订阅 wiki

Share wiki

Bookmark

Bull Market

0%

Bull Market

**牛市(或牛市行情)**是指资产价格持续上涨的时期,通常由强劲的经济和就业水平的提高所支撑。在牛市期间,经济状况良好,表明市场呈上升趋势,并且通常伴随着投资者对持续上升趋势的乐观情绪。[1][2] 在加密货币领域,牛市是指加密货币价格上涨或预计上涨的一段时间。这通常发生在需求大于供应,以及投资者对加密货币行业的未来持乐观态度时。[8]

概述

术语“牛市”描述了市场内的积极价格趋势。这个概念被广泛应用,不仅在传统市场中,而且在加密货币领域中也是如此。本质上,牛市表明了一种强劲的上升趋势,其特征是在相对较短的时间内价格大幅上涨。

没有一个普遍标准化的指标来确定牛市。在股票市场中,最广泛接受的牛市定义是股票价格从最近的低点上涨20%或更多。这与熊市形成对比,在熊市中,价格在持续一段时间内下跌20%或更多。[1][4]

与传统市场相比,加密货币市场相对较小,因此表现出更高的波动性。因此,见证显著且持续的牛市行情并不罕见,在这些行情中,仅在1或2天内价格迅速上涨40%或更多的情况非常频繁。[3][9]

指标

识别牛市通常就像观察价格趋势一样简单,价格趋势通常显示各种加密货币的持续上涨。为了确定牛市,会考虑以下因素和指标,以进行更全面的财务分析:

- 价格上涨:牛市行情的典型特征是价格上涨的延长阶段,这是由于信心增强和需求增加所致。例如,在2020年和2021年的牛市行情中,比特币和以太坊等主要加密货币分别达到了69,000美元和4,880美元的历史新高。[6]

- 积极的市场情绪:在牛市期间,通常存在积极的投资者情绪,其特征是对上涨轨迹的乐观和信心。这意味着投资者对加密货币的潜力充满信心和热情,他们愿意承担更多风险并投入更多资金。这种情绪可以通过调查、市场情绪指标和媒体报道来衡量。[1][4][5]

- 交易量增加:牛市通常会见证交易量的增加。这意味着更多的人在买卖加密货币,这创造了更多的流动性和价格发现。交易量的增加表明投资者信心增强,并积极参与市场。[2][5]

- 更高的市值:流通中所有加密货币的总价值都在增加,这反映了人们对加密货币日益增长的兴趣和采用。[8]

例子

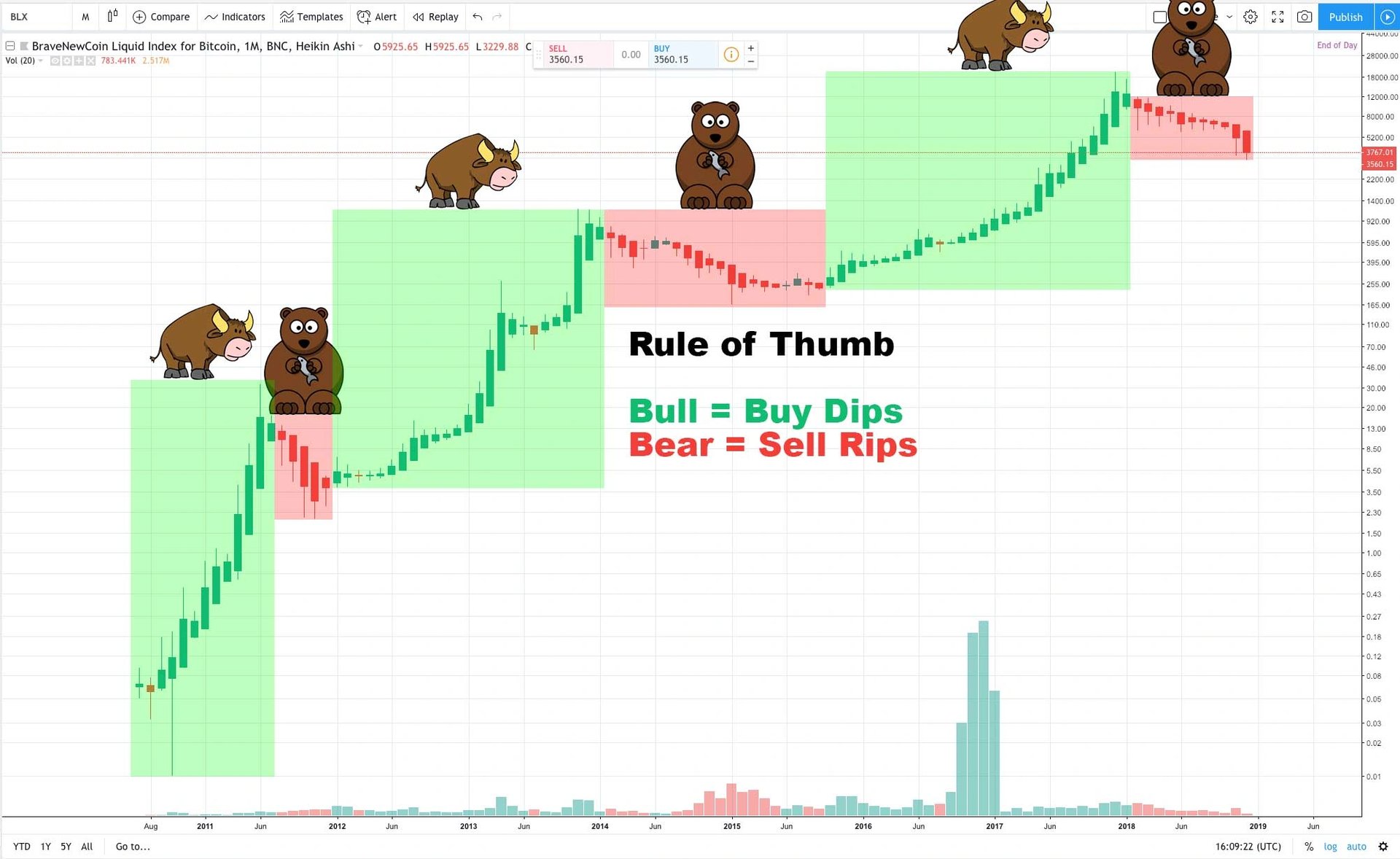

2013年牛市

比特币的价格从1月份的约13美元飙升至12月份的超过1,000美元,这一显著增长引起了广泛关注,并为加密货币市场的未来发展奠定了基础。[5]

2017年牛市行情

加密货币领域最具代表性的牛市行情之一发生在2017年。在此期间,加密货币价格经历了前所未有的飙升。比特币在2017年12月达到了近20,000美元的历史新高。以太坊、瑞波和莱特币等其他加密货币也经历了大幅的价格上涨。2017年的牛市行情是由比特币期货的推出、主流意识的提高和加密货币的采用,以及加密货币领域新项目和创新的出现等因素推动的。[5]

2019年牛市

在2018年的熊市之后,加密货币在2019年出现了复苏。比特币的价格从年初的约3,700美元飙升至6月底的近14,000美元。这次反弹重振了投资者对加密货币市场的兴趣和乐观情绪。[5]

2020-2021年牛市

比特币的价格从2020年3月的约4,000美元上涨至2021年4月超过64,000美元的历史新高。以太坊和各种山寨币在此期间也获得了显著的价格上涨。2020-2021年的牛市行情是由COVID-19大流行等因素推动的,这增加了对传统金融的数字和去中心化替代方案的需求,机构和企业采用加密货币,例如特斯拉购买了价值15亿美元的比特币,以及去中心化金融(DeFi)和非同质化代币(NFT)等加密货币行业新领域和趋势的发展和增长。[5][8]

2021年山寨币牛市行情

与2021年比特币的反弹同时,许多山寨币也出现了大幅牛市行情。以太坊、币安币、卡尔达诺等加密货币的价格也大幅上涨。去中心化金融(DeFi)和非同质化代币(NFT)等因素在推动这次上涨中发挥了作用。[5]

这些不同的牛市行情展示了加密货币市场的动态和不断发展的性质,展示了价格大幅上涨的时期,并吸引了投资者和爱好者的关注。[5]

发现错误了吗?