Subscribe to wiki

Share wiki

Bookmark

Ethena

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Ethena

Ethena Labs is a decentralized protocol developed on the Ethereum blockchain. Its purpose is to offer a crypto-based alternative to traditional banking systems. Founded by Guy Young, the protocol introduces a globally accessible and permissionless savings instrument known as the 'Internet Bond,' (USDe) denominated in dollars. [1][2][3]

Overview

Ethena is a DeFi startup that offers derivative infrastructure to transform Ethereum into the first crypto-native yield-bearing synthetic dollar, independent of traditional banking systems. [1][3]

Ethena's product suite includes a delta-neutral synthetic dollar, USDe featuring embedded yield, globally accessible floating and fixed-rate USD-denominated bonds, and capital-efficient and composable leverage. Users can deposit USD, Ethereum, or liquid staking tokens as collateral to create USDe. This marks the first decentralized, scalable, and stable asset, deriving returns from the economic activity of Ethereum and futures markets. [3]

To ensure security, transparency, and programmability, Ethena distributes collateral to a diverse set of on-chain MPC (Multi-Party Computation) custodial contracts, eliminating the reliance on centralized servers for custody and mitigating counterparty risk. [1]

USDe generates embedded yield for users through staked Ethereum returns and by capturing the basis in ETH perpetual funding rates. [1]

“We want to separate the most important instrument in crypto, which is the stablecoin, from the banking system. The point of everything we're trying to do is to create a self sufficient system, and yet the most important asset is completely centralized”. - [Guy Young] - (https://iq.wiki/wiki/guy-young) on goals for Ethena & its stablecoin, USDe

2025 Roadmap

Ethena's 2025 roadmap focuses on integrating its synthetic dollar product into traditional finance (TradFi). The primary initiative for the first quarter is the launch of iUSDe, an extension of sUSDe, incorporating a wrapper contract with transfer restrictions at the token level. Ethena plans to collaborate with TradFi distribution partners to expand access to iUSDe.

Targeted users include asset managers, private credit funds, exchange-traded products, private investment trusts, and prime brokers. The roadmap highlights the potential for yield-bearing synthetic dollars to attract interest from the $190 trillion fixed-income market. By leveraging staking rewards and shorting Ether perpetual futures, Ethena seeks to position its synthetic dollar as a viable alternative for capital preservation and yield generation in both crypto and traditional finance sectors. [9]

Converge Blockchain Launch

Ethena Labs, in collaboration with Securitize, is set to launch Converge, an Ethereum Virtual Machine (EVM)-compatible blockchain designed to integrate traditional finance (TradFi) with decentralized finance (DeFi). Expected to go live in Q2 2025, Converge aims to facilitate both retail and institutional access to DeFi and tokenized assets. [10]

Funding

In July 2023, Ethena raised $6 million in a seed funding round led by crypto-focused venture capital firm Dragonfly with participation from BitMEX founder Arthur Hayes and his family office, Maelstrom. Additionally, major crypto derivatives exchanges Deribit, Bybit, OKX, Gemini, and Huobi, along with several venture capital and trading firms, also invested in the round. [4]

The $6 million seed investment was to enable Ethena to prepare for the launch of its stablecoin and bond asset, USDe. The company planned to complete the testnet phase, establish partnerships with industry leaders, and conduct smart contract audits to ensure the security and efficiency of the protocol. [4][5]

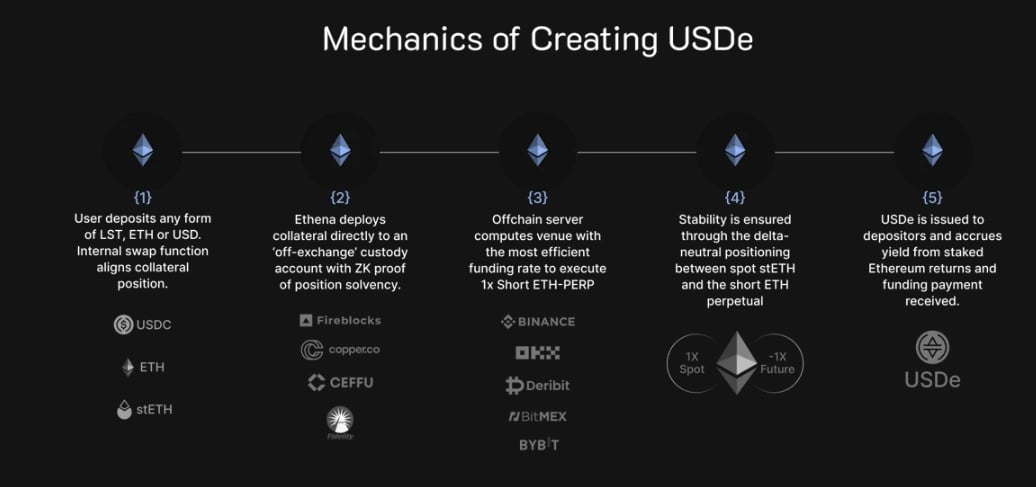

USDe Creation Mechanics

USDe is generated through a user depositing either LST, ETH, or USD. The internal swap function harmonizes with the collateral position. Subsequently, Ethena directs the collateral to an off-exchange custody account, providing a ZK proof of position solvency. The off-chain server calculates the venue with the most efficient funding rate, executing a 1x short ETH-PERP. Stability is ensured through the delta-neutral positioning between spot stETH and the short ETH perpetual. [3]

Depositors receive issued USDe, which accumulates yield from staked Ethereum returns and funding payments received. This process ensures a transparent and secure mechanism for creating and maintaining USDe within the Ethena ecosystem. [1][3]

Scalability is achieved by utilizing derivatives which allow for USDe to scale without significant over-collateralization since the staked ETH collateral can be perfectly hedged with a short position of equivalent notional, the stablecoin only requires 1:1 collateralization.

Stability is provided through unlevered short perpetual positions executed against the collateral immediately on issuance which ensures the position is delta-neutral and that USDe is never issued to users without the initial notional balance being perfectly hedged. [3]

Censorship Resistance is achieved by separating collateral from the banking system and storing trustless crypto collateral outside of centralized liquidity venues in on-chain, transparent, 24/7 auditable, programmatic custody account solutions. [3]

Developments

Ethena Labs x WLFI

On December 18, 2024, Ethena Labs announced a strategic partnership with Donald Trump-backed World Liberty Financial to integrate Ethena’s sUSDe token — a staked version of its USDe “synthetic dollar” — with World Liberty Financial’s Aave instance, enabling users to deposit USDe and receive rewards in both sUSDe and World Liberty’s WLF token. [7]

"Ethena has entered into a strategic partnership with @worldlibertyfi. A governance proposal has been submitted to add sUSDe to WLFI's upcoming Aave instance as a core collateral asset

Should it pass, this proposal will enable @worldlibertyfi users to benefit from sUSDe rewards and also WLF token rewards. This integration will increase stablecoin liquidity and utilization rates on the protocol, as sUSDe's integration has on Aave's Core instance" - the Ethena Labs team tweeted

Ethena Withdraws from German Market

On April 15, 2025, Ethena agreed to wind down its operations in Germany.

The decision comes three weeks after BaFin, Germany's finance regulator, identified "serious deficiencies" in Ethena's USDe token and said that the company was offering securities in Germany without approval.

"We have agreed with BaFin to wind down all activities of Ethena GMBH and will no longer be pursuing the MiCAR authorization in Germany," Ethena said in a tweet.

It added that all previous users will be onboarded to Ethena BVI, the protocol's entity in the British Virgin Islands. [11]

Ethena x TON

On May 1st, 2025, Ethena announced a partnership with The Open Network (TON) to make its stablecoins available to Telegram’s user base of over one billion people.

The partnership was announced at Token2049 in Dubai, which will see the deployment of Ethena’s USDe and Ethena Staked USDe (sUSDe) natively within the TON blockchain.

The sUSDe variant will be integrated under the name tsUSDe, enabling Telegram users to access US dollar-denominated savings directly within Telegram. [12]

The deployment involves two major Ethena integrations, including one in the custodial Wallet in Telegram and the second in the TON Space wallet, a self-custodial wallet integrated in the messenger.

"This represents one of Ethena's most meaningful launches to date

Telegram has truly global distribution across its billion users, with presence in emerging economies in regions like Asia, Africa, and Latin America

Users within these countries can now all benefit from a globally accessible dollar savings vehicle via Ethena's USDe right within their Telegram app" - Ethena tweeted [13]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)