Subscribe to wiki

Share wiki

Bookmark

MetaStreet

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

MetaStreet

MetaStreet is a decentralized finance (DeFi) protocol operating on the Ethereum blockchain, specializing in structured lending solutions for various on-chain assets, including NFTs. Founded on permissionless and oracleless lending principles, MetaStreet allows users to define risk parameters and participate in collaborative lending pools, fostering liquidity and capital efficiency in the DeFi ecosystem. David Choi, Conor Moore, and Ivan Sergeev are its founders. [1]

Overview

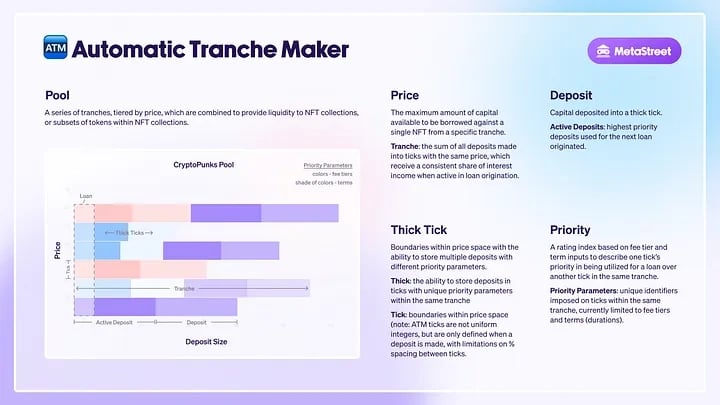

MetaStreet is a permissionless structured credit protocol to finance various illiquid on-chain assets, including artwork, collectibles, domain names, and luxury watches. Any on-chain asset with an ETH address can be used as collateral. The protocol functions as a yield infrastructure, organizing high-yield sources into a tradable asset. Its v2 feature, the Automatic Tranche Maker (ATM), is a permissionless lending protocol that automatically allocates capital in a pool based on depositors' risk and return profiles. [2]

The protocol enables the creation of tradable assets through its Liquid Credit Token (LCT), an ERC-20 token representing each lender's position within a pool. The MetaStreet v2 Pool is a permissionless lending pool for NFT collateral with automatic tranching, organizing lending capital with different risk and rate profiles into fixed-duration loans for borrowers. [2]

Pools can be created without permission for any ERC-721 token. Deposited capital comes with user-defined risk parameters, including maximum loan limits, maximum loan durations, and interest rate tiers. Borrowers can construct loans using deposits of ascending loan limits, with higher tranches receiving greater interest but bearing higher default risk. In the event of default, higher tranches absorb losses first, with lower tranches compensated up to available liquidation proceeds. Loans are fixed-duration with prorated repayments, and borrowers can refinance their loans, extending them beyond the pool's maximum fixed duration. Overdue loans face liquidation, but borrowers have a grace period for repayment, with any surplus from liquidation returned to them. [2]

Features

Automatic Tranche Maker (ATM)

MetaStreet's v2, the Automatic Tranche Maker (ATM), is an NFT lending protocol that operates without centralized oracle or governance dependencies. It allows for user-defined tranches within a larger pool of capital, fostering economies of scale. This permissionless and oracleless protocol supports any type of collateral and enables users to choose their risk tolerances independently. By pooling users' preferences, it offers a single "market rate" to borrowers, making it capital-efficient. [3]

The MetaStreet ATM facilitates NFT lending through tiered pools of capital, where lenders deposit funds that become instantly available to borrowers. These pools are specific to individual NFT collections or subsets, utilizing "thick ticks" infrastructure containing information about each depositor's risk preferences. This framework enables capital to be stacked into tranches, ensuring borrowers can access liquidity with favorable terms. [3]

Thick Ticks

The MetaStreet ATM allows users to specify their risk preferences using "thick ticks," encompassing three parameters: price, term, and fee tier. Each tick represents a unique depositor address and can support various risk profiles within the same price range. [3]

- Tick Pricing: Lenders decide on the maximum price per NFT they are willing to lend, creating tranches of ticks at the same price. The protocol prioritizes the ten highest-priced tranches to fill a loan.

- Tick Term: Lenders select the maximum term for lending, choosing between 3, 7, or 30 days. Longer terms signify higher risk, and the protocol seeks to match the borrower's requested term with a corresponding lender term.

- Tick Fee Tier: Lenders opt for a fee tier (10%, 30%, or 50%) representing annual interest rates. However, the actual return may differ based on tick utilization and interest allocation. Lower fee tiers are prioritized within the same tranche to incentivize lenders offering lower rates.

Liquid Credit Token (LCT)

Liquid Credit Tokens (LCTs) offer a novel method to enhance liquidity and increase yield for various illiquid on-chain assets, from NFTs to tokenized physical goods. Functioning as ETH derivative tokens, LCTs provide double-digit yields ranging from 10% to 125%, accumulating staked ETH yields as interest payments from NFT loans. [4]

Unlike traditional lending protocols where crypto is deposited into a pool, MetaStreet now issues ERC-20 tokens called Liquid Credit Tokens (LCTs) representing the loan position, tradable on secondary markets, and spot DEXs. This process allows the lending position (LCT) to be a fully composable token, tradable, exchanged, or leveraged across other DeFi applications. [4]

The benefits of minting an LCT include enabling long-duration loans by providing lenders with access to secondary liquidity during the loan term, supporting digital asset stability by deepening lending markets and encouraging higher LTV loans, maximizing lending yield as fully composable tokens usable in various DeFi aspects, and preventing cascading liquidation on NFT collections. [4]

Ecosystem

Powersweep

PowerSweep introduces leverage sweeping for NFTs, empowering traders with increased purchasing power and flexibility. Users can sweep NFTs with up to 3x margin, extend debt perpetually, and avoid liquidation risks. It operates through MetaStreet Capital Vaults, aligning with their parameters for approved collateral types, maximum LTVs, and durations. Initially, approved collateral types include Wrapped CryptoPunks, BoredApeYachtClub, Nouns, Azuki, Doodles, and others, with potential expansions as the product evolves and MetaStreet Capital Vault designs progress. [5]

Ascend Program

Launched in February 2024, the Ascend Rewards Program incentivizes community engagement and the exploration of yield-generating possibilities in NFT loans. Participants can earn experience points (XP) by engaging in different activities, with a potential increase of over 300% at the program's onset, based on deposit tiers and liquidity supply duration. Additionally, participants can access further rewards through partner integrations within the LSDfi, NFT, and Blast ecosystem. [6]

In the Ascend program, XP can be earned through Reserve Actions and Prestige Actions, which collectively determine 80% of the total XP allocation: [7]

- Reserve Actions involve depositing wstETH into MetaStreet’s Lending Towers to earn XP and mint Liquid Credit Tokens (mwstETH). Each deposited wstETH yields 1,000 XP, with bonuses, encouraging early participation for higher APRs. Supplying liquidity to Liquid Credit Token pools on Curve Finance using wstETH or mwstETH further boosts XP, with 3,000 XP per LP deposit, alongside daily vested bonuses.

- Prestige Actions emphasize community engagement, encouraging activities such as sharing invite codes, participating in social quests, holding specific NFTs, or joining MetaStreet events for additional XP.

MSTR

On February 8th, 2024, MetaStreet announced a future release of their ERC-404 token, $MSTR. It's scheduled to launch after their Ascend program finishes in May 2024. [8]

Partnerships

Allora

On February 22nd, 2024, MetaStreet integrated Allora AI price predictions to facilitate watch-backed NFT lending. Through this integration, MetaStreet users could access Allora Network's AI pricing models, enabling them to generate lending terms for tokenized luxury watches based on market dynamics. [9]

Spacebar

On February 21st, 2024, MetaStreet's LCTs were integrated into Spacebar, an on-chain GameFi platform, on the Blast mainnet. Users could access the Metastreet Mission Portal via SpaceBar's Squares and engage in missions that required on-chain actions to be completed for mission fulfillment. [10]

Particle

On February 18th, 2024, MetaStreet collaborated with Blast's ecological derivative protocol, Particle, introducing a points activity. mwstETH LCT holders gained the opportunity to earn double-digit basic interest rates by participating in pledging/NFT loans and utilizing LCT for lending and trading, among other activities, within Particle. [11]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)