订阅 wiki

Share wiki

Bookmark

Stake DAO

0%

Stake DAO

Stake DAO 是一个建立在 Ethereum 上的 DeFi 平台,于 2021 年初推出。 [1][2][4]

Stake DAO 通过提供一种解决方案来解决当前 DeFi 协议的局限性,该解决方案不会迫使用户在投票权或收益之间做出选择。借助 Stake DAO 的 Liquid Lockers,用户可以提高收益、保持流动性、行使治理权并访问跨链功能。这是通过围绕 veToken 和 Liquid Lockers 的一系列产品实现的。 [4]

Liquid Lockers

Stake DAO Liquid Lockers 允许用户锁定他们的代币以换取 sdTokens,sdTokens 是锁定代币的流动版本。用户可以将这些 sdTokens 质押在 Stake DAO 上以赚取奖励,同时保持他们的投票权,或者只是在底层协议上将它们用作流动代币。 [5]

借助 Liquid Lockers,用户可以将原生代币锁定在 Liquid Locker 中,并获得 sdTOKEN 作为回报。例如,用户可以通过 Liquid Lockers 锁定他们的 FXS,从而获得 sdFXS 代币作为回报。对于锁定的每个 FXS,储物柜将铸造一个 sdFXS。这种架构允许 sdFXS 持有者每周一次通过 Snapshot 进行链下投票,以决定 Frax 上的 FXS 计量器分配。 [5]

MAV Liquid Locker 上线

2023 年 7 月 7 日,Stake DAO 宣布 MAV Liquid Locker 现已上线。这为用户提供了存入 Maverick Protocol 的 MAV 代币并获得等量 sdMAV 的能力。 sdMAV 代表 Stake DAO 的 veMAV 储物柜的流动份额。[9]

通过持有 sdMAV,用户可以体验 veMAV 的优势,包括增强的治理权、投票激励以及未来潜在的原生收益。 [9]

Votemarket

Votemarket 是一个旨在通过激励选民为特定计量器投票来增强个人和协议能力的平台。这会影响 veTokenomics 协议中奖励通胀的方向,这是持续追求增加池中流动性的一个关键方面。 [6][7]

Votemarket 技术

Votemarket 是一个智能合约,每个 veToken 协议都有一个合约。它读取底层计量器投票合约,以跟踪用户在本期中投出的票数。然后,根据激励者设置的每票金额和剩余的周期数来分配奖励。 [6]

该合约以 7 天为周期运行,每周四 UTC 时间凌晨 12 点结束。用户可以在 epoch 更改时领取他们的激励,金额基于他们的投票参与度,并受每票最高奖励的限制。 [6]

Tokenomics

Stake DAO 代币

SDT(Stake DAO 代币)是 Stake DAO 的治理代币。它与 2021 年协议的启动一起推出。它是用户将代币存入 DAO 所赚取的代币,并同时充当平台的原生代币。在设定的时间到期后,存入的 SDT 代币将以与个人存款为 DAO 平台产生的收入费用数量成比例的方式分配给所有用户。为了接收和领取他们应得的 DAO 费用,代币持有者需要质押他们赚取的 SDT。 [2][7]

SDT 的总完全稀释供应量为 100,000,000 SDT。它的分配方式如下:

- 初始空投:1.5%(1,500,000 SDT),于 2021 年 1 月 20 日分发

- 初始贡献者、天使投资者和基金会:36%(36,000,000 SDT),从 2021 年 1 月起线性归属 2 年

- Stake DAO 基金会(为将来使用而保留的代币):4%(4,000,000 SDT)

- 协议用户:57.35%(57,352,941 SDT)以治理设定的速率分配

- 国库:1.15%(1,147,059 SDT)以与协议用户相同的速率分配(每次从 MasterChef 合约中铸造 SDT 时,都会铸造 0.02 SDT 并发送到国库) [7]

veSDT

veSDT 是 Stake DAO 的治理代币。它是一种指示性代币,表示已将 SDT 锁定一段时间。用户锁定的时间越长(最多 4 年),他们在整个平台上的提升和收益就越大。 [7]

治理流程

Stake DAO 生态系统由 veSDT 代币持有者控制,他们对管理生态系统的链下提案(在 Stake DAO 快照上)进行投票。获得多数支持(>50% 的选票)的提案由 DAO Multisig 执行。 [11]

为了实现成功的治理流程,用户需要首先使用提案框架创建一个提案,以便在论坛上分享,然后在论坛上与社区交流至少 2 天。之后,用户可以通过遵循提案框架在 Stake DAO 快照上发布提案。如果成功,提案有效负载将由 DAO Multisig 执行和实施。 [11]

策略

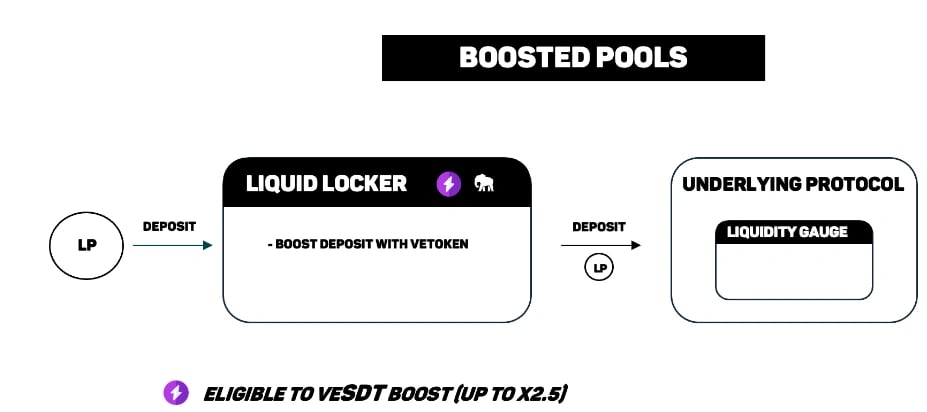

策略是 Stake DAO 的一个组成部分。它们旨在优化 Liquid Lockers 的潜力。底层协议中具有计量器的每个池都可以在 Stake DAO 上具有相应的策略。这些策略由 Liquid Locker 拥有的 veToken 推动,使所有已存入相应策略的用户受益。 [12]

技术

用户可以将他们通过在底层协议中提供流动性而获得的 LP 代币存入策略中,这些代币将被定向到底层流动性计量器。他们可以选择在没有额外 gas 成本的情况下进行存款,随后的存款人将获得先前存款人余额的百分比。策略使用 Liquid Locker veToken 余额来提高奖励,用户可以直接领取奖励或将其重新复利到 Liquid Locker 中,从而确保持续的全面提升。策略也可能获得 SDT 激励以增加收益。 [12]

合作伙伴

B2B

生态系统

架构

Stake DAO 学院

Stake DAO 启动了 Stake DAO 学院,以确保他们的用户了解平台处理的所有术语。学院的目标是成为用户在 crypto 领域学习需求的综合资源。 [8]

Reserve 的投资

2023 年 6 月,stablecoin 协议 Reserve 宣布将投资 2000 万美元用于收益耕作应用程序 Stake DAO (SDT)、Curve (CRV) 和 Convex (CVX) 的治理代币。这项投资旨在增加 Reserve 的稳定币(称为 RTokens)的流动性,并增加 Reserve 在这些应用程序的治理系统中的投票权。 [10]

Reserve 团队表示,2000 万美元的投资可能会为 RTokens 带来新功能,包括“抵押贷款、钱包产品、代币化现实世界资产以及更透明的金融科技系统”。[10]

发现错误了吗?