订阅 wiki

Share wiki

Bookmark

Zyberswap

0%

Zyberswap

Zyberswap 是 Arbitrum 和 Optimism 网络上的一个去中心化交易所 (DEX)。它提供自动化做市 (AMM) 和流动性管理功能。它使用户能够以低费用进行交易和提供流动性,同时通过其 sZYB 代币支持治理参与。 [1]

概述

Zyberswap 是一个去中心化交易所 (DEX),具有一个在 Arbitrum 和 Optimism 上运行的自动化做市商 (AMM),提供低费用的 加密货币 资产兑换。它通过 质押 和 收益耕作 提供丰厚的回报,同时让用户参与治理决策。该平台遵循公平启动策略进行代币分配,从而促进去中心化和平等访问。Zyberswap 通过与 SolidProof 合作来优先考虑安全性,确保强大的审计,并为新项目提供免费审计和 KYC 流程的机会。 [2]

特点

Zyberswap 提供了几个关键功能。它允许使用 自动化做市商 (AMM) 进行去中心化的代币兑换,费用极低,并将 交易费用 分配给 流动性提供者 作为激励。流动性池允许用户存入等量的两种代币,从而获得 ZLP 代币作为提供流动性的证明。每笔交易都会收取少量费用,其中一部分会返回到流动性池。通过 质押流动性提供者代币并积累 交易费用 和 $ZYB 代币,Zyberswap 上的 收益耕作 使用户能够获得奖励。此外,Zyberswap 通过 Arbitrum 桥支持跨链资产转移,从而可以在 Arbitrum 侧链上进行更快、更便宜的交互,同时保持 以太坊 的安全性。 [3][4][5]

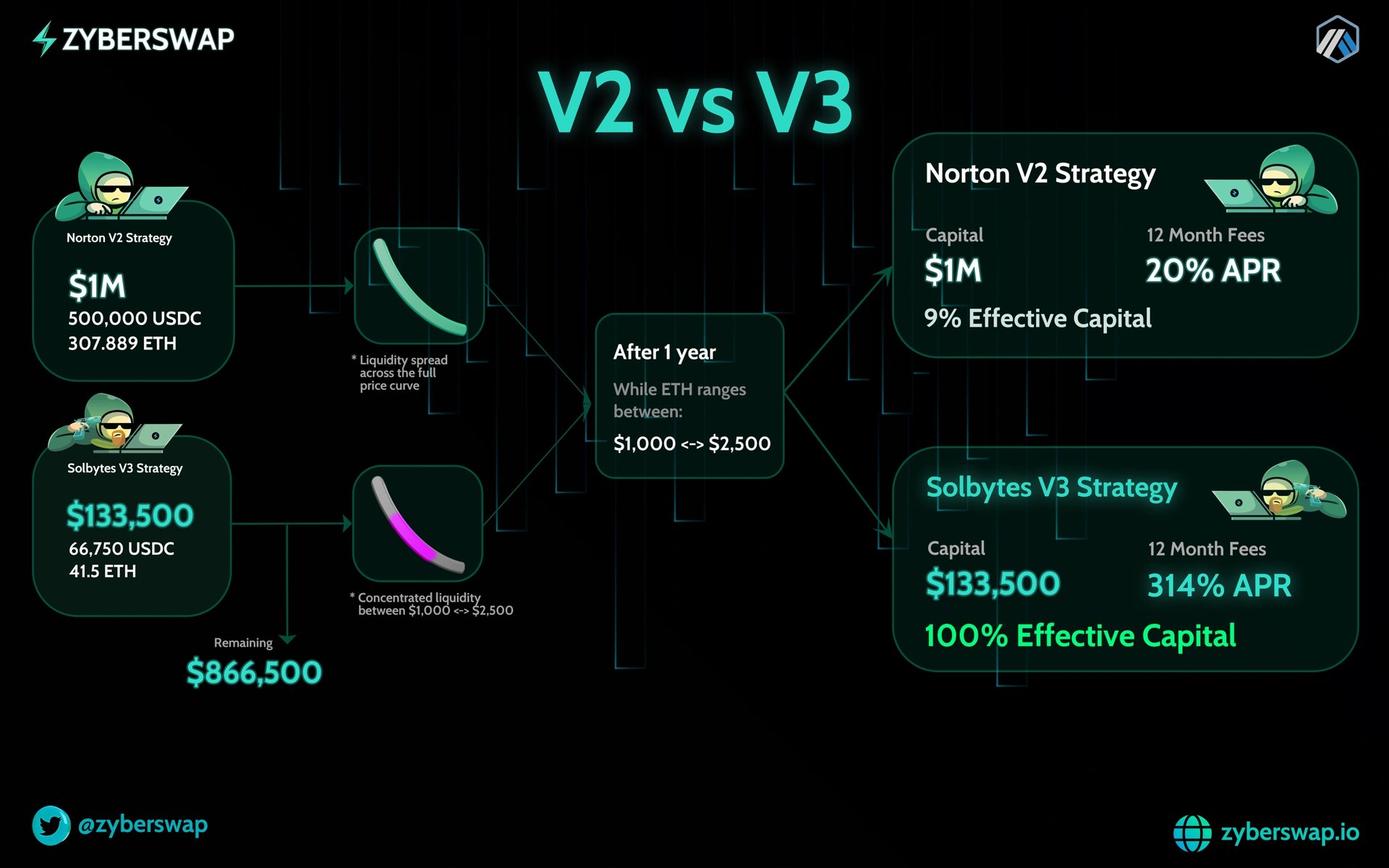

集中流动性

Zyberswap 的集中流动性功能允许流动性提供者 (LP)通过将流动性集中在特定价格范围内来优化其资本,从而提高效率并最大限度地减少无常损失。LP 可以在定义的价格区间内 质押 代币对,一旦市场价格进入所选范围,他们的流动性就会被利用。这种方法与传统的 AMM 形成对比,后者将流动性分散在所有价格水平上,由于未充分利用的流动性,导致费用较低且滑点较高。通过此模型,LP 可以设置多个头寸以符合他们的策略,并在使用其流动性时赚取更多费用。交易者还可以从这些集中的价格范围内的更深流动性和减少的滑点中受益。 [6]

主动流动性管理

Gamma 为 Zyberswap 用户提供主动流动性管理 (ALM) 工具,从而自动重新平衡流动性头寸并复合兑换费用,以提高资本效率。它是一种非托管协议,可管理集中的流动性,而无需托管资产。它使用数据驱动的策略来处理重新平衡、设置头寸和处理费用。 [7]

由于其复杂性、无常损失风险的增加以及对价格范围的持续监控,主动流动性管理对于集中的流动性是必要的。如果市场价格超出其流动性范围,用户将面临更高的无常损失风险,这需要频繁调整。对于管理其流动性的项目,集中的流动性需要更多的时间和资源。 [7]

Gamma 的 ALM 自动执行这些任务,从而允许用户外包流动性管理并避免手动监督的复杂性。该系统还通过将 LP 头寸表示为 ERC-20 代币来增强可组合性,从而允许它们在 Zyberswap 的农场和其他 DeFi 应用程序中使用。 [7]

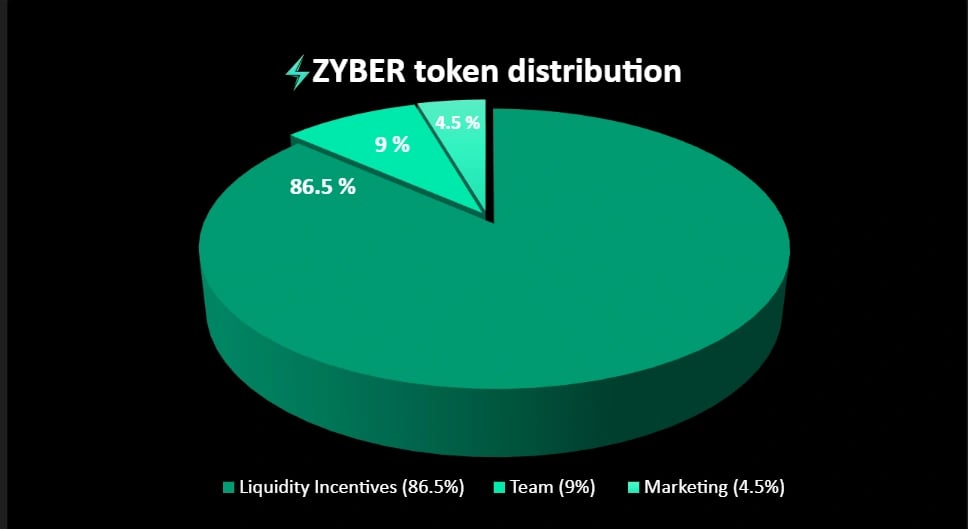

ZYB

- 流动性激励:86.5%

- 团队:9%

- 营销:4.5%

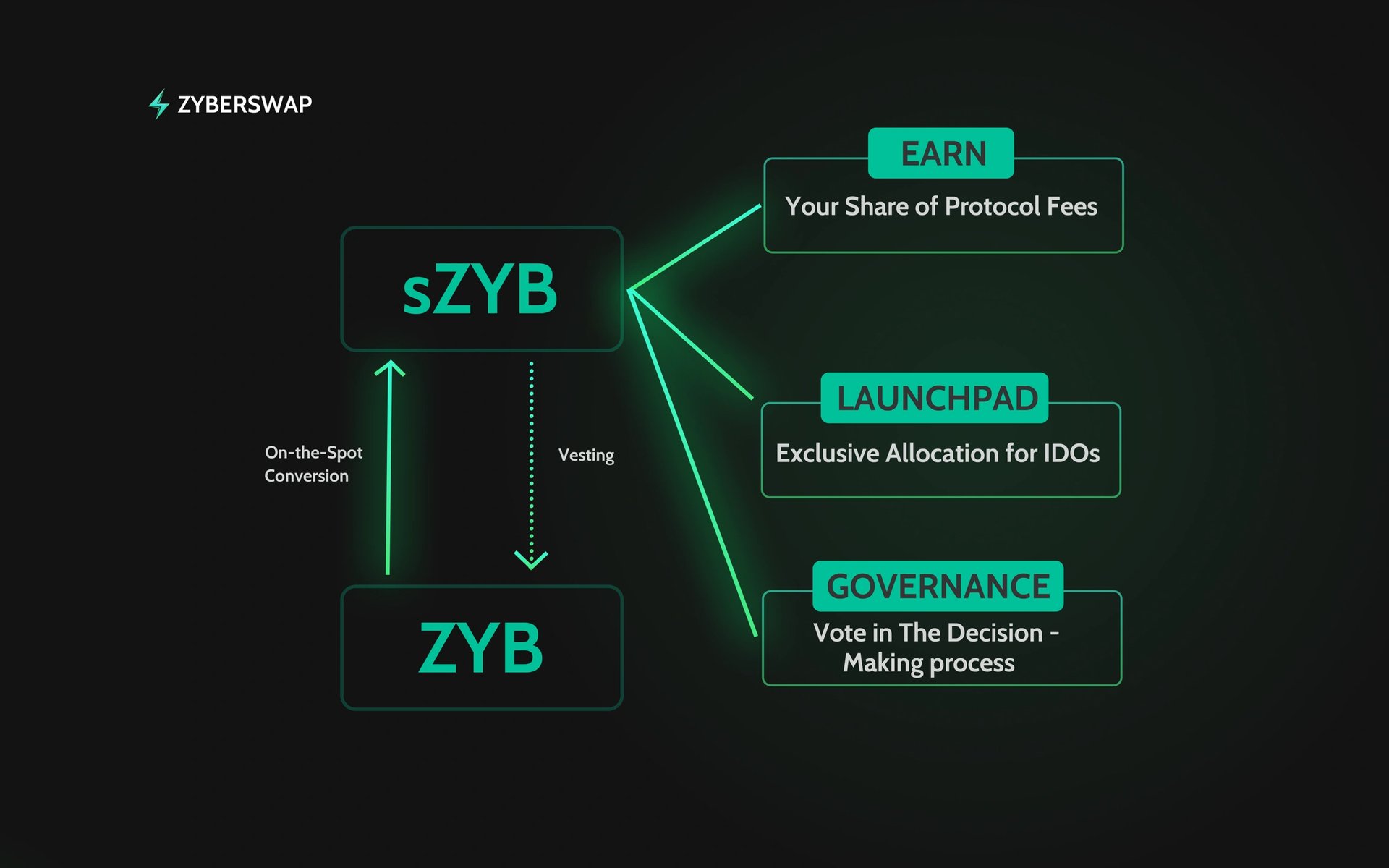

sZYB

分享协议利润

启动板特权

治理投票

合作伙伴

发现错误了吗?