Subscribe to wiki

Share wiki

Bookmark

1INCH

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

1INCH

The 1inch Network is a decentralized exchange aggregator designed to optimize trades across various decentralized exchanges (DEXes). By sourcing liquidity from multiple platforms, 1inch aims to provide users with the best possible rates and minimize slippage. Sergej Kunz and Anton Bukov are the co-founders of 1inch. On October 1, 2025, the project announced a comprehensive rebrand to reflect its evolution into a core DeFi infrastructure provider. The rebrand included a new visual identity, a mission to unite DeFi with traditional finance, and a new primary domain at 1inch.com.[17][18]

Overview

The 1inch Network, established during the ETHGlobal New York hackathon in May 2019, brings together decentralized protocols to facilitate efficient, fast, and secure operations within the DeFi landscape. Its suite of tools includes the Aggregation Protocol v6, Liquidity Protocol, Limit Order Protocol, P2P transactions, and the 1inch Mobile Wallet. The 1inch dApp, a web-based application connected to supported blockchains via smart contracts, provides access to deep aggregated liquidity and competitive token swap rates across various decentralized exchanges (DEXes), offering unique features such as partial fills and optimal swap path identification across multiple liquidity sources. [1]

Central to the 1inch Network is the Aggregation Protocol, powered by the Pathfinder algorithm (1inch API v5), which facilitates asset exchanges at the best available rates on the market. The Liquidity Protocol, formerly known as Mooniswap, is an automated market maker (AMM) designed to provide capital-efficient liquidity while protecting users from front-running. The Limit Order Protocol also enables users to place limit orders and RFQ orders, offering flexibility and high gas efficiency through gasless limit order features. [1]

Further enhancing its offerings, 1inch facilitates peer-to-peer transactions, allowing users to engage in over-the-counter-style trades of ERC-20 tokens. The 1inch Mobile Wallet, available on iOS and Android, provides a non-custodial solution with optimized swap rates and a seamless Web3 browsing experience. [1]

The 1inch protocols are deployed across numerous blockchain networks, including Ethereum, BNB Chain, Polygon, Arbitrum, Optimism, Gnosis Chain, Avalanche, Base, Linea, Solana, Sonic, Unichain, and zkSync Era, ensuring broad accessibility and interoperability within the DeFi ecosystem. [1]

2025 Rebrand

On October 1, 2025, 1inch unveiled a comprehensive rebrand at the Token2049 conference in Singapore, marking a new phase in its development. The initiative was designed to align the company's identity with its evolution from a DEX aggregator to a core DeFi infrastructure provider a Software-as-a-Service (SaaS) model. At the time of the rebrand, the platform served 25 million users with over $500 million in daily trading volume.[18][19][20]

The rebrand introduced a new slogan, "We move forward as 1," and a refined mission to unite the fragmented DeFi ecosystem and bridge it with traditional financial systems. Co-founder Sergej Kunz stated, "Soon, DeFi will be indistinguishable from traditional finance, but this doesn't mean centralization, it means traditional financial systems and users coming on-chain." The project's web presence was consolidated under the new domain 1inch.com. [20][19]

The new visual identity is based on three principles: simplicity, sophistication, and maturity. It aims to make DeFi more intuitive and accessible for mass adoption while conveying the advanced technology that powers the platform. [18]

Institutional Focus and Security

To support its goal of integrating with traditional finance, 1inch has achieved ISO 27001 certification and a SOC 2 (Type 1) attestation. Announced in October 2025 in partnership with Web3 security firm zeroShadow, the ISO 27001 certification is a globally recognized standard that validates 1inch's information security management system, including its processes for data protection and threat intelligence. With this achievement, 1inch joins other certified industry leaders such as Binance, Coinbase, and Chainlink Labs. These certifications are intended to meet the strict requirements of institutional partners and establish 1inch as a trusted, enterprise-level collaborator capable of meeting the same security standards as traditional finance. [19][20][21]

1inch Network

The 1inch Network comprises three main stakeholders: the 1inch Foundation, the 1inch core contributors, and the 1inch DAO. Each group works independently towards the shared objective of decentralized growth. While they align on goals, they operate autonomously. For instance, the DAO may propose changes, yet if the Foundation cannot execute them, the DAO must finance and implement the changes independently. [1]

1inch Foundation

The 1inch Foundation, an independent non-profit entity, is dedicated to nurturing the growth of the 1inch Network and backing projects beneficial to its community. While the Foundation issued the 1INCH token, the token smart contract control lies with the 1inch DAO within the network. The Foundation manages its funds for funding initiatives, distinct from the DAO treasury. [1]

In June 2025, the 1inch Foundation submitted a proposal to its DAO to compensate users affected by a supply chain vulnerability that occurred in October 2024. The proposal, 1IP-80, outlined a plan to reimburse victims with a total of $768,026 in USDC, sourced from the DAO's treasury. Under the proposed plan, the Foundation would manage the verification and distribution process, which required affected users to complete Know Your Customer (KYC) verification, provide evidence of their losses, and file a report with law enforcement.[22]

1inch Core Contributors

The 1inch Core Contributors constitute a decentralized team within the 1inch Network, primarily focusing on its technical development. Notably, 1inch Labs is the major contributor, specializing in various aspects. These include offering software development services for the 1inch Network and external entities. Moreover, 1inch Labs maintains critical components like the 1inch Pathfinder algorithm and its accompanying API. Additionally, the team serves as a Software-as-a-Service (SaaS) provider, extending its Pathfinder algorithm to specific enterprise clients. [1]

1inch DAO

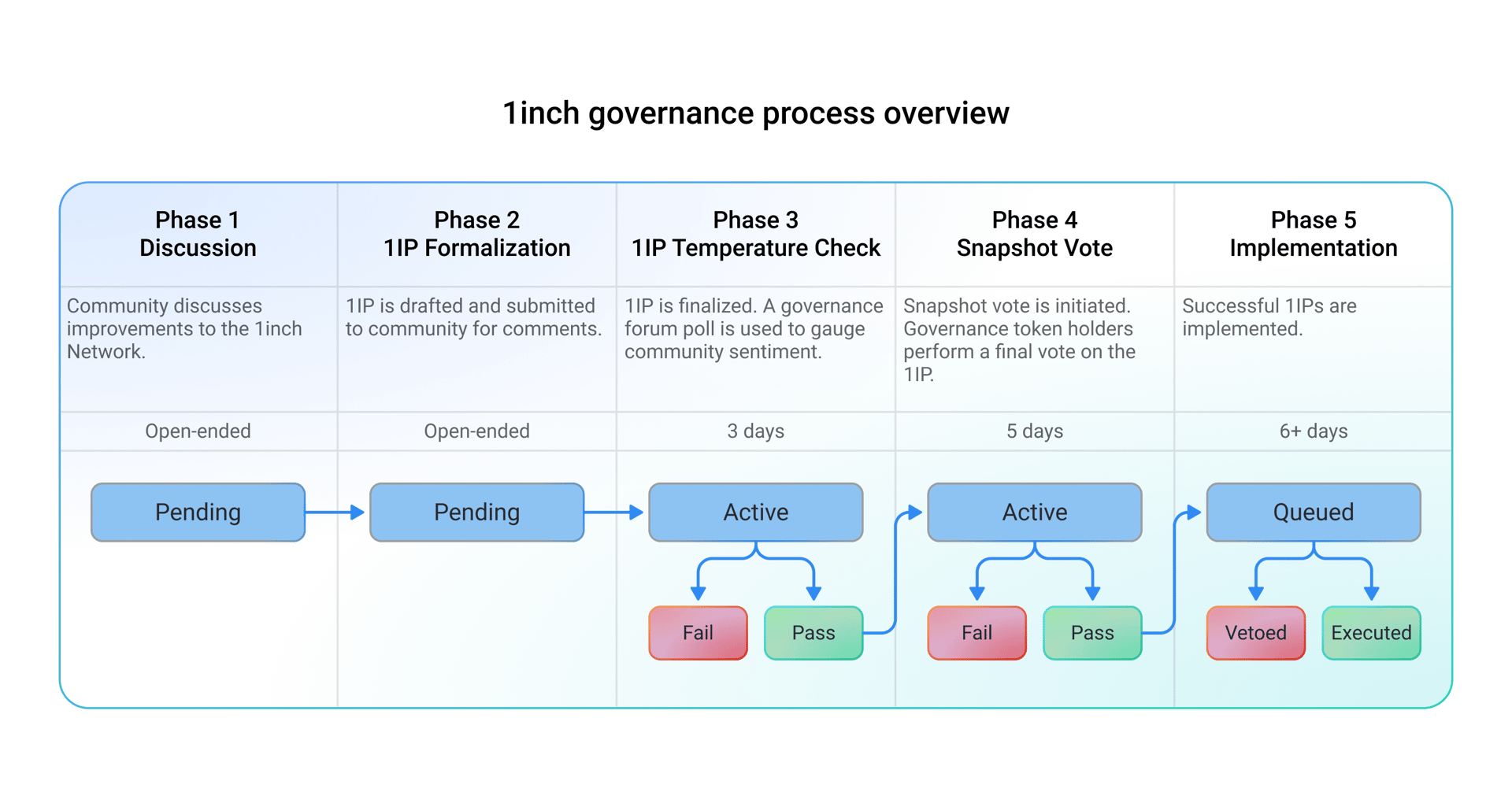

The 1inch DAO is the decentralized autonomous organization responsible for overseeing governance within the 1inch Network, facilitated by a series of on-chain smart contracts. Decisions within the DAO are determined through the 1INCH token, a governance token initially distributed to the broader community of 1inch Network users in late 2020. The 1inch DAO controls various key aspects, including the Liquidity Protocol Instant Governance, Aggregation Protocol Instant Governance, 1INCH token, 1inch Network revenue stream, and 1inch Network DAO Treasury. [1]

Furthermore, beyond managing on-chain assets, the DAO can finance the development of additional modules and contracts and deploy them as needed. This could encompass a range of initiatives, such as alternative front-end platforms, new network deployments, or even fresh API integrations. Given its trust-minimized structure, any actions undertaken by the 1inch DAO necessitate approval through a vote from the 1INCH token holders. [1]

Technology

Pathfinder

The 1inch API v5, Pathfinder, is an advanced discovery and routing algorithm designed to facilitate asset exchanges at optimal rates. It efficiently identifies the most effective paths for token swaps, capable of swiftly navigating between various protocols and market depths to ensure swift execution. [1]

Fusion Swap

The 1inch Fusion Mode allows users to execute swaps without incurring gas fees or facing front-running risks. Conceptually similar to a swap for the user, Fusion Mode technically operates as a limit order with a fluctuating exchange rate, filled by a third party called a Resolver. The exchange rate of the order gradually decreases from the desired rate to the minimal return amount through a Dutch auction mechanism, attracting Resolvers to fill the order. Multiple resolvers compete to fill the order before the rate reaches the minimal return amount. Additionally, Fusion mode is designed to simplify the user experience for cross-chain swaps by abstracting away the technical complexity of traditional bridges and removing the need for users to interact with them directly.[1][23]

Limit Order Protocol

The 1inch Limit Order Protocol comprises smart contracts compatible with various EVM-based blockchains. This protocol offers notable features such as flexibility and gas efficiency by employing two distinct order types: regular Limit Orders and RFQ (Request for Quote) Orders. Users can place these orders off-chain, signed according to EIP-712 standards, before being filled on-chain. This approach ensures a seamless execution process while optimizing gas usage and maintaining high flexibility. [1]

Spot Price Aggregator

The 1inch spot price aggregator comprises smart contracts that extract price data for tokens traded on decentralized exchanges (DEXes) from the blockchain. However, to prevent price manipulations within a transaction, it is advised to utilize the spot price aggregator exclusively off-chain. Using it on-chain may lead to undesirable outcomes. [1]

Rabbithole

The RabbitHole feature addresses sandwich attacks for MetaMask wallets that lack Flashbots support. Implemented initially for MetaMask wallets on the Mainnet from October 17th, 2022, it is a proxy server bridging MetaMask and Flashbots. MetaMask transactions are vulnerable to sandwich attacks when sent to the memory pool instead of directly to validators. To mitigate this, RabbitHole switches MetaMask from the Mainnet to an ad hoc network called RabbitHole, which mirrors the Mainnet but with the ID "1". MetaMask signs transactions under the impression of interacting with the Mainnet but sends them via RabbitHole. The RabbitHole node scrutinizes the transaction destination: if it's the 1inch Router, the transaction is forwarded to Flashbots; otherwise, it's directed to the Mainnet. Users must manually switch networks to RabbitHole in MetaMask as it's not yet supported within dApps. [1]

Tokenomics

1INCH

1INCH, an ERC-20 token, is a governance and utility token within the 1inch Network. Initially introduced to grant governance rights in the 1inch DAO, its utility has expanded to include staking and delegation to 1inch Resolvers responsible for executing 1inch Fusion swaps. [1]

1INCH has a total supply of 1,500,000,000 tokens, with a distribution plan that was scheduled to be completed by the end of 2024. The token had the following initial distribution: [1][3]

- Backers: 30.7%

- Community Incentive Programs: 30%

- Core Contributors: 22.5%

- Growth and Development: 14.5%

- Small Backers: 2.3%

Chi Gastoken

The Chi Gastoken (CHI) is an ERC-20 utility token created by 1inch to help users reduce transaction costs on the Ethereum network. It functions by tokenizing gas, allowing users to mint CHI when gas prices are low and burn it to pay for transactions when gas prices are high. The token is based on the original GasToken concept but includes optimizations for improved efficiency. [2]

Chi operates on the same "storage refund" principle as GasToken. When a user mints CHI, it stores data in a smart contract. When the token is later burned during a transaction, this data is cleared, and the Ethereum network provides a gas refund for freeing up storage space. This refund can offset a significant portion of the transaction's cost. Chi was designed to be more efficient than its predecessor, with minting being 1% more gas-efficient and burning being 10% more gas-efficient than GasToken (GST2). [2]

Funding

In August 2020, the 1inch team closed the first investment round, raising $2.8 million from top institutional investors, including Binance Labs, which led the funding round, Galaxy Digital, Greenfield One, Libertus Capital, Dragonfly Capital Partners, FTX, IOSG, LAUNCHub Ventures, Divergence Ventures, Loi Luu, the founder of Kyber Network, and Illia Polosukhin, the co-founder of NEAR Protocol. [3]

In December 2020, the 1inch team announced a successful closure of a $12 million funding round from institutional investors, including Pantera Capital, ParaFi Capital, and Nima Capital. These funds were used to develop various 1inch products further, hire additional team members, fuel the project’s expansion into new markets, and amplify marketing activities. The full list of investors in this round includes Pantera Capital, ParaFi Capital, Nima Capital, LAUNCHub Ventures, Spark Capital, gumi Cryptos, Fabriс Ventures, Struck Capital, Rockaway Blockchain Fund, Spartan Group, Blockchain Capital, as well as Josh Hannah, Kain Warwick, and Alexander Pack. [3]

In 2021, 1inch raised an additional $175 million from institutional investors. [3]

Partnerships

xBTC

On September 17th, 2020, 1inch announced a partnership with xBTC, the inaugural token of Social Capital. As part of this collaboration, xBTC was granted an Initial Mooniswap Offering (IMO). The partnership aimed to benefit both parties mutually, expanding xBTC's exposure to a broader audience while allowing 1inch users to capitalize on xBTC trade volumes. [4]

“IMOs on 1inch are more attractive for token issuers than other platforms because we provide protection from so-called front running. In turn, 1inch liquidity providers will benefit from the xBTC IMO as there will be substantial trade volumes at the initial stage, and they’ll be able to collect significant interest.” - Sergej Kunz, 1inch co-founder.

Bitquery

On March 2nd, 2021, 1inch partnered with Bitquery.io, a blockchain data provider, to transform the decentralized exchange market landscape with next-generation trading tools. Through this collaboration, Bitquery provided a real-time trading data feed from various decentralized exchanges (DEXes) and protocols to 1inch. This integration enabled 1inch to display intricate DEX trade data, enhancing the overall trading experience for users on the platform. [5]

Ren

On March 23rd, 2021, the 1inch Foundation announced a partnership with Ren, offering liquidity providers additional benefits through a joint liquidity mining program. The program involved distributing an equivalent of $20,000 in 1INCH tokens and an equivalent amount in renBTC among liquidity providers to the 1INCH-renBTC pool over a four-week period, ending on April 21, 2021. [6]

Mercuryo

On May 27th, 2021, 1inch Wallet integrated with Mercuryo, allowing users to purchase DeFi assets using a fiat-on-ramp gateway. This integration aimed to reduce the barrier to entry for DeFi solutions by enabling users to buy cryptocurrency with fiat quickly and easily. With this update, the 1inch Wallet for iOS introduced the fiat feature, providing access to millions of users worldwide through the Mercuryo fiat-to-crypto gateway solution. Consequently, the 1inch Wallet became a comprehensive entry point to DeFi, offering users access to deep liquidity and secure swaps within a single mobile app. [7]

Bitpay

On August 31st, 2021, the 1inch Network announced its integration with BitPay, a global Bitcoin and cryptocurrency payment services provider. This integration enabled BitPay Wallet app users to access the 1inch DEX aggregation functionality directly within the application. Users could benefit from competitive rates for cryptocurrency swaps offered by the 1inch Network without needing to switch between apps, enhancing the overall user experience and expanding the utility of the BitPay Wallet app for cryptocurrency enthusiasts. [8]

Hashflow

In September 2021, the 1inch Network integrated with Hashflow, a DeFi exchange, to bring institutional liquidity and pricing strategies to the DeFi space to enhance market efficiency. This collaboration provided Hashflow with increased visibility and access to a broader customer base, while users of 1inch gained access to another significant liquidity provider. [14]

Travala

On May 26th, 2022, the 1inch Network announced an exciting partnership with Travala.com, the prominent crypto-friendly online travel agency. This collaboration facilitated the addition of the 1INCH token as a payment option on the Travala.com platform, providing users with more flexibility and choice when booking travel accommodations. [9]

“Mass adoption of 1inch products and solutions is always high on the agenda. And the integration with Travala.com is a major step in that direction, as it creates new utility for the 1INCH token and provides exposure to numerous potential users.” - Sergej Kunz, 1inch co-founder.

Wirex

On August 2nd, 2022, the 1inch Network announced a new integration with the fiat/crypto payment platform Wirex, marking another significant milestone. This integration involves adding the 1inch Aggregation API to Wirex's non-custodial wallet, enabling users to access token exchange functionality powered by 1inch's advanced algorithms. With this integration, Wirex users can benefit from favorable token exchange rates facilitated by 1inch's Pathfinder algorithm, enhancing their trading experience within the platform. [10]

UnstoppableDomains

On October 4th, 2022, the 1inch Network revealed an exciting collaboration with Unstoppable Domains, a provider of NFT domain names and digital identity solutions. This partnership introduces a new feature for 1inch Wallet users, allowing them to utilize human-readable domain names when conducting transactions, thereby simplifying the process of buying or sending crypto assets. [11]

Burrito Wallet

On February 9th, 2023, the 1inch Network unveiled a strategic collaboration with Burrito Wallet, a Web3 wallet developed by Bithumb, a Korean cryptocurrency exchange. This partnership aims to empower Bithumb users by offering them seamless access to optimal token prices on decentralized exchanges (DEXes). By leveraging this integration, Bithumb users can tap into extensive liquidity pools across various DEXes, potentially leading to cost savings or profit opportunities when trading cryptocurrencies. [12]

Revolut

On February 27th, 2023, the 1inch Network initiated a crypto "Learn & Earn" course in collaboration with Revolut, a global financial super-app. This partnership proved highly beneficial, effectively disseminating DeFi knowledge to individuals worldwide. [13]

Lighter.xyz

On June 30th, 2023, the 1inch Network announced a partnership with Lighter.xyz, a decentralized spot order book exchange. Lighter's order books comprise 30-50% of 1inch's Arbitrum volume, further strengthening their ability to provide market efficiency and optimal price discovery. [15]

“Active traders appreciate the advantages of utilizing on-chain order books, which are further amplified when applied in highly liquid markets like WBTC and WETH. Lighter is dedicated to delivering exceptional trade execution while further strengthening our partnership with 1inch. We eagerly anticipate exploring additional opportunities to support 1inch in maintaining their market-leading aggregation experience.” - Vladimir Novakovski, Lighter.xyz CEO.

Ground X

On August 2nd, 2023, the 1inch Network announced a partnership with Ground X, an affiliate of South Korean Internet giant, Kakao. This collaboration involved integrating the 1inch Swap API into Klip, a multichain mobile wallet launched by Ground X. [16]

Coinbase

As part of its expanding SaaS business segment, 1inch's Swap API was integrated into the Coinbase app, which was highlighted as one of 1inch's most significant U.S. clients. The integration provides Coinbase users with direct access to a wide array of on-chain assets through 1inch's aggregation technology, expanding beyond the limited set of coins previously offered in its centralized environment. This partnership is a key example of 1inch's strategy of providing non-custodial swap solutions for centralized crypto and TradFi companies. Other major platforms that utilize 1inch's infrastructure for swaps include Binance, Ledger, MetaMask, and Trust Wallet. [19][18]

Ledger

1inch has integrated Ledger's direct connectivity feature, becoming the first dApp to do so. This allows users to connect their Ledger hardware wallets to the 1inch dApp on desktop with a single click, streamlining the process for secure token swaps. The integration maintains Ledger's security standards by keeping users' private keys offline and requiring physical confirmation for every transaction on the hardware device. The feature launched for use on Chromium-based browsers like Chrome and Brave and is available for EVM-compatible chains.[24]

Blockscan

On December 15, 2025, 1inch announced a collaboration with Blockscan, the cross-chain arm of the Etherscan team, to launch a dedicated explorer for its cross-chain transactions. This tool, the 1inch Cross-chain Swap scanner, offers the first explorer-grade view into 1inch's cross-chain swaps. The scanner aims to improve transparency and traceability by allowing users to view an entire transaction end-to-end, which also helps with more efficient debugging and integrator support.[25]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)