Subscribe to wiki

Share wiki

Bookmark

Convergence

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Convergence

Convergence is a decentralized governance hedge fund and liquidity provider within the DeFi 2.0 space. Its goal is to accumulate governance over various protocols while optimizing their yields. The project utilizes mechanisms like gauges, staked assets tokenization, and bonding, incorporating features from protocols like Curve, Convex, and OlympusDAO. [1]

Overview

Convergence is a layer deployed on different DeFi protocols, starting with Stake DAO. It aims to gather governance rights and optimize yield by combining mechanisms from Curve, Convex, and OlympusDAO, including gauges, staked assets tokenization, and bonding. [2]

Convergence acts as both a governance entity and a provider of liquidity, initially focusing on liquidity protocols. The protocol introduces a governance token (CVG) and a distinct revenue distribution mechanism called the Govearn mechanism. This ensures stakeholders, especially governance participants, receive dividends from yields generated through internal or external growth. [2]

Staking

Convergence facilitates enhanced rewards for stakers and liquidity providers across various protocols partnering with Stake DAO. By depositing Stake DAO's liquid locker tokens (sdTKNs) and LP tokens (LPs) into Convergence, stakers can claim boosted rewards like CRV and SDT, with CVG as an additional benefit. The platform also offers a liquid staking solution for SDT, where staked cvgSDT earns native veSDT rewards, SDT rewards, and CVG. [3]

Convergence imposes no deposit or withdrawal fees, but there are fees on SDT received by the system. The governance power on Stake DAO delegated to Convergence is managed through CVG lockers. [3]

cvgSDT Staking

Convergence enables Stake DAO users to stake cvgSDT, a liquid derivative of veSDT, allowing for flexible staking and unstaking. Stakers of cvgSDT receive rewards in the form of native veSDT rewards (sdFRAX3CRV) and a share of 10% of the SDT harvested from staking pools (LPs), with additional CVG emissions based on the cvgSDT gauge weight. [4]

The treasury contributes to earnings by allocating 50% of the SDT harvested from the cvgSDT/SDT stablepool-owned liquidity, along with an extra SDT boost from the treasury's bootstrapping module. [4]

cvgSDT stakers also have the opportunity to benefit from potential bribes, earned through the protocol's veSDT holdings, which can be exchanged for SDT or cvgSDT. [4]

sdTKNs Staking

Convergence enables stakers of sdTKNs (such as sdCRV, sdBAL, etc.) to enhance their earnings through the veSDT boost socialization model. Supported sdTKNs include sdCRV, sdBAL, sdFXS, sdANGLE, sdPENDLE, and sdFXN. [5]

Stakers of sdTKNs on Convergence receive native rewards from underlying veTKNs and Stake DAO's fees. They also get boosted bribes earnings (distributed as sdTKNs) and CVG rewards based on each sdTKN's gauge weight on Convergence. Some staking pools may receive additional rewards through the treasury's bootstrapping module. [5]

The voting power held by Convergence through its sdTKNs holdings is delegated to Stake DAO's delegation addresses to maximize user yields. [5]

LPs Staking

Convergence allows liquidity providers from various protocols, like Curve and Balancer, to stake their LP tokens (LPs) and earn enhanced rewards. In addition to the native rewards from each protocol, already boosted by Stake DAO (such as boosted CRV rewards for Curve), LP stakers receive increased SDT rewards. They also earn CVG rewards based on gauge weights. Certain staking pools may benefit from extra rewards through the treasury's bootstrapping module. [6]

Gauges

Each Convergence staking pool (cvgSDT, sdTKNs, and LPs) is paired with a gauge, and each gauge is assigned a weight. This weight dictates the share of the weekly CVG inflation received by a specific staking pool. Unlike Curve's gauges, where user shares are determined by gauges, in Convergence, shares in staking pools are directly governed by each staking pool contract. [7]

The potential implementation of gauge types may occur if the DAO decides to introduce variations later. However, initially, all gauges have the same type. The distribution of CVG for staking pools is conducted weekly based on gauge weights and synchronized with Convergence's Cycles (cvgCycles). The amount of CVG allocated to a specific staking pool is influenced by its corresponding gauge weight (the sum of the total weight deployed in this gauge) and the overall weight across all gauges. [7]

Bonds and Treasury

Convergence dedicates 30% of the total CVG supply to bond sales, motivating users to contribute diverse assets. This strategy helps the protocol secure its liquidity and establish a treasury. However, CVG is not designed as a decentralized reserve currency. With a maximum supply and a treasury that doesn't provide backing or risk-free value (RFV), Convergence's treasury should not be seen as any assurance for CVG's price. [8]

Convergence uses the Treasury and POL to generate yields and incentivize users to lock CVG through the Govearn or Govern-or-earn mechanism. Every three months, 80% of Treasury yields are distributed to NFT holders based on their proportion of the total ysCVG supply. This distribution event is named Treasury Distribution Event (TDE). [9]

Cycles

Convergence operates and distributes rewards based on two types of cycles: cvgCycles and tdeCycles. [10]

- cvgCycles: cvgCycles are the weekly cycles in Convergence, coordinating gauge votes and rewards distribution for Stake DAO and Convergence. [10]

- tdeCycles: tdeCycles, an abbreviation for Treasury Distribution Event cycles, equate to 12 cvgCycles. The synchronization of Treasury yield distribution occurs within the framework of tdeCycles. [10]

Rewards

Staking rewards for cvgSDT, sdTKNs, and LPs are distributed on a weekly basis, beginning at the start of each cvgCycle. If an individual stakes assets (cvgSDT, sdTKNs, or LPs) in a specific cvgCycle N, their rewards become available at the onset of cvgCycle N+2. Staking rewards are distributed on a weekly basis, corresponding to cvgCycles, based on the weight of gauges and users' shares in staking pools. [11][12]

Treasury rewards are claimable every 3 months (tdeCycles). NFT holders can claim treasury rewards based on their ysCVG shares. [13]

CVG Token

CVG serves as the governance token for the Convergence protocol. Users can engage in governance for both Convergence and its underlying protocols by locking CVG. CVG lockers have the ability to vote for Convergence's gauge weights and can claim shares of treasury yields during each Treasury Distribution Event (TDE). [14]

Locked CVG tokens currently confer governance rights over Convergence (CIP) and all future protocols integrated by Convergence. The governance rights acquired by Convergence through its conversion mechanism are delegated to CVG lockers. [14]

Voting takes place on Snapshot, and Convergence's metagovernance aligns with the voting outcomes of each underlying protocol. [14]

Tokenomics

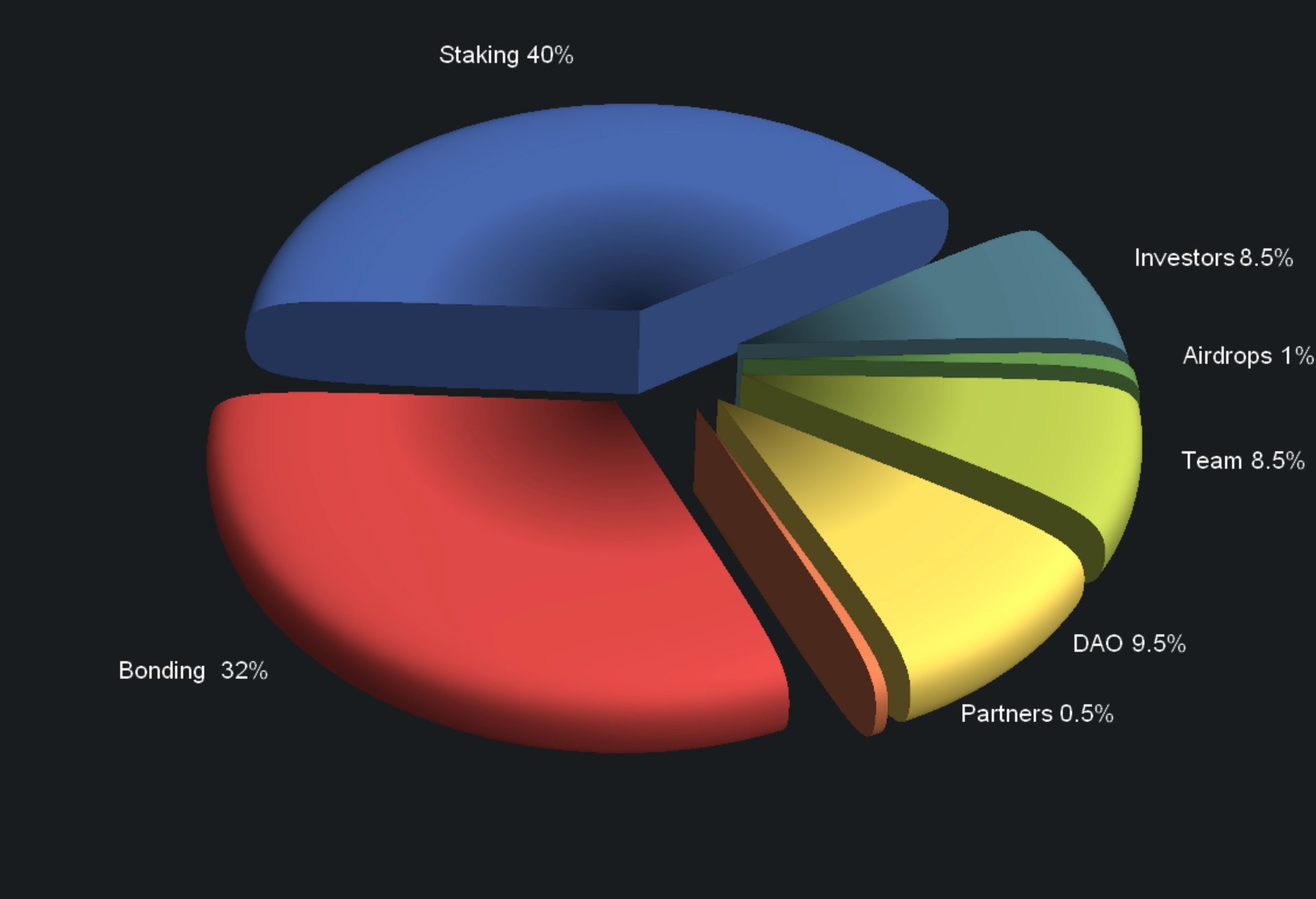

The total supply of the CVG token is 150,000,000. 42% is allocated to staking rewards, 30% to bonds, 9.5% to the DAO, and 8.5% to the team, 8.5% to investors, 0.5% to partners, and 1% to airdrops. [15]

Around 60,000,000 CVG is released per week for about 400 years in staking. Emissions decrease every two years by a factor. The reduction stops after 20 years, maintaining a tail emission until the full staking inflation is released. The initial weekly inflation is 60,576 CVG. [15]

For bonds, 40,000,000 CVG is released over 240 weeks (4.6 years), with 30% allocated to bonds. An unplanned reserve of 8,000,000 CVG is maintained in the bonding program to provide flexibility. [15]

The DAO allocation is vested over 1.5 years, from which 5% is available at launch. The team allocation is vested over 2 years. Investors are allocated 8.5%, with 33% available to the whitelist at launch. The remaining 67% vests over 3 months. Seed investors experience a 120-day cliff, followed by a 5% allocation release, with the remaining 95% vesting over 15 months. [15]

CVG Locking

Locking CVG provides users with the ability to vote for gauge weights, engage in governance, and claim shares on treasury yields. This lock is tokenized as an NFT when a user locks CVG, associated with veCVG, mgCVG, and/or ysCVG. Holders of this NFT can participate in voting and/or claim governance rewards during Treasury Distribution Events (TDE), with the flexibility to trade these NFTs on the open market. [16]

Upon creating a lock, users can choose the percentage of CVG allocated to veCVG and ysCVG. The option to allocate the entire CVG amount to either veCVG or ysCVG is available. To obtain mgCVG, users need to allocate CVG to veCVG, while locking to ysCVG exclusively does not generate mgCVG. [16]

Funding

Convergence has raised a total of 1.8 million, having as lead investors Prismatic Capital and Dewhales Capital, and other investors NGC Ventures and County Capital. [1]

Convergence Hack

On August 1, 2024, the Convergence protocol was hacked sending its token's price (CVG) to near-zero. The hacker created (minted) 58 million of the protocol's CVG token using a vulnerability in the protocol's codebase, and swapped the tokens for 60 wrapped ether (wETH) and 15,900 crvFRAX stablecoin using liquidity pools on Curve, web3 security auditing firm QuillAudits said. [17]

Blockchain data on Etherscan shows that the attacker's address converted the funds to Ether (ETH) and sent the tokens to Tornado Cash. [17]

The attack caused about $210,000 loss - QuillAudits added.

On how it happened, the Convergence team explained in a blog post:

Security has always been a concern for us, and Convergence Finance has been audited 4 times by different companies. However, we modified this part of the code post-audit. The modification (gas-optimization on the first hand) led us to remove the line of code that was checking the input given to the function.[18]

On August 6, 2024, the team provided a situation update on their X profile informing its users that all Convergence’s staking contracts were safe and also adding that funds in these contracts never were at risk. [19]

"Users can deposit back if they wish, as the protocol will continue to function normally for the Stake DAO integration until further notice, without $CVG emissions." - they tweeted[19]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)