Subscribe to wiki

Share wiki

Bookmark

Buffer Finance

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Buffer Finance

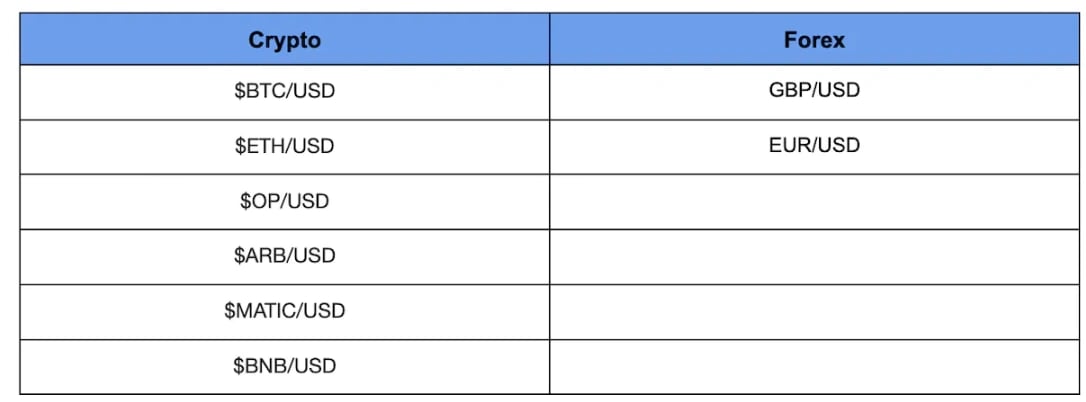

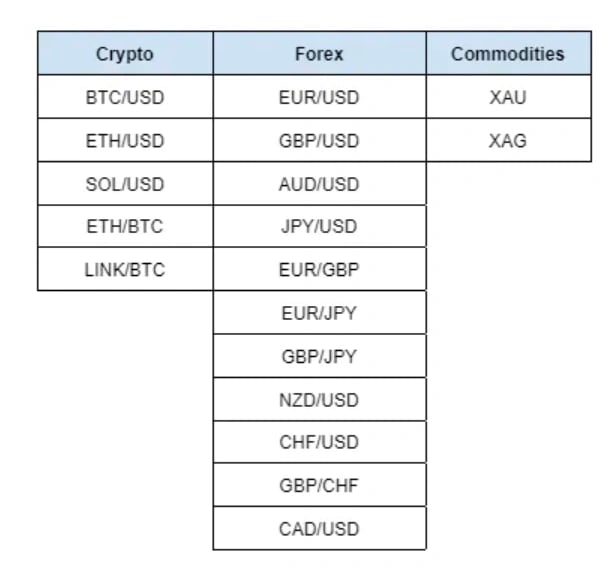

Buffer Finance is a non-custodial exotic options trading platform offering defined outcome and fast-paced trading over crypto and non-crypto markets (like forex, commodities, and indices). Buffer abstracts complexity from options trading and lets DeFi-native traders trade multiple assets completely on-chain without the added complexity of liquidation, funding rates, or scam-wicks. [5][6][13]

Overview

Buffer was founded in 2021 by Wer Heisenberg and Ric Feyman. The initial DEX offering (IDO) took place on Sep. 20, 2021.[4]

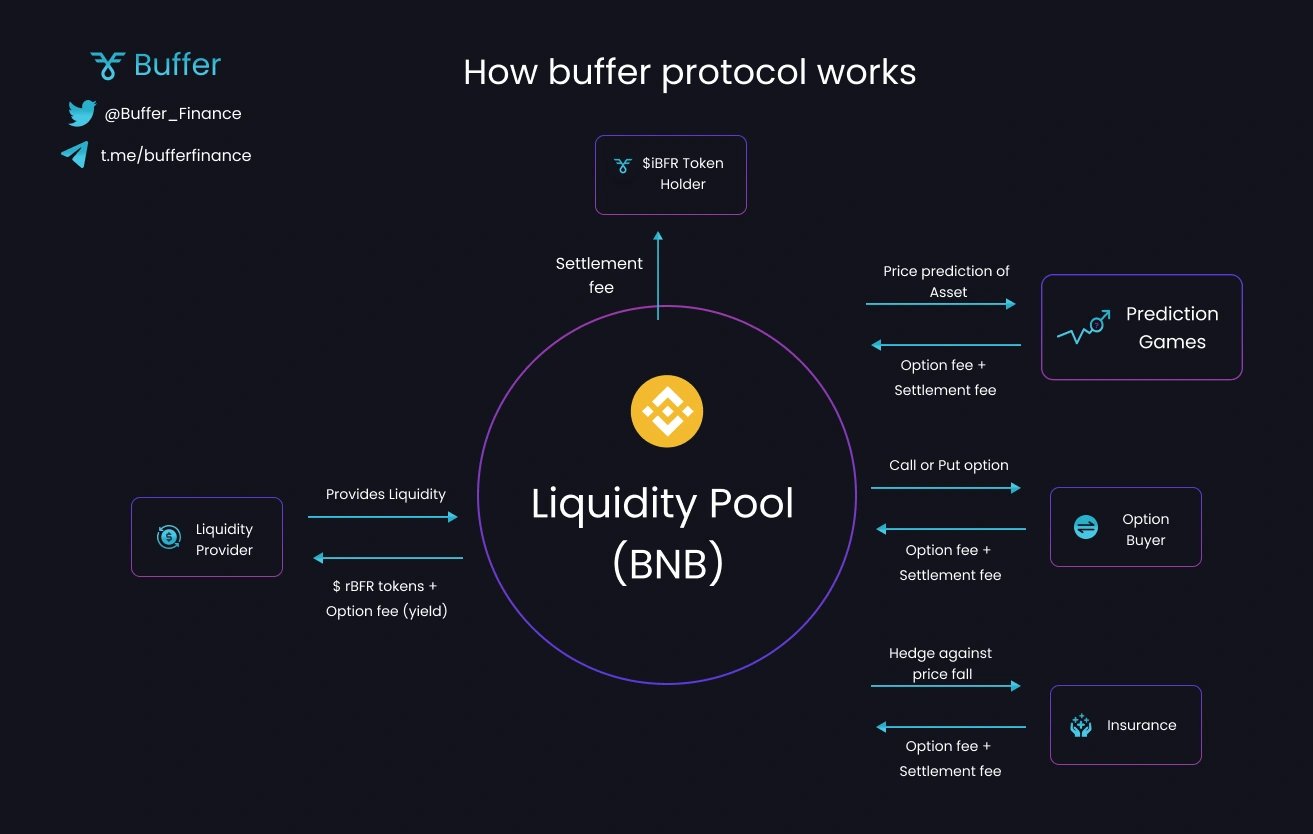

Buffer is the first on-chain peer-to-pool options trading protocol built on Binance Smart Chain. It works like an Automated Market Maker (AMM) (e.g.: PancakeSwap) where traders can create, buy, and settle options against a liquidity pool without the need for a counterparty (option writer).

There are three stakeholders involved in the protocol and the process goes;

- Liquidity providers (LP): LPs provide liquidity for a particular BEP-20 token’s liquidity pool and receive write buffer tokens($rBT) against it. The provided liquidity is used to write both call and put options and the premium paid by the option buyer (strike fee + option fee) is distributed among the $rBT holders as yield.[13]

- Option buyer: An option buyer can set any strike price and buy a put or call option after paying an option premium and a settlement fee (1% of the option amount). The bought options can be exercised anytime before the expiry date directly against the liquidity pool.

- Token holders: Buffer protocol has 3 types of tokens, each with its own utility and benefits.

- $iBFR token: $iBFR is the native token of the buffer protocol — $iBFR can be staked to farm $BFR tokens or sold against regular buybacks.

- $BFR token: $BFR token is the perpetual revenue-earning uncapped token and its price increases with token supply. $BFR holders get 100% of the settlement fee and reflection rewards on buy and sell.

- $rBFR token: Write $rBFR tokens are issued to the liquidity providers. $rBFR tokens holders earn yield over the provided liquidity, or they can stake $rBFR tokens to farm $iBFR tokenS.[3]

Architecture

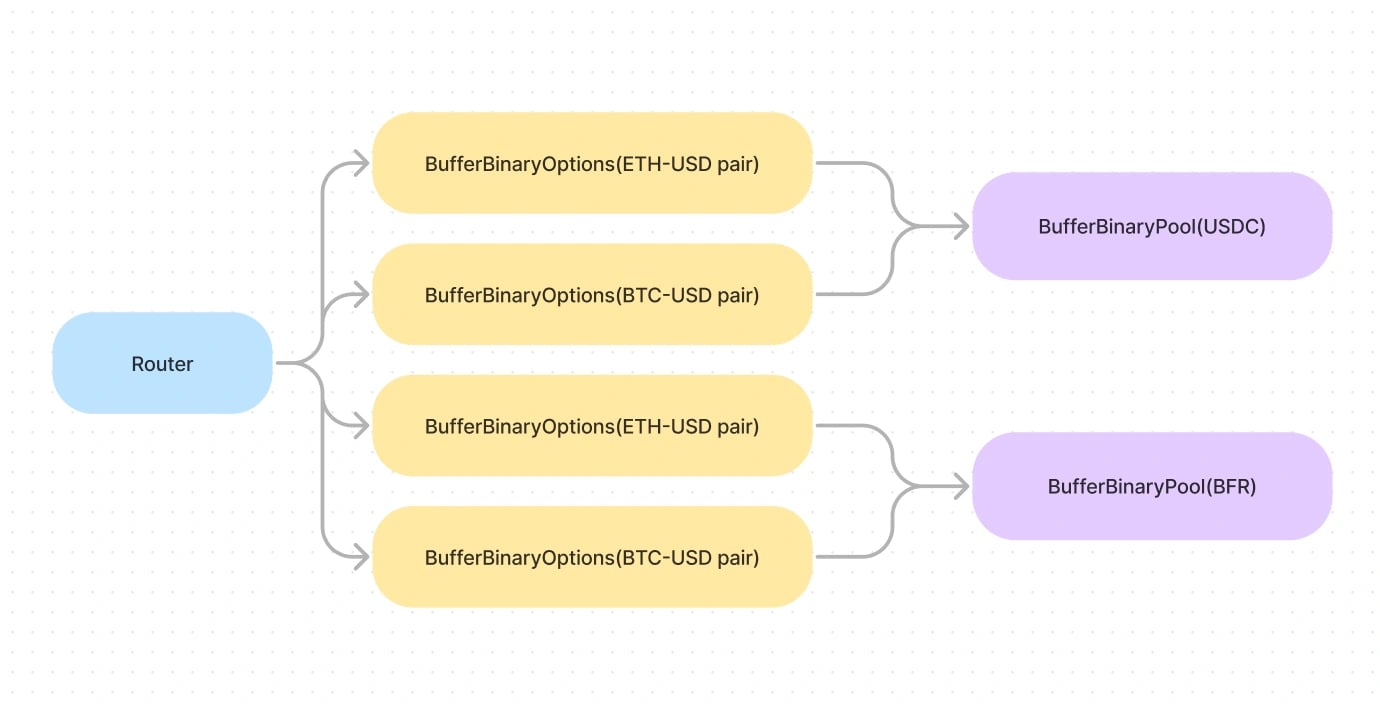

BufferRouter

This is the main contract that the users and keepers interact with. The users call the initiateTrade() from the router in order to open a trade. This function simply collects the fees from the user for opening his trade and adds the user’s request to the trade queue. The keeper listens to these requests and calls the resolveQueuedTrades() with one or more trades at a time with the data signed(verified) by the publisher and opens or cancels the trades as per the conditions. The keeper also keeps track of all the active options. Whenever an option goes from the active to the expired state the keeper runs the unlockOptions() with the data signed(verified) by the publisher and closes it based on the moneyness of the option at the time of expiry.

BufferBinaryOptions

This is an ERC-721 contract where each option is an NFT. The router calls this contract to open and close options. Whenever the router opens a trade, this contract mints an NFT token for the user and burns it at the time of closing. The fee collected by the router is distributed amongst the BufferBinaryPool and SettlementFeeDisbursal. Additional discounts on the settlement fee are given based on TraderNFTs and referrals.

BufferBinaryPool

The BufferBinaryOptions contract sends the premium charged while buying an option to the pool. Pool locks the liquidity at the time of option buying in order to pay the profit for the ITM options at the time of expiry. For ITM options at the time of expiry, the locked liquidity is sent as a reward thus resulting in a loss for the poolFor ATM/OTM options at the time of expiry, the locked liquidity is released and nothing is sent to the user. The pool thus makes a profit from the premium collected at the time of option buying. The admin and other liquidity providers add this liquidity that’s locked in the pool to reward the users for ITM options and make a profit from the OTM and ATM options. This profit is distributed amongst the LP in the ratio of the liquidity added.

Tokenomics

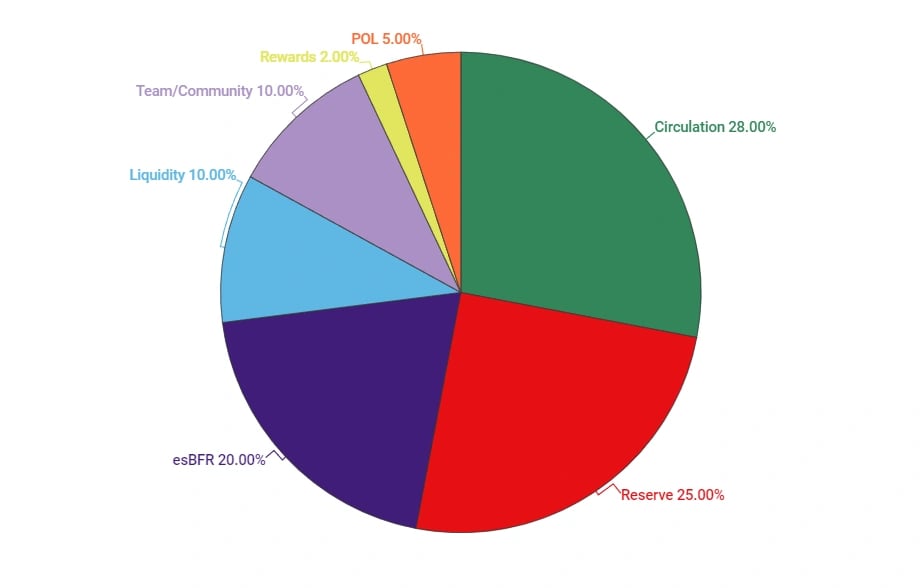

The Buffer Token, BFR is the native governance and utility token of the Buffer Finance protocol on Arbitrum. Staked BFR earns 40% of fees generated from the platform's trading fees in contrast to BLP, which accrues 55% of the fees (the remaining 5% is reserved for traders who participate in the Buffer Weekly trading contests).

BLP is the liquidity provider token of the platform. It can be minted using any of the tokens within the liquidity pool. Since LPs act as the counterparty to options traders, they earn both trading fees and mark-to-market P&L as position takers. If options traders' net positions lose money, LPs benefit from the distribution of wealth effects. [2]

As of March 2023, token distribution is the following:

- Approximately 28 million tokens are in circulation.

- 20 million BFR reserved to be distributed as escrowed BFR (esBFR) which is a non-transferable token that matures into liquid BFR over 365 days when put into the vesting vault. Out of 20 million, 3 million is reserved for later migrators, and 2 million is reserved for Over-The-Counter (OTC) sales to raise working capital & POL. The remaining 15 million esBFR are being emitted at 100,000 esBFR every month to the BFR staking pool. Any changes to the emissions can be done after voting.

- 10 million for DEX liquidity will be used for active market making on Uniswap v3 and liquidity mining rewards. All fees earned while making the market will be re-invested in it.

- 10 million community and team compensation to be released at 200,000 BFR every month for the next 50 months (only liquid BFR emission). It includes team and community member compensation and all previous vesting schedules.

- 2 million reward pool to pay keeper network and fund rewards for trading competitions.

- 5 million protocol-owned liquidity to enable trading with BFR tokens. PnL of the trader adds to the POL balance (more traders lose more tokens are locked). 50% of the fee generated will be added to the BFR reserve to be sent as esBFR rewards. The remaining 50% of the settlement fee goes to the reward pool.

- 25 million of the supply will be locked under a 6-month cliff period. When the cliff period is over, the community can vote on what to do with these tokens.[2]

Buffer Improvement Proposal

On May 15, 2023, the Buffer Community published a proposal regarding the implementation of a deflationary mechanism for the $BFR token through supply reduction, burn protocol initiation, and a hard supply cap.

The community proposed a burn community allocation to reduce $BFR Total supply by burning 20,000,000 BFR tokens upon unlock (06.04.2023) and burning of the remaining 5,000,000 BFR from the community allocation and 5,000,000 from the POL allocation reserved for burning upon reaching a set milestone[8]

The community also proposed implementing a sink into Buffer Finance i.e. fees that lead to the token being destroyed/burned. The proposal is to establish $BFR-based trading pools for all Buffer products wherein: 50% of fees accrued from $BFR trading is burned, and 50% allocated to LBFR Loyalty Program rewards to incentivize trading volume. [8]

Lastly, the community proposed a maximum circulating supply of 50M for $BFR in order to ensure the economic sustainability of the platform under the widest possible variety of circumstances.

"The token is meant to be a scarce multi-utility asset, representing stakeholdership in the ecosystem and granting access to the yield generated by a wide range of products under the Buffer Finance brand."

"Protecting current stakeholders and long-term supporters from inflation and putting $BFR on a path toward long-term deflation is the core motivation behind the proposed measures." - the website stated[8]

The Up/Down Options Trading went live on $BFR trading pool in June 2023, which allows traders to trade Up/Down trades positions on the buffer app using BFR. The pool size is 5M BFR with a pool type of POL (protocol-owned liquidity). [9]

Buffer v2.5

Announced on July 14, 2023, Buffer v2.5 is an upgrade to the platform with new features including One-click trading (1CT) that allows users to access the experience of a CEX with self-custody, Zero gas fee for registration or spend approvals, Early close which allows users choose to close a position early to lock in profits or to limit losses when trading up/down options on Buffer. [7]

v2.5 also features Limit orders and instant trading which allows traders to execute greater control over their trade entries on Buffer Finance, Private trading that hides the direction of trades from the public trading database, and advanced user interface (UI) upgrades. [7]

Buffer x Metavault x Polygon

Announced in February 2023, Metavault will power up/down trading on Buffer - Polygon by providing 500K USDC as liquidity to the Buffer liquidity pool (BLP). Since Metavault will be the counterparty to all trades, 50% of the protocol-generated trading fees will be shared with Metavault. The remaining 50% will be added to the Buffer Treasury. The accumulated trading fee (USDC) in the Buffer treasury is subject to community governance. [10]

With this deployment, Buffer became the first exotic options trading platform on Polygon. [10]

Optopi NFT

Optopi, introduced in January 2023, is a collection of 8,888 unique, collectible PFP-friendly NFTs on Arbitrum. Optopi can be used as a profile picture representing Buffer fam and offers key utility to traders trading over the Buffer Platform. [11][12]

The Optopi collection is divided into four tiers: Diamond, Platinum, Gold, and Silver. Diamond is the rarest to mint and Silver is the most common. The lower the mint probability, the higher the utility of that tier for the trader. [12]

NFT Utility

The Optopi NFT can be used as a payout boost for Up/Down options. The boost % depends on the tier of the NFT being held (highest tier = max payout boost, lowest tier = least payout boost). Optopi NFTs can also be used to access Trading leagues. A trader can be part of any of the five leagues Bronze, Silver, Gold, Platinum, and Diamond, with Diamond having the highest reward and Bronze having the lowest. [12]

It can be used to access Buffer Prime — a private discord group dedicated to Giga brain trading geniuses, and pro traders, where they can share trading setups, strategies, and everything else in between. It can also be used in Trader Rebates — For traders holding Optopi, USDC rebates will be distributed based on their share of weekly trading volumes. [12]

Minting Process

There are 3 phases of minting for the first batch of 2,222 Optopi. NFTs will be revealed after each mint phase is over.

The first phase is the Buffer community which will be available to BFR stakers, traders, and liquidity providers (USDC vault). The second phase is Partner whitelists which includes partner project community where each partner will be offered 50–100 WL spots and they can decide their whitelisting criteria. The third phase is the Open minting phase/clearing out phase, in case the first batch of 2,222 Optopi is not completely minted in the first two phases we will be opening up minting for all the wallets. [12][11]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)