위키 구독하기

Share wiki

Bookmark

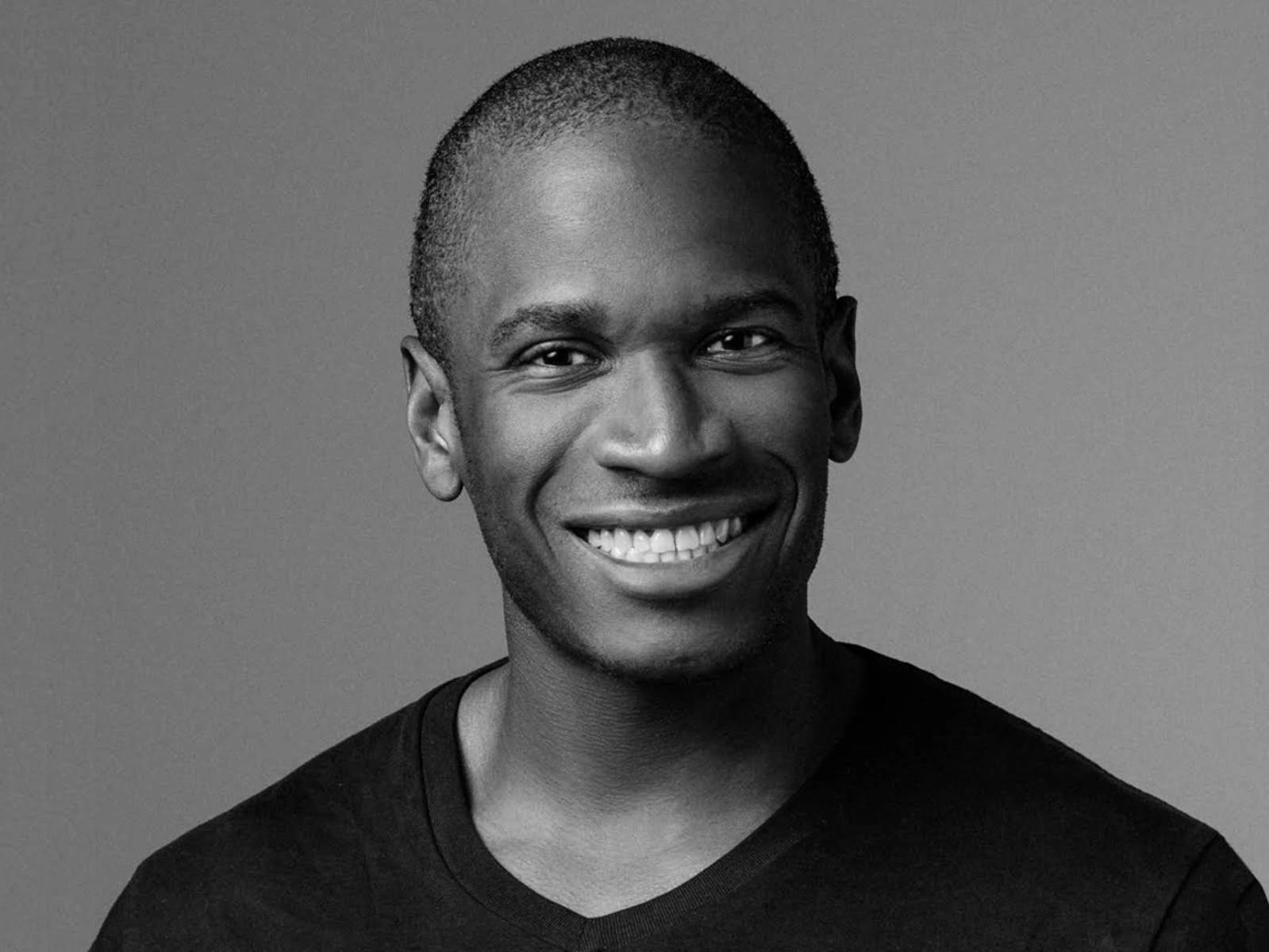

Arthur Hayes

0%

Arthur Hayes

아서 헤이즈(1985년 출생)는 미국의 기업가이자 암호화폐 거래소 BitMEX (비트코인 머천트 익스체인지)의 공동 창립자 겸 전 CEO입니다. 그는 또한 100x 그룹의 공동 창립자이자 Maelstrom의 최고 투자 책임자입니다. 그는 홍콩에 거주하고 있습니다. [1][2][6]

초기 생애 및 교육

아서 헤이즈는 미국 미시간주 디트로이트에서 제너럴 모터스(GM)에서 일하는 중산층 부모에게서 태어났습니다. 그는 뉴욕주 버팔로에 있는 사립 예비 학교인 니콜스 스쿨에 다녔으며, 그곳에서 대표 테니스 선수와 대표 크로스컨트리 선수로 활동했습니다. 그는 2004년에 반에서 2등으로 졸업했습니다. 그의 가족은 그가 학생이자 운동선수로서 이상적인 학습 환경을 제공할 것이라고 생각하는 학교를 찾은 후 버팔로로 이사했습니다. 헤이즈는 이후 학생들이 니콜스에서 받은 것과 같은 양질의 교육을 경험할 수 있도록 장학금을 만들었습니다. 그의 어머니인 바바라 헤이즈는 "니콜스는 그에게 번성할 수 있는 환경, 자극, 그리고 한때는 장학금을 제공했습니다."라고 말했습니다. [4][5]

2006년 헤이즈는 홍콩 과기대 경영대학원에 다녔습니다. 그는 2008년 펜실베이니아 대학교 와튼 스쿨에서 경제학, 금융학 학사 학위를 받았습니다. [3][5]

경력

헤이즈는 도이치 은행에서 대학원 프로그램 계약을 체결하여 런던 사무실에서 근무한 후 투자 은행 경력을 이어가기 위해 홍콩으로 이주했습니다. 그는 2008년부터 2011년까지 도이치 은행에서 주식 파생 상품 트레이더 및 어소시에이트로 근무했습니다. 2011년에는 헤이즈는 도이치 은행을 떠나 2013년 5월까지 홍콩의 씨티은행에서 델타 원 트레이더로 일하기 시작했으며, 이는 이후 암호화폐 관련 작업의 기반이 되었습니다. [2][5]

BitMEX

아서 헤이즈는 옥스퍼드에서 교육을 받은 수학자/소프트웨어 개발자 벤 델로와 프로그래머/암호화폐 애호가 사무엘 리드와 협력하여 2014년에 암호화폐 거래소 BitMEX를 공동 설립했습니다. 그들은 "Coinbase, Binance, Coinmama와 직접 경쟁할 수 있는 최고의 P2P 거래 플랫폼"을 구축하고자 했습니다. 그들은 레버리지 계약, 콴토 선물, 영구 스왑을 사용하여 복잡한 시스템을 구축했습니다. 이를 통해 사용자는 다른 파생 상품을 거래할 수 있는 것처럼 비트코인을 거래할 수 있었습니다.

“2013년에 거래를 시작했을 때 [\[\[\비트코인] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)을 거래할 수 있는 더 전문적인 거래소를 만들고 싶었습니다. 이런 것은 없었습니다.” [5]

Bitmex는 시장 조성자 역할을 하며 가격 변동 위험 때문에 기업들이 대차대조표나 결제 수단으로 암호화폐를 받아들이기를 주저할 때 비트코인을 보유합니다. Bitmex는 가장 복잡한 거래 시스템 중 하나를 구축하여 투자자들을 유치했습니다. 첫날 거래에서 5천만 달러의 수익을 올렸고, 첫해에는 10억 달러 이상의 수익을 창출했습니다. [1][5]

“우리는 돈 이체 측면에서 [\아날로그] - (https://iq.wiki/wiki/analog) 사회에서 디지털 사회로 이동하고 있으며, 이는 엄청난 혼란을 야기할 것입니다. 그리고 저는 [\[\[\비트코인] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)과 암호화폐를 통해 이 엄청나게 혼란스러운 변화로부터 이익을 얻을 수 있는 회사를 만들 수 있는 기회를 보았습니다. 그리고 [\[\[\비트코인] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)의 가장 큰 장점은 [\허가 불필요] - (https://iq.wiki/wiki/permissionless)하다는 것입니다. 소프트웨어가 있습니다. 저와 제 공동 창업자들은 비즈니스 모델이 있다는 것을 알았습니다. 우리는 이것을 구축하기 위해 허가를 요청할 필요가 없었고, 다른 어떤 산업에서 세 명의 남자가 가서 하루에 수십억 달러의 매출을 올리는 거래소를 구축하려고 할 수 있겠습니까?” – 2020년 8월 Forkast 팟캐스트와의 인터뷰에서 헤이즈가 말했습니다. [7]

2019년 12월, BitMEX와 CEO는 전 JPMorgan Chase 상품 파생 상품 거래자이자 2015년 BitMEX의 첫 시드 투자자라고 주장하는 Frank Amato와 RGB Coin Ltd.로부터 3억 달러에 대한 소송을 당했습니다. 소송에 따르면 초기 3만 달러 투자는 나중에 지분으로 전환될 예정이었지만 지분을 받지 못했다고 보고서는 덧붙였습니다. 2021년 1월, 소송은 법정 밖에서 합의되었다고 주장하는 한 변호사와 함께 종료되었습니다. [8][9][10]

2020년 10월, 헤이즈와 그의 사업 파트너들은 미국 상품 선물 거래 위원회(CFTC)로부터 적절한 자금 세탁 방지 프로그램을 시행하고 유지하지 않아 은행 비밀 보호법을 위반했다는 혐의로 기소되었습니다. 6개월 후인 2021년 4월, 아서 헤이즈는 하와이에서 미국 당국에 자수했습니다. 그는 뉴욕에서 향후 절차가 진행되는 동안 1천만 달러의 보석금을 내고 석방되었습니다. [11][12]

2021년 8월, BitMEX는 CFTC 및 금융범죄단속네트워크(FinCEN)와의 소송 해결을 위해 최대 1억 달러를 지불하기로 합의했습니다. 발표에서 CFTC는 뉴욕 남부 지방 법원이 HDR Global Trading Limited, 100x Holding Limited, ABS Global Trading Limited, Shine Effort Inc Limited 및 HDR Global Services Limited에 대해 BitMEX 플랫폼을 불법적으로 운영한 혐의로 동의 명령을 내렸다고 밝혔습니다. [13]

2022년 2월, Hayes와 BitMEX 공동 창립자들은 자금세탁 방지 프로그램이 없었던 것에 대해 유죄를 인정했습니다. Hayes는 자선 활동 경력이 있는 초범으로서 범죄로 인한 이익을 반영하여 6개월의 가택 연금, 2년의 보호 관찰 및 1천만 달러의 벌금형을 선고받았습니다. [14]

100x 그룹

아서 헤이즈는 2020년 7월에 100x 그룹을 공동 설립하고 2020년 10월까지 CEO를 역임했습니다. 100x 그룹은 BitMEX의 모회사인 HDR Global Trading을 포함하는 지주 회사입니다. 이 그룹은 디지털 금융 시스템을 보다 포괄적인 시스템으로 재편성하는 것을 목표로 설립되었습니다. [15]

Maelstrom

2022년 12월, 아서 헤이즈는 상품, 인프라 및 서비스에 투자하는 헤이즈 가족 사무실 펀드인 Maelstrom의 최고 투자 책임자(CIO)가 되었습니다. 2023년 3월, 헤이즈는 링크드인에 다음과 같이 게시했습니다.

"가족 사무실인 Maelstrom에 대해 더 공개하게 되어 기쁩니다. 글로벌 컨퍼런스에서 투자 책임자인 Akshat Vaidya를 보실 수 있을 것입니다. 한번 제대로 망쳐봅시다!"[32][16]

2024년 7월 17일, Maelstrom은 비트코인 개발자를 지원하기 위한 보조금 프로그램을 발표했습니다.

"[[[비트코인] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)은 암호화폐 공간의 기반 자산이며 다른 암호화폐 프로젝트와 달리 [[[비트코인] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)은 기술 개발을 위한 자금 조달을 위해 제안을 진행한 적이 없습니다. Maelstrom은 이 공간의 다른 회사와 마찬가지로 오픈 소스 [[[비트코인] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin) 개발자의 작업에 간접적으로 의존합니다. 따라서 우리는 암호화폐 생태계가 의존하는 [[[비트코인] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin) 기술에 환원하고 기부하고 싶습니다." - 웹사이트에 명시되어 있습니다[29]

이 프로그램의 목표는 비트코인의 기술 개발을 돕고 복원력, 확장성, 검열 저항 및 개인 정보 보호 특성을 향상시키는 것입니다. 웹사이트에 따르면 보조금은 개발자당 50,000달러에서 최대 150,000달러까지 다양합니다. [29][30]

Covalent

2024년 6월 11일, 아서 헤이즈는 블록체인 데이터 인프라 스타트업인 코발런트의 전략 고문으로 합류했습니다. 헤이즈는 코발런트가 특히 이더리움 생태계 내에서 선도적인 데이터 인프라 스타트업이 되고 인공지능(AI) 산업에 기여하도록 돕고자 합니다. [31]

"코발런트의 이더리움 웨이백 머신(EWM)은 지속적이고 장기적인 블록체인 데이터 접근을 보장하며, 이는 특히 AI 모델을 포함한 차세대 사용 사례를 지원할 것입니다."라고 헤이즈는 더 블록에 말했습니다. [31]

더 블록이 코발런트의 고문으로 합류하게 된 동기를 묻자, 헤이즈는 코발런트의 CQT 토큰이 다음과 같다고 말했습니다.

"경쟁사(예: The Graph)에 비해 오랫동안 저평가되어 왔습니다. 투자자들은 그 스토리를 완전히 놓쳤습니다. 이제 코발런트가 제품을 더욱 확장함에 따라 견인력과 내러티브 간의 불협화음이 커졌습니다. 스토리텔러로서 저는 그 간격을 좁히는 데 도움을 주고자 합니다."

헤이즈는 CQT 토큰으로 보상을 받고 있다고 말했습니다. 왜냐하면 "일반적으로 우리는 팀, 투자자, 고객 및 소매업체와 완전히 일치한다고 믿기 때문에 토큰으로만 보상을 받습니다. 우리는 모두 같은 여정을 함께합니다." [[32]] - (#cite-id-bx6f7krj01s)

암호화폐 관련 관점

바이낸스

아서 헤이즈는 미국의 처벌의 자의적인 성격에 대해 우려를 표명하며, 바이낸스가 지불한 43억 달러의 합의금을 예로 들었습니다. 2023년 11월 28일 그의 블로그 게시물에서 헤이즈는 바이낸스와 전 CEO인 창펑 자오(CZ)에 대한 처우가 시스템의 불공정성을 강조한다고 주장했습니다. 헤이즈는 바이낸스가 전통적인 플레이어 없이도 일반 사람들이 중개인과 암호화폐 자산을 소유할 수 있도록 한 역할을 강조했습니다. [17][18]

"데스크톱 및 모바일 거래 앱을 통해 10분 안에 산업 혁명의 일부를 소유할 수 있었던 적은 없었습니다."[17]

헤이즈는 기존 금융 및 정치 권력이 바이낸스와 같은 중개인에 의해 위협을 느꼈다고 주장했습니다. 바이낸스는 개인이 전통적인 기관을 우회하고 암호화폐 혁명에 직접 참여할 수 있도록 했습니다. [18]

“분명히 CZ와 [[[바이낸스] - (https://iq.wiki/wiki/binance)] - (https://iq.wiki/wiki/binance)] - (https://iq.wiki/wiki/binance)에 대한 처우는 터무니없으며 국가의 자의적인 처벌의 성격을 강조할 뿐입니다.”[17]

헤이즈는 독자들에게 CZ와 바이낸스를 처벌하는 데 엄청난 에너지가 투입되는 것을 목격한 후 암호화폐, 특히 비트코인(BTC)에 투자할 것을 권장합니다.

"CZ와 [[[바이낸스] - (https://iq.wiki/wiki/binance)] - (https://iq.wiki/wiki/binance)] - (https://iq.wiki/wiki/binance)에 대해 국가가 얼마나 많은 에너지를 쏟았는지 보고도 비트코인과 다른 암호화폐를 매수하고 싶지 않다면, 무엇을 더 봐야 할지 모르겠습니다." - 헤이즈는 그의 블로그에 썼습니다.[17]

비트코인

2023년 12월 1일, 아서 헤이즈는 다음과 같이 트윗했습니다.

"12월입니다. 여러분은 어떨지 모르겠지만 저는 나이든 백인 남자가 선물을 주기를 기다리고 있습니다. 제이파월, 금리를 인하하고 $BTC를 달로 보내줘!" - 아서 헤이즈 [19]

헤이즈는 제롬 파월 연방준비제도(Fed) 의장의 연설을 간절히 기다리고 있습니다. 그는 농담으로 그것을 "나이든 백인 남자"로부터의 가능한 "선물"이라고 언급했습니다. 헤이즈는 파월이 금리를 대폭 인하하는 대담한 조치를 취할 것으로 기대하고 있습니다. 그는 그러한 결정이 비트코인을 전례 없는 높이로 끌어올릴 수 있다고 믿습니다. [20]

헤이즈는 또한 이전에 비트코인에 대해 강세적인 견해를 표명했습니다. 2023년 11월 25일, 그는 순 역레포 계약(RRP) 및 재무부 일반 계정(TGA) 잔액 변동을 보여주는 차트와 함께 X(구 트위터)에 자신의 생각을 공유하면서 재무부 장관 재닛 옐런을 "Bad Gurl Yellen"이라고 불렀습니다.[23] [21][22]

"발 관리를 받으면서 Bad Gurl Yellen이 금융 자산을 펌핑하는 데 얼마나 바쁜지 관찰하고 있습니다. 정신을 놓지 마세요. $ 유동성이 증가하고 있으며 $BTC도 상승할 것입니다. 이것은 순 RRP 및 TGA 잔액 변동 차트입니다."[21]

X 게시물에서 헤이즈는 동료 비트코인 애호가들에게 집중력을 유지하도록 격려하면서 미국 달러 유동성의 상당한 증가를 강조했습니다. 그는 BTC가 달러 유동성의 증가를 반영하여 가격 상승으로 이어질 가능성이 높다고 제안했습니다. [22]

2023년 12월 22일 블로그 게시물에서 아서 헤이즈는 현물 비트코인 ETF에 대한 자신의 의견을 공유했습니다. 그는 비트코인이 "움직이기" 때문에 가치가 있다고 설명했습니다. 그러나 현물 비트코인 ETF는 "자산을 빨아들여" "비유적인 금고에 보관"하도록 만들어졌다고 그는 말했습니다. [24][25]

"서구와 중국의 가장 큰 자산 관리자들이 유통되는 모든 [[[비트코인] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)을 보유하는 미래를 상상해 보세요. 사람들은 금융 자산을 가치 저장소로 혼동하기 때문에 이러한 일이 자연스럽게 발생합니다. 그들의 혼란과 게으름 때문에 사람들은 [[[비트코인] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)을 직접 보관하는 지갑에서 구매하고 보유하는 대신 [[[비트코인] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin) ETF 파생 상품을 구매합니다. 이제 소수의 회사가 모든 [[[비트코인] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)을 보유하고 있고 [[[비트코인] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin) [블록체인] - (https://iq.wiki/wiki/blockchain)을 실제로 사용할 필요가 없기 때문에 코인은 다시는 움직이지 않습니다. 최종 결과는 채굴자들이 기계를 작동하는 데 필요한 에너지를 더 이상 지불할 수 없기 때문에 기계를 끄는 것입니다. 안녕, [[[비트코인] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)!"

헤이즈는 새로운 암호화폐 통화 네트워크가 비트코인을 대체하고 사토시 나카모토의 원래 P2P 전자 화폐 비전을 확장하는 시나리오를 상상했습니다.

"생각해 보면 아름답습니다. 만약 [[[비트코인] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)이 또 다른 국가 통제 금융 자산이 된다면, 사용되지 않기 때문에 죽습니다. [[[비트코인] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)의 죽음은 다른 암호화폐 통화 네트워크가 그 자리를 차지하고 성장할 수 있는 공간을 만듭니다. 이 네트워크는 [[[비트코인] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)의 재부팅이거나 원래 [[[비트코인] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)의 개선된 적응일 수 있습니다. 어느 쪽이든, 사람들은 다시 한번 국가 통제되지 않는 통화 자산과 금융 시스템을 갖게 될 것입니다. 바라건대, 두 번째에는 개인 키를 대머리들에게 넘겨주지 않는 법을 배우게 될 것입니다." - 그는 [24]라고 결론지었습니다.

스테이블코인

아서 헤이즈는 2023년 12월 30일에 게시된 Laura Shin과의 팟캐스트에서 대형 은행들이 현재 USDT를 운영하는 테더가 지배하는 스테이블코인 사업을 인수할 것으로 예상한다고 밝혔습니다. [26]

헤이즈는 테더가 암호화폐 시장에서 훌륭한 제품으로 자리매김했지만, 이는 미국 은행 시스템이 유사한 제품을 제공하지 않았기 때문이라고 설명했습니다. [26]

"테더를 소유한 사람들은 매년 40억 달러 또는 50억 달러의 잉여 현금 [흐름] - (https://iq.wiki/wiki/flow)을 벌어들입니다. 기본적으로 이자율과 같습니다. 그들은 기본적으로 달러를 가져와 은행 계좌에 넣고 국채를 사서 스프레드를 얻습니다."[28]

그는 은행들이 디지털 통화로 시장에 진입할 경우 혼란이 발생할 수 있다고 예측합니다. 헤이즈는 은행들이 이 분야의 수익 잠재력을 인식하면 기존 인프라와 고객 신뢰를 활용하여 빠르게 지배할 것이라고 예측했습니다. 그는 은행들이 디지털 자산 부문과 협력할 수 있는 승인을 받으면 필요한 포괄적인 금융 네트워크와 규정 준수 프레임워크를 갖추고 즉시 시작할 수 있다고 말했습니다. [27]

헤이즈는 JPMorgan과 같은 은행들이 자체 스테이블코인을 출시하면 테더 및 다른 스테이블코인 회사를 대체할 것이라고 예측합니다. [27]

“결국 그들은 은행에 자금을 보관하고 죽은 상품을 거래하도록 허용하는 데 의존하기 때문에 방어할 수 있는 사업이 없습니다.”라고 그는 결론지었습니다.[28]

이더리움

2025년 8월 초, 아서 헤이즈는 ETH 토큰이 3,500달러 근처에서 거래될 때 약 832만 달러 상당의 2,373개를 매도했습니다. 이 매도는 1,300만 달러 이상의 암호화폐 자산 청산의 일환이었으며, 헤이즈는 미국 관세 가능성과 7월 비농업 고용 보고서 부진을 포함한 거시 경제적 우려 때문이라고 밝혔습니다. 그는 이러한 압력으로 인해 이더 가격이 3,000달러까지 하락할 수 있다고 예측했습니다. [33][34][35]

그러나 며칠 후, 이더리움 가격이 반등하자 헤이즈는 입장을 바꿨습니다. 그는 4,150달러 이상의 가격으로 ETH를 다시 매수하며 1,050만 달러를 지출했는데, 이는 그의 매도 시점보다 약 18% 높은 가격입니다. 헤이즈는 X(구 트위터)에 "전부 다시 사야 했다"고 올리며 자신의 실수를 인정했고, "다시는 이익을 취하지 않겠다고 맹세한다"는 유머러스한 말을 덧붙였습니다. 이러한 반전은 2025년 7월 10일 이후 고래와 기관들이 41억 7천만 달러 이상의 자산을 축적하면서 상당한 기관들의 ETH 축적 속에서 일어났습니다. [33][34][36]

2025년 8월 투자

2025년 8월 중순, 헤이즈는 5일 동안 1,400만 달러가 넘는 다양한 암호화폐를 매수하는 대규모 매수 활동을 벌였습니다. 이 움직임은 특히 DeFi 생태계 내 특정 토큰에 대한 강력한 자신감을 나타냈습니다. 구매는 바이낸스 및 크라켄과 같은 중앙화 거래소와 탈중앙화 프로토콜을 포함하여 여러 지갑과 플랫폼 전반에서 실행되었습니다. [37][38][39]

그의 인수는 유동성 스테이킹, 수익 창출 및 합성 자산에 중점을 둔 다양한 자산을 포함했습니다. 구매 내역은 다음과 같습니다. [36][38]

- 1,750 ETH: 약 743만 달러 상당

- 58,631 HYPE (Hyperliquid): 262만 달러 상당

- 310만 ENA (Ethena): 248만 달러 상당

- 129만 LDO (Lido DAO): 183만 달러 상당

- 184,610 PENDLE: 102만 달러 상당

- 420,000 ETHFI (Ether.fi): 516,600 달러 상당

이 투자 전략은 이더리움과 같은 기존 자산과 고성장 부문의 신흥 프로젝트를 혼합한 것을 강조했습니다. LDO, ENA, PENDLE 및 ETHFI와 같은 토큰의 선택은 혁신적인 DeFi 프로토콜에 대한 목표 집중을 나타냅니다. 시장 분석가들은 헤이즈가 시장 심리가 혼조세일 때 대담하고 집중적인 투자를 하는 경향이 있으며, 종종 Web3 생태계 내에서 명확한 유틸리티를 가진 자산을 목표로 삼는다고 언급했습니다. [37][40]

Ethena와 Hyperliquid 모두의 전략적 고문으로서 헤이즈는 ENA 및 HYPE 토큰의 상당한 보유량을 활용했습니다. 2025년 9월 초, USDH 통합에 대한 거버넌스 투표 직전에 헤이즈는 48시간 동안 995,000달러 상당의 ENA 토큰 121만 개를 추가로 구매하여 총 보유량을 약 391만 달러 상당의 502만 개 토큰으로 늘렸습니다. 그는 Ethena 프로토콜과 Hyperliquid 거래소 모두에서 새로운 탈중앙화된 수익 창출 스테이블코인인 USDH를 담보 자산으로 통합하는 데 찬성표를 던졌습니다. 헤이즈는 그의 근거를 설명하면서 "더 많은 담보 유형은 더 많은 사용자를 의미하고, 이는 ENA 및 HYPE 스테이커에게 더 많은 수수료를 의미합니다."라고 말했습니다. [41][42]

잘못된 내용이 있나요?