订阅 wiki

Share wiki

Bookmark

Swell Network

0%

Swell Network

Swell Network 是一个去中心化且非托管的 以太坊 (ETH) 质押 协议,旨在提高 去中心化金融 (DeFi) 领域的收益。用户可以通过在 Swell 上质押 ETH 来赚取被动收入,从而获得 区块链 和重新质押的 AVS 奖励,以换取可在 DeFi 生态系统中使用的生息流动性代币(LST 或 LRT)。Daniel Dizon 是 Swell 的首席执行官兼创始人。 [1]

概述

Swell Network是一个去中心化的以太坊(ETH) 质押协议,旨在提高去中心化金融(DeFi)领域的收益率,同时为用户提供访问其质押ETH的灵活性。通过社区驱动的治理模式,Swell使用户能够通过对重要决策进行投票来塑造协议的未来。它优先考虑安全性,进行持续审计,并提供漏洞赏金以确保稳健的开发。 [1][2]

Swell简化了质押流程,允许用户质押 ETH并接收swETH,这是一种计息代币,同时保留流动性以用于其他DeFi机会。该平台的用户友好界面便于轻松参与质押:用户直接通过平台质押 ETH,立即开始赚取奖励,并且可以通过将swETH存入即将推出的收益优化金库来进一步最大化回报。此外,Swell DAO促进社区参与,使用户能够通过协作决策为生态系统的发展和治理做出贡献。 [1][2]

Swell DAO

Swell DAO 的成立是为了开发一种流动性质押协议,该协议允许 以太坊 (ETH) 持有者通过质押赚取收益,而无需锁定其资本。 Swell 旨在培育一个更安全、去中心化和透明的金融未来,促进经济自由,且无歧视或审查。 Swell 专注于推进流动性质押,使其成为 去中心化金融 (DeFi) 的重要组成部分,确保其与以太坊生态系统完全集成,并适应可组合性。 [1]

Swell Voyage

2023年5月,Swell Labs推出了Swell Voyage活动,代表了Swell从成立到成熟状态的演进。该活动由四个章节组成:阳光区、暮光区、午夜区和Swell City,在此期间,治理权将逐步下放并扩展到早期社区参与者。用户可以在活动期间收集与$SWELL空投份额相对应的珍珠。这些珍珠将在航程的最后一章授予持有者治理代币。每个航程章节都有不同的目标,但参与者可以继续进行质押和提供流动性,以最大限度地收集珍珠。随着旅程的进行,个人可以为开发一种流动性质押代币做出贡献,该代币将使Swell Aquanauts、Swell的Discord社区、DeFi和更广泛的以太坊生态系统受益。 [3][4]

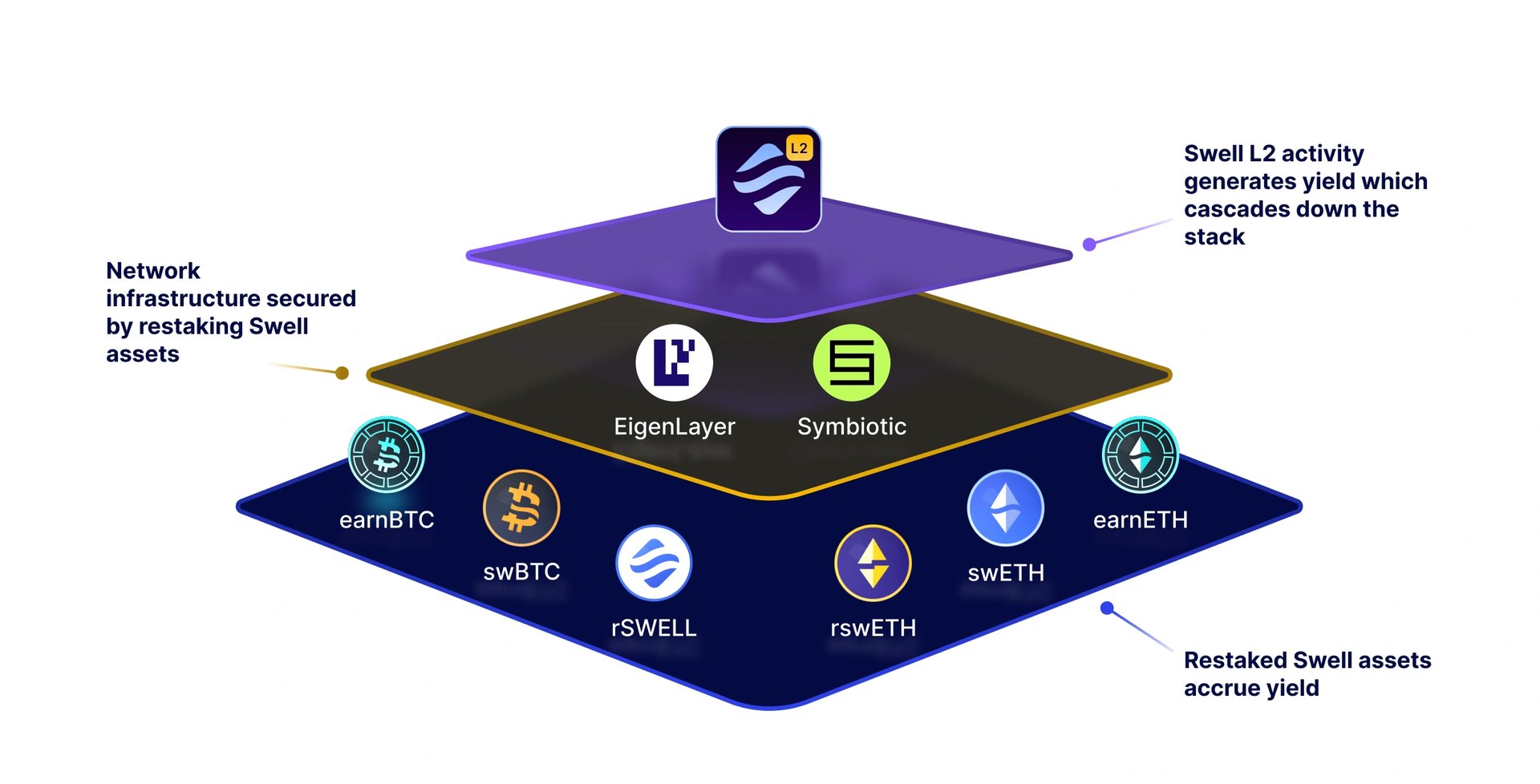

Swell L2

Swell L2 是一个建立在 Polygon CDK 上的 ZK-validium,专注于再质押。受 EigenLayer 和 Symbiotic 等再质押协议兴起的启发,Swell 在 swETH 于 EigenLayer 上获得广泛采用后,推出了自己的再质押流动性代表代币 (LRT) rswETH。Swell 意识到其 LRT 背后的安全性可用于以模块化方式去中心化和扩展 L2,其中专业提供商管理每个组件。该 L2 由三种代币(SWELL、swBTC 和 rswETH)保护,从而将价值导向 Swell 的 流动性质押 和再质押产品,同时支持下一代 Layer 2 上的 DeFi。 [15]

Proof of Restake

Proof of Restake (PoR) 旨在提高 Swell 的 L2 生态系统内外质押资产的效用。通过使用流动性质押代币 (LRT) 来保护支持 rollup 和链的基础设施,PoR 提高了资本效率,并允许质押者在参与生态系统的同时为网络安全做出贡献。PoR 使 验证者、节点运营商、构建者和用户之间的激励保持一致,从而加深 流动性 并提高安全性。[16]

质押者将资产存入代币化为 LRT 的资产,这些资产产生 质押 奖励,并保持流动性,以便用于基础设施服务、DeFi 和跨链协议。链上活动产生收入并支持 验证者、中继者、节点 运营商和排序器,同时为 Swell 资产积累收益。随着网络活动的增长,流动性 加深,加密-经济安全性增强,从而使 dApp 受益并吸引更多构建者和用户。[16]

PoR 的模块化架构使 Swell L2 的基础设施能够不断发展,使其更加分散和高效。通过使用重新质押的资产来保护关键组件,网络与以太坊的安全性保持一致,避免了与中心化基础设施相关的问题。PoR 还通过将网络产生的收入作为重新质押收益传递给用户,从而最大限度地提高资产生产力,促进创新,并为利用 Swell L2 的去中心化服务和 以太坊 安全性的 dApp 释放 流动性。[16]

Swell 代币

swETH 代币

Swell Ether (swETH) 是 Swell 协议上的一个流动性质押代币 (LST),代表在以太坊网络上质押的 ETH。Chainlink 储备证明验证了底层 ETH。swETH 作为一个重定价代币,随着质押奖励的积累,其价值会随着时间的推移而增加。 [5]

rswETH

于 2024 年 1 月 29 日推出的 rswETH,即 Restaked Swell ETH,是一种 ERC-20 流动性再质押代币 (LRT),旨在为希望在 EigenLayer 等再质押协议中“再质押”其 ETH 的用户提供流动性,而无需锁定其再质押的 ETH。它作为一种重新定价的代币,代表用户产生收益的 ETH,这些 ETH 由验证者用于验证 以太坊 区块链 上的交易。 [1][6][7]

于 2024 年 4 月 17 日宣布的 rswETH v2 引入了受支持的流动性质押代币 (LST) 和 rswETH 之间的可组合性。通过此更新,swETH 和其他 LST(如 stETH)可用作 抵押品 来 铸造 rswETH。这允许 swETH 持有者有效地获得 rswETH,而无需依赖二级市场。 [12]

rswETH v2 将自动将通过 rswETH 再质押的 ETH 和 LST 委托给 EigenLayer AVS 运营商。这确保了信誉良好的运营商管理资产,并且再质押者可以从整个生态系统中获得奖励,包括实际的再质押收益(一旦启用)、潜在的 AVS 空投 以及在 Swell L2 中存入 rswETH 获得的额外奖励。用户可以通过 Swell 应用程序以一级市场价格提取 rswETH,从而减少对二级市场的依赖并提高其稳定性。在此功能上线之前,rswETH 可以在 DEX 或聚合器上兑换回 ETH。可以使用 Chainlink 储备证明来验证支持 rswETH 的质押资产。 [12]

增强的 rswETH 将成为 Swell L2 上 Tri-Staking 的一个重要组成部分,允许 SWELL、ALT 和 rswETH 通过 AltLayer 的 AltVault 来保护 Swell L2 AVS。rswETH 还将作为 Swell L2 的原生 gas 代币,通过 质押 和再质押奖励来提高实用性并优化用户体验和 gas 支出。 [12]

SWELL Token

SWELL 是 Swell 的原生代币,主要用于三个目的:管理 Swell DAO,重新质押以保护 Swell L2 应用程序和基础设施,以及支付网络上的 gas 费用。用户可以重新质押他们的 SWELL 以获得 rSWELL,从而获得保护 Swell L2 的奖励。rSWELL,即流动性重新质押代币,与 SWELL 保持 1:1 的治理权,可以部署在 DeFi 中以获得额外收益,或者存入 Swell L2 中以获得生态系统 空投。治理允许 SWELL 和 rSWELL 持有者在 Swell DAO 中提交提案并进行投票,其职责包括决定 流动性 激励、协议参数、赠款分配和 节点 运营商的加入。SWELL 还用作 Swell L2 交易的 gas 代币。SWELL 的总供应量为 100 亿个代币,其中 8.5% 分配给 Voyage 空投。[1][14]

合作关系

Bunni

2023年5月,Swell在Bunni上推出了他们的swETH-ETH池,Bunni是一个解决DeFi流动性激励的项目。由于Swell在LST领域仍然是新手,因此存在无需治理代币即可引导流动性的机会。与Bunni合作的决定受到多种因素的影响,例如其作为较新的协议以及veLIT的估值相对较低。这种战略合作伙伴关系允许维持更突出的地位,并将排放导回,从而在不需要治理代币的情况下增强流动性。 [8]

Chainlink

2023 年 5 月 16 日,Swell 在 以太坊 上集成了 Chainlink 储备证明 (PoR),确保 swETH 代币完全由 质押 的 ETH 以 1:1 的比例支持。Chainlink PoR 的集成为支持 swETH 的 ETH 储备提供了一项监控服务,为用户提供可靠及时的更新。此举旨在增强用户对 以太坊 Beacon 链储备完全支持的信心和透明度。用户可以访问 储备证明 馈送以进行验证。 [9]

“Chainlink 储备证明 帮助我们为用户提供无与伦比的透明度,了解支持 swETH 的储备。用户现在可以一站式查看 swETH 储备余额的近实时更新,让您安心,每个代币都由质押的 ETH 以 1:1 的比例支持” - Daniel Dizon,Swell Network 的联合创始人兼首席执行官。

2024 年 2 月,Swell 加入了 Chainlink 的 BUILD 计划,以利用 Chainlink 的 预言机 基础设施,旨在增强安全性和可靠性。作为 BUILD 的成员,Swell Network 获得了各种好处,例如 Chainlink 的跨链互操作协议 (CCIP),用于安全的跨链传输,Chainlink 储备证明,用于验证跨链储备,智能合约 触发的自动化,用于准确市场数据的价格馈送,用于链下数据和自定义计算的功能,以及提前访问新的 Chainlink 产品版本。为了回报这些服务,Swell Network 承诺逐步将其原生代币供应的一部分提供给 Chainlink 服务提供商,包括质押者。这种互惠互利的安排促进了两个社区之间的相互支持。 [10]

“我们很高兴加入 Chainlink BUILD 计划,因为 Chainlink 网络的行业标准服务对于帮助 Swell 支持 DeFi 中 流动性质押 的采用至关重要。我们期待继续合作,并欢迎充满热情的 Chainlink 社区加入 Swell Network 生态系统。” - Daniel Dizon,Swell Network 的联合创始人兼首席执行官。

AltLayer

2024年3月13日,Swell与AltLayer和EigenDA合作,推出了用于重新质押的Layer 2rollup。Swell的L2将专注于EigenLayer上的流动性重新质押资产,通过利用AltLayer的“重新质押rollup”框架,区别于传统的rollups。该框架包括主动验证服务(AVS),如去中心化排序、验证,以及通过EigenLayer的重新质押机制实现的更快最终性。[\11](#cite-id-0l8njv81pssf)

该rollup将为Swell生态系统参与者提供原生重新质押收益、更高的可扩展性、更低的费用和新的DeFi原语。原生gas代币将是rswETH,治理代币将是SWELL。Chainlink将支持L2,该L2建立在Polygon的zkEVM技术之上,使用EigenDA和AltLayer。[\11](#cite-id-0l8njv81pssf)

“将Swell的流动性重新质押产品扩展到用于重新质押的L2是Swell社区和DAO的下一个合乎逻辑的步骤。它扩展了协议的现有愿景,即为DeFi提供最佳的流动性重新质押体验。Swell的L2将推动Swell社区的逐步变革,并为DeFi带来新的创新,以及EigenLayer及其不断增长的主动验证服务(AVS)生态系统。” - Swell Network联合创始人兼首席执行官Daniel Dizon。

OKX

2024年3月29日,Swell宣布深化与OKX的合作,以支持其最近推出的Layer 2的增长,并在OKX的原生Layer 2网络上进行再质押。此次合作旨在Swell的再质押rollup和OKX的Layer 2之间建立协同效应,两者都建立在Polygon的CDK之上。这些网络旨在通过Polygon AggLayer在更广泛的ZK驱动的Layer 2s网络中互操作。[13]

发现错误了吗?