - Martin Granstrom, Unizen CTO.

THORChain

On April 25th, 2023, Unizen announced a strategic partnership with THORChain. Specifically, Unizen integrated the THORChain settlement layer to facilitate swaps between ETH (Ethereum) and AVAX (Avalanche C-chain) to BTC (Bitcoin) and vice versa. [14]

Mises

On June 1st, 2023, Unizen announced a strategic partnership with Mises, an extension-supported mobile Web3 browser. This collaboration aimed to integrate Unizen's advanced operating system into the Mises platform, providing users seamless access to a unified Web3 experience. [15]

Decentr

On February 29, 2024, Unizen announced a strategic partnership with Decentr. Decentr integrated Unizen's advanced API to offer native DeFi access to its 20,000 daily users. This collaboration aimed to enhance the user experience by providing direct access to DeFi services through Decentr's Web3 browser, aligning with their commitment to user empowerment and innovation in the digital space. [16]

Telos

On March 12th, 2024, Unizen unveiled a strategic partnership with Telos Network. This collaboration signifies an advancement in DeFi accessibility and efficiency, marked by the seamless integration of Telos EVM into the Unizen ecosystem. [17]

MC²

On March 19th, 2024, Unizen revealed a strategic collaboration with MC², a user-friendly decentralized finance (DeFi) platform. This partnership represents a noteworthy advancement in the evolution of DeFi, amalgamating Unizen's API solutions with MC²'s Finance Protocol to drive innovation and efficiency in the Web3 sector. [18]

Payonramp

On March 22nd, 2024, Unizen announced its strategic alliance with Payonramp, a groundbreaking Fiat-to-Crypto on

- and off-ramp solution. This partnership aims to simplify asset conversion processes and expand user market accessibility, underscoring a dedication to innovation and inclusivity. [19]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)