Subscribe to wiki

Share wiki

Bookmark

Maverick Protocol

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Maverick Protocol

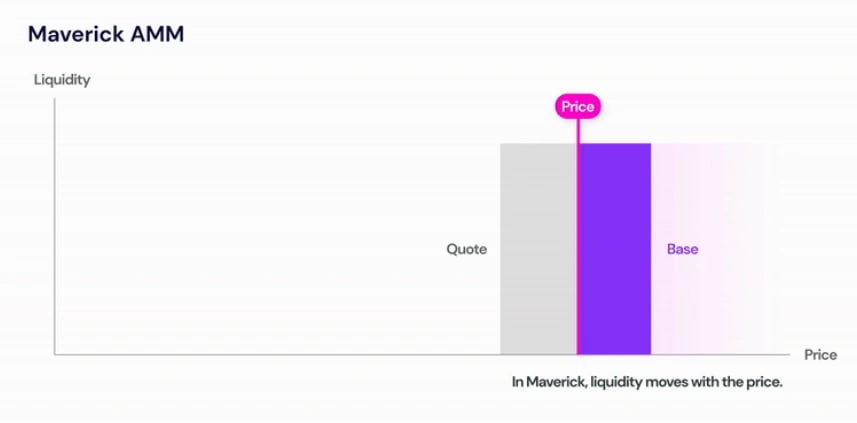

Maverick Protocol offers decentralized finance (DeFi) infrastructure designed to enhance liquidity in the market for traders, liquidity providers, decentralized autonomous organization (DAO) treasuries, and developers. It utilizes a Dynamic Distribution Automated Market Maker (AMM) to optimize capital efficiency and automate liquidity concentration. [1]

Overview

Maverick Protocol introduced their Dynamic Distribution AMM on March 8, 2023, aiming to bring efficiency to liquidity management in smart contracts. By automating liquidity strategies that previously required frequent maintenance or external protocols, Maverick Protocol enables more liquid markets and improved prices for traders. Liquidity providers (LPs) can choose directional bets on specific tokens, concentrating their exposure within a pool. This approach eliminates the need for manual adjustments and reduces gas fees. The Maverick dApp, available on Ethereum and zkSync Era, allows users to trade and provide liquidity with a user-friendly Swap interface and Pools interface. [1][2][3]

Maverick AMM Features

Automated Concentration Liquidity

Maverick AMM automates the movement of liquidity concentration as prices change, maximizing capital efficiency for liquidity providers. This feature eliminates the need for manual adjustments and reduces gas fees, resulting in more liquid markets and improved prices for traders. Liquidity providers can select from various liquidity shifting modes that monitor and reconcentrate liquidity based on price movements, ensuring optimal capital utilization. [2]

Directional LPing

Directional LPing

Liquidity providers can choose to follow the price of a specific token in a single direction, allowing them to make directional bets on asset prices. By automatically reconcentrating liquidity as the price moves in the chosen direction, liquidity providers can capture more fees and avoid impermanent loss. This directional LPing feature enables LPs to align their liquidity positions with their market beliefs and optimize their risk-reward profile. [2][4]

Modes

Maverick introduces four distinct modes for directional LPing, offering liquidity providers (LPs) various options to align their liquidity positions with their price predictions. [5]

Static Mode

In the "Static" mode, LPs can stake their liquidity within a fixed range, similar to conventional range AMM LPing. This mode provides stability and is suitable for LPs who prefer a conservative approach without actively adjusting their positions in response to price fluctuations. [5]

Right Mode

For LPs with a bullish outlook, the "Right" mode allows them to stake their liquidity in the bin to the left of the active bin as the price increases. By following the price movement, LPs can capture potential gains and benefit from upward price trends. This mode is well-suited for LPs who believe that the asset's value will appreciate and wish to optimize their returns in a rising market. [5]

Left Mode

Conversely, the "Left" mode caters to LPs with a bearish stance. LPs utilizing this mode stake their liquidity in the bin to the right of the active bin as the price decreases. This approach enables them to capitalize on downward price movements and mitigate potential losses during price declines. The "Left" mode is ideal for LPs who anticipate a decrease in the asset's value and aim to protect their capital from adverse market conditions. [5]

Both Mode

In the "Both" mode, LPs have the flexibility to stake liquidity in both directions. This mode allows LPs to adapt to market dynamics and capture opportunities in price movements, regardless of the direction. LPs using the "Both" mode can benefit from the versatility of having liquidity positioned on both sides of the active bin, enabling them to generate fees and optimize returns in various market scenarios. [5]

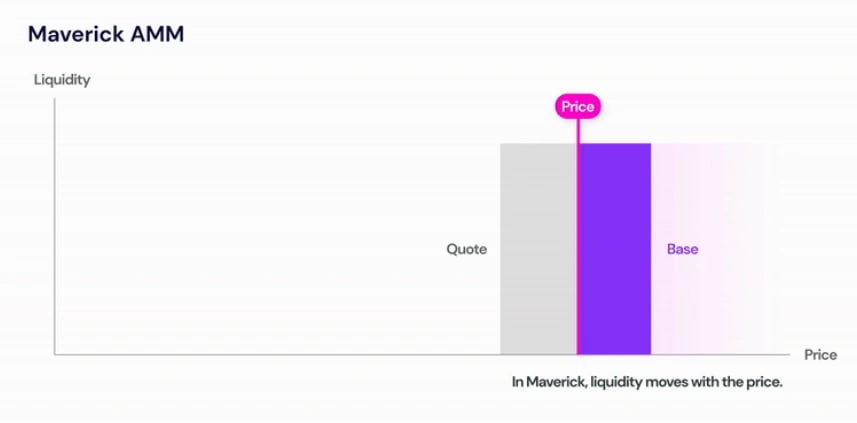

Customizable Liquidity Positions

Customizable Liquidity Positions

Maverick offers LPs the flexibility to configure their own distribution of liquidity along a pool's price range. This customization empowers liquidity providers to implement risk-optimized strategies and tailor their liquidity positions to specific market conditions. By designing their own custom distribution, LPs can maximize their fee rewards while managing their impermanent loss exposure effectively. [2]

MAV Token

MAV serves as the native utility token within the Maverick ecosystem, primarily intended for staking, voting, and boosting purposes. This ERC-20 token incorporates LayerZero's Omnichain Fungible Token (OFT) extension, allowing for seamless bridging of MAV across different chains (to be introduced in the future). Currently, MAV is operational on Ethereum mainnet, zkSync Era, and Binance Smart Chain. [6]

Tokenomics

The total supply of MAV tokens is set at 2,000,000,000, representing the maximum amount that will ever be created. The circulating supply of MAV tokens amounts to 250,000,000, which constitutes approximately 12.5% of the total token supply. [7]

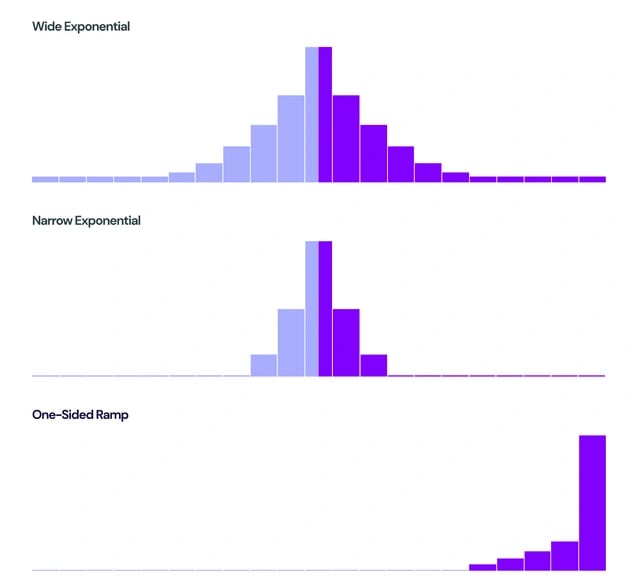

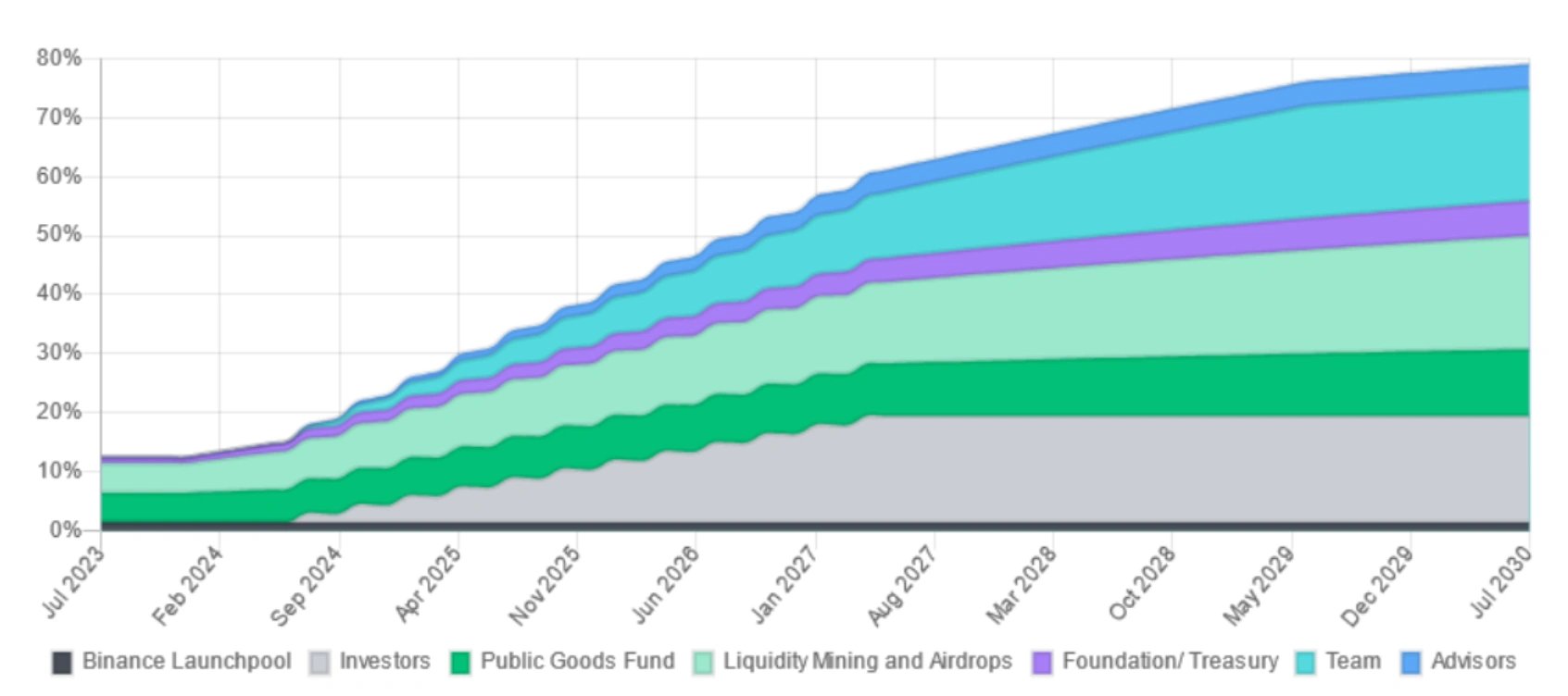

Token Allocation

MAV tokens are allocated among various categories as follows: [8]

- Binance Launchpool: 1.50% of the total token supply

- Investors: 18.00% of the total token supply

- Public Goods Fund: 16.50% of the total token supply

- Liquidity Mining and Airdrops: 30.85% of the total token supply

- Foundation/Treasury: 10.00% of the total token supply

- Team: 19.00% of the total token supply

- Advisors: 4.15% of the total token supply

Token Release Schedule The remaining allocation for the Public Goods Fund, Liquidity Mining and Airdrops, and Foundation/Treasury categories will gradually vest beyond July 2030, ensuring a controlled release of MAV tokens over time. [8]

Staking

The Maverick ecosystem offers users the opportunity to participate in staking MAV tokens and earn vote-escrowed MAV (veMAV). veMAV is a governance token that cannot be transferred and is obtained by staking MAV tokens in the Maverick voting-escrow contract. The veMAV balance determines the user's voting power in governance proposals and influences incentive direction on the Maverick Protocol. [9]

The veMAV balance is calculated based on the amount of MAV tokens staked and the duration of the stake. A larger veMAV balance is achieved by staking more MAV tokens for a longer period. This ensures that users with a stronger commitment to the long-term success of the protocol have a greater influence in the voting process. [9]

During the staking period, the staked MAV tokens cannot be redeemed. At the end of the staking period, if a user claims their MAV tokens, the corresponding veMAV balance will be burned. Users have the flexibility to extend the duration of their stake at any time. Maverick utilizes the Origin voting-escrow contract, which has been specifically developed for this purpose. [9]

Maverick's model, inspired by Curve's success, aims to provide a strategic edge. Unlike traditional ve systems, Maverick introduces "Boosted Positions," enabling precise targeting of liquidity distribution within a pool. This approach optimizes incentive efficiency, enabling protocols to achieve liquidity goals with minimal capital. [16]

Voting Power Calculation

The veMAV balance directly correlates to the user's voting power within the protocol. It is determined by two factors: the amount of MAV tokens staked and the duration of the staking period. A multiplier is applied to the staked MAV tokens, and this multiplier increases as the duration of the staking period lengthens. The maximum staking period is 4 years, while the minimum is one week. [10]

The staking multiplier grows exponentially with each additional year in the staking period. It follows a 1.5x growth pattern, meaning that extending the staking period by one year results in a 1.5x boost to the veMAV balance. The staking multiplier curve can be expressed as 1.5^(staking period end - contract launch), where the further the staking period end is from the contract launch, the higher the staking multiplier. [10]

Over time, the voting power of older stakes will dilute as newer stakes with higher multipliers are introduced. Maximizing voting power involves staking MAV for the maximum 4-year period and regularly extending the staking period. [10]

Airdrop

The Maverick Ecosystem Incentives Pre-Season Airdrop, rewards users and community members who contributed to Maverick's growth and success during the pre-launch and early launch phases. The airdrop includes participants on Ethereum mainnet and zkSync Era, with a total of 26,155 Ethereum wallet addresses and 96,075 zkSync Era wallet addresses from the snapshot taken on June 22, 10:00 UTC. The airdrop encompasses various criteria and rewards, which are divided across both chains and allocated based on specific behaviors and personas. [11]

Upon claiming the airdrop, users have the option to stake their MAV tokens in the Maverick Voting Escrow contract to receive veMAV tokens. Staking the airdropped tokens makes users eligible for a share in the subsequent airdrop for veMAV holders. A second snapshot for veMav voting incentives will be taken on July 27, with 10,000,000 MAV distributed pro rata based on the veMav balance on that date. [11]

Allocation

The airdrop is allocated as follows:[12]

- Liquidity Providers: 60.7% of the airdrop, totaling 18,210,000 MAV

- Ethereum mainnet: 60% allocation

- zkSync Era: 40% allocation

- Maverick Warriors: 1.3% of the airdrop, totaling 390,000 MAV

- Ethereum mainnet: 100% allocation

- Voters: 3% of the airdrop, totaling 900,000 MAV

- zkSync Era: 100% allocation

- Traders: 15% of the airdrop, totaling 4,500,000 MAV

- Ethereum mainnet: 70% allocation

- zkSync Era: 30% allocation

- MAVA Holders: 20% of the airdrop, totaling 6,000,000 MAV

- Ethereum mainnet: 37% allocation

- zkSync Era: 63% allocation

Criteria

Each category has specific criteria for determining rewards, such as the dollar value of liquidity provided and the duration of liquidity provision for liquidity providers, Maverick Warrior Credits earned for Maverick Warriors, participation in early governance for voters, and trading volume for traders. MAVA holders are rewarded based on their ownership of specific MAVA NFTs distributed during different phases of Maverick's development. [13]

Maverick Warriors Program

On November 24, 2022, Maverick Protocol launched the Maverick Warrior Program, a 60 day community-driven incentive program designed to recognize and reward community leaders and contributors known as Maverick Warriors. This program aimed to foster collaboration and empower community members to contribute their talent and effort towards the growth and education of the Maverick community. [14]

“What we need to do next is build a robust and thoughtful framework that fosters ideas and initiatives that come from the community itself.”

Program Structure

The Maverick Warrior Program consists of two key components: the Maverick Warrior Credit (MWC) system and the Workflow.[14]

Maverick Warrior Credit (MWC) System

The Maverick Warrior Credit (MWC) System is a reputation-based framework designed to recognize and promote leaders and contributors within the Maverick community. It consists of different roles, including Community Members, Voters, Maverick Warriors - Contributors, Maverick Warriors - Key Contributors, and the Maverick Committee. Each role has specific qualifications and powers, such as the ability to review ideas, submit proposals, participate in the execution process, and manage community voting.[14]

Workflow

The Maverick Warrior Program follows a structured workflow to ensure effective execution of ideas and proposals. Community members can review, comment on, and discuss ideas or proposals on the Maverick Discord platform. Voters, who hold Mava NFTs, can join the proposal execution process as performers, with their work being evaluated for qualified deliverables. Contributors can submit proposals to the Maverick Committee and actively participate in the execution process. Key Contributors have the authority to present proposals directly to the community without prior committee approval. The Maverick Committee manages proposal vetting, community voting, verification of deliverables, and the distribution of rewards. This workflow ensures transparency and accountability in the Maverick Warrior Program.[14]

Funding

On June 21, 2023, Maverick Protocol announced the completion of a $9M strategic funding round. The round was led by Founders Fund, a venture capital firm, and saw participation from notable blockchain-focused venture firms, including Pantera Capital, Binance Labs, Coinbase Ventures, and Apollo Crypto. The funds will be used to expand the development of more efficient Liquid Staking Token (LST) infrastructure and address cross-chain liquidity inefficiencies. Additionally, the capital will support the protocol's expansion to new chains, provide support for developers building on its infrastructure, and attract more projects to its growing ecosystem. [15]

“Maverick has quickly established itself as a hub for liquid staking token trading whilst having greater capital efficiency for liquidity providers. The company’s surgical approach to decentralized finance will push the entire industry forward,” - Joey Krug, Partner at Founders Fund.

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)