订阅 wiki

Share wiki

Bookmark

Liberty Finance

0%

Liberty Finance

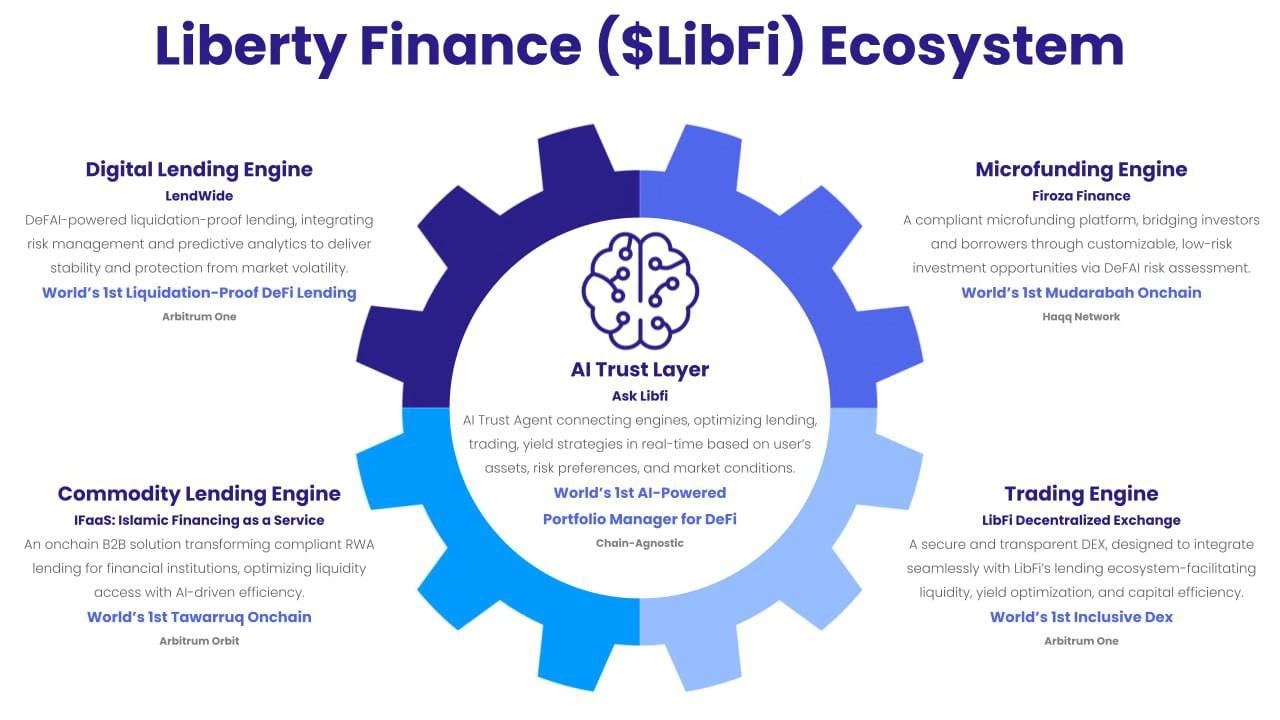

Liberty Finance 是一个在怀俄明州注册的 DAO (Liberty Governance DAO LLC),它构建由人工智能和 区块链 驱动的合规金融引擎,使数字金融变得简单,并解锁合规的现实世界资产 (RWA) 贷款。 [2]

概述

Ask LibFi 是 Liberty Finance 通往去中心化金融的对话式入口,使用户能够通过简单的人工智能聊天界面执行交易、获得贷款和优化投资组合。通过将实时市场数据、合规控制和风险评估嵌入到直观的聊天流程中,它加速了用户入门,并确保每个行动都符合伊斯兰教法原则,而无需手动复杂性。

在这一无缝的人工智能层之下,Liberty Finance 部署了一系列专门的引擎,以应对伊斯兰和数字金融中的关键挑战。Firoza Finance 与 HAQQ Network 合作构建,利用 Mudarabah 利润分享模式将资本汇集到透明的小额贷款池中,为小型企业和企业家提供服务。LendWide 通过将基于商品的合同与人工智能驱动的对冲相结合,推出固定利率、防清算的贷款,以保护借款人免受市场波动的影响。对于机构贷款人,IFaaS 在 LibFi 专用的 Arbitrum Orbit Roll-up 链上运行,以自动化基于 Tawarruq 的融资工作流程,将审批时间从几天缩短到几分钟。同时,Amana Vaults 提供 $LIBFI 代币的质押,以保护网络并将 100% 的净利润分配给参与者。作为这些产品的补充,LibFi Academy 提供人工智能定制的 DeFi 基础知识和伊斯兰教法合规课程,LibFi DEX 提供由 DeFAI 驱动的包容性、无息交易所,以优化流动性并最大限度地减少滑点。

这些相互关联的引擎共同构成了一个透明、高效且符合道德规范的生态系统,将传统的现实世界资产融资与现代 DeFi 创新连接起来。 [1]

生态系统

Ask LibFi

Ask LibFi是Liberty Finance的人工智能驱动网关,供web2用户零摩擦地访问DeFi - 这就是去中心化金融人工智能(DeFAI)。无需安装钱包或进行复杂的设置,用户可以通过自然语言聊天在ask.libfi.ai上启动链上/链下转换、发现最佳的道德收益机会、分析代币基本面和技术指标、运行情景模拟、执行交易、借入或偿还、质押代币以及管理投资组合。在底层,Ask LibFi集成了实时市场数据、道德合规规则和DeFAI驱动的风险引擎,自动将批准的请求路由到适当的Liberty Finance引擎(Firoza小额融资、LendWide借贷、IFaaS Tawarruq融资或Amana Vaults质押)。这种无缝的入门和端到端编排消除了新用户的障碍,确保了透明、可审计的操作,并保证每一步都符合Liberty Finance的道德金融标准。

Firoza Finance

Firoza Finance是由Liberty Finance和HAQQ Network合资成立的公司,推出了世界上首个真实的Mudarabah智能合约,标志着符合伊斯兰教法的去中心化金融领域的一项重大发展。通过其试点计划,Firoza允许投资者将加密资产汇集到三个投资池中,总锁定总价值超过200万美元,目标是到2026年达到1亿美元。这些资金池旨在产生回报,同时为Liberty Finance的Amana Vaults做出贡献。Firoza在HAQQ Network的区块链上运行,并由Liberty Finance的基础设施提供支持,提供透明、安全的交易,并降低运营成本。这使得该平台能够为借款人,特别是小型企业和企业家提供负担得起的资金,解决了传统DeFi和传统金融的高成本和道德限制。

作为LibFi的小额融资引擎,Firoza Finance建立在Mudarabah模式之上,这是一种利润分享结构,将投资者与企业家按照预先约定的条款配对,确保符合伊斯兰金融原则。区块链透明度和人工智能驱动的决策相结合,使Firoza Finance成为服务不足地区可扩展、合乎道德且包容的小额融资解决方案。 [4] [8] [10]

LendWide

LendWide是一个去中心化借贷平台,消除了清算风险,提供更稳定、安全的借贷体验。与传统的DeFi平台不同,在传统DeFi平台中,抵押品价值的下降会触发强制清算,LendWide使用基于DeFAI的风险调整动态对冲(RADH)机制来保护用户免受此类结果的影响,即使在高度市场波动期间也是如此。这种方法增强了借款人的安全性,支持了市场稳定,并提高了资本效率。LendWide围绕商品穆拉巴哈原则构建,发行固定利率贷款,并预先确定还款条款,确保符合伊斯兰金融,并为借款人提供清晰、预先的成本结构,而没有意外费用。

该平台与IFaaS引擎集成,使机构贷款人能够以最小的运营复杂性提供合规的金融产品。这种集成使LendWide能够在零售和机构市场中扩展,将DeFi的透明度和自动化与符合伊斯兰教法的金融的道德要求相结合。通过消除清算风险并提供稳定的固定利率贷款,LendWide为寻求DeFi生态系统中合乎道德且可预测的金融解决方案的用户提供了一个可靠的选择。 [8]

IFaaS

IFaaS (Islamic Financing as a Service) 是一个区块链贷款引擎,旨在通过解决传统Tawarruq模式的低效率问题来实现伊斯兰金融的现代化。Tawarruq是一种常见的以现金出售商品的方法,通常涉及中介、延误和高运营成本。IFaaS通过集成智能合约和基于DeFi的人工智能 (DeFAI) 来自动化此过程,以简化交易、缩短处理时间并实时执行符合伊斯兰教义的原则。这在严格遵守伊斯兰金融标准的同时,实现了更快、更透明和更具成本效益的运营。

该平台利用人工智能算法增强现实世界资产 (RWA) 融资,以提高效率、减少瓶颈,并为金融机构提供可扩展的贷款服务。IFaaS弥合了传统伊斯兰金融和去中心化技术之间的差距,为希望实现贷款业务现代化的机构提供了一个合规且适应性强的解决方案。IFaaS通过其区块链透明度和自动化合规工具的结合,为数字环境中的道德商品贷款提供了强大的基础设施。 [3] [8]

为了大规模支持IFaaS并满足机构要求,该平台将在Liberty Finance的专用Arbitrum Orbit Rollup链LibFi Orbit上运行。LibFi Orbit将采用混合隐私架构,使获得许可的节点运营商能够安全地处理私人交易,同时将公共状态锚定在以太坊上以进行审计。机构合作伙伴可以部署和管理自己的节点,从而确保专有融资工作流程的机密性并符合监管标准。运营商可以获得质押奖励和协议费用,从而使经济激励与网络安全和性能保持一致。该基础设施提供了大规模、符合伊斯兰教义的机构贷款所需的可扩展性、隐私性和透明度。

Liberty Finance已获得非洲第五大银行的概念验证兴趣、来自商品供应商的27亿美元流动性承诺以及来自Alchemy的31万美元基础设施赠款,以支持LibFi Orbit链。

Amana Vaults

Amana Vaults是LibFi的质押机制,旨在以符合伊斯兰教法的包容性方式将去中心化金融(DeFi)与传统金融系统融合。通过质押 $LIBFI代币,用户有助于保护LibFi的私有链,并获得参与平台更广泛金融运营的机会。

Amana Vaults的收入分享模式将高达100%的传统和DeFi活动的净收入分配给参与者。这种结构奖励用户的参与,并协调整个生态系统中的激励措施。它还通过将用户参与直接与平台成功联系起来,鼓励持续参与。通过这种模式,Amana Vaults促进金融包容性,并创建一个统一的、合乎道德的金融环境,该环境集成了安全的质押、合规贷款和共享经济价值。 [9]

LibFi 学院

LibFi 学院是 Liberty Finance 的教育平台,旨在提高去中心化金融 (DeFi) 和伊斯兰金融领域的金融知识水平。它为用户提供量身定制的资源,包括课程、教程和工具,涵盖 DeFi 基础知识、伊斯兰教法合规、风险管理和交易策略等核心主题。通过使用去中心化金融人工智能 (DeFAI),学院通过根据每个用户的目标、经验水平和金融活动调整内容,实现个性化学习。

LibFi 学院与更广泛的 Liberty Finance 生态系统集成,提供 IFaaS、Firoza Finance 和 LendWide 等产品的实际应用,使用户能够通过实际应用进行学习。它还可以作为交互式数字导师,回答用户问题并提供有关 DeFi 和合规主题的指导。这种人工智能驱动的方法旨在使金融教育更容易获得,尤其是在服务不足的社区。

Liberty Finance 强调教育是包容性和可持续性的基础。通过弥合知识差距并揭开复杂金融系统的神秘面纱,LibFi 学院使用户能够以符合其道德和宗教价值观的方式自信地参与 DeFi。该策略支持长期用户参与,鼓励负责任的参与,并有助于合规且知情的金融生态系统的发展。 [1] [8]

LibFi DEX

LibFi DEX 旨在促进安全、透明且符合伊斯兰教法的数字资产交易。与依赖基于利息机制或投机交易的传统 DeFi 平台不同,LibFi DEX 消除了这些元素,以支持寻求道德替代方案的用户。该平台由 去中心化金融人工智能 (DeFAI) 驱动,通过实时合规性检查和智能模式分析来增强交易执行和流动性管理。DeFAI 动态平衡 流动性池,减少 滑点,并优化交易效率,同时确保所有资产和活动都符合伊斯兰金融原则。其基于 Mudarabah 的模型为 流动性提供者 提供无需涉及利息的收入分成机会,符合道德标准并促进公平参与。

LibFi DEX 建立在 Arbitrum 的 以太坊 Layer-2 网络上,提供快速、低成本的交易,同时不影响用户安全。该平台整合了 多重签名钱包、智能合约 审计和实时监控等安全措施来保护资产。它还与 Liberty Finance 更广泛的生态系统(包括 IFaaS、Firoza Finance 和 LendWide)无缝集成,从而实现跨平台资产交易。通过 区块链 透明度和 DeFAI 驱动的自动化,LibFi DEX 为去中心化交易提供了一个合规、高效和包容的解决方案,为 DeFi 领域的道德金融树立了新的基准。 [5] [8]

LIBFI 代币

LIBFI 代币是 LibFi 生态系统的原生资产。它的用途涵盖整个平台的治理、运营和激励。LIBFI 持有者参与去中心化治理,对协议升级、费用结构和产品增加进行投票。该代币还用于 Amana Vaults 中的质押,允许用户从平台收入中赚取收益,同时支持 LibFi DEX 和 Firoza Finance 等服务的流动性。

LibFi 产品中的交易费用以 LIBFI 支付,其中一部分被销毁以产生通货紧缩压力。该代币还激励参与交易、借贷和流动性提供的用户,从而促进生态系统的增长。

其他功能包括解锁 LibFi Academy 上的高级教育内容以及获得 Firoza Finance 上的优先功能。LIBFI 还需要运行中继器和链节点,以支持网络去中心化和可扩展性。LIBFI 代币通过这些多重角色支撑着平台的功能和可持续性。 [8]

代币经济学

LIBFI 的代币总供应量为 10 亿,分配如下:[7] [8]

- DAO 基金会: 40%

- 团队: 16.5%

- 种子/预售/IDO: 12%

- 流动性: 10%

- 空投 & 社区: 10%

- 顾问: 8.5%

- 承包商期权: 3%

合作伙伴

发现错误了吗?