订阅 wiki

Share wiki

Bookmark

Aerodrome Finance

0%

Aerodrome Finance

Aerodrome Finance 是 Base 网络上的一个 去中心化交易所,它将多种 自动化做市商 模型集成到一个统一的平台中。它是 Base 生态系统中交易、流动性提供和治理的中心枢纽。[5]

概述

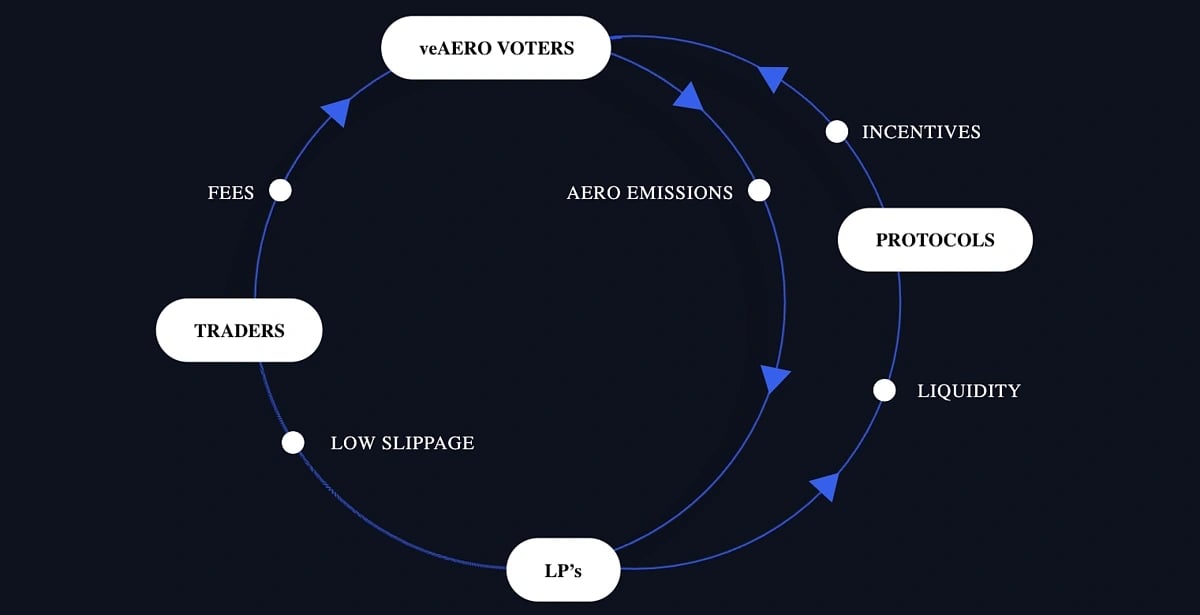

Aerodrome Finance 是一个于 2023 年 8 月 28 日在 Base 区块链上推出的 去中心化交易所。它结合了各种 AMM 模型的特性——包括 Uniswap V2 和 V3、Curve 和 Convex——作为 Base 的主要流动性中心。该平台支持代币交换,产生交易费用,并通过 AERO 代币发行来激励流动性提供。用户可以锁定 AERO 以获得 veAERO,从而获得治理权和协议费用分成。

Aerodrome 由 Optimism 上的 Velodrome 的创建者开发,建立在 Solidly 协议的元素之上,并将其应用于 Base,一个 以太坊 Layer 2。在没有原生 Base 代币的情况下,AERO 是主要的激励和治理资产。Coinbase Ventures 通过锁定 AERO 代币并对排放进行投票来参与该协议,从而加强了 Aerodrome 在 Base 生态系统中的战略作用。[6]

特性

飞行学校

飞行学校是 Aerodrome Finance 上的一项循环激励计划,它向创建新代币锁定的用户分发额外的 veAERO。要获得资格,用户必须在四周内(称为“课程”)锁定至少 2,500 个 veAERO。在每节课结束时,奖金分配与每个参与者在符合条件的 veAERO 总额中所占的份额成正比。Coinbase One 会员在奖金计算中,其锁定的代币权重为 1.3 倍。自推出以来,该计划已以 veAERO 形式分发了超过 4260 万个 AERO。[7]

AERO Fed

AERO Fed 是 Aerodrome Finance 上的一个治理机制,允许 veAERO 持有者影响 AERO 代币的排放率。最初,AERO 排放遵循固定的时间表,每周减少 1%。从第 67 个 epoch(2024 年 12 月 4 日)开始,该系统过渡到 智能合约 控制的流程,使 veAERO 投票者能够每周调整排放量,在设定的限制范围内增加、减少或维持当前排放率。

AERO Fed 旨在使排放政策与市场状况和生态系统需求保持一致。排放量范围可以从每周总供应量的 1%(年化 52%)到最低 0.01%(年化 0.52%)。在初始实施阶段,排放量会自动减少,同时社区熟悉新系统。一旦过渡结束,veAERO 持有者将通过链上投票完全控制排放调整。[8]

Slipstream

Slipstream 是 Aerodrome 对集中 流动性池 的自定义实现,旨在提高 Base 网络上的资本效率和交易执行。与标准 clAMM 池相比,它提供高达 10 倍的每单位 TVL 交易量,使用可定制的 tick 间距、优化的费用和定制的费用算法。随着其在 Base 交易量中所占份额的增长,veAERO 投票者将从增加的费用奖励中受益,从而加强 Aerodrome 的流动性激励。[9]

ALM V2

ALM V2 由 Mellow 推出,并于 1 月份由 Aerodrome 集成,更新了 流动性提供者 的自动化流动性管理。该升级具有通过动态参数自动调整的策略、流式奖励、用于管理安全性和风险敞口的金库上限,以及针对 流动性质押 和重新质押代币的优化。它旨在简化 Slipstream 的参与并提高流动性提供的整体效率。[11]

池启动器

Aerodrome 的池启动器是一项无需许可的功能,允许在其平台上为任何代币创建 流动性池。它利用引导式流程,使用户能够设置标准池或集中池,通过配对或单边存款添加流动性,并以原生方式锁定流动性以表示长期承诺。该系统支持新兴代币,这些代币可以在界面中标记,使其在交易和存款方面更具可见性。

以这种方式启动的池直接赚取所有交换费用,平台不收取任何份额,从而使创建者能够获取收入或资助激励计划。此外,满足某些标准的池可以自动过渡到基于排放的池,与 Aerodrome 更广泛的激励结构集成,而无需迁移。此设置将易用性与 Aerodrome 流动性市场中的可见性、费用获取和可扩展性机制相结合。[11]

AERO

AERO 代币是一种 ERC-20 资产,用于奖励 Aerodrome Finance 上的 流动性提供者。虽然它可以交易或用于 流动性池,但其主要功能是锁定以参与治理和激励对齐。Aerodrome 基金会持有的所有代币均已锁定,贡献者或团队成员没有流动性归属分配,这使他们与系统中的其他参与者处于同等地位。[2] [10]

veAERO

veAERO 是一种 ERC-721 非同质化代币,代表 Aerodrome Finance 上用于治理目的的锁定 AERO 代币。用户最多可以锁定 AERO 四年以获得 veAERO,投票权根据锁定期的长短线性增加。例如,锁定四年 100 个 AERO 等于 100 个 veAERO,而锁定一年相同的数量则产生 25 个 veAERO。可以将额外的 AERO 添加到现有的 veAERO NFT 中,这些代币用于参与治理决策。[10]

代币经济学

AERO 和 veAERO 具有以下分配:[10]

- veVELO 锁定者空投:40%

- 公共物品基金:21%

- 基金会:19%

- 飞行学校:10%

- 投票者激励:8%

- 创世流动性激励:2%

融资

2024 年 2 月,Aerodrome Finance 获得了 Base 生态系统基金的投资,该基金是由 CB Ventures 领导的一项计划,旨在支持 Base 网络中的链上项目。虽然金额未公开,但该投资标志着对 Aerodrome 的战略支持,根据 DeFiLlama 的数据,当时 Aerodrome 在 Base 上拥有 30% 的市场份额,并且 总锁定价值 超过 1.32 亿美元。该基金此前曾支持其他基于 Base 的项目,例如 Avantis、BSX、Onboard 和 Truflation。Aerodrome 将这项投资描述为在推进 Base 的基础设施和流动性生态系统方面进行更深入合作的一步。[3] [4]

合作伙伴

- Base

- Coinbase

- Tairon AI

- Reserve Protocol

- Neiro

- Spheron

- FLock

- Syndicate

- AubrAI

- Tig Foundation

- Retake

发现错误了吗?