订阅 wiki

Share wiki

Bookmark

Celsius Network

0%

Celsius Network

Celsius Network 曾是一个 加密货币 和金融贷款平台,于 2022 年 6 月破产。该平台之前允许加密货币持有者以代币形式赚取资产利息,或者使用该公司的 CEL 代币以其 加密货币 获得 现金 贷款。[1]

概述

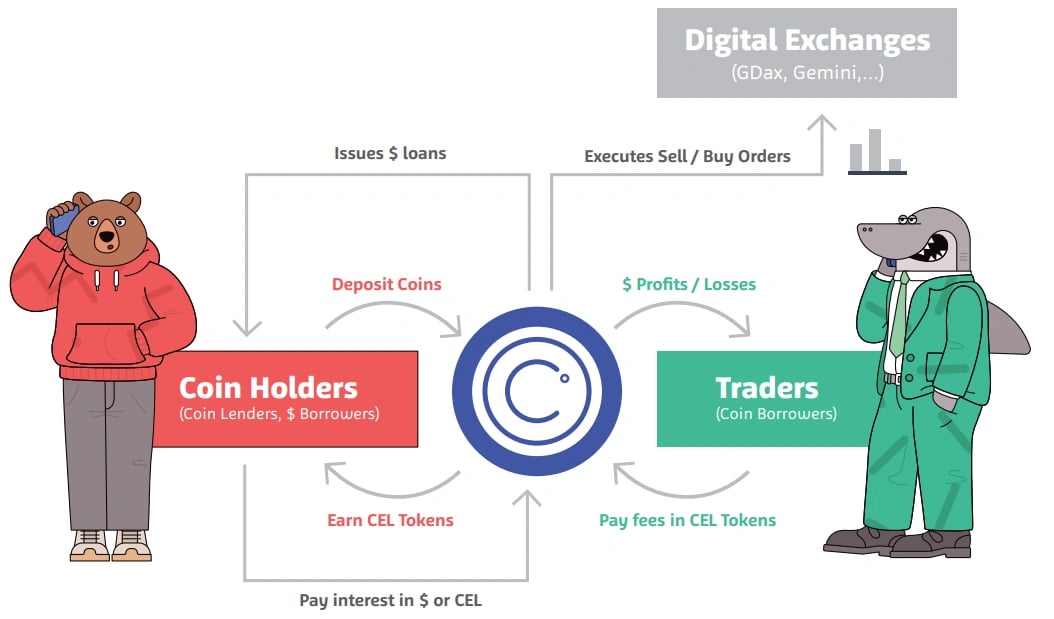

Celsius Network 成立于 2017 年,总部位于伦敦,利用其在 以太坊 区块链上的 ERC-20 代币 CEL 提供交易所钱包,与传统金融机构相比,借贷加密货币的利率更低。他们的目标是用可以通过借出加密货币获得回报的代币持有者取代大型银行和期货交易所。 [3][9]

该网络还提供了一个平台,用户可以通过该平台的钱包 UI 管理其资产,并使用 CelPay。借贷选项允许以加密货币为抵押的贷款,利率相对较低。用户可以从每周奖励、促销代码和推荐奖励中受益。CelsiusX 是 Celsius 的 DeFi 分支,提供中心化和去中心化金融的融合,开发人员可以使用 Celsius API 门户。 [22]

CelPay

CelPay是Celsius应用程序中的一项功能,旨在简化加密货币支付。用户可以将数字资产发送给应用程序中的联系人,或分享链接让收款人在创建并验证钱包后领取加密货币。交易需要电子邮件确认,并且为了安全起见,每日交易限额为2500美元。 [23]

CelsiusX

CelsiusX是Celsius Network的去中心化金融(DeFi)部门,充当中心化金融(CeFi)和DeFi之间的桥梁。它促进了跨区块链的资产转移,从而促进了互操作性。CelsiusX将CeFi借贷扩展到DeFi,为用户提供了两种金融模式的优势。 [24]

CEL 代币

CEL 代币于 2018 年通过代币销售推出,筹集了超过 5000 万美元,作为一种实用代币,用于访问 Celsius 平台服务。 [4]

Celsius 忠诚度奖励

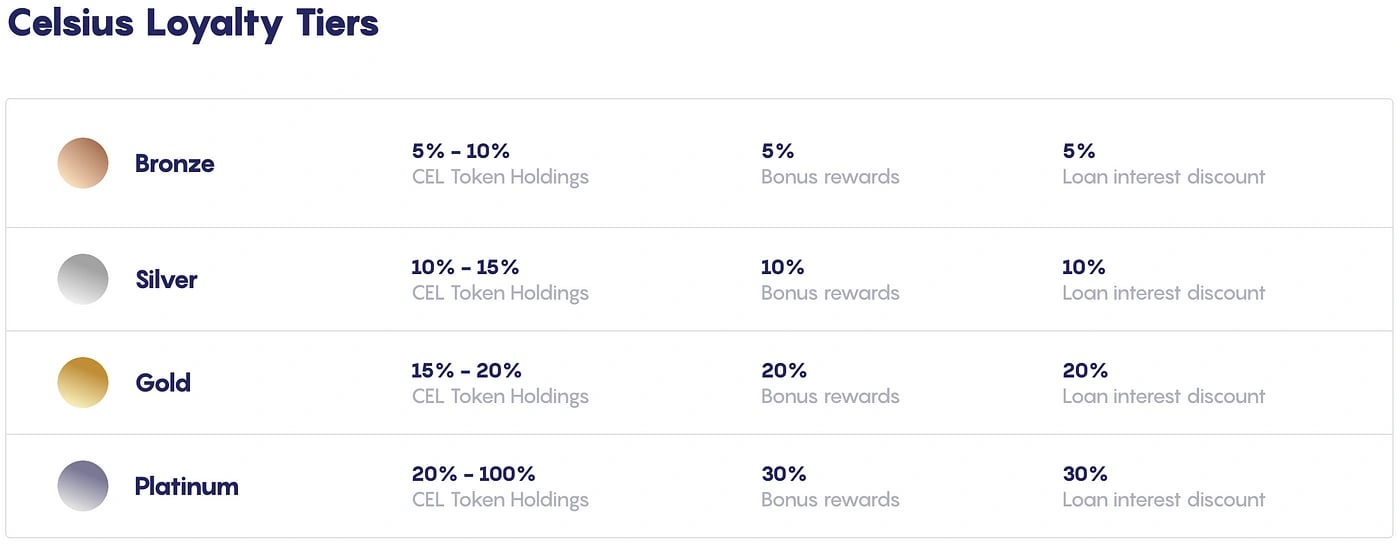

Celsius Network 拥有一个忠诚度奖励系统,该系统根据 CEL 代币持有量分为四个等级。奖励随市场和钱包使用情况而波动。较高等级提供额外利息和贷款利息折扣,在白金等级中分别上限为 35% 和 30%。 [5][11]

CEL代币实用性

持有CEL代币在Celsius应用程序中提供了多种好处,例如美元贷款请求的优先权、更低的贷款利率(高达30%的折扣)、降低的加密货币贷款利率,以及对于那些以CEL代币接收每周利息的人来说,更高的利率(高达35%)。顶级持有者还可以获得独家福利。 [6][10]

代币经济学

CEL代币持有者从机构交易者使用CEL代币支付费用所产生的利息中获得奖励。Celsius以非营利方式运营,将大部分资金分配回社区。 [10]

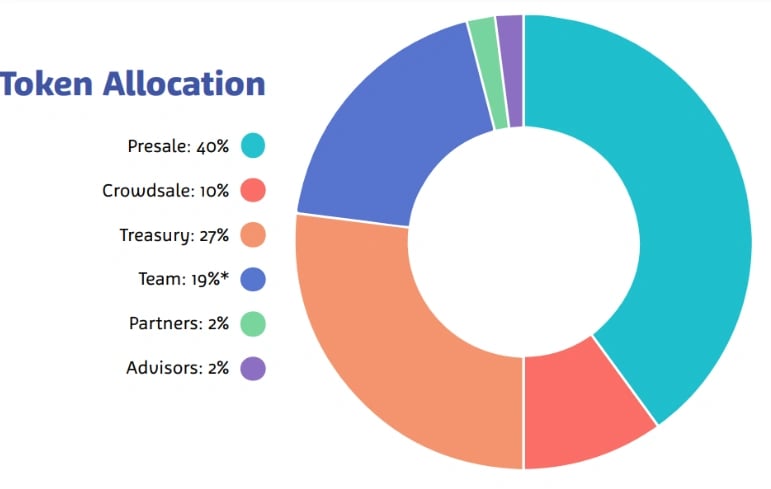

代币分配

历史

首次代币发行 (ICO)

2018年5月,Celsius进行了首次代币发行(ICO),通过出售3.25亿个CEL代币筹集了5000万美元,约占代币总供应量的一半。购买后,代币持有者可以通过平台上的“借款”功能赚取CEL代币作为利息。 [12][13]

股权众筹

2020年8月,Celsius Network通过股权众筹筹集了超过2000万美元。该众筹活动吸引了1000多名投资者,并经历了多次延期。最初的目标是1000万至1500万美元,但最终超过了目标,其中Tether贡献了1000万美元。Alex Mashinsky宣布延期,以便让更多投资者参与此次发行。 [8]

破产

申请破产

2022年7月,由于面临流动性危机,摄氏网络决定在美国纽约南区破产法院申请第11章破产保护。此前,该公司暂停了平台上的提款、兑换和转账,旨在稳定业务并保障客户利益。这一战略性暂停旨在防止早期提款使某些客户处于不利地位,让其他客户等待从长期资产部署活动中完成价值创造后才能获得补偿。 [25]

法官对 Celsius 作出裁决

2023年1月,一位联邦破产法官裁定,Celsius Network对其高息Earn计划中存入的加密货币拥有所有权。该计划允许用户存入比特币、以太坊和Tether等加密货币,并获得每周利息支付。根据法院的裁决,存入Earn账户的资产,包括稳定币,成为Celsius Network的财产,这一裁决受到该平台明确条款和条件的影响。 [26]

达成和解以退出破产程序

2023年7月20日,Celsius Network达成关键和解,解决了782亿美元的无担保债权,允许将资产返还给客户,并最终结束破产程序。这些和解方案需经Martin Glenn法官评估,并在8月3日前公开回应,其中包括将客户回收率提高5%的措施,并为Earn计划的参与者提供解决方案。这一进展突显了Celsius Network克服挑战、重建信任和推进破产后愿景的决心。 [27]

法律纠纷

庞氏骗局指控

2022年11月,Celsius Network面临前投资经理Jason Stone提起的诉讼,他指控该加密货币借贷平台从事欺诈活动并以庞氏骗局运作。Stone声称,Celsius人为抬高其原生数字货币的价格,未能实施适当的风险管理策略,并利用客户存款来操纵其代币的价值。诉讼称,Celsius首席执行官Alex Mashinsky以牺牲储户的利益为代价来致富。 [14][15]

Stone进一步声称,Celsius未能对冲交易风险,并且拥有以加密货币以太币计价的巨额负债,但没有足够的持有量来弥补这些负债。因此,当客户试图提取存款时,Celsius被迫以高价购买更多的以太币,从而遭受了巨大的损失。诉讼指控Celsius采取提供两位数利率的方式来吸引新的储户并偿还早期的投资者,并将该公司描述为庞氏骗局。 [14][15]

由于流动性危机和暂时中止用户提款,Celsius面临额外的审查。据称,Stone于2021年3月离开Celsius的原因是该公司资产负债表上出现1亿至2亿美元的无法解释的漏洞。诉讼称,Celsius继续控制一个以太坊钱包,首席执行官据称将其用于个人利益,包括将有价值的非同质化代币转移到他妻子的钱包中。 [14][15]

针对 Celsius 和 Mashinsky 的诉讼

2023年7月13日,包括美国司法部(DOJ)、证券交易委员会(SEC)、联邦贸易委员会(FTC)和商品期货交易委员会(CFTC)在内的多个联邦机构提起了一系列诉讼。这些法律行动的目标是 Celsius Network 公司及其前首席执行官 Alex Mashinsky。 [16]

美国司法部 (DOJ) 诉讼

2023年7月13日,美国司法部对 Mashinsky 提起刑事指控,其中包括欺诈客户和私吞 4200 万美元的指控。起诉书指控 Mashinsky 和其他 Celsius 高管策划了一项阴谋,抬高 Celsius 原生代币 CEL 的价值,以便从其销售中获利。Mashinsky 和他的同事,前首席营收官 Roni Cohen-Pavon,均因这些犯罪活动被起诉。[16][17]

今天,我宣布公开一份起诉书,指控 Celsius 的创始人兼首席执行官 Alex Mashinsky 策划了一项阴谋,通过一系列关于 Celsius 平台基本安全性的虚假声明来欺骗 Celsius 的客户,并参与了一项与 Celsius 首席营收官 Roni Cohen-Pavon 抬高 Celsius 专有代币 CEL 价格的阴谋。

- 美国检察官 Damian Williams

美国证券交易委员会(SEC)诉讼

2023年7月14日,美国证券交易委员会(SEC)也对Celsius Network和Mashinsky提起诉讼,指控该公司多次向客户谎报其平台的安全性。SEC声称,Celsius在监管批准方面做出了虚假陈述,歪曲了其用户基础,并参与了市场操纵。该诉讼进一步指控Celsius通过其贷款计划提供和销售未注册的证券。 [16][18]

联邦贸易委员会 (FTC) 诉讼

2023年7月13日,FTC 指控 Celsius 通过误导消费者存入资产并随后不当管理其投资来欺骗消费者。FTC 声称,Celsius 向投资者撒谎,未能维持足够的流动资产以供提款,并虚假地将自己宣传为传统银行的安全替代品。该诉讼不仅指控了 Celsius Network,还指控了其联合创始人 Shlomi Daniel Leon 和 Hanoch "Nuke" Goldstein。 [16][19]

“Celsius 吹捧一种新的商业模式,但却从事一种老式的诈骗。今天的行动禁止 Celsius 处理人们的资金,并追究其高管的责任,这应该清楚地表明,新兴技术并不凌驾于法律之上。” - FTC 消费者保护局局长 Samuel Levine。

商品期货交易委员会 (CFTC) 诉讼

CFTC 指控 Mashinsky 和 Celsius Network 在运营 Celsius 的数字资产金融平台时存在欺诈和重大虚假陈述行为。CFTC 声称 Celsius 向客户发布虚假声明,并在公司杠杆方面欺骗了他们。Celsius 高级管理层曾特别警告 Mashinsky 停止发布误导性声明。 [16][20]

后果和和解

由于这些诉讼,亚历克斯·马辛斯基被捕并面临刑事指控,而摄氏网络及其附属公司则受到罚款、处罚和禁令。马辛斯基对欺诈和操纵CEL代币的指控表示不认罪。在他被捕后,美国地方法院法官将马辛斯基的保释金定为4000万美元。作为保释协议的一部分,他被限制旅行,并被禁止开设新的银行或加密货币账户。马辛斯基的妻子签署了保释书,保释书由他对他在纽约市的住所和银行账户的财务索赔担保。司法部、联邦贸易委员会以及联邦证券和商品监管机构宣布了针对马辛斯基和其他高管的协调法律行动。马辛斯基的律师表示,他否认这些指控,并期待在法庭上为自己辩护。 [21]

Celsius 关闭

2023年8月9日,Celsius 提交了披露声明,声明他们将在提交日期后的 90 天内关闭。一个名为“NewCo”的新实体将接管,由华氏集团管理,并由 Celsius 的债权人所有。90 天的提款窗口期结束后,用户将无法访问其 Celsius 账户。不过,该公司计划偿还债权人,包括通过合作伙伴计划和其他交易所获得奖励的债权人。在这些发展之后,加密货币联盟华氏有限责任公司介入,赢得以 20 亿美元收购 Celsius 的竞标。他们的目标是向债权人分配至少 20.3 亿美元的加密货币,但会受到价格波动的影响,并使用像 Paypal 这样的第三方分销代理商向美国债权人分发。 [28][29][30]

发现错误了吗?